After a decade of rapid and profitable growth, America's credit-card business is slowing down and turning cut-throat. Card companies must adap to survive.-The Economist, November 2, 1991

Abstract

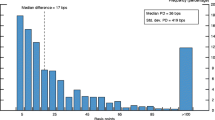

This article measures the riskiness and profitability of financial institutions specializing in credit-card loans and related plans. Focusing on explicit accounting returns on explicit credit-card assets, we find that credit-card banks, whether subsidiaries of bank holding companies or independent banks, earned extraordinary returns over the years 1984 to 1991. On average, credit-card firms had pretax return on assets of 3.36 percent compared to .95 for noncredit-card banks. The costs of the higher returns are greater variability of ROA and higher probabilities of insolvency, indicating that credit-card banks are riskier than other commercial banks.

Similar content being viewed by others

References

Ausubel, Lawrence. ”The Failure of Competition in the Credit Card Market.”The American Economic Review 81 (March 1991), 50–81.

Berger, Allen N., and Udell, Gregory F. “Securitization, Risk, and the Liquidity Problem in Banking.” In: Michael Klausner and Lawrence J. White, eds.,Structural Change in Banking. Homewood Hills, IL: Irwin Publishing, 1993, 227–291.

“The Big Squeeze.”The Economist (November 2, 1991), 69–70.

Boyd, J. H., Graham, S. L., and Hewitt, R. S. “Size and Performance in Banking: Testing the Predications of Theory.” Mimeo, Federal Reserve Bank of Minneapolis, 1991.

Consolidated Reports of Condition and Income. Springfield, VA: National Technical Information Service, U.S. Department of Commerce, 1984–1991.

Duffy, Helene. “Credit Card Banks Hit Choppy Waters.”Bank Management 66 (September 1990) 29–36.

Eisenbeis, Robert A., and Kwast, Myron L. “AreReal Estate Depositories Viable? Evidence from Commercial Banks.”Journal of Financial Services Research 5 (March 1991), 5–24.

Hannn, Timothy H., and HHanweck, Gerald A. “Bank Insolvency Risk and the Market for Large Certificates of Deposit.”Journal or Money, Credit and Banking 20 (May 1988), 203–211.

Liang, J. Nellie, and Savage, Donald T. “The Nonbank Activities of Bank Holding Companies.”Federal Reserve Bulletin 77 (May 1990), 280–292.

Mandell, Lewis,The Credit Card Industry: A History. Boston: Twayne Publishers, 1990.

McAllister, Patrick H., and McManus, Douglas A. “Diversification Rid Risk in Banking: Evidence from Ex Post Returns.” Finance and Economics Discussion Seris, Board of Governors of the Federal Reserve System, June 1992.

Musumeci, James, and Sinkey, Joseph F., Jr. “The International Debt Crisis and Bank Loan Loss Decisions: The Signalling Content of Partially Anticipated Events.”Journal of Money, Credit, and Banking 22 (August 1990), 370–387.

Nash, Robert C. and Sinkey, Joseph F., Jr. “The Riskiness of Credit Card Banks and the Role of Hidden Asset..” Working Paper, The University of Georgia, April 1993.

Nilson Report. Los Angeles: HSN Consultants, biweekly, 1986–1989.

“Profitability of Credit Card Operations of Depository Institution..” Annual Report by the Board of Governors of the Federal Reserve System submitted to Congress pursuant to Section 8 of the Fair Credit and Charge Card Disclosure Act of 1988, September 1991.

Quarterly Banking Profile. Division of Research and Statistics, FDIC, Washington, D.C., 3rd Quarter, 1991.

Sinkey, Joseph F., Jr.,Commercial Bank Financial Management in the Financial-Services Industry. New York: Macmillan Publishing, 1992, ch. 19.

Stewart, John. “The Gravy Train Loses Steam.”Credit Card Management (May 1991), 60–61.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Sinkey, J.F., Nash, R.C. Assessing the riskiness and profitability of credit-card banks. J Finan Serv Res 7, 127–150 (1993). https://doi.org/10.1007/BF01046902

Issue Date:

DOI: https://doi.org/10.1007/BF01046902