Abstract

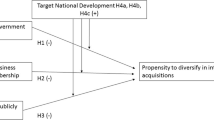

Although foreign equity ownership around the world has increased substantially over the last three decades, there is little evidence on the role of foreign ownership in the host country. Using a large sample of foreign partial acquisitions in the US from 1981 to 1999, we examine the determinants of foreign acquirers’ governance activities in US targets. We focus on the information asymmetries that foreign acquirers face in the US as a key determinant of their governance activities in US targets, and hypothesize that such information asymmetries provide them with weak incentives to engage in governance activities. Consistent with our hypothesis, we find that foreign acquirers whose countries share a common language and a common culture with the US are more likely to engage in post-acquisition governance activities than are other foreign acquirers. Moreover, the probability of foreign acquirers’ governance activities is positively related to their previous acquisition activities in the US, but negatively related to the physical distance from the targets and the difference in shareholder rights scores between the US and their home countries. Our results suggest that information asymmetries that foreign acquirers face in the host country are an important determinant of their governance activities in domestic targets.

Similar content being viewed by others

Notes

Choe, Kho, and Stulz (2005) find that individual domestic investors in Korea have a short-lived information advantage over foreign investors. Further, Orpurt (2004) and Bae, Stulz, and Tan (2008) show that local analysts make more precise earnings forecasts than foreign analysts. These findings suggest that domestic investors and analysts have a significant information advantage over their foreign counterparts.

Covrig, Lau, and Ng (2006) show that foreign and domestic mutual fund managers have similar preferences for stock characteristics.

We end the sample period in 1999 because the total amount of FDI in the US drops significantly after 2000. For example, the total amount of FDI in the US was $314 billion in 2000, but was only $159 billion in 2001, $74 billion in 2002, and $53 billion in 2003. We find a similar pattern for the number of foreign block acquisitions in the US.

There are 12 cases in which the foreign firm acquires more than 50% of a target firm's shares outstanding within the 3 years after the initial acquisition announcement. In untabulated tests we exclude these 12 acquisitions from the sample and repeat all analyses in the paper. The results are qualitatively similar to those reported in the paper.

We employ acquirer–target product market relationships as one of our matching criteria because the motives behind foreign partial acquisitions may be different from those behind domestic partial acquisitions. For example, foreign firms may acquire US target equity for synergistic rather than disciplinary purposes. Therefore controlling for this difference in motivation is important in drawing an unbiased interpretation of the results.

Using a sample of 24,143 block acquisitions in 43 countries during the period 1990–2005, Liao (2008) finds that the relief of a target's financial constraints, not the consideration of product market relationships with the acquirer, is a primary motive for the sale of target equity stakes.

Distance is calculated using both the capital city and the economic center (the most important city in terms of population) of the two countries, since for several countries the capital is not populated enough to represent the economic center of the country. We report results based upon the economic center of countries, but the results reported below do not change when we use the capital city.

The shareholders rights score is created by adding 1 when: (1) shareholders are allowed to mail their proxy vote; (2) shareholders are not required to deposit their shares prior to the general shareholders’ meeting; (3) cumulative voting or proportional representation of minorities on the board of directors is allowed by law; (4) an oppressed minorities mechanism is in place; (5) the minimum percentage of capital that entitles a shareholder to call for an extraordinary shareholders’ meeting is less than or equal to 10%; or (6) when shareholders have preemptive rights that can be waived only by a shareholders’ vote. The range for the score is therefore 0–6, with a higher score indicating better investor protection (La Porta et al., 1998).

Of the 19 foreign acquisitions (five private placements and 14 open market purchases) in which acquirers seek representation on targets’ boards, 11 acquirers eventually secure such representation but eight do not. In tests not reported here we repeat all analyses in the paper excluding the sample of acquisitions in which board representation is not achieved, and find that the results are qualitatively unchanged.

These results are similar to those of Kang, Kim, Liu, and Yi (2006), who show that layoffs and selloffs are less important in justifying the US target premium in foreign mergers than in domestic mergers.

In unreported tests we also include 16 dummy variables for the year of acquisition and seven dummy variables for industry. The results are similar if time or industry effects are taken into account.

Following Bethel, Liebeskind, and Opler (1998), we define active investors as those who announce their intention of influencing firm policies, or who are known for having pursued active policies in the past. We find that 36 domestic acquirers (13.4%) are classified as active investors while only 26 (9.7%) foreign acquirers are taken to be active investors. This result again suggests that domestic investors have stronger incentives to play an active governance role in influencing target management than do foreign investors.

As alternative tests, we define a well-managed target as a target whose past operating performance is above the sample median, and obtain similar results. Using industry-adjusted excess returns as a measure of past performance leads to a similar conclusion.

References

Allen, J., & Phillips, G. 2000. Corporate equity ownership, strategic alliances, and product market relationships. Journal of Finance, 55 (6): 2791–2815.

Bae, K., Stulz, R., & Tan, H. 2008. Do local analysts know more? A cross-country study of the performance of local analysts and foreign analysts. Journal of Financial Economics, 88 (3): 581–606.

Baik, B., Kang, J., & Kim, J. 2010. Local institutional investors, information asymmetries, and equity returns. Journal of Financial Economics, 97 (1): 81–106.

Bethel, J., Liebeskind, J., & Opler, T. 1998. Block purchases and corporate performance. Journal of Finance, 53 (2): 605–634.

Butz, D. 1994. How do large minority shareholders wield control? Managerial and Decision Economics, 15 (4): 291–298.

Chan, K., Covrig, V., & Ng, L. 2005. What determines the domestic bias and foreign bias? Evidence from mutual fund equity allocations worldwide. Journal of Finance, 60 (3): 1495–1534.

Choe, H., Kho, B., & Stulz, R. 2005. Do domestic investors have an edge? The trading experience of foreign investors in Korea. Review of Financial Studies, 18 (3): 795–829.

Coval, J., & Moskowitz, T. 1999. Home bias at home: Local equity preference in domestic portfolios. Journal of Finance, 54 (6): 2045–2073.

Covrig, V., Lau, S., & Ng, L. 2006. Do domestic and foreign fund managers have similar preferences for stock characteristics? A cross-country analysis. Journal of International Business Studies, 37 (3): 407–429.

Demsetz, H., & Lehn, K. 1985. The structure of corporate ownership: Causes and consequences. Journal of Political Economy, 93 (6): 1155–1177.

Dyck, A., & Zingales, L. 2004. Private benefits of control: An international comparison. Journal of Finance, 59 (2): 537–600.

Fama, E., & French, K. 1997. Industry cost of equity. Journal of Financial Economics, 43 (2): 153–193.

Fee, E., Hadlock, C., & Thomas, S. 2006. Corporate equity ownership and the governance of product market relationships. Journal of Finance, 61 (3): 1217–1251.

Forbes, K. 2008. Why do foreigners invest in the United States?, NBER working paper No. 13908, National Bureau of Economic Research, Cambridge, MA.

Grinblatt, M., & Keloharju, M. 2001. How distance, language and culture influence stockholdings and trades. Journal of Finance, 56 (3): 1053–1073.

Harris, R., & Ravenscraft, D. 1991. The role of acquisitions in foreign direct investment: Evidence from the US stock market. Journal of Finance, 46 (3): 825–844.

Hofstede, G. 1980. Culture's consequences: International differences in work-related values. Beverly Hills, CA: Sage Publications.

Ivkovich, Z., & Weisbenner, S. 2005. Local does as local is: Information content of the geography of individual investors’ common stock investments. Journal of Finance, 60 (1): 267–306.

Jensen, M. 1986. Agency costs of free cash flow, corporate finance, and takeovers. American Economic Review, 76 (2): 323–329.

Jensen, M., & Meckling, W. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3 (4): 305–360.

Jensen, M., & Ruback, R. 1983. The market for corporate control: The scientific evidence. Journal of Financial Economics, 11 (1): 5–50.

John, K., & Senbet, L. 1998. Corporate governance and board effectiveness. Journal of Banking and Finance, 22 (4): 371–403.

Kang, J. 1993. The international market for corporate control: Mergers and acquisitions of US firms by Japanese firms. Journal of Financial Economics, 34 (3): 345–371.

Kang, J., & Kim, J. 2008. The geography of block acquisitions. Journal of Finance, 63 (6): 2817–2858.

Kang, J., Kim, J., Liu, W., & Yi, S. 2006. Post-takeover restructuring and the sources of gains in foreign takeovers: Evidence from US targets. Journal of Business, 79 (5): 2503–2537.

Kho, B., Stulz, R., & Warnock, F. 2009. Financial globalization, governance, and the evolution of the home bias. Journal of Accounting Research, 47 (2): 597–635.

Kogut, B., & Singh, H. 1988. The effect of national culture on the choice of entry mode. Journal of International Business Studies, 19 (3): 411–432.

Krug, J., & Nigh, D. 1998. Top management departures in cross-border acquisitions: Governance issues in an international context. Journal of International Management, 4 (4): 267–287.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. 1997. Legal determinants of external finance. Journal of Finance, 52 (3): 1131–1150.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. 1998. Law and finance. Journal of Political Economy, 106 (6): 1113–1155.

Liao, C. 2008. Corporate block acquisitions around the world, Working paper, Rutgers University.

Lerner, J. 1995. Venture capitalists and the oversight of private firms. Journal of Finance, 50 (1): 301–318.

Leuz, C., Lins, K., & Warnock, F. 2009. Do foreigners invest less in poorly governed firms? Review of Financial Studies, 22 (8): 3245–3285.

Mikkelson, W., & Ruback, R. 1985. An empirical analysis of the interfirm equity investment process. Journal of Financial Economics, 14 (4): 523–553.

Morck, R., & Yeung, B. 1991. Why investors value multinationality. Journal of Business, 64 (2): 165–187.

Morck, R., & Yeung, B. 1992. Internalization: An event study test. Journal of International Economics, 33 (1): 41–56.

Orpurt, S. 2004. Domestic analyst earnings forecast advantages in Europe, Working paper, The University of Chicago.

Petersen, M., & Rajan, R. 2002. Does distance still matter? The information revolution in small business lending. Journal of Finance, 57 (6): 2533–2570.

Roth, K., & O’Donnell, S. 1996. Foreign subsidiary compensation strategy: An agency theory perspective. Academy of Management Journal, 39 (3): 678–703.

Seth, A., Song, K., & Pettit, R. 2000. Synergy, managerialism or hubris? An empirical examination of motives for foreign acquisitions of US firms. Journal of International Business Studies, 31 (3): 387–405.

Shleifer, A., & Vishny, R. 1986. Large shareholders and corporate control. Journal of Political Economy, 94 (3): 461–488.

Stulz, R., & Williamson, R. 2003. Culture, openness, and finance. Journal of Financial Economics, 70 (3): 313–349.

Sussman, O., & Zeira, J. 1995. Banking and development, CEPR Discussion Paper No. 1127, Centre for Economic Policy Research, London.

Van de Ven, W. P. M. M., & Van Praag, B. M. S. 1981. The demand for deductibles in private health insurance: A probit model with sample selection. Journal of Econometrics, 17 (2): 229–252.

Zwiebel, J. 1995. Block investment and partial benefits of corporate control. Review of Economic Studies, 62 (2): 161–185.

Acknowledgements

We are grateful for comments from Chirok Han, Vincent Intintoli, William Johnson, Jae Jung, Noolee Kim, Cheng-Few Lee, Dong Wook Lee, Yangru Wu, and seminar participants at the 2008 Financial Management Association meeting, the 2008 Korean Finance Association meeting, Hitotsubashi University, Nanyang Technological University, Rutgers University, Seoul National University, University of South Carolina, and University of Tennessee. We also thank three anonymous referees and Lemma Senbet (the editor) for many detailed and helpful comments.

Author information

Authors and Affiliations

Corresponding author

Additional information

Accepted by Lemma Senbet, Area Editor, 7 January 2010. This paper has been with the authors for four revisions.

APPENDIX

APPENDIX

Variable Definitions

This appendix provides a detailed description of the construction of all the variables used in the tables.

See Table A1.

Rights and permissions

About this article

Cite this article

Kang, JK., Kim, JM. Do foreign investors exhibit a corporate governance disadvantage? An information asymmetry perspective. J Int Bus Stud 41, 1415–1438 (2010). https://doi.org/10.1057/jibs.2010.18

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/jibs.2010.18