Abstract

COVID-19 unexpectedly ensnared the entire world and wreaked havoc on global economic and financial systems. The stock market is sensitive to black swan events, and the COVID-19 disaster was no exception. Against this backdrop, this study explores the impact of COVID-19 and economic policy uncertainty (EPU) on Chinese stock markets’ returns for the period spanning January 23, 2020 to August 04, 2021. The outcomes of the novel quantile-on-quantile regression analysis revealed that both COVID-19 and EPU had a significant negative impact on both Shanghai and Shenzhen stock market returns, while COVID-19 aggravated the level of economic uncertainty in both financial markets. The quantile causality approach of Troster et al. (2018) validates our main estimations. We conclude that COVID-19 and a high level of EPU enervated the returns of China’s leading stock markets. Our study provides key insights to policymakers and market participants to determine the behavior of China’s stock market returns vis-à-vis COVID-19 during the peak of the pandemic and beyond. Specifically, our findings apprise portfolio investors to augment their portfolio diversification fronts.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Out of the blue, COVID-19 took the entire world in its grip, espousing severe economic uncertainty and wreaking havoc on the global economic and financial systems. The world’s largest stock markets mirrored COVID-19-induced uncertainty and remained extremely volatile compared to former economic and financial crises in history (Baker et al. 2020a). From the onset of the pandemic, China faced economic consequences resulting from lockdowns across the country. Consequently, China’s gross domestic product (GDP) dropped by 6.8%, and the unemployment rate rose to 6.2% in the first quarter of 2020 (National Bureau of Statistics of China, 2020). Similarly, household consumption and fixed asset investment also experienced a significant decline (Zhao, 2020). China responded to the pandemic by implementing a range of exigent steps, including home isolation, business closures, and industrial shutdowns. All of these measures contributed significantly to uncertainty in the economic environment of the country.

China’s stock markets followed suit and experienced a marked decline due to the Chinese government’s virus containment measures, which exacerbated the level of economic uncertainty even further. This uncertainty in the economic environment, or economic policy uncertainty (EPU), is the uncertainty surrounding governmental policies that have a substantial negative impact on a country’s economic and business climate (Nagar et al. 2019; Amin and Dogan 2021). Economic uncertainty has a considerable impact on both the returns and volatility of stock markets (Kannadhasan and Das 2020; Liu and Zhang 2015; Pastor and Veronesi 2012; Yu et al. 2018). Due to COVID-19, financial markets were prone to high levels of volatility, and the level of economic uncertainty remained at a peak amid the pandemic, resulting in unstable and turbulent financial markets (Apergis and Apergis 2020; Zhang et al. 2020a).

The literature pertaining to the economic and financial consequences of COVID-19 is still in the burgeoning phase. In the extant literature, studies have linked COVID-19 to stock returns, but these studies are mainly focused on the USA (Albulescu 2021; Choi 2020; Hong et al. 2021; Latif et al. 2021; Sharif et al. 2020), (Latif et al. 2021; Xu 2021) and Europe (Mogi and Spijker 2021). Limited studies, such as the work of (see, Al-Awadhi et al. 2020b), attempted to explore the impact of COVID-19 on China’s stock market returns. The difference between our study and previous studies in the literature is that they have directly examined the impact of COVID-19 on stock returns. In contrast, this study attempts to examine the linkage between COVID-19 and stock returns via the economic uncertainty channel, particularly in the context of China. By augmenting the COVID-19 and stock market returns nexus via the economic uncertainty channel, we summarize our study’s contribution as follows. First, unlike previous studies covering the first wave of COVID-19, we extend the sample period and explore the response of China’s financial market vis-à-vis COVID-19 for a relatively long period, including the second wave of COVID-19 in China. We contend that examining the impact of COVID-19 and economic policy uncertainty on China’s stock market returns is worth exploring for an extended period of time, as it will provide a better picture of the intensity of the response of financial markets to COVID-19 and how these markets changed or remained similar from the first wave to the second wave. In this way, policy-makers and other financial stakeholders will be able to observe the behavior of the Chinese stock market during the peak of the pandemic and beyond. Second, utilizing a novel economic policy uncertainty measure, we posit that (a) COVID-19 bolstered economic uncertainty in China and (b) economic uncertainty decreased stock returns of both the Shanghai and Shenzhen stock markets. Researchers working on economic uncertainty and stock market linkage have mainly utilized the Bakers (2016) economic uncertainty index. The main drawback of this index is that it derives uncertainty terms from Hong Kong-based newspapers and therefore fails to reflect the overall economic uncertainty in China. In this regard, Huang and Luk (2020) developed a novel EPU index that is based on uncertainty terms extracted from ten Chinese mainland newspapers and gauges economic uncertainty in China more accurately. Third, for estimation purposes, we utilized the novel quantile-on-quantile (QQ) regression methodology. The QQ approach includes a typical quantile regression model, which states how the quantiles of predictive variables affect the provisional quantiles of the outcome variable. The novelty of the QQ approach is that it integrates the fundamentals of quantile regression and nonparametric estimation. The QQ approach not only highlights nonlinearities in the data series but also delineates the detailed relationship between the quantiles of explanatory variables and the quantiles of the outcome variable. In summary, this methodology allows us to gauge the characteristics of the complete distribution of independent variables (IVs) and dependent variables (DVs) and, concurrently, reveals the complex asymmetric association between IVs and DVs. This asymmetric approaches including the QQ approach have now been widely used by researchers in recent times for addressing questions in various domains of economics and finance (Adebayo et al. 2022a, b; Akadiri et al. 2022; Arain et al. 2020; Bouri et al. 2017; Chang et al. 2020; Çıtak et al. 2021; Fareed et al. 2021, 2022; Hashmi et al. 2021; Lin and Su 2020; Mishra et al. 2019; Sharif et al. 2019, 2020; Sim and Zhou 2015; Syed et al. 2022; Yasmeen et al. 2022). Fourth, we intend to explore the causal association between COVID-19 and stock market returns in China, utilizing the Troster et al. (2018) quantile causalities approach. This technique pinpoints the causal associations among variables in quantiles context and works as a robustness tool for the QQ approach. The prime advantage of this technique is to decipher causalities across the whole distribution in the vector autoregression (VAR) framework, often overlooked by the conventional Granger causality (Granger 1969) approach.

The prime motivation behind this study is to determine the impact of COVID-19 on China’s stock market returns in the presence of economic policy uncertainty (EPU) measure for an extended period of time spanning January 23, 2020, to August 04, 2021. Utilizing the novel EPU index introduced by Huang and Luk (2020) and the advanced batteries of econometrics such as the quantile-on-quantile approach; the outcomes of the study imply that COVID-19 propelled economic uncertainty in China and that the response of the stock returns of both the Shanghai and Shenzhen stock markets was negative toward COVID-19. We observed that owing to COVID-19, as the level of economic uncertainty increased, the stock returns of both the Shanghai and Shenzen stock markets returns exhibited negative trends. Our main outcomes turn out to be robust to alternative econometrics specifications. The findings of our study will assist policy-makers and investors in judging the behavior of China’s stock markets during the peak period of the COVID-19 crisis and beyond and educate portfolio investors to complement their portfolio diversification strategies.

The remainder of the study unfolds as follows. The “Theoretical underpinning” and the “Data and econometric methodology” sections describe the theoretical rationale and data and methodological framework, respectively. The “Empirical results and discussion” section presents empirical outcomes and discussion. The “Conclusion and policy implications” section presents concluding remarks and policy implications. The “Limitations and future research avenues” section, which is the last section, reports the study’s limitations and outlines future research directions.

Theoretical underpinning

This research work builds upon its rationale on the efficient market theory, the prospect, and the black swan theories. The efficient market theory proposed by Fama (1965) states that the stock prices are vulnerable to all the available information in the market, which consists of financial information in the past (weak form efficiency), newly public information (semi-strong form efficiency), and all new private financial information of an asset (strong form efficiency). The prospect pioneered by Kahneman and Tversky (1979), also known as the “Fathers of Behavioral Finance,” claims that investors avoid risk when they are confronted by highly uncertain situations. In such scenarios, they prefer investments with certain expected values commensurate to certain risks. The black swan theory explicates that financial markets are prone to highly uncertain black swan events (Nicholas Taleb 2015; Taleb 2007). Owing to the COVID-19 pandemic, the speed of economic activities derailed, and the level of economic uncertainty has elevated, which led to an unemployment surge, lower household spending, and compelled investors to adopt a wait-and-see investment strategy, ultimately resulting in an aggregate demand reduction. Being the epicenter of COVID-19, not only the speed of economic activities slow down, but the financial markets in China received significant blows and exhibited severe bearish trends.

Data and econometric methodology

We obtained the data for COVID-19 measured via daily COVID incidents from the Center for Systems Science and Engineering of Johns Hopkins University. The sample period starts from the first date of the Chinese government complete lockdown, i.e., January 23, 2020, to August 04, 2021, which was our final analysis date. We argue that the selection of the period is important since it not only encompasses the first wave of COVID-19 but also incorporates the second wave during which the financial markets remained highly volatile. Majority of the previous studies considered the first wave of the pandemic. However, they failed to account for the impact of the second wave, which could provide valuable insights to the market players. Daily data for the Shanghai and Shenzhen stock markets are retrieved from the CEIC database. We obtained the daily returns of both markets via \(P_{it}\;=\;P_{it}/P_{it-1}\;\), where Pit denotes the daily closing prices. Due to stock exchange holidays, we commensurated the COVID-19 daily cases to the available data of both stock markets. Finally, we visited the website (www.economicpolicyuncertaintyinchina.weebly.com) to obtain daily EPU data. The data used for analysis was taken in logarithmic form.

We used the quantile-on-quantile regression (QQ) estimation technique suggested by Sim and Zhou (2015) to examine the impact of COVID-19 and economic policy uncertainty on Chinese stock markets. This section highlights the attributes of the quantile-on-quantile regression approach, together with the model specifications used in the study. This approach can be considered an extension of the standard quantile regression model, which estimates how the quantile of one variable affects the conditional quantile of another variable. Previous studies first used the classical linear regression model to study the relationship between time-series data and later shifted to the Koenker and Bassett Jr (1978) conventional quantile regression approach (QR). The QQ approach combines the features of both nonparametric estimation and QR estimation techniques. Under this approach, the first QR approach was used to investigate the impact of explanatory variables on the quantiles of the dependent variables. Unlike conventional least square estimation, the QR estimation technique inspects the impact of explanatory variables both at the center and at the tail of the distribution of dependent variables and thus provides the opportunity to comprehensively evaluate the relationship between the different periods of the study (Koenker and Ng 2005). Second, local linear regression given by Stone (1977) and Cleveland (1979) was also employed to evaluate the local effect between the variables and to avoid the curse of dimensionality. Local linear regression helped to investigate the local impact of a specific quantile of an independent variable on the dependent variable by assigning more weight to the close neighbors in the sample. Thus, combining these two approaches, the QQ approach helped comprehensively assess the relationship between the quantile of dependent and independent variables compared to other OLS estimation techniques. The QQ approach is widely used in various energy and growth economics to study how the quantile of one variable impacts the conditional quantile of another variable (Kumah and Mensah 2020). Hence, based on the above benefits, we employed the QQ estimation technique to estimate the impact of the quantiles of economic policy uncertainty and COVID-19 on the quantile of the Chinese stock exchange. The following equation represents the starting point of the QQ approach.

where SRt represents the stock returns for the period t and COVt denotes the COVID-19 incidents at period t, and θ denotes the θth quantile distribution of SRt The subscript, \({\mu}_t^{\theta }\) represents the quantile error terms whose conditional θth is zero. Since we have no prior knowledge about the relationship between economic policy uncertainty, COVID-19 and stock markets, we assumed βθ(∙) as an unknown function.

This model measures the impact of economic policy uncertainty and COVID-19 on the Chinese stock market returns while permitting EPU and COVID-19 to vary across different quantiles of China’s stock market. This approach is superior to previously reported results because of its flexible specification, as there is no functional form of the relationship developed between economic policy uncertainty, COVID-19, and China’s stock market return. The ability to capture dependence is one of the limitations of the QR estimation technique. In reference, the QR model does not consider that the nature of the COVID-19 shock affected the manner in which COVID-19 and the Chinese stock market returns are related. For instance, there can be an asymmetric relation between the stock market return and COVID-19, or the impact of the large positive shock of COVID-19 may vary from the small positive shocks vis-à-vis stock market returns.

To restate the relationship between the θth quantile of COVID-19, economic policy uncertainty and the τth quantile of stock market returns, Eq. 1 was investigated in the neighborhood of COVIDτ by using local linear regression. Based on the unknown value of βθ(∙), the equation was expanded using the first-order Taylor expansion method around the quantile of COVIDτ.

where \({\beta}^{\theta^{\prime }}\) denotes the partial derivative of (COVt), which is also referred to as the marginal response and is equivalent to the slope of the coefficient in a linear regression model.

An important trait of Eq. 2 is that parameters βθ(COVτ) and \({\beta}^{\theta^{\prime }}\) (COVτ) are doubled indexed in θ and τ.Consequently, βθ(COVτ) and \({\beta}^{\theta^{\prime }}\) (COVτ) are functions of θ and COVτ. Furthermore, COVτ is a function of τ.It is evident that βθ(COVτ) and \({\beta}^{\theta^{\prime }}\) (COVτ) are functions of θ and τ.Moreover, βθ(COVτ) and \({\beta}^{\theta^{\prime }}\) (COVτ) can be rewritten as β0 (θ, τ) and β1 (θ, τ), respectively.

Subsequently, Eq. (2) can be rewritten as:

The following Eq. 4 is formed by replacing Eq. (3) and Eq. (1):

where (∗) denotes the conditional quantile of the stock market returns. In addition, Eq. 4 highlights the relationship between the quantile stock market return (θth), the quantile of COVID-19 and the economic policy uncertainty (τth) of parameters β0 and β1 including indices θ and τ. Moreover, we did not consider a linear relationship between the quantiles of the variables. Consequently, Eq. 4 evaluated the overall dependence between stock market returns, COVID-19 and EPU through the dependence between their distributions. As in OLS, a simple minimization is used to derive Eq. 4.

where ρθ is the quantile loss function constituted as ρθ(u) = u( θ – 1(u<0)), and i denotes the function of the indicator. Furthermore, K (∗) and h are the kernel density function and bandwidth parameters, respectively. K (∗) measures the observation of EPU, COVτ, where the minimal weights are negatively assigned to the distribution function of \(\widehat{COV_t}\) as \({F}_n\widehat{\left({COV}_t-\tau \right)}=\frac{1}{n}{\sum}_{k=1}^nI\Big(\widehat{COV_k}<\widehat{COV_t}\)).

Previous studies highlight that using nonparametric estimation makes the selection of bandwidth more critical (Shahzad et al. 2017). It determines the smoothness of the results by calculating the dimensions of the neighborhood around the target point. A smaller bandwidth results in estimates with higher variance, whereas a larger bandwidth will provide an estimate with a higher bias. Hence, the selection of an optimal bandwidth is needed to maintain a balance between the variance and bias. Based on the approach of Sim and Zhou (2015), we used the bandwidth parameter h=[0.05 to 0.95].

Granger causality in quantiles

To ascertain the causal association between quantiles of COVID, economic policy uncertainty and quantiles of stock market returns, we employed the quantile Granger causality approach pioneered by Troster et al. (2018). This methodology not only delineates the causal directional associations in quantiles between predictor and outcome variables but also serves as a robustness check for the main estimates. The prime advantage of this approach is capturing the tail dependency in the series by highlighting the causal associations at different locations of the outcome variable in the vector autoregression (VAR) framework, which is ignored by the conventional Granger causality (Granger 1969) approach. Linear Granger causality estimates may be unreliable, as they are determined based on the median, which cannot uncover causal associations that may exist among different quantiles.

Empirical results and discussion

The descriptive statistics of all the indicators are presented in Table 1. Most of the descriptive statistics are positive. The summary statistics contain the mean, median, maximum, minimum, standard deviation, skewness kurtosis, and Jarque-Bera statistics. The values of the Jarque-Bera test were obtained by inferring that our model exhibits deviation from the normal distribution and thereby necessitates an asymmetric approach such as quantile-on-quantile for empirical estimation (Shahbaz et al. 2017; Ullah et al. 2021; Ullah et al. 2020b).

Broock, Deschert, and Sheinkman test (BDS)

To further verify the nonlinear behavior of our data series, we employed the Broock et al. (1996) test, also known as the BDS test. In this test, the null hypothesis H0 assumes independent and identically distributed (i.i.d) residuals, whereas the alternative hypothesis assumes that the residual series exhibits an aberration from independence, hence signifying nonlinear dependenceFootnote 1. The outcomes of the BDS test reported in Table 2 show that H0 of (i.i.d.) residuals is rejected in favor of the alternative hypothesis. The outcomes provide sufficient evidence that the data series exhibited nonlinear behavior, thereby necessitating the applicability of a nonlinear methodology (Atil et al. 2014; Ullah et al. 2020a)

To further examine whether the variables included in the model exhibit a nonlinear trend, we have employed the Kruse (2011) nonlinear unit root test to examine. The outcomes of the test suggest that the linear unit root postulation for all the variables receive rejection at the level of 1% and 5% significance levels, respectively. Hence, it is deduced that the linearity postulation is rejected, and our model is following a nonlinear stationary process. Table 3 reports the outcomes of the Kruse (2011) nonlinear unit root test.

This study intends to probe the relationship between COVID-19 and stock market returns in quantiles context; it is desirable to verify the stationarity proprieties in quantiles for our data series. To this end, we have employed the quantile unit root test proposed by Koenker and Xiao (2006). The estimations of the quantile unit root test suggest that the variables included in the model are level nonstationary. These outcomes are reported in Table 4.

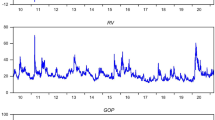

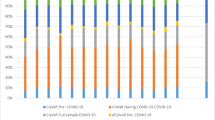

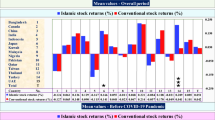

Figure 1 portrays the association between the quantiles of COVID-19 and economic policy uncertainty (EPU) quantiles. We noticed that the higher quantiles of COVID-19 had a positive effect on the medium and higher quantiles of EPU. These empirical outcomes entailed that EPU exhibited a surge with the increase in daily cases of COVID-19 in China. The impact of COVID-19 on stock returns for both the Shanghai and Shenzhen stock markets was negative. Figures 2 and 3 denote that the upper quantiles of COVID-19 negatively influenced the upper quantiles of both the Shanghai and Shenzhen stock markets. The negative relationship between COVID-19 and China’s stock market was imminent as the Chinese government adopted strict measures to contain the spread of the novel coronavirus. Our findings support the results of Shen et al. (2020), who discovered that both the investment scale and the total industrial revenue of Chinese corporations exhibited declines due to the COVID-19 pandemic. The total number of deaths confirmed cases and fear of COVID-19 had a detrimental effect on stock returns (Al-awadhi et al. 2020a; Subramaniam and Chakraborty 2021). Black swan events such as the COVID-19 compel investors to adopt wait-and-see investment strategies and urge them to opt for alternative asset investments to hedge their risk. In the extant literature, our findings are congruent with the outcomes of (Li et al. 2021). They asserted owing to the COVID-19 pandemic, governments had no option except implementation of traveling ban, schools’ closure, lockdown, shutting down business operations. These measures inhibited various pillars of economic growth, including stock exchange performance, as investors confronted huge losses amid the recent pandemic. The reaction of equity markets vis-à-vis COVID-19 was hostile as stock markets experienced high volatility during the recent pandemic (Baker et al. 2020b; Zhang et al. 2020a). Our findings support the supply of stock market returns postulation, which asserts that economic development/growth defines returns volatility and volume of shares trading in the stock markets. The dismal performance of the equity markets is defined by the slow pace of real economic activities amind the recent pandemic (Baker et al. 2020b; Fernandes 2020; McKibbin and Fernando 2021).

We established that COVID-19 exacerbated economic policy uncertainty and led to dwindling stock market returns in China. We further inquired whether EPU had some influence on the returns of the Shanghai and Shenzhen stock markets. Our empirical findings reported in Figs. 4, 5 and 6; imply that the extreme lower and extreme higher quantiles of the EPU negatively influence all the quantiles of both stock markets’ returns. The medium quantiles of EPU bear positive influence on the medium quantiles of stock returns of both financial markets. These outcomes entail that the initial response of Chinese stock markets was negative toward COVID; however, with the passage of time and the introduction of vaccines, the level of EPU became moderate and the Chinese stock markets exhibited recovery. Owing to the second wave, the EPU level rose gain and the response of the stock markets’ returns became hostile vis-à-vis higher levels of EPU. Based on these findings, we establish that COVID spurred China’s economic uncertainty, which, in turn, dissipated the returns of both the Shanghai and Shenzhen stock markets. Real options theory postulates that managers adopt wait-and-see investment attitudes by deferring their investments in response to increased uncertainty. COVID-19 prompted managers to adopt risk-averse attitudes and led to a surge in their cash holdings as they coped with the recent crisis. The motive for excess cash tends to reduce investments in profitable projects and decrease the revenue of corporations, which, in turn, subsidizes the overall stock returns. Corporations experienced nominal productivity and a record low revenue because of the strict quarantine measures (Hu and Zhang 2021; Wu et al. 2021). The containment of COVID-19 cases with tools such as smart lockdowns and provision of subsidies and the introduction of expansionary policies will not only save precious lives and at the same will instill steadiness in economic activities. Such measures will reduce economic uncertainty and leverage investors’ confidence, which, in turn, will propel the performance of stock markets in China.

Granger causality in quantiles

Subsequent to the quantile-on-quantile estimations, it is necessary to inquire about the causal links among the quantiles of variables included in the model. In this respect, we utilized the quantile causality approach recently introduced by Troster et al. (2018). Tables 5 and 6 show the empirical results of the Granger causality in quantiles. The results indicate that there is a lead-lag relationship between COVID-19 and economic policy uncertainty at the 0.05, 0.45, and 0.95 quantiles and that this association is significant at the 5% level. The Granger causality in quantiles outcomes show that COVID-19 affected the stock returns of both the Shanghai and Shenzhen stock markets at low, medium, and high quantiles. These outcomes validate the vulnerability of stock market returns to the COVID-19 catastrophe. The returns of both markets have a causal linkage with COVID-19, which confirmed the feedback effect between COVID-19 and the Shanghai and Shenzhen stock markets. As COVID-19 exacerbated economic uncertainty and influenced Chinese stock market returns, we inquired whether there was a causal linkage between EPU and stock market returns. The results show that all the quantiles of EPU (0.10, 0.15, 0.20 to 0.65, 0.70, 0.75, 0.80), except for a few quantiles, influenced the returns for both stock markets. Moreover, we also observed a feedback relationship between EPU and both markets.

Conclusion and policy implications

COVID-19 has led to an unprecedented economic environment and has attracted the attention of organizations, policy-makers, and individual investors to manage and diversify its implications on financial markets and economies around the globe. Due to the virus’ contagious nature, governments around the world adopted several aggressive policies, which may have had adverse effects on economic activities. Economies around the world were disrupted with the onset of COVID-19, which carried consequences for economic and financial systems, and uncertainty in political and economic environments also increased manifold during this period. In this context, this study explores the relationship between COVID-19, economic policy uncertainty (EPU), and stock market returns in the Shanghai and Shenzhen stock markets by utilizing a quantile-on-quantile (QQ) approach. The empirical findings of this study signify that both COVID-19 and EPU adversely affect Shanghai and Shenzhen’s stock market returns, while COVID-19 increases the level of economic uncertainty in both markets. Unlike previous studies, we utilized extended time periods, and based on the outcomes, inferred that Chinese stock returns still exhibit a hostile nature toward COVID-19 and high levels of EPU during the first and second waves.

In terms of the policy implications, our findings offer key insights to the policy-makers, as it emphasizes the need to strive to subsidize economic uncertainty through conspicuous communication concerning macroeconomic fundamentals and ease the regulatory pressure to assist investors in the COVID-stricken financial stress periods. To this end, policy-makers must introduce expansionary policies to slow down the considerable contraction in economic activities. In addition to the unmatchable measures taken for curbing the novel coronavirus, the Chinese government should leverage COVID-stricken industries by designing preferential policies and allocating subsidies for their smooth recovery. The provision of loans at lower interest rates and tax reductions may assist companies in bouncing back from the financial heart attack attributed to COVID-19. Our findings corroborate that the behavior of Chinese stock markets toward the second wave of COVID-19 remained akin to the first wave. Based on these findings, we suggest that the prospective waves of COVID-19 can be better handled by taking lessons from the previous waves, and the policymakers should safeguard investors by designing policies aimed at subsiding volatility in the stock markets. The results of our study also suggest that investors should be wary of investing during turmoil periods and investments in highly diversified portfolios should be preferred. A relatively stable market with minimum fluctuations would be a better choice for designing investment portfolios. Conversely, our study also guides investors to opt for alternative investments such as gold to cope with a highly volatile market.

Limitations and future research avenues

As the epicenter of COVID-19, this study only focused on China’s stock markets. Our research work may guide other emerging economies to delineate the impact of COVID-19 on their financial markets via the economic policy uncertainty channel; in particular, the applicability of sophisticated econometric methodology in our case may guide researchers to establish reliable results for the policy-makers and investors to determine the stock market behavior amid recent pandemic. The scope of this study is predicated on a macro level. Future studies should further probe the impact of COVID-19 on China’s stock market on a sectoral level. This exercise will further assist policymakers and particularly the portfolio investors in identifying asymmetries and gauge the response of stock return vis-à-vis COVID on a disaggregate level. Put differently, determining the impact of COVID-19 on stock returns on a disaggregate level will portray a comprehensive picture regarding the positive/negative response of each sector toward COVID-19. In this study, we have used a bivariate methodology to investigate the impact of COVID-19 and economic policy uncertainty on China’s stock market returns. Future studies may analyze the question at hand in a multivariate framework utilizing time series or panel-based econometrics batteries. We hope to bridge these gaps in our future research work.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author upon reasonable request.

Notes

Detailed explanation of the BDS test is available in Broock et al. (1996) paper

References

Adebayo TS, Agyekum EB, Altuntaş M, Khudoyqulov S, Zawbaa HM, Kamel S (2022a) Does information and communication technology impede environmental degradation? fresh insights from non-parametric approaches. Heliyon 8(3):e09108. https://doi.org/10.1016/j.heliyon.2022.e09108

Adebayo TS, Akadiri SS, Akpan U, Aladenika B (2022b) Asymmetric effect of financial globalization on carbon emissions in G7 countries: fresh insight from quantile-on-quantile regression. Energy Environ 0958305X2210842. https://doi.org/10.1177/0958305X221084290

Akadiri SS, Adebayo TS, Asuzu OC, Onuogu IC, Oji-Okoro I (2022) Testing the role of economic complexity on the ecological footprint in China: a nonparametric causality-in-quantiles approach. Energy Environ 0958305X2210945. https://doi.org/10.1177/0958305X221094573

Al-awadhi AM, Alsaifi K, Al-awadhi A, Alhammadi S (2020a) Journal of Behavioral and Experimental Finance Death and contagious infectious diseases : impact of the COVID-19 virus on stock market returns. J Behav Exp Financ 27:100326. https://doi.org/10.1016/j.jbef.2020.100326

Al-Awadhi AM, Alsaifi K, Al-Awadhi A, Alhammadi S (2020b) Death and contagious infectious diseases: impact of the COVID-19 virus on stock market returns. J Behav Exp Financ 27:100326. https://doi.org/10.1016/j.jbef.2020.100326

Albulescu CT (2021) COVID-19 and the United States financial markets’ volatility. Financ Res Lett. https://doi.org/10.1016/j.frl.2020.101699

Amin A, Dogan E (2021) The role of economic policy uncertainty in the energy-environment nexus for China: evidence from the novel dynamic simulations method. J Environ Manag 292:112865. https://doi.org/10.1016/j.jenvman.2021.112865

Apergis E, Apergis N (2020) Can the COVID-19 pandemic and oil prices drive the US Partisan Conflict Index? Energy Res Lett. https://doi.org/10.46557/001c.13144

Arain H, Han L, Sharif A, Meo MS (2020) Investigating the effect of inbound tourism on FDI: the importance of quantile estimations. Tour Econ 26(4):682–703. https://doi.org/10.1177/1354816619859695

Atil A, Lahiani A, Nguyen DK (2014) Asymmetric and nonlinear pass-through of crude oil prices to gasoline and natural gas prices. Energy Policy 65:567–573. https://doi.org/10.1016/j.enpol.2013.09.064

Baker SR, Bloom N, Davis, SJ, Kost K, Sammon MC, Viratyosin T (2020a) The unprecedented stock market impact of COVID-19. The Review of Asset Pricing Studies 10(4):742–758

Baker SR, Bloom N, Davis SJ, Kost K, Sammon M, Viratyosin T (2020b) The unprecedented stock market reaction to COVID-19. Rev Asset Pric Stud 10(4):742–758

Bouri E, Gupta R, Tiwari AK, Roubaud D (2017) Does Bitcoin hedge global uncertainty? Evidence from wavelet-based quantile-in-quantile regressions. Financ Res Lett 23:87–95. https://doi.org/10.1016/j.frl.2017.02.009

Broock WA, Scheinkman JA, Dechert WD, LeBaron B (1996) A test for independence based on the correlation dimension. Econ Rev 15(3):197–235. https://doi.org/10.1080/07474939608800353

Chang BH, Sharif A, Aman A, Suki NM, Salman A, Khan SAR (2020) The asymmetric effects of oil price on sectoral Islamic stocks: new evidence from quantile-on-quantile regression approach. Res Policy 65(December 2019):101571. https://doi.org/10.1016/j.resourpol.2019.101571

Choi S-Y (2020) Industry volatility and economic uncertainty due to the COVID-19 pandemic: evidence from wavelet coherence analysis. Financ Res Lett 37:101783. https://doi.org/10.1016/j.frl.2020.101783

Çıtak F, Şişman MY, Bağcı B (2021) Nexus between disaggregated electricity consumption and CO2 emissions in Turkey: new evidence from quantile-on-quantile approach. Environ Ecol Stat. https://doi.org/10.1007/s10651-021-00504-5

Cleveland WS (1979) Robust locally weighted regression and smoothing scatterplots. J Am Stat Assoc 74(368):829–836. https://doi.org/10.1080/01621459.1979.10481038

Fama EF (1965) The behavior of stock-market prices. J Bus. https://doi.org/10.1086/294743

Fareed Z, Salem S, Adebayo TS, Pata UK, Shahzad F (2021) Role of export diversification and renewable energy on the load capacity factor in Indonesia: a fourier quantile causality approach. Front Environ Sci. https://doi.org/10.3389/fenvs.2021.770152

Fareed Z, Rehman MA, Adebayo TS, Wang Y, Ahmad M, Shahzad F (2022) Financial inclusion and the environmental deterioration in Eurozone: the moderating role of innovation activity. Technol Soc 69:101961. https://doi.org/10.1016/j.techsoc.2022.101961

Fernandes N (2020) Economic effects of coronavirus outbreak (COVID-19) on the world economy. SSRN Electron J. https://doi.org/10.2139/ssrn.3557504

Granger CWJ (1969) Investigating causal relations by econometric models and cross-spectral methods. Econometrica. https://doi.org/10.2307/1912791

Hashmi SH, Fan H, Fareed Z, Shahzad F (2021) Asymmetric nexus between urban agglomerations and environmental pollution in top ten urban agglomerated countries using quantile methods. Environ Sci Pollut Res 28(11):13404–13424. https://doi.org/10.1007/s11356-020-10669-4

Hong H, Bian Z, Lee CC (2021) COVID-19 and instability of stock market performance: evidence from the US. Financial Innov. https://doi.org/10.1186/s40854-021-00229-1

Hu S, Zhang Y (2021) COVID-19 pandemic and firm performance: cross-country evidence. Int Rev Econ Financ 74:365–372. https://doi.org/10.1016/j.iref.2021.03.016

Huang Y, Luk P (2020) Measuring economic policy uncertainty in China. China Econ Rev 59(June 2019):101367. https://doi.org/10.1016/j.chieco.2019.101367

Kahneman D, Tversky A (1979) Prospect theory: an analysis of decision under risk. Econometrica 47(2):363–391

Kannadhasan M, Das D (2020) Do Asian emerging stock markets react to international economic policy uncertainty and geopolitical risk alike? A quantile regression approach. Financ Res Lett 34:101276

Koenker R, Bassett G Jr (1978) Regression quantiles. Econometrica: J Econ Soc 46(1):33–50

Koenker R, Ng P (2005) Inequality constrained quantile regression. Sankhyā: Indian J Stat 2005:418–440

Kruse R (2011) A new unit root test against ESTAR based on a class of modified statistics. Stat Pap 52(1):71–85. https://doi.org/10.1007/s00362-009-0204-1

Kumah SP, Mensah JO (2020) Are cryptocurrencies connected to gold? A wavelet-based quantile-in-quantile approach. Int J Financ Econ, ijfe.2342. https://doi.org/10.1002/ijfe.2342

Latif Y, Shunqi G, Bashir S, Iqbal W, Ali S, Ramzan M (2021) COVID-19 and stock exchange return variation: empirical evidences from econometric estimation. Environ Sci Pollut Res 28(42):60019–60031. https://doi.org/10.1007/s11356-021-14792-8

Li W, Chien F, Kamran HW, Aldeehani TM, Sadiq M, Nguyen VC, Taghizadeh-Hesary F (2021) The nexus between COVID-19 fear and stock market volatility. Econ Res-Ekonomska Istrazivanja 0(0):1–22. https://doi.org/10.1080/1331677X.2021.1914125

Lin B, Su T (2020) The linkages between oil market uncertainty and Islamic stock markets: evidence from quantile-on-quantile approach. Energy Econ 88:104759. https://doi.org/10.1016/j.eneco.2020.104759

Liu L, Zhang T (2015) Economic policy uncertainty and stock market volatility. Financ Res Lett 15:99–105. https://doi.org/10.1016/j.frl.2015.08.009

McKibbin W, Fernando R (2021) The global macroeconomic impacts of covid-19: Seven scenarios. Asian Econ Pap. https://doi.org/10.1162/asep_a_00796

Mishra S, Sharif A, Khuntia S, Meo MS, Rehman Khan SA (2019) Does oil prices impede Islamic stock indices? Fresh insights from wavelet-based quantile-on-quantile approach. Res Policy 62:292–304. https://doi.org/10.1016/j.resourpol.2019.04.005

Mogi R, Spijker J (2021) The influence of social and economic ties to the spread of COVID-19 in Europe. J Popul Res 6(2):1–17

Nagar V, Schoenfeld J, Wellman L (2019) The effect of economic policy uncertainty on investor information asymmetry and management disclosures. J Account Econ. https://doi.org/10.1016/j.jacceco.2018.08.011

Nicholas Taleb N (2015) The black swan: the impact of the highly improbable. Victoria 250:595–7955

Pastor L, Veronesi P (2012) Uncertainty about government policy and stock prices. J Financ 67(4):1219–1264. https://doi.org/10.1111/j.1540-6261.2012.01746.x

Shahbaz M, Van Hoang TH, Mahalik MK, Roubaud D (2017) Energy consumption, financial development and economic growth in India: new evidence from a nonlinear and asymmetric analysis. Energy Econ 63:199–212. https://doi.org/10.1016/j.eneco.2017.01.023

Shahzad SJH, Shahbaz M, Ferrer R, Kumar RR (2017) Tourism-led growth hypothesis in the top ten tourist destinations: new evidence using the quantile-on-quantile approach. Tour Manag 60:223–232. https://doi.org/10.1016/j.tourman.2016.12.006

Sharif A, Shahbaz M, Hille E (2019) The transportation-growth nexus in USA: fresh insights from pre-post global crisis period. Transp Res A Policy Pract 121:108–121. https://doi.org/10.1016/j.tra.2019.01.011

Sharif A, Aloui C, Yarovaya L (2020) COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: fresh evidence from the wavelet-based approach. Int Rev Financ Anal. https://doi.org/10.1016/j.irfa.2020.101496

Shen H, Fu M, Pan H, Yu Z, Chen Y (2020) The impact of the COVID-19 pandemic on firm performance. Emerg Mark Financ Trade 56(10):2213–2230. https://doi.org/10.1080/1540496X.2020.1785863

Sim N, Zhou H (2015) Oil prices, US stock return, and the dependence between their quantiles. J Bank Financ. https://doi.org/10.1016/j.jbankfin.2015.01.013

Stone CJ (1977) Consistent nonparametric regression. Ann Stat:595–620

Subramaniam S, Chakraborty M (2021) COVID-19 fear index: does it matter for stock market returns? Rev Behav Finance. https://doi.org/10.1108/RBF-08-2020-0215

Syed AA, Kamal MA, Ullah A, Grima S (2022) An asymmetric analysis of the influence that economic policy uncertainty, institutional quality, and corruption level have on India’s digital banking services and banking stability. Sustainability 14(6):3238. https://doi.org/10.3390/su14063238

Taleb NN (2007) Black swans and the domains of statistics. Am Stat 61(3):198–200

Troster V, Shahbaz M, Uddin GS (2018) Renewable energy, oil prices, and economic activity: a Granger-causality in quantiles analysis. Energy Econ 70:440–452. https://doi.org/10.1016/j.eneco.2018.01.029

Ullah A, Xinshun Z, Kamal MA, JiaJia Z (2020a) Modeling the relationship between military spending and stock market development (a) symmetrically in China: an empirical analysis via the NARDL approach. Physica A: Stat Mech Its Appl 554:124106. https://doi.org/10.1016/j.physa.2019.124106

Ullah A, Zhao X, Abdul Kamal M, Zheng J (2020b) Environmental regulations and inward FDI in China: fresh evidence from the asymmetric autoregressive distributed lag approach. Int J Financ Econ 27(1):1340–1356. https://doi.org/10.1002/ijfe.2218

Ullah A, Zhao X, Kamal MA, Riaz A, Zheng B (2021) Exploring asymmetric relationship between Islamic banking development and economic growth in Pakistan: fresh evidence from a non-linear ARDL approach. Int J Financ Econ 26(4):6168–6187. https://doi.org/10.1002/ijfe.2115

Wu W, Lee C-C, Xing W, Ho S-J (2021) The impact of the COVID-19 outbreak on Chinese-listed tourism stocks. Financial Innov 7(1):22. https://doi.org/10.1186/s40854-021-00240-6

Xu L (2021) Stock Return and the COVID-19 pandemic: evidence from Canada and the US. Financ Res Lett. https://doi.org/10.1016/j.frl.2020.101872

Yasmeen R, Hao G, Ullah A, Shah WUH, Long Y (2022) The impact of COVID-19 on the US renewable and non-renewable energy consumption: a sectoral analysis based on quantile on quantile regression approach. Environ Sci Pollut Res 5(1):1–16

Yu H, Fang L, Sun W (2018) Forecasting performance of global economic policy uncertainty for volatility of Chinese stock market. Physica A: Stat Mech Its Appl 505:931–940

Zhang D, Hu M, Ji Q (2020a) Financial markets under the global pandemic of COVID-19. Financ Res Lett. https://doi.org/10.1016/j.frl.2020.101528

Zhang D, Hu M, Ji Q (2020b) Financial markets under the global pandemic of COVID-19. Financ Res Lett 36:101528. https://doi.org/10.1016/j.frl.2020.101528

Author information

Authors and Affiliations

Contributions

Assad Ullah conceived the idea, wrote original draft, and finished formal analysis. Xinshun Zhao supervised the article and contributed toward conceptual and computational part of the study. Azka Amin and Aamir Aijaz Sayyed revised literature review section and verified the methodology. Adeel Riaz analyzed the data and reviewed final draft. All authors discussed the results and reviewed and finalized the draft.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Arshian Sharif

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ullah, A., Zhao, X., Amin, A. et al. Impact of COVID-19 and economic policy uncertainty on China’s stock market returns: evidence from quantile-on-quantile and causality-in-quantiles approaches. Environ Sci Pollut Res 30, 12596–12607 (2023). https://doi.org/10.1007/s11356-022-22680-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-22680-y