Summary

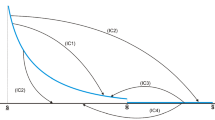

In this paper we study a repeated principal-agent situation with moral hazard. We focus on a class of incentive schemes, calledbankruptcy contracts. The agent is “scored” in each period, and is paid a fixed wage per period until the current score falls to zero, at which time the agent is terminated and the principal hires a new agent. The agent's current score at any time equals an initial score, plus the total output up to that time, minus an amount that is proportional to the total time. With standard assumptions about the utility functions of the principal and agent, we characterize the second-best bankruptcy contracts and show that in such a contract, the principal pays the agent an efficiency wage. We also demonstrate that such contracts lead to approximately first-best (Pareto efficient) outcomes if the principal and agent are sufficiently patient (have small discount rates). Most importantly, if the two players have a common discount rateδ, then the loss of efficiency under the second-best bankruptcy contract goes to zero at least as fast asO(gd 1/2lnδ). In order to obtain increased precision, the analysis is carried out in a continuous-time framework.

Similar content being viewed by others

References

Abreu, D., Pearce, D., Stachetti, E.: Optimal cartel equilibria with imperfect monitoring. J. Econ. Theory39, 251–269 (1986)

Berge, C.: Topological spaces. New York: MacMillan 1963

Benes, V.: Existence of optimal stochastic control laws. SIAM J. Control9, 446–472 (1971)

Brock, W.A., Evans, L.T.: The space of contracts in continuous time asymmetric information models. University of Wisconsin, Madison, unpublished (1992)

Davis, M.H.A.: On the existence of optimal policies in stochastic control. SIAM J. Control11, 587–594 (1973)

Dutta, P.K.: Bankruptcy and expected utility maximization. J. Econ. Dynam. Control, forthcoming (1993)

Dutta, P.K., Radner, R.: Optimal principal agent contracts for a class of incentive schemes: a characterization and the rate of approach to efficiency. University of Rochester Working Paper #300, 1991

Fellingham, J., Newman, D., Suh, Y.: Contracts without memory in multiperiod agency models. J. Econ. Theory37, 340–355 (1985)

Fudenberg, D., Maskin, E.: Discounted repeated games with unobservable actions, I: one sided moral hazard. Harvard University Working Paper, #1280, 1986

Fudenberg, D., Holmstrom, B., Milgrom, P.: Short term contracts and long term relationships. J. Econ. Theory51, 1–31 (1990)

Heath, D., Orey, S., Prestien, V., Sudderth, W.: Maximizing or minimizing the expected time to reach zero. SIAM J. Control Optimiz.25, 195–205 (1987)

Holmstrom, B., Milgrom, P.: Aggregation and linearity in the provision of intertemporal incentives. Econometrica55, 303–329 (1987)

Kaplan, R.S.: Advanced management accounting. New Jersey: Prentice-Hall 1982

Karatzas, I., Shreve, S.: Brownian motion and stochastic calculus. New York: Springer 1987

Krylov, N.: Controlled diffusion processes. New York: Springer 1981

Lambert, R.A.: Long-term contracts and moral hazard. Bell J. Economics14, 441–452 (1983)

Majumdar, M., Radner, R.: Linear models of economic survival under uncertainty. Econ. Theory1, 13–31 (1990)

Radner, R.: Monitoring cooperative agreements in a repeated principal-agent relationship. Econometrica49, 1127–1148 (1981)

Radner, R.: Repeated principal-agent games with discounting. Econometrica53, 1173–1198 (1985)

Radner, R.: Repeated moral hazard with low discount rates. In: Heller, W., Starr, R., Starrett, D. (eds.) Essays in honor of Kenneth Arrow. Cambridge: Cambridge University Press 1986

Rogerson, W.: Repeated moral hazard. Econometrica53, 69–76 (1985)

Rubinstein, A.: Offenses that may have been committed by accident — an optimal policy of retribution. In: Brarns, S.J., Schotter, A.S., Schrodiauer, G.S. (eds). Applied game theory. Würzburg: Physica 1979

Rubinstein, A., Yaari, M.: Repeated insurance contracts and moral hazard. J. Econ. Theory30, 74–97 (1983)

Sheng, D.: Two-mode control of absorbing Brownian motion. Bell Laboratories Technical Memorandum, Murray Hill, NJ, 1980

Spear, S., Srivastava, S.: On repeated moral hazard with discounting. Rev. Econ. Studies55 (1988)

Yaari, M.: A law of large numbers in the theory of consumption choice under uncertainty. J. Econ. Theory12, 202–217 (1976)

Author information

Authors and Affiliations

Additional information

This is a considerably revised version of a manuscript titled “Principal Agent Games in Continuous Time”. We have benefited from the comments of seminar participants (on the earlier version) at Columbia, Northwestern, Illinois and Stony Brook. The revised version benefited from a presentation to the Game Theory Conference at Ohio State, July 1990. We would like to acknowledge helpful comments from Dilip Abreu, Tatsuro Ichiishi, Eric Maskin, William Rogerson and Aloysius Siow as well as an anonymous referee. This paper was begun while the first author was at AT&T Bell Laboratories and completed while visiting the Department of Economics at the University of Rochester; the two organizations are thanked for all help rendered.

The views expressed here are those of the authors, and not necessarily those of AT&T Bell Laboratories.

Rights and permissions

About this article

Cite this article

Dutta, P.K., Radner, R. Optimal principal agent contracts for a class of incentive schemes: a characterization and the rate of approach to efficiency. Econ Theory 4, 483–503 (1994). https://doi.org/10.1007/BF01213620

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01213620