Conclusions

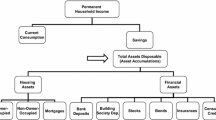

The existence of predatory behavior, when measured by the number of lawyers per capita and the crime rate, seems to have an impact on saving and investment behavior in U.S. households. Where the risk of redistribution are lowest, the incentives to save are higher and, a fortiriori, the willingness to invest in highly vulnerable financial instruments is enhanced. Either because of low saving rates or because of disintermediation, households in states where the risks of redistribution are greater avoid accumulating financial assets.

Recent years have seen a considerable decline in the U.S. saving rate. There is also evidence of large differences in saving rates from one country to another, with U.S. households among the lowest savers. Yet not all of these variations have been explained satisfactorily in empirical studies based on conventional theory. Perhaps one explanation which has been inadequately studied is the reduced expected retirement time horizon whether it be due to objective conditions such as retirement age and life expectancy or to uncertainty. Some reasons for myopic planning horizons are macroeconomic instability (McCauley and Zimer, 1989), the possibility of nuclear war (Slemrod, 1982, 1986 and 1989); Henderschott and Peek, 1985 and 1987); and the fear of socio-political conflict (Stewart and Venieris, 1985). I have suggested and tested here yet another factor: the fear of future redistribution. Using differences in interest income across U.S. states, this paper shows that fear of redistribution does seem to have a large influence on saving behavior.

Similar content being viewed by others

References

Auerbach, A.J. (1985). Saving in the U.S.: Some conceptual issues. In P. Hendershott (Ed.), The level and composition of household saving, 115–138. Cambridge, MA: Ballinger.

Durden, G. (1989). The effect of rent-seeking on family income levels: Some suggestive empirical evidence. Public Choice (forthcoming).

Grayson, P.E. (1988). Interest income and deductions on individual income tax returns, 1968–1984. SOI Bulletin 49–59.

Hendershott, P. and Peek, J. (1985). Household saving: An econometric investigation. In P. Hendershott (Ed.), The level and composition of household saving. Cambridge, MA: Ballinger.

Hendershott, P. and Peek, J. (1987, June). Private saving in the United States: 1950–1985. National Bureau of Economic Research Working Paper No. 2294.

Internal Revenue Service (1968–1987). Statistics of income. U.S. Department of the Treasury.

Laband, D.N. and Sophocleus, J.P. (1988). The social cost of rent-seeking: First estimates. Public Choice 58 (3): 269–275.

McCauley, R.N. and Zimmer, S.A. (1989). Explaining international differences in the cost of capital. Federal Reserve Bank of NY Quarterly Review 14 (2): 7–28.

Slemrod, J. (1982, May). Post-war capital accumulation and the threat of nuclear war. National Bureau of Economic Research Working Paper No. 887.

Slemrod, J. (1986). Saving and the fear of nuclear war. Journal of Conflict Resolution 30 (3): 403–419.

Slemrod, J. (1988, December). Fear of nuclear war and intercountry differences in the rate of saving. National Bureau of Economic Research Working Paper No. 2801.

Stewart, D.B. and Venieris, Y.P. (1985). Sociopolitical instability and the behavior of savings in less-developed countries. Review of Economics and Statistics 47 (4): 557–563.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Courbois, J.P. The effect of predatory rent-seeking on household saving and portfolio choices: A cross section analysis. Public Choice 70, 251–265 (1991). https://doi.org/10.1007/BF00156234

Received:

Accepted:

Issue Date:

DOI: https://doi.org/10.1007/BF00156234