Abstract

This research work seeks to examine a specific issue of the Algerian public debt sustainability using a nonlinear model approach. The results obviously indicate that the existence of threshold effects in the Algerian public debt depends on the sixth lag in oil price (US $ 80.85 per barrel). Thus, nonlinear unit root tests accept the null hypothesis of the unit roots; this intends to convey that the time series of public debt is not stationary and therefore cannot sustain the public debt in Algeria over the long term.

Similar content being viewed by others

Notes

MENAP oil exporters include: Algeria, Bahrain, Iran, Iraq, Kuwait, Libya, Oman, Qatar, Saudi Arabia, the United Arab Emirates, and Yemen.

Public entities include: Algérie Poste, local governments, and other public institutions. The government has an obligation to replenish the deposits used to finance the budget deficit, although there is no set timeframe.

Algeria created an oil stabilization fund (Fonds de Regulation des Recettes, or FRR) in 2000 to insulate the Algerian economy from volatility in hydrocarbon prices. There is a saving rule that stipulates that oil revenue is saved into the FRR above the oil price threshold of US$37 per barrel. The FRR was depleted in February 2017.

The central government also finances part of its deficit by using deposits from other public entities in the single treasury account “circuit du Trésor”. The government does not include such financing as public debt although, in essence, it incurs a liability.

The government issued bonds for about 9% of GDP to finance the purchase of debt owed by a utility company to a public bank and to compensate the state-owned oil company for losses incurred from selling imported refined fuel in the domestic market at subsidized prices. Debt figures including central government guarantees of 48% of GDP in 2017. Government guarantees consisted of guarantees of public enterprises’ borrowing from state-owned banks (21% of GDP in 2017).

The distinction between finite and infinite horizon will be important when it comes to defining the various sustainability indicators.

See Table 6 in appendix for strengths and weaknesses of each of the approaches.

Whether Zt is a strongly or weakly exogenous process, a necessary and sufficient condition for the transversality condition given by (9) to be satisfied is that, if Xt is structurally stable, then it should be a zero-mean stationary process.

This state dependent two regime process will imply that the further the fiscal balance deviates from the equilibrium, the faster will be the mean reversion.

For more details see: Chibi et al. (2014).

We refer to this test as the nonlinear augmented Dickey–Fuller (NLADF) test.

Hence, Sollis (2009) proposes a KSS-type test, which distinguishes between asymmetric or symmetric effects under the alternative hypothesis, i.e., the speed of mean reversion will be different depending on the sign of the shock and not only its size. He proposes to test for unit roots in this nonlinear framework using the auxiliary equation:

$$\Delta Y_{t} = \beta_{1} \,Y_{t - 1}^{3} + \beta_{2} \,Y_{t - 1}^{4} + {\text{error}}$$The null hypothesis of symmetric STAR versus the alternative of asymmetric STAR.

For more details about this method see the appendix in Chibi et al. (2014).

Total gross central government debt to GDP ratio annual data is gathered from: Carmen M. Reinhart website data (1964–1990), Trading economics website data (1991–2014) and Knoema website Data (2015–2016).

Crude Oil Prices quarterly data are compiled from: Federal Reserve Bank of ST. Louis and OPEC basket price.

Government public spending (% GDP) annual data are gathered from: Ministry of Finance, Quandl website data and IFS.

The results in this part were obtained with the JMulTi econometric package.

Number of delays seems logical considering that the search for a lender and debt deal arrangements are often exceed for 1 year.

The lags from 2 to 7 provided matrix inversion problem for the p values of F tests.

References

Alesina A, Drazen A (1991) Why are stabilizations delayed? A political economy model. Am Econ Rev 81(5):1170–1188

Andersen TM, Pedersen LH (2006) Assessing fiscal sustainability and the consequences of reforms. In: Economic papers. Presented at the budgetary implications of structural reforms, European commission, Bryssels, pp 4–47

Apergis N (2015) Old wine in a new bottle: public debt sustainability-evidence from a number of EU countries under fiscal consolidation. Econ Bus Lett 4(4):131–136

Artis M, Marcellino MG (2000) The solvency of government finances in Europe. In: Fiscal sustainability. Presented at the fiscal sustainability, Banca d’Italia, Perugia, Italy, pp 209–242

Auerbach AJ, Gokhale J, Kotlikoff LJ (1991) Generational accounts: a meaningful alternative to deficit accounting. Tax Policy Econ 5:55–110

Balassone F, Monacelli D (2000) EMU fiscal rules: Is there a gap?. Banca d’Italia. Temi di Discussione, No. 375

Bertola G, Drazen A (1993) Trigger points and budget cuts: explaining the effects of fiscal austerity. Am Econ Rev 83(1):11–26

Bi H (2012) Sovereign default risk premia, fiscal limits, and fiscal policy. Euro Econ Rev 56(3):389–410

Blanchard OJ (1990) [Can severe fiscal contractions be expansionary? Tales of two small European countries]: Comment. NBER Macroecon Annu 5:111–116

Blanchard O, Chouraqui J.-C, Hagemann RP, Sartor N (1990) The sustainability of fiscal policy: new answers to an old question. OECD Econ Stud 7–36

Bohn H (1998) The behavior of US public debt and deficits. Q J Econ 113(3):949–963

Bohn H (2005) The sustainability of fiscal policy in the United States (CESifo Working Paper Series No. 1446). CESifo Group Munich

Bohn H (2008) The sustainability of fiscal policy in the United States. In: Neck R, Sturm J (eds) Sustainability of public debt. MIT Press, Cambridge, pp 15–49

Barnhill TM, Kopits G (2003) Assessing fiscal sustainability under uncertainty. IMF working paper, No. 03/79

Buiter WH (1985) A guide to public sector debt and deficits. Econ Policy 1(1):13–61

Buiter WH, Persson T, Minford P (1985) A guide to public sector debt and deficits. Econ Policy 1(1):13–79

Chibi A, Benbouziane M, Chekouri SM (2014) The impact of fiscal policy on economic activity over the business cycle: an empirical investigation in the case of Algeria. In: Economic Research Forum Working Papers (No. 845)

Cochrane JH (2010) Understanding policy in the great recession: some unpleasant fiscal arithmetic (Working Paper No. 16087). National Bureau of Economic Research

Considine J, Gallagher LA (2008) UK debt sustainability: some nonlinear evidence and theoretical implications. Manch Sch 76(3):320–335

Cuestas JC, Regis PJ (2018) On the dynamics of sovereign debt in China: sustainability and structural change. Econ Model 68:356–359

Eklund B (2003) A nonlinear alternative to the unit root hypothesis (No. 547). SSE/EFI Working Paper Series in Economics and Finance

Franses PH, van Dijk D (2003) Nonlinear time series models in empirical finance. Cambridge University Press, New York

Gokhale J, Smetters KA, Smetters K (2003) Fiscal and generational imbalances: new budget measures for new budget priorities (No. 5). American Enterprise Institute

Hamilton JD, Flavin MA (1986) On the limitations of government borrowing: a framework for empirical testing. Am Econ Rev 76(4):808–819

Hepsag A (2019) A unit root test based on smooth transitions and nonlinear adjustment. Commun Stat Simul Comput. https://doi.org/10.1080/03610918.2018.1563154

International Monetary Fund (2002) Assessing sustainability. Policy Development and Review Department, Washington

International Monetary Fund (2016) (Middle East and Central Asia Department): Regional Economic Outlook. April 2016

International Monetary Fund (2017) Algeria selected issues. IMF Country Report No. 17/142

International Monetary Fund (2018) Algeria selected issues. IMF Country Report No. 18/168

Kapetanios G, Shin Y, Snell A (2003) Testing for a unit root in the nonlinear STAR framework. J Econom 112(2):359–379

Krejdl A (2006) Fiscal sustainability: definition, indicators and assessment of Czech Public finance sustainability. Czech National Bank, Economic Research Department, Na Příkopě

Kruse R (2011) A new unit root test against ESTAR based on a class of modified statistics. Stat Pap 52(1):71–85

Lee J, Strazicich MC (2003a) Minimum LM unit root test with one structural break. Manuscript, Department of Economics, Appalachian State University, Boone, pp 1–16

Lee J, Strazicich MC (2003b) Minimum Lagrange multiplier unit root test with two structural breaks. Rev Econ Stat 85(4):1082–1089

Leeper EM, Walker TB (2011) Fiscal limits in advanced economies (Working Paper No. 16819). National Bureau of Economic Research

Lumsdaine RL, Papell DH (1997) Multiple trend breaks and the unit-root hypothesis. Rev Econ Stat 79(2):212–218

Luukkonen R, Saikkonen P, Teräsvirta T (1988) Testing linearity against smooth transition autoregressive models. Biometrika 75(3):491–499

Naraidoo R, Raputsoane L (2015) Debt sustainability and financial crises in South Africa. Emerg Mark Finance Trade 51(1):224–233

Neaime S (2010) Sustainability of MENA public debt and the macroeconomic implications of the recent global financial crisis. Middle East Dev J 2(02):177–201

Neaime S (2012) The global financial crisis and the Euro-Mediterranean partnership. In: Costa-Font J (ed) Europe and the Mediterranean economy. Routledge, London, pp 138–154

Ng S, Perron P (1995) Unit root tests in ARMA models with data-dependent methods for the selection of the truncation lag. J Am Stat Assoc 90(429):268–281

Ostry J, Ghosh A, Kim J, Qureshi MS (2010) Fiscal space. IMF Staff Position Notes 2010(11):1

Perron P (1989) The great crash, the oil price shock, and the unit root hypothesis. Econom J Econom Soc 57:1361–1401

Piergallini A, Postigliola M (2013) Nonlinear budgetary policy: evidence from 150 years of Italian public finance. Econ Lett 121(3):495–498

Saikkonen P, Lütkepohl H (2002) Testing for a unit root in a time series with a level shift at unknown time. Econom Theory 18(2):313–348

Sarno L (2001) The behavior of US public debt: a nonlinear perspective. Econ Lett 74(1):119–125

Sarvi T (2011) Some approaches for assessing the sustainability of public finances. Master’s thesis, Aalto University School of Economics

Sollis R (2009) A simple unit root test against asymmetric STAR nonlinearity with an application to real exchange rates in Nordic countries. Econ Model 26(1):118–125

Teräsvirta T (1994) Specification, estimation, and evaluation of smooth transition autoregressive models. J Am Stat Assoc 89(425):208–218

Teräsvirta T (1998) Modeling economic relationships with smooth transition regressions. In: Ullah A, Giles DE (eds) Handbook of applied economic statistics. Marcel Dekker, New York

Teräsvirta T (2004) Smooth transition regression modeling. In: Lutkepohl H, Kratzig M (eds) Applied time series econometrics. Cambridge University Press, Cambridge

Tran N (2018) Debt threshold for fiscal sustainability assessment in emerging economies. J Policy Model 40(2):375–394

Uctum M, Wickens M (2000) Debt and deficit ceilings, and sustainability of fiscal policies: an intertemporal analysis. Oxf Bull Econ Stat 62(2):197–222

Van Ewijk C, Draper N, ter Rele H, Westerhout E (2006) Ageing and the sustainability of Dutch public finances (CPB Special Publication No. 61). CPB Netherlands Bureau for Economic Policy Analysis

Zivot E, Andrews D (1992) Further evidence of great crash, the oil price shock and unit root hypothesis. J Bus Econ Stat 10(3):251–270

Acknowledgements

We owe a huge debt of gratitude to: Timo Teräsvirta, Franses and van Dijk, Junsoo Lee, Aycan Hepsag and Sahnoune Nisrine, for providing JMulTi econometric package and the GAUSS, WinRATS code used in this paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Table 6 and Figs. 4, 5, 6, 7, 8, 9 and 10.

Source: IMF (2016) (Middle East and Central Asia Department): Regional Economic Outlook. April 2016. P: 3

Fiscal consolidation measures, 2015–2016. (% of non-oil GDP).

Source: IMF (2016) (Middle East and Central Asia Department): Regional Economic Outlook. April 2016. P: 10

Decrease in Spending Needed to Balance Budget.

Source: IMF (2017): Country Report No. 17/142. P: 5

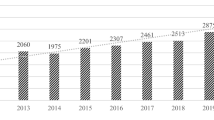

Algeria: deficit financing, 2009–2016 (DZD billions).

Source: IMF (2018): Country Report No. 18/168. P:7

Oil stabilization fund (Stock, 2011–17).

Source: IMF (2018): Country Report No. 18/168. P: 42

Composition of Algerian public debt (% of GDP).

Rights and permissions

About this article

Cite this article

Chibi, A., Chekouri, S.M. & Benbouziane, M. Debt sustainability, structural breaks and nonlinear fiscal adjustment: empirical evidence from Algeria. Int Rev Econ 66, 369–397 (2019). https://doi.org/10.1007/s12232-019-00327-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12232-019-00327-8