Abstract

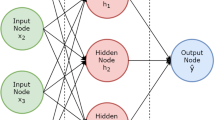

This paper investigates the problem of predicting daily returns based on five Canadian exchange rates using artificial neural networks and EGARCH-M models. First, the statistical properties of five daily exchange rate series (US Dollar, German Mark, French Franc, Japanese Yen and British Pound) are analysed. EGARCH-M models on the Generalised Error Distribution (GED) are fitted to the return series, and serve as comparison standards, along with random walk models. Second, backpropagation networks (BPN) using lagged returns as inputs are trained and tested. Estimated volatilities from the EGARCH-M models are used also as inputs to see if performance is affected. The question of spillovers in interrelated markets is investigated with networks of multiple inputs and outputs. In addition, Elman-type recurrent networks are also trained and tested. Comparison of the various methods suggests that, despite their simplicity, neural networks are similar to the EGARCH-M class of nonlinear models, but superior to random walk models, in terms of insample fit and out-of-sample prediction performance.

Similar content being viewed by others

References

Gallant A, Hsieh D, Tauchen G. On fitting a recalcitrant series: The pound/dollar exchange rate, 1974–1983. In W Bartnett et al., eds, Nonparametric and Semiparametric Methods in Econometrics and Statistics. Cambridge University Press, New York, 1991

Baillie R, McMahon P. The Foreign Exchange Market: Theory and econometric evidence. Cambridge University Press, Cambridge, MA, 1989

White H, Gallant A, Hornik K, Stinchcombe M, Wooldridge J. Artificial Neural Networks: Approximation and Learning Theory. Blackwell, Cambridge, MA, 1992

Ballie R, Bollerslev T. The message in daily exchange rates: A conditional-variance tale. Journal of Business and Economic Statistics 1989; 7(3): 297–305

Hsieh D. Modeling heteroskedasticity in daily foreign-exchange rates. Journal of Business and Economic Statistics 1989; 7(3): 307–317

Domowitz I, Hakkio C. Conditional variance and risk premium in foreign exchange market. Journal of International Economics 1985; 19: 47–66

Akgiray V, Booth G. Modeling the stochastic behaviour of Canadian foreign exchange rates. Journal of Multinational Financial Management 1991; 1(1): 43–72

Theodossiou P. The stochastic properties of major Canadian exchange rates. The Financial Review 1994; 29(2): 193–221

Refenes A, Azema-Barac M, Chen L, Karoussos S. Currency exchange rate prediction and neural network design strategies. Neural Computing & Applications 1993; 1: 46–58

Kuan C. Forecasting exchange rates using feedforward and recurrent neural networks. Working Paper, University of Illinois, Urbana-Champaign, 1994

Poddig T. Short term forecasting of the USD/DM- exchange rate. Proc First Int Workshop Neural Networks in the Capital Markets, London Business School, 1993

Pi H. Dependency analysis and neural network modeling of currency exchange rates. Proc First Int Workshop Neural Networks in the Capital Markets, London Business School, 1993

Brock W, Hsieh D, LeBaron B. Nonlinear dynamics, chaos, and instability. MIT Press, Cambridge, MA, 1991

Nelson D. Conditional heteroskedasticity in asset returns: A new approach. Econometrica 1991; 59(2): 347–370

Engle R. Autoregressive conditional heteroskedasticity with estimates of the variance of United Kingdom inflation. Econometrica 1982; 50: 987–1007

Bollerslev T. Modelling the coherence in short-run nominal exchange rates: A multivariate generalized ARCH approach. Review of Economics and Statistics 1990; 72: 498–505

Black F. Studies of stock market volatility changes. Proc American Statistical Association, Business and Economic Statistics Section 1976; 177–81.

Hamao, Y, Masulis R, Ng V. Correlations in price changes and volatility across international stock markets. The Review of Financial Studies 1990; 3(2): 281–307

Bera A, Higgins M. ARCH models: Properties, estimation and testing. Journal of Economic Surveys 1992; 7(4): 305–366

Froot K, Obsfeld M. Stochastic process switching: Some simple solutions. Econometrica 1991; 59(1): 241–250

White H. Economic prediction using neural networks: The case of IBM daily stock returns. IEEE Int Conf Neural Networks 1988: 451–458

Refenes A, Zapranis A, Francis G. Stock performance modeling using neural networks: A comparative study with regression models. Neural Networks 1994; 7(2): 375–388

Tang Z, de Alameida C, Fishwick P. Time series forecasting using neural networks vs. Box-Jenkins methodology. Simulations 1991; 303–310

Edmonds A. Multivariate prediction of financial time series using recent developments in chaos theory. Proc First Int Workshop Neural Networks in the Capital Markets, London Business School, 1993

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Episcopos, A., Davis, J. Predicting returns on Canadian exchange rates with artificial neural networks and EGARCH-M models. Neural Comput & Applic 4, 168–174 (1996). https://doi.org/10.1007/BF01414877

Issue Date:

DOI: https://doi.org/10.1007/BF01414877