Abstract

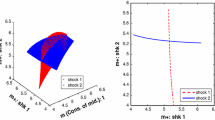

Overlapping generations model of fiat money yields an infinity of competitive equilibrium solutions, only one of which is stationary. Economies reported in this paper involved a sequence of overlapping generations of three or four individuals; each individual lived for two periods. In their young age individuals were endowed with “chips” that could be traded for fiat money wish the individuals of the old generation. In their old age, individuals could exchange their units o flat money for the consumption good. Results of the experiments exhibit some support for the stationary solution. The results are robust to two designs of exchange institutions (double oral auctior and supply schedule auction) and to two different endogenous ways of converting money into “chips” at the end of the game (average price prevailing during the last period the game is actually played and the average price forecast made during the last period the game is actually played).

Similar content being viewed by others

References

Azariadis C (1982) Self fulfilling prophecies. Journal of Economic Theory 25:380–396.

Berg J, Daley L, Dickhaut J, O'Brien J (1986) Controlling preferences for units of experimental exchange. Quarterly Journal of Economics 101:2, 201–306

Calvo G (1978) On the indeterminacy of interest rates and wages with perfect foresight. Journal of Economic Theory 19:321–37

Cass D, Shell C (1983) Do sunspots matter?, Journal of Political Economy 91:2, 193–227

Grandmont J (1986) Stabilizing competitive business cycles. Journal of Economic Theory 40:1, 57–76

Kehoe TJ, Levine DK (1985) Comparative statics and perfect foresight in infinite horizon models. Econometrica 53:433–453

Lucas RE Jr (1972). Expectations and the neutrality of money. Journal of Economic Theory 4:103–24

Lucas RE Jr (1986) Adaptive behavior and economic theory. Journal of Business 59:S401-S426

Marimon R, Spear SE, Sunder S (1993) Expectationally-driven market volatility: Experimental evidence. Journal of Economic Theory 61:1, 74–103

Marimon R, Sunder S (1993) Indeterminacy of equilibria in a hyperinflationary world: Experimental evidence. Econometrica 61:1073–1107

Marimon R, Sunder S. (1994) Expectations and learning under alternative monetary regimes: An experimental approach. Economic Theory 4:131–162

Samuelson PA (1958) An exact consumption-loan model of interest with or without the social contrivance of money. Journal of Political Economy 66:467–82

Shubik M (1973) Commodity money, oligopoly, credit and bankruptcy in a general equilibrium model. Western Economic Journal 11:1, 23–38

Spear S, Srivastava S (1985) Indeterminacy and sun spots in a stochastic overlapping generations model. Carnegie Mellon Working Paper

Wallace N (1980) The overlapping generations model of fiat money. In: Kareken JH, Wallace N (Eds.) Models of Monetary Economics, Minneapolis, Federal Reserve Bank of Minneapolis. 49–82

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Lim, S.S., Prescott, E.C. & Sunder, S. Stationary solution to the overlapping generations model of fiat money: Experimental evidence. Empirical Economics 19, 255–277 (1994). https://doi.org/10.1007/BF01175874

Issue Date:

DOI: https://doi.org/10.1007/BF01175874