Abstract

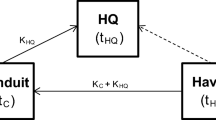

The paper analyses the financial structure of German inward FDI. Intra-company loans granted by the parent should be all the more strongly preferred over equity the lower the tax rate of the parent and the higher the tax rate of the German affiliate. We find that the corporate tax rate of the foreign parent has no significant impact on the financial structure of a German subsidiary. However, among subsidiaries that are directly held by a foreign investor those firms that on average are profitable react more strongly to changes in the German corporate tax rate than this is the case for less profitable firms. This gives support to the frequent concern that high German taxes are partly responsible for the high levels of intra-company loans. Taxation, however, does not fully explain the high levels of intra-company borrowing. Roughly 60 per cent of the cross-border intra-company loans turn out to be held by firms that are running losses.

Similar content being viewed by others

References

Alworth, J. (1988). The Finance, Investment and Taxation Decisions of Multinationals. Oxford: Basil.

Altshuler, R., and H. Grubert (2003). Repatriation Taxes, Repatriation Strategies and Multinational Financial Policy. Journal of Public Economics 87 (1): 73–107.

Collins, J. H., and D. A. Shackelford (1997). Global Organizations and Taxes: An Analysis of the Dividend, Interest, Royalty, and Management Fee Payments between U.S. Multinationals’ Foreign Affiliates. Journal of Accounting and Economics 24 (2): 151–173.

Desai, M. A., C. F. Foley, and J. R. Hines (2003). Chains of Ownership, Regional Tax Competition, and Foreign Direct Investment. In H. Herrmann und R. Lipsey (eds.), Foreign Direct Investment in the Real and Financial Sector of Industrial Countries. Berlin: Springer.

Desai, M. A., C. F. Foley, and J. R. Hines (2004). A Multinational Perspective on Capital Structure Choice and Internal Capital Markets. Journal of Finance 59 (6): 2451–2488.

Deutsche Bundesbank (1993). Trends in International Capital Links between Enterprises from the End of 1989 to the End of 1991. Monthly Report (April): 33–48.

Deutsche Bundesbank (1997). International Capital Links between Enterprises from the End of 1993 to the End of 1995. Monthly Report (May): 63–76.

Ederveen, S., and R. de Mooij (2001). Taxation and Foreign Direct Investment: A Meta-Analysis. Quarterly Review of CPB Netherlands Bureau for Economic Policy Analysis (1): 25–30.

Gentry, W. M. (1994). Taxes, Financial Decisions and Organizational Form: Evidence from Publicly Traded Partnerships. Journal of Public Economics 53 (2): 223–244.

Givoly, D. C., A. Hain, R. Ofer, and O. Sarig (1992). Taxes and Capital Structure: Evidence from Firms’ Response to the Tax Reform Act of 1986. Review of Financial Studies 5 (2): 331–355.

Gordon, R. H., and Y. Lee (1999). Do Taxes Affect Corporate Debt Policy? Evidence from U.S. Corporate Tax Return Data. NBER Working Paper 7433. National Bureau of Economic Research, Cambridge, Mass.

Graham, J. R. (1999). Do Personal Taxes Affect Corporate Financing Decisions? Journal of Public Economics 73 (2): 147–185.

Gropp, R. E. (2002). Local Taxes and Capital Structure Choice. International Tax and Public Finance 9 (1): 51–71.

Grubert, H., and J. H. Mutti (1991). Taxes, Tariffs and Transfer Pricing in Multinational Corporate Decision Making. Review of Economics and Statistics 73 (2): 285–293.

Harris, M., and A. Raviv (1991). The Theory of Capital Structure. Journal of Finance 46 (1): 297–355.

Jog, V., and J. Tang (2001). Tax Reforms, Debt Shifting and Tax Revenues: Multinational Corporations in Canada. International Tax and Public Finance 8 (1): 5–25.

Keen, M. (1991). Corporation Tax, Foreign Investment and the Single Market. In L. A. Winters and A. J. Venables (eds.), European Integration: Trade and Industry. Cambridge: Cambridge University Press.

Lipponer, A. (2003). Deutsche Bundesbank’s FDI Micro Database. Schmollers Jahrbuch – Zeitschrift für Wirtschafts- und Sozialwissenschaften 123 (4): 593–600.

MacKie-Mason, J. K. (1990). Do Taxes Affect Corporate Financial Decisions? Journal of Finance 45 (5): 1471–1493.

Mintz, J. (2004). Conduit Entities: Implications of Indirect Tax-Efficient Financing Structures for Real Investment. International Tax and Public Finance 11 (4): 419–434.

OECD (1991). Taxing Profits in a Global Economy: Domestic and International Issues. Paris: OECD.

Rajan, R. G., and L. Zingales (1995). What Do We Know about Capital Structure? Some Evidence from International Data. Journal of Finance 50 (5): 1421–1460.

Rousslang, D. J. (1997). International Income Shifting by US Multinational Corporations. Applied Economics 29 (7): 925–934.

Weichenrieder, A. (1995). Besteuerung und Direktinvestition. Tübingen: Mohr.

Author information

Authors and Affiliations

Corresponding author

Additional information

JEL no.

F23, H25

About this article

Cite this article

Ramb, F., Weichenrieder, A. Taxes and the Financial Structure of German Inward FDI. Rev. World Econ. 141, 670–692 (2005). https://doi.org/10.1007/s10290-005-0051-7

Issue Date:

DOI: https://doi.org/10.1007/s10290-005-0051-7