Abstract

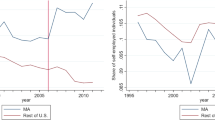

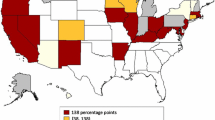

This paper investigates the impacts of national health insurance on the labor market, by considering the case of Taiwan, which implemented national health insurance in March 1995. Taiwan’s national health insurance is financed by premiums, which are proportional to an employee’s salary. These premiums may introduce distortions to the labor market. Based on repeated cross-sections of individual data we find that, on average, private sector employees’ work hours declined relative to their public sector counterparts, whereas their relative wage rates were almost unchanged with the introduction of national health insurance. The results suggest that neither private sector employers nor their employees were able to shift their premium burden to each other.

Similar content being viewed by others

References

Anderson PM, Meyer BD (2000) The effects of the unemployment insurance payroll tax on wages, employment, claims and denials. J Public Econ 78:81–106

Anderson PM, Meyer BD (1997) The incidence of a firm-varying payroll tax: the case of unemployment insurance. J Public Econ 65:119–145

Blake CH, Adolino JR (2001) The enactment of national health insurance: a boolean analysis of twenty advanced industrial countries. J Health Polit Policy Law 26(4):679–708

Borjas GJ (2003) Welfare reform, labor supply, and health insurance in the immigrant population. J Health Econ 22:933–958

Bruce D (2000) Effects of the United States tax system on transitions into self-employment. Labour Econ 7:545–574

Cheng S-H, Chiang T-L (1997) The impact of a universal health insurance on medical care utilization in Taiwan: results from a natural experiment. J Am Med Assoc 278:89–93

Chi PS-K, Hsin P-L (1999) Medical utilization and health expenditure of the elderly in Taiwan. J Fam Econ Issues 20(3):251–270

Chou S-Y, Liu J-T, Hammitt JK (2003) National health insurance and precautionary saving: evidence from Taiwan. J Public Econ 87:1873–1894

Chou S-Y, Liu J-T, Hammitt JK (2004) National health insurance and technology adoption: evidence from Taiwan. Contemp Econ Policy 22(1):26–38

Chou, Y-J, Staiger D (2001) Health insurance and female labor supply in Taiwan. J Health Econ 20(2):187–211

Cutler DM, Johnson R (2002) The birth and growth of the social insurance state: explaining old age and medical insurance across countries. Working paper, Harvard University

Gertler PJ (1998) On the road to social health insurance: asian experience. World Dev 26(4):717–732

Gruber J, Krueger AB (1991) The incidence of mandated employer-provided insurance: lessons from workers compensation insurance. In: David Bradford (ed) Tax policy and the economy. MIT Press, Cambridge 111–144

Gruber J, Hanratty M (1995) The labor market effects of introducing national health insurance: evidence from Canada. J Bus Econ Stat 13(2):163–173

Gruber J (1997) The incidence of payroll taxation: evidence for Chile. J Labor Econ 15(3):S72–S101

Hanratty MJ (1996) Canadian national health insurance and infant health. Am Econ Rev 86(1):276–284

Kugler A, Kugler M (2003) The labour market effects of payroll taxes in a middle-income country: evidence from Colombia. IZA Discussion Papers No. 852

Lee L-F (1982) Some approaches to the correction of selectivity bias. Rev Econ Stud 49(3):355–372

Lee L-F (1983) Generalized econometric models with selectivity. Econometrica 51:507–512

Lindsay CM, Zycher B (1984) Substitution in public spending: who pays for canadian national health insurance? Econ Inq 22(3):337–359

Mete C, Schultz TP (2002) Health and labor force participation of the elderly in Taiwan. Economic Growth Center Discussion Paper No. 846, Yale University

Moore RL (1983) Self-employment and the incidence of the payroll tax. Natl Tax J 36:491–501

Mullahy J (1999) Interaction effects and difference-in-difference estimation in loglinear models. NBER Technical Working Paper No. 245

Rosenbaum PR, Rubin DB (1983) The central role of the propensity score in observational studies for causal effects. Biometrika 70:41–55

Stabile M (2004) Payroll taxes and the decision to be self-employed. Int Tax Public Financ 11(1):31–53

Summers LH (1989) Some simple economics of mandated benefits. Am Econ Rev 79(2):177–183

Tsai W-D, Li I-H (2002) Hospital nonprice competition and market structure: an empirical study of hospitals’ acquisition of high-tech medical equipment. Academia Economic Papers 30(1):57–78, in Chinese, with English summary

Vella F, Verbeek M (1999) Estimating and interpreting models with endogenous treatment effects. J Bus Econ Stat 17(4):473–478

Wong J (2003) Deepening democracy in Taiwan. Pac Aff 76(2):141–146

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Junsen Zhang

Rights and permissions

About this article

Cite this article

Kan, K., Lin, YL. The labor market effects of national health insurance: evidence from Taiwan. J Popul Econ 22, 311–350 (2009). https://doi.org/10.1007/s00148-007-0135-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-007-0135-x