Abstract

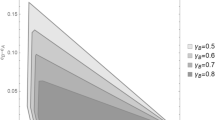

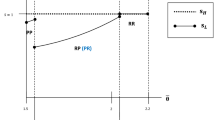

This paper examines strategic manipulations of incentive contracts in a model where firms compete in quality as well as in price. Compensation schemes for managers are based on a linear combination of profits and sales. For a given level of quality, a firm desires to reduce the manager's compensation when product sales increase; this serves as the firm's commitment to raise prices. Nevertheless, in general, a manager has a stronger incentive to produce goods of higher quality if he is compensated according to sales. Therefore, a compensation scheme that penalizes a manager when sales increase may result in products that are inferior to those of its rival. We show that, depending on the nature of quality, a positive weight on sales may be desirable when firms compete in quality and price. Welfare implications are also explored.

Similar content being viewed by others

References

Dixit, A. (1979): “Quality and Quantity Competition.”Review of Economic Studies 46: 587–599.

Fershtman, C. (1985): “Managerial Incentives as a Strategic Variable in Duopolistic Environment.”International Journal of Industrial Organization 3: 245–253.

Fershtman, C., and Judd, K. L. (1987): “Equilibrium Incentives in Oligopoly.”American Economic Review 77: 927–940.

Fershtman, C., Judd, K. L., and Kalai, E. (1991): “Observable Contracts: Strategic Delegation and Cooperation.”International Economic Review 32: 551–559.

Holmström, B., and Milgrom, P. (1991): “Multitask Principal-Agent Analyses: Incentive Contracts, Asset Ownership, and Job Design.”Journal of Law, Economics and Organization 7: 26–52.

Ishibashi, K. (1998): “Agency Contracts and Oligopolistic Competition.” Ph.D. dissertation, Boston University.

Katz, M. L. (1991): “Game-Playing Agents: Unobservable Contracts as Precommitments.”Rand Journal of Economics 22: 307–328.

Ma, C.-t. A., and Burgess, J. F., Jr. (1993): “Quality Competition, Welfare, and Regulation.”Journal of Economics/Zeitschrift für Nationalökonomie 58: 153–173.

Sklivas, S. D. (1987): “The Strategic Choice of Managerial Incentives.”Rand Journal of Economics 18: 452–458.

Spence, A. M. (1975): “Monopoly, Quality, and Regulation.”Bell Journal of Economics 6: 417–429.

Vickers, J. (1985): “Delegation and the Theory of the Firm.”Economic Journal, Suppl. 95: 138–147.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Ishibashi, K. Strategic delegation under quality competition. Zeitschr. f. Nationalökonomie 73, 25–56 (2001). https://doi.org/10.1007/BF02339580

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF02339580