Abstract

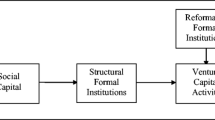

This paper investigates the political and legal determinants of cross-country differences in venture capital (VC) investments. Our results show strong and positive effects of a favorable sociopolitical and entrepreneurial environment on the inception and development of VC investment activity. Controlling for effects due to the legal system prevailing in each country, we find strong evidence that this factor plays an important role in explaining cross-sectional variance. This result conveys important normative implications: entrepreneurship and innovation benefit significantly from an active VC industry, which also allows the ignition of virtuous cycles. Activating this cycle, though, relies on some socioeconomic prerequisites that government and institutions should primarily address.

Similar content being viewed by others

Notes

NY Times, “World Bank Report on Governing Finds Level Playing Field”, 5/11/2007; The Economist, “Order in the jungle”, 3/13/2008.

Henceforth LLSV.

EVCA (2005), Re-awakening the bear. Country Reports, European Venture Capital Journal, http://www.ventureeconomics.com/evcj/protected/ctryreps/1107338767047.html.

The closest previous observation is a not further specified “late 1990” (OECD).

This does not conflict with what is implied by the level of IPO: in fact, a stock market can be large due to a slow-growing number of listed companies with a low level of IPO activity. In fact, a common possible bias in financial market studies is represented by the fact that markets with relatively large stocks but low turnover should be more liquid and efficient than markets with a smaller median value for stocks traded but higher turnover.

This is available on Rafael La Porta’s website at http://mba.tuck.dartmouth.edu/pages/faculty/rafael.laporta/publications/LaPorta%20PDF%20Papers-ALL/Law%20and%20Finance-All/Law_fin.xls.

In unreported tests, we have performed a robustness analysis running fixed-effects regressions on a sub-sample of 15 countries, which excludes the US, at the same time the largest VC market and also the country with the highest degree of stability for all explanatory variables. However, excluding these observations does not distort our results.

CPI constituents are provided by: Columbia University, Economist Intelligence Unit, Freedom House, Information International, International Institute for Management Development, Merchant International Group, Political and Economic Risk Consultancy, United Nations Economic Commission for Africa, World Economic Forum and World Markets Research Centre.

To further control for multicollinearity issues, we again ran VIF tests obtaining a value of 2.29.

References

Abed, G. T., & Gupta, S. (2002). In G. T. Abed & S. Gupta (Eds.), Governance, corruption, and economic performance. International Monetary Fund.

Acs, Z., Audretsch, D., Braunerhhjem, P., & Carlsson, B. (2009). The knowledge spillover theory of entrepreneurship. Small Business Economic, 32, 15–30.

Armour, J., & Cumming, D. J. (2006). The legislative road to Silicon Valley. Oxford Economic Papers, 58, 596–635.

Armour, J., & Cumming, D. J. (2008). Bankruptcy law and entrepreneurship. American Law and Economics Review, 10(2), 303–350.

Beck, T., Demirguc-Kunt, A., & Levine, R. (2003a). Law and finance: Why does legal origin matter? Journal of Comparative Economics, 4, 653–675.

Beck, T., Demirguc-Kunt, A., & Levine, R. (2003b). Law, endowments, and finance. Journal of Financial Economics, 2, 137–181.

Berkowitz, D., Pistor, K., & Richard, J. F. (2003). Economic development, legality and the transplant effect. European Economic Review, 47(1), 165–195.

Black, B. S., & Gilson, R. J. (1998). Venture capital and the structure of capital markets: Banks versus stock markets. Journal of Financial Economics, 47, 243–277.

Blanchflower, D. G. (2000). Self-employment in OECD countries. Labor Economics, 7(5), 471–505.

Blanchflower, D. G., Oswald, A., & Stutzer, A. (2001). latent entrepreneurship across nations. European Economic Review, 45(4–6), 680-691.

Boquist, A., & Dawson, J. (2004). US venture capital in Europe in the 1980s and the 1990s. The Journal of Private equity, 8(1), 39–54.

Brunetti, A. (1998). Political variables in cross-country growth analysis. Journal of Economic Surveys, 11, 2.

Brunetti, A., & Weder, B. (1998). Investment and institutional uncertainty: A comparative study of different uncertainty measures. Weltwirtschaftliches Archives, 134(3),513–533.

Busse, M. (2003). Democracy and FDI. Discussion Paper Series 26260, Hamburg Institute of International Economics.

Cahuc, P., & Koeniger, W. (2007). Employment protection legislation. The Economic Journal, 117(521), F185–F188.

Cumming, D., Schmidt, D., & Waltz, U. (2010). Legality and Venture Capital Governance around the world. Journal of Business Venturing, 25(1), 54–72.

Da Rin, M., Hege, U., Liobet, G., & Walz, U. (2006). The law and finance of venture capital financing in Europe. European Business Organization Law Review, 7, 525–547.

Dimov, D., & Murray, G. (2008). Determinants of the incidence and scale of seed capital investments by venture capital firms. Small Business Economics, 30(127), 127–152.

Easterly, W. (2009). Can the west save Africa?. Journal of Economic Literature, 47, 2.

Easterly, W. (2001). The lost decades: Explaining developing countries’ stagnation in spite of policy reform 1980–1998. Journal of Economic Growth, 6(2), 135–157.

Elango, B., Fried, V. H., Hisrich, R. D., & Polonchek, A. (1995). How venture capital firms differ. Journal of Business Venturing, 10, 157–179.

Freytag, A., & Thurik, R. (2006). Entrepreneurship and its determinants in a cross-country setting. Journal of Evolutionary Economics, 17, 117–131.

Fuss, R., & Schweizer, D. (2008). Dynamic interactions between venture capital returns and the macroeconomy: Theoretical and empirical evidence from the United States. Unpublished Working Paper, European Business School (EBS) and WHU.

Galtung, F. (2006). Measuring the immeasurable: Boundaries and functions of (macro) corruption indices. In C. Sampford, A. Shacklock, C. Connors & F. Galtung (Eds.), Measuring corruption (pp. 101–130). Aldershot: Ashgate.

Gastanaga, V. M., Nugent, J. B., & Pashamova, B. (1998). Host country reforms and FDI inflows: How much difference do they make? World Development, 26(7), 1299–1314.

Gentry, W. M., & Hubbard, R. G. (2000). Tax policy and entrepreneurial entry. The American Economic Review, 90(2), Papers and Proceedings of the One Hundred Twelfth Annual Meeting of the American Economic Association (pp. 283–287).

Gompers, P., & Lerner, J. (1998). What drives venture capital fundraising? Brookings Papers on Economic Activity. Microeconomics, 149–192.

Gordon, R. (1998). Can high personal tax rates encourage entrepreneurial activity? IMF Staff Papers, 45, 49–80.

Guiso, L., Sapienza, P., & Zingales, L. (2006). Does culture affect economic outcomes? Journal of Economic Perspectives, 20(2), 23–48.

Henisz, W. J. (2000a). The institutional environment for economic growth. Economics and Politics, 12, 1–31.

Henisz, W. J. (2000b). The institutional environment for multinational investment. Journal of Law, Economics and Organization, 16, 334–364.

Henisz, W. J., & Delios, A. (2001). Uncertainty, imitation, and plant location: Japanese multinational corporations, 1990–1996. Administrative Science Quarterly, 46, 443–475.

Henisz, W. J., & Williamson, O. (1999). Comparative economic organization—within and between countries. Business and Politics, 1, 261–277.

Hessels, J., van Gelderen, M., & Thurik, R. (2008). Entrepreneurial aspirations, motivations, and their drivers. Small Business Economics, 31, 3.

Howell, L. D., & Chaddick, B. (1994). Models of political risk for foreign investment and trade. Columbia Journal of World Business, Fall, 70–91.

Jeng, L. A., & Wells, Ph. C. (2000). The determinants of venture capital funding: Evidence across countries. Journal of Corporate Finance, 6(3), 241–289.

Jodice, D. (1985). Political risk assessment: An annotated biography. Westport, CT: Greenwood Press.

Kaufmann, D., Kraay, A., & Mastruzzi, M. (2008). Governance matters VIII: Aggregate and individual governance indicators, 1996–2008. World Bank Policy Research Working Paper No. 4978.

Keuschnigg, C., & Nielsen, S. (2003). Tax policy, venture capital and entrepreneurship. Journal of Public Economics, 87(1), 175–203.

Kortum, S., & Lerner, J. (2000). Assessing the contribution of venture capital to innovation. RAND Journal of Economics, 31(4), 674–692.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. (1997). Legal determinants of external finance. Journal of Finance, 52(3), 1131–1150.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. (1998). Law and finance. Journal of Political Economy, 106(6), 1113–1155.

Lerner, J., & Gurung, A. (Eds.) (2008). The global economic impact of private equity report 2008. Geneva: World Economic Forum.

Li, Q., & Resnick, A. (2003). Reversal of fortunes: Democratic institutions and foreign direct investment inflows to developing countries. International Organization, 57(1), 175–211.

Mattei, U. (1997). Comparative Law and Economics. Ann Arbor, MI: Michigan University Press.

Mauro, P. (1995). Corruption and growth. The Quarterly Journal of Economics, 110(3), 681–712.

Megginson, W. L. (2004). Towards a global model of venture capital? Journal of Applied Corporate Finance, 16(1), 89–107.

Nicoletti, G., Scarpetta, S., & Boylaud, O. (1999). Summary indicators of product market regulation with an extension to employment protection legislation OECD. ECO Working Paper No. 226.

Prast, W. G., & Lax, H. L. (1982). Political risk as a variable in the TNC decision-making. Natural Resources Forum, 6, 183–191.

Schertler, A. (2003). Driving forces of venture capital investments in Europe: A dynamic panel data analysis, European integration, Financial Systems and Corporate Performance (EIFC). Working Paper no 03-27, United Nations University.

UNDP (2008). A user’s guide to measuring corruption (1st ed.). Oslo: United Nations Development Programme.

Acknowledgement

The authors acknowledge financial support from Bocconi University. We are grateful to the Editor, Professor Zoltan Acs, two anonymous reviewers, Stefano Caselli, Pedro Santa-Clara, Stefano Gatti, Douglas Cumming, Marina Balboa, Juan-Carlos Gomez Sala and seminar participants at the UCLA Finance Seminar 2006, Bocconi University Seminar 2007, EFMA Meeting 2007, PFN Conference 2008 for helpful comments and suggestions We are specially indebted with Simona Zambelli for invaluable support and encouragement. This paper was developed while Stefano Bonini was a Visiting Associate Professor at NYU Stern. The ideas expressed in this paper are those of the authors and do not necessarily reflect the position of the authors’ respective institutions. Any errors remain our own.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bonini, S., Alkan, S. The political and legal determinants of venture capital investments around the world. Small Bus Econ 39, 997–1016 (2012). https://doi.org/10.1007/s11187-011-9323-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-011-9323-x