Abstract

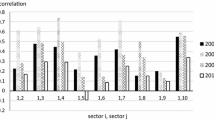

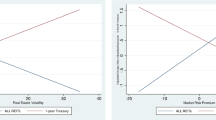

Recent evidence suggests that the variation in the expected excess returns is predictable and arises from changes in business conditions. Using a multifactor latent variable model with time-varying risk premiums, we decompose excess returns into expected and unexpected excess returns to examine what determines movements in expected excess returns for equity REITs are more predictable than all other assets examined, due in part to cap rates which contain useful information about the general risk condition in the economy. We also find that the conditional risk premiums (expected excess returns) on EREITs move very closely with those of small cap stocks and much less with those of bonds.

Similar content being viewed by others

References

Campbell, John Y. “Stock Returns and the Term Structure.” Journal of Financial Economics 18 (1987), 373–399.

Campbell, John Y. “Intertemporal Asset Pricing Without Consumption.” Working Paper, Princeton University, 1990.

Campbell, John Y., and Hamao, Yasushi. “Predictable Stock Returnn in the United States and Japan: A Study of Long-Term Capital Market Integration.” Working Paper, Princeton University, 1991.

Chan, K.C., Hendershott, Patric, and Sanders, Anthony. “Risk and Return on Real Estate: Evidence from Equity REITs.” AREUEA Journal 18 (1990), 431–452.

Chen, Nai-fu, Roll, Richard, and Ross, Stephen. “Economic Forces and the Stock Market.” Journal of Business, 59 (1986), 386–403.

Colwell, Peter, and Park, Hun Y. “Seasonality and Size Effects: The Case of Real-Estate-Related Investment.” Journal of Real Estate Finance and Economics 3 (1990), 251–260.

Connor, Gregory, and Korajczyk, Robert A. “Risk and Return in an Equilibrium APT: Application of a New Test Methodology.” Journal of Financial Economics 21 (1988), 255–289.

Corgel, John B., and Rogers, Ronald C. “Market Trading Characteristics of REITs: Tests of the Stock Market and Hybrid Securities Hypotheses.” Working Paper, Cornell University, 1991.

Fama, E., and French, K. “Dividend Yields and Expected Stock Returns.” Journal of Financial Economics 22 (1988), 3–25.

Fama, E., and French, K. “Business Conditions and Expected Return on Stocks and Bonds.” Journal of Financial Economics 25 (1989), 23–49.

Fama, E., and Schwert, G. William. “Asset Returns and Inflation.” Journal of Financial Economics 5 (1977), 115–146.

Ferson, W. “Changes in Expected Security Returns, Risk, and Level of Interest Rates.” Journal of Finance 44 (1989), 1191–1217.

Ferson, W. “Are the Latent Variables in Time-Varying Expected Returns Compensatin for Consumption Risk?” Journal of Finance 45 (1990), 397–430.

Ferson, W., and Harvey, C. “The Variation of Economic Risk Premiums.” Journal of Political Economy (forthcoming, 1990).

Ferson, Wayne, Kandel, Shmuel and Stambaugh, Robert. “Test of Asset Pricing with Time-Varying Expected Risk Premiums and market Betas.” Journal of Finance 42 (1987), 201–219.

Geltner, David. “Risks and Returns in Commercial Real Estate: An Exploration of Some Fundamental Relationships.” Doctoral dissertation thesis, Massachusetts Institute of Technology, 1989.

Gibbons, Michael R., and Ferson, Wayne. “Testing Asset Pricing Models with Changing Expectations and an Unobservable Market Portfolio.” Journal of Financial Economics 14 (1985), 217–236.

Giliberto, S. Michael. “Equity Real Estate Investment Trust and Real Estate Returns.” Journal of Real Estate Research 5 (1990), 259–263.

Gyourko, Joseph, and Keim, Donald. “What Does the Stock Market Tell Us About Real Estate Returns?” Working Paper, The Wharton School, 1991.

Harvey, Campbell R. “Time-Varying Conditional Covariances in Tests of Asset Pricing Models.” Journal of Financial Economics 24 (1989), 289–317.

Keim, Donald B. “Size Related Anomalies and Stock Return Seasonality: Empirical Evidence.” Journal of Financial Economics 12 (1983), 13–32.

Keim, D., and Stambaugh, R. “Predicting Returns in the Stock and Bond Markets.” Journal of Financial Economics 17 (1986), 357–390.

Mei, Jianping. “New Method for the Arbitrage Pricing Theory and the Present Value Model.” Doctoral dissertation, Princeton University, 1990.

Mengden, Ann, and Hartzell, David J. “Real Estate Investment Trusts—Are They Stocks or Real Estate?” Stock Research-Real Estate, Solomon Brothers Inc., 1986.

Nourse, Hugh O. “The ‘Cap Rate’ 1966–1984: A Test of the Impact of Income Tax Changes on Income Property.” Land Economics 63 (1987), 147–152.

Roll, Richard, and Ross, Stephen A. “An Empirical Investigation of the Arbitrage Pricing Theory.” Journal of Finance 35 (1980), 1073–1103.

Ross, Stephen. “The Arbitrage Theory of Capital Asset Pricing.” Journal of Economic Theory 13 (1976), 341–360.

White, Halbert. “A Heteroskedasticity-Consistent Covariance Matrix Estimator and a Direct Test for Heteroskedasticity.” Econometrica 48 (1980), 817–838.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Liu, C.H., Mei, J. The predictability of returns on equity REITs and their co-movement with other assets. J Real Estate Finan Econ 5, 401–418 (1992). https://doi.org/10.1007/BF00174808

Issue Date:

DOI: https://doi.org/10.1007/BF00174808