Abstract

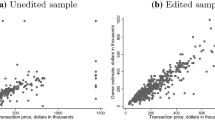

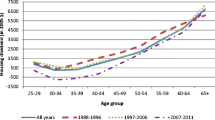

The residential property tax is often criticized because housing value may not be a good measure of a household's ability to pay. To examine this criticism, a series of equations is estimated in which the dependent variable is housing price and the independent variables include household income. While the coefficient on income is always significant, it has little explanatory power. Further, the strength of the relationship between income and value weakens as length of tenure in the housing unit increases. Because housing value is a poor proxy for income, modifications to the tax structure such as tax deferment and curcuit breaker programs must be used to improve the viability of property taxation in terms of the ability-to-pay principle.

Similar content being viewed by others

References

Aaron, H. J., “What Do Circuit-Breaker Laws Accomplish?” in G. E. Peterson, editor,Property Tax Reform, Washington, D.C.: The Urban Institute, 1973.

Aaron, H. J.,Who Pays the Property Tax? A New View, Washington, D.C.: The Brookings Institution, 1975.

Bird, R. M. and N. E. Slack,Residential Property Tax Relief in Ontario, Ontario Economic Council Research Study 15, 1978.

Boehm, T. P. and J. H. Mark, “A Principal Component Logistic Analysis of the Mobility Decision in Transitional Neighbourhoods,”American Real Estate and Urban Economics Association Journal, Vol. 8 No. 3 (September 1980), pp. 299–319.

Bowman, J. H., “Property Tax Circuit Breakers Reconsidered. Continuing Issues Surrounding a Popular Program,”American Journal of Economics and Sociology, Vol. 39, No. 4 (October, 1980), pp. 355–372.

British Columbia Ministry of Education,School Taxation Report, Victoria, B. C., September, 1981.

Carruthers, N. and J. Mark, “A Synthesis of Urban Theories from Central Place and Cumulative Causation to Property Taxation,” University of British Columbia unpublished paper, 1982.

Central Mortgage and Housing Corporation,1974 Survey of Housing Units: Background information and Statistical Notes, Publication NHA 5146, Volume 24, 1977.

Freeman, A. M., “The Hedonic Price Approach to Measuring Demand for Neighborhood Characteristics,” in D. Segal, editor,The Economics of Neighborhood, New York: Academic Press, 1979.

Ihlanfeldt, K. R., “The Incidence of the Property Tax on Homeowners: Evidence from the Panel Study of Income Dynamics,”National Tax Journal, Vol. 32, No. 4 (1979), pp. 535–541.

Ihlanfeldt, K. R., “An Empirical Investigation of Alternative Approaches to Estimating the Demand for Housing,”Journal of Urban Economics, Vol. 9, No. 1 (January, 1981), pp. 97–105.

Kain, J. and J. Quigley, “Note on Owner's Estimate of Housing Value,”Journal of the American Statistical Association, Vol. 67, No. 340 (December 1972), pp. 803–860.

Mark, J., “A Preference Approach to Measuring the Impact of Environmental Externalities,”Land Economics, Vol. 56, No. 1 (February, 1980), pp. 103–116.

Mark, J. H. and N. Carruthers, “Property Tax Deferment as a Method of Reducing Cash Flow Problems,” University of British Columbia, Working Paper 879, 1982.

Musgrave, R. and P. Musgrave,Public Finance in Theory and Practice, Second Edition, New York: McGraw-Hill Book Company, 1973.

Netzer, D.,Economics of the Property Tax, Washington, D.C.: The Brookings Institution, 1966.

Author information

Authors and Affiliations

Additional information

The authors would like to acknowledge the financial support of the Faculty of Commerce and Business Administration of the University of British Columbia and the Real Estate Education and Research Foundation Grants Fund A Committee. Stanley Hamilton and Barry Anderson provided helpful comments on an earlier draft. They also wish to thank Frank Ma and Nelson Eng for their able computer assistance.

Rights and permissions

About this article

Cite this article

Mark, J.H., Carruthers, N.E. Property values as a measure of ability-to-pay: An empirical examination. Ann Reg Sci 17, 45–59 (1983). https://doi.org/10.1007/BF01284380

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01284380