Abstract

Wage employment is the most commonly observed type of employment after a spell of entrepreneurship. The purpose of this paper is to investigate the effects of having been an entrepreneur on earnings after individuals exit. The question is how the entrepreneurship spell influences their value in the labor market? Based on a theoretical framework and earlier literature, our specific interest lies in how these outcomes interact with education level and the nature of the entrepreneurial venture. To investigate this question, we use longitudinal register data on firms and individuals in Sweden. The empirical strategy builds on matching techniques and estimations of earnings equations in a difference-in-differences framework with heterogenous treatment years. We provide evidence that there exists an earnings penalty when highly educated entrepreneurs return to wage employment. This effect is persistent throughout the time period that we observe. For individuals with lower educational attainment, we find no or weak evidence of a wage penalty. Our results suggest that the wage penalty for highly educated individuals operates through the depreciation of specific specialized skills valuable in wage employment.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Most new firms exit from the market within a relatively short time frame (Evans & Leighton, 1989; Shane, 2009). This observation implies that there is significant churning of firms and following from this, individuals entering and exiting entrepreneurship. The entrepreneurs may exit not only due to business failure but also for various other reasons. Consequently, exits should not be equated with failure and in some cases exits can be considered a success, for example the sale of a profitable business (Wennberg et al., 2010).Footnote 1Wage employment has been shown to be the most common career path for individuals after a spell in entrepreneurship (Hessels et al., 2011) and the entry mode can predict the exit routes from entrepreneurship (Rocha et al 2015). The individuals who venture into entrepreneurship typically make large personal investments in the form of effort, time, and financial capital. However, as most new firms exit only a few years after start-up, this means that starting a firm is a risky endeavor, and therefore, the character of the fallback option is of vital importance for prospective entrants.

Recent literature on the impact of entrepreneurship experience on wages in later employment finds heterogeneous effects connected to the characteristics of the experience and of individuals (Daly, 2015; Kaiser & Malchow-Møller, 2011). Recently, Mahieu et al. (2019) show that wage losses in subsequent wage employment can be shown to occur only for entrepreneurs who transition into entrepreneurship from the higher end of the wage distribution, while there are no losses identified for individuals from the lower end. On the other hand, Daly (2015) finds that individuals from the higher end of the income distribution and workers in professional and technical occupations enjoy the largest positive returns from self-employment experience in the long-term. Previous studies, therefore, show that there are differences among groups based on income, and we argue that these wage distributions mirror the productivity and skill levels of entrepreneurs, which leads to the importance of distinguishing between individuals with higher and lower education levels.

We analyze the difference between the two groups of people arising from differences in education and the associated skills used in entrepreneurial tasks, following the work of Lazear (2004, 2005). We do this because related literature has shown that entry and earnings in entrepreneurship correlate with whether entrepreneurs are “stars” or “misfits”, i.e., come from the top or the bottom end of the ability distribution (Andersson Joona & Wadensjö, 2013; Levine & Rubinstein, 2016; Unger et al., 2011). Specifically, Astebro et al. (2011) show and test that bimodal entry into entrepreneurship is consistent with an occupational choice model and use education as a proxy for these two groups of entrepreneurs. Therefore, if the entry is bimodal and it is relevant for evaluating the effects of entrepreneurship experience in later employment, it is important to distinguish the two groups of entrepreneurs both theoretically and empirically.Footnote 2 We do this by differentiating between highly and less educated entrepreneurs. This is the main contribution of the present paper.

Our principal intention is to differentiate the impact of a spell in entrepreneurship on later wages for two differently educated groups of entrepreneurs, assuming that the level of education attainment is reflective of human capital. Hyytinen and Rouvinen (2008) are the only authors (to our knowledge) that have differentiated between entrepreneurs based on education in this context. However, we analyze the two different types of entrepreneurs separately throughout the paper, which enables us to distinguish the underlying mechanisms of the potential earnings losses for each type as well as the specific role that education plays in the earning dynamics of post-entrepreneurship careers. In essence, we build and extend on the findings of these earlier efforts.

We use longitudinal register-matched employer-employee data for Sweden covering the period 1994 until 2018. To correctly identify the effects that we are interested in, we investigate the earnings of individuals who exit entrepreneurship and re-enter wage employment somewhere during the time window between 2006 and 2010. This means that we have information for a long time period both before and after treatment and that we can estimate the earnings of individuals in a difference-in-difference framework, where entrepreneurship experience is used as the treatment. Further, the exit windows mean that we are dealing with heterogeneous treatments, i.e., we accommodate different durations of the entrepreneurship spell. We match individuals who have a one-time entrepreneurship experience to individuals who remain as regular wage employees during the time period that we observe. Our empirical strategy builds on two key components: i) matching the entrepreneurs with a control group of employees who are comparable in the pre-entrepreneurship period based on a set of observable and unobservable characteristics and ii) estimating earnings equations in a difference-in-difference framework with a full set of individual and firm fixed effects with leads and lags that control for any remaining biases arising from sorting. The main emphasis is placed on post-entrepreneurship earnings, i.e., what happens to individuals' earnings when they exit entrepreneurship and return to regular wage employment, with the focus being on how earnings trajectories differ between individuals with low and high levels of education.

Our findings support the idea that less educated individuals do not find themselves worse off after trying out entrepreneurship in comparison to individuals who stay in wage employment. We find no or limited evidence of skill depreciation for this group of individuals. However, highly educated entrepreneurs experience persistent earnings losses when returning to wage employment that do not dissipate during the nine years in wage employment that we observe after the entrepreneurship spell. The results are in line with those of Mahieu et al. (2019), who document similar effects for individuals from different parts of the earnings distribution. The results suggest that there may be significant costs to trying out entrepreneurship for highly educated individuals and that these effects operate through the depreciation of their specific skills and human capital, not through the complexity of the firms that they start and run. They can also reduce some of these losses by hiring employees in their firms and enabling them to preserve more of the industry- and management-specific human capital. We find that the deterioration of the specific skills that entrepreneurs have is on average 1% higher for each year of entrepreneurship experience for highly educated individuals. The results are robust to various sample selection alternatives and post-entrepreneurship employment forms.

The outline of the rest of the paper is as follows. Section 2 discusses the previous literature on the topic, whereas Section 3 outlines our theoretical framework. In Section 4, we describe our data, sample restrictions, matching method, and empirical application. In Section 5, we present and discuss our main findings and test the robustness of the results. Section 6 outlines and tests the mechanisms that we propose in the theoretical framework. Section 7 concludes.

2 Literature review

There is substantial movement in and out of entrepreneurship each year, with approximately half of all spells of self-employment lasting less than six years (Evans & Leighton, 1989; Kuhn & Schuetze, 2001). Much of the research in the past has been focused on entry into entrepreneurship (see Parker 2018 for a review and discussion)Footnote 3 and the earnings differentials of entrepreneurs when they are running their own firms versus working as wage employees (Hamilton 2000; Astebro and Chen 2014). Entrepreneurs have been found to have an earnings distribution with fat tails, where few earn high incomes and most individuals earn below the average (Hamilton, 2000). It has emerged as a stylized fact that entrepreneurship does not pay off compared to wage employment, since it is associated with incomes with higher variability and risk.Footnote 4 However, in recent years, more emphasis has been placed on the fact that individuals also regularly exit entrepreneurship and the potential reasons for and outcomes from that (Wennberg & DeTienne, 2014; Wennberg et al., 2010). The literature has shown that wage employment is the most common career path after entrepreneurship (Hessels et al., 2011; Kaiser & Malchow-Møller, 2011; Shane, 2009) and that exits do not automatically indicate failures (Baird & Morrison, 2005; Gimeno et al., 1997; Taylor, 1999).

In this growing exit literature, there are a handful of studies that have explicitly estimated the effects of entrepreneurship or self-employment on subsequent wages upon (re-)entry of regular employment (e.g.Daly, 2015; Mahieu et al., 2019; Williams, 2000). The theoretical underpinnings imply that entrepreneurship experience can have a positive impact on wages in later employment if it causes human capital accumulation (Becker, 1962, 1964) or a negative impact if it results in depreciation of specific skills or signals career instability (Koellinger et al., 2015; Spence, 1973). The empirical literature has provided evidence for the possibility of both of these outcomes with caveats relating to the nature of the entrepreneurial experience or individual characteristics.

There is evidence supporting positive effects on individuals’ earnings when they enter wage employment (Campbell, 2013; Ferber & Waldfogel, 1998; Manso, 2016). Luzzi and Sasson (2015) also show that individuals who exit entrepreneurship enjoy positive rewards in subsequent paid employment and that the performance of the exited firm strongly predicts the earnings premium. Daly (2015) finds that in the long run, individuals with entrepreneurship experience enjoy 8 to 20% higher present discounted values of later wage income and that individuals who work in technical/professional occupations earn large wage premiums and work more.

Some of the previous empirical evidence shows that entrepreneurship experience leads to earnings losses in subsequent wage employment. Williams (2000) finds rates of return to previous self-employment experience that are significantly lower among women than among men. Hyytinen and Rouvinen (2008) also find that formerly self-employed individuals earn less in subsequent wage employment, using data for a large sample of European Union countries. Bruce and Schuetze (2004) find that brief periods in self-employment mainly reduce average hourly earnings upon a return to wage employment.

Other studies find mixed consequences of entrepreneurship experience. Kaiser and Malchow-Møller (2011) show that a period of self-employment is associated with lower hourly wages in comparison to those of wage employees. However, the effect becomes positive for those who find employment in the same sector. Their results indicate that the average negative effect is caused by switching sectors rather than an outcome of the entrepreneurship spell per se. Baptista et al. (2012) find that the returns to business ownership experience are lower than the returns to wage-employee experience, but they also find that former business owners enter firms at higher job levels and progress faster up the hierarchy, which in itself indicates the existence of positive nonpecuniary returns from the experience. Mahieu et al. (2019) find that wage penalties exist, especially for those at the upper end of the wage distribution, but that wage losses diminish with the uncertainty of the hiring process and seem to occur only for entrepreneurs who return quickly to wage employment and who do not return to the same employer.

A common empirical issue involved in estimating the impact of entrepreneurship experience on later wage employment is the problem of selection. Some previous findings solve endogeneity bias by including pre-entrepreneurship wages as a control for productivity or unobserved individual characteristics. The most recent studies rely on matching techniques to find suitable control groups based on a set of observable characteristics (Campbell, 2013; Daly, 2015; Kaiser & Malchow-Møller, 2011; Luzzi & Sasson, 2015; Mahieu et al., 2019). Many of the studies focus on rather short time periods, usually time windows of 5 years, the exception being Daly (2015). Other empirical weak points of previous studies lie in the lack of controls for firm-specific wage differentials and sorting of individuals into firms and the failure to include individual fixed effects. Manso (2016) is an exception and does include individual fixed effects in the estimations.

3 Theoretical considerations and analytical framework

In this section, we develop a framework aimed at studying the expected individual wage effects emanating from entering and subsequently exiting entrepreneurship after a period of time. The intention is to show why such effects are likely different between highly educated and less educated individuals. A priori, the effect of a spell in entrepreneurship could influence later earnings in either direction. The effect may be positive if a spell of entrepreneurship leads to accumulation of human capital that is also useful in wage employment. It may be negative if human capital specific to wage employment depreciates during the period in entrepreneurship or if prior entrepreneurship carries a negative signal for prospective employers (Parker, 2018).

Here, we use the term human capital in a broad sense. Human capital is made up of a set of specific skills and generally indicates how well one is able to perform different tasks. Education and schooling are one way for individuals to influence their skill level and function as an investment in human capital. Another type of investment is participation in learning-by-doing and on-the-job training.

Human capital is also subject to depreciation. This may result from lack of use, for example, due to unemployment or other career interruptions. Human capital depreciation may come from a failure to keep up with innovation and acquire knowledge about new technologies or techniques. Over time, demand for old skills will be supplemented or replaced by demand for new skills. Thus, the market value of older skills declines. The development of the individual human capital level is thus the outcome of investment and depreciation.

There is extensive literature investigating the loss of human capital through lack of use; however, the literature is not entirely in agreement with the conclusions. Edin and Gustavsson (2008) investigate skill depreciation as a result of being out of work. Their results show that the depreciation of general skills is statistically and economically significant. One more general conclusion is that in the labor market, wage-worker experience is valued more highly than business ownership experience (Baptista, et al. 2012). When considering the type of education, Weber (2014) finds that specific human capital depreciates faster than more general human capital. The long-term income losses of displaced workers point to a type of firm-specific human capital that is less useful in other firms (Jacobson et al, 1993; Couch & Placzek, 2010).

We start with a perspective akin to Lazear’s view of the entrepreneur as a jack-of-all-trades. To run a (small) firm with all its different and diverse tasks, an entrepreneur needs to possess a diverse skill set (Lazear, 2004). Professional wage employees, on the other hand, must master only a few tasks (or even just one). Lazear posits that wage employees are rewarded for their strongest skill, while entrepreneurs are rewarded for their weakest skill since this skill limits their ability (since they have to use many different skills) to run their firms effectively. This leads entrepreneurs and employees to follow different strategies in regard to investments in the skills that make up their human capital.

In contrast to Lazear (2004), we are not researching investment in human capital in the pre-entrepreneurship period; instead, we consider effects on human capital from entering entrepreneurship and running a firm. However, we do use Lazear’s ideas on skill usefulness in employment and entrepreneurship.

We study people who are employed in regular wage employment and then enter entrepreneurship by way of running a firm. Then, after a period of entrepreneurship, they return to wage employment. Thus, we observe individuals during three consecutive time periods: i) during wage employment pre-entrepreneurship, ii) during entrepreneurship, and iii) during wage employment post-entrepreneurship. The question that we ask is how the earnings compare between someone who follows a career path like the one outlined in i)-iii) and someone who stays in wage employment through all three periods.

The specific concern of the present inquiry is how skills and education interact with the above-described expected effects. We assume that more highly educated individuals do not use their specialized skills as much in entrepreneurship as in wage employment. This leads to this skill depreciating relatively fast. Less educated individuals use their strongest skill to a fuller extent, which means that it does not depreciate as fast. We aim to identify how this mechanism may work and the testable hypotheses that it leads to.

A worker who leaves employment for entrepreneurship uses her strongest skill less intensively running a firm because there are many other tasks that demand her attention. We assume that this leads to a (relative) depreciation of this skill. This may mean that she actually loses that skill over time or that she fails to keep up relative to other workers who continue developing the skill through on-the-job learning-by-doing. The point is that a skill gap develops between workers in wage employment and those who try out entrepreneurship and return to wage employment after some time.

Relatively speaking, the more specialized a skill is, the less useful it is likely to be in running a firm. A more general skill is more likely to deteriorate at a slower pace since it may not be very different from certain tasks necessary for running a firm. Thus, we expect that possible wage penalties should be more substantial for more educated individuals.

The entrepreneurship period may be viewed as a treatment period. Since this treatment is not randomly allocated between individuals, it is challenging to be able to draw causal inferences on its effects. For this reason, the selection of individuals to be included in a control group is of fundamental importance to our empirical design. We return to this issue when we implement our empirical setup.

A similar conclusion may be reached using a signaling framework. The ability signal sent by former entrepreneurs is likely relatively noisy. Information about productivity is harder to signal for former entrepreneurs than for employees. Mahieu et al. (2019) develop a number of arguments in a signaling framework on why former entrepreneurs are penalized with lower wages when returning to wage work in comparison with wage workers who remain employees. They argue that former employees are more able to send reliable signals via, for instance, previous wage level, history of promotions, and references from former employers. These signals are harder to obtain for former entrepreneurs, and even if this information can be found, it is likely much less accurate. For this reason, this uncertainty translates into comparatively lower wages for former entrepreneurs re-entering wage employment, i.e., the lower wage functions as compensation for uncertain and costly information (Mahieu, et al., 2019).

Further, Mahieu et al. (2019) argue that this wage penalty is likely higher for high-ability workers. There are three main reasons for this. First, prospective employers find it harder to estimate the value of unusually high (or low) abilities, which hurts former entrepreneurs more. Second, because high-ability (high-wage) employees have a higher opportunity cost of running a firm, it may be more likely that their business does not offset this cost. This means that their trial as a business owner is more likely to be a short one. This may damage the perceived ability from the perspective of a prospective employer. Third, unsuccessful employees in high-level jobs may cause more harm to a business. Therefore, the upshot from Mahieu et al. (2019) is that we should expect a wage penalty for former entrepreneurs returning to wage employment and that this penalty should be larger for high-ability individuals.

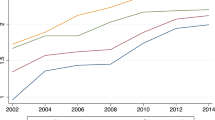

In Fig. 1, a graph is shown with time on the horizontal axis and wage on the vertical axis. There are two upward-sloping lines showing the development of wages for highly and less educated individuals. Time is divided into three intervals, t0 to t1, t1 to t2, and t2 and onwards. In the first interval, all people are wage employed. In the second interval, some start firms and are entrepreneurs, while others stay in wage employment.

We assume that there is uncertainty about future returns from the entrepreneurship venture. Additionally, entrepreneurs do not know how long they will run the firm. In particular, they do not take into account possible effects on the amount of their human capital and its future value in the regular labor market. These assumptions are made to avoid a situation where no risk-neutral, rational, forward-looking agent would ever choose entrepreneurship. However, there exists the possibility that some people would choose entrepreneurship even if there is a positive probability of incurring a pecuniary loss in the long run. The reason for this may be an intrinsic preference for running a firm and being one’s own boss or just the willingness to accept risk.

In the third interval, the entrepreneurs leave entrepreneurship and become wage employees. The upper upward-sloping line indicates the wage level of highly educated individuals. The unbroken line indicates workers who stay in wage employment during all three periods. For these workers, there is a steady increase in their wages during their whole career. Some of the highly educated individuals start a firm at t1. These are indicated by the dashed line.

The upper dashed line has no slope, which indicates that human capital is depreciating during entrepreneurship. We assume that wages are determined by the marginal return to human capital. Therefore, a relative depreciation of human capital translates to a lower wage (or lower wage growth) in comparison with that of workers in regular wage employment. The exact slope of this line is not decisive for the story, just that the slope is smaller than the one for people staying in wage employment. The result is that at time t2, the individuals who stayed in wage employment receive a higher wage than those who ventured into entrepreneurship. This means that there is a wage penalty for highly educated individuals, denoted by ΔH.

The lower upward-sloping line indicates the wage of individuals with a low education level. Additionally, in this group, in the first time interval, all are wage employed. At t2, some become entrepreneurs, and some stay in wage employment (but again change employers). The dashed line represents entrepreneurs. The dashed line has a lower slope than the solid line; however, the slope is still positive. This indicates that the skill of individuals with low education in entrepreneurship depreciates in comparison with that of workers who stay in wage employment. However, it does not depreciate as much as that of highly educated individuals relative to the skill of workers who stay in wage employment. The result is that the difference in wages in the third period, denoted by ΔL, is smaller than ΔH. Thus, the main point is that the wage penalty is higher for people with high education than for those with low education. Next, we discuss several factors that impact the size of skill depreciation during entrepreneurship.

It seems obvious that the type of firm that the entrepreneur starts impacts the use, accumulation, return, and depreciation of human capital and hence the size of the possible wage penalty. Additionally, this effect on wages is likely to differ between highly educated and less educated individuals. The duration of entrepreneurship should also influence the size of the effect. In terms of the figure, it is shown that the greater the interval between t1 and t2, the larger the wage difference after t2. Furthermore, the size of the effect is expected to be higher among highly educated individuals.

The size and range of demands in running the firm play a role in the size of the wage penalty. The variation or scope of demands in the firm may be proxied by, for instance, the liability of the owner or the technology requirements of the firm. For example, incorporated limited liability firms are more demanding to run than sole trader enterprises in terms of book-keeping and taxes. Additionally, they are more costly to start up. A more complex and advanced firm should presumably influence the usefulness of specific skills. More advanced (complex) start-ups require more differentiated (and specialized) tasks to be carried out.

One factor that is likely to be of importance is whether the new firm employs workers. On the one hand, a firm with employees requires more management-type work tasks. On the other hand, hiring workers means that they carry out some of the tasks. This means that there should be some specialization among workers and management in the firm. The result may be that a highly educated entrepreneur does not have to spread her time over many different tasks but is able to retain responsibility for some of the specialized tasks fitting her education. Hence, the wage penalty is likely smaller for a highly educated entrepreneur who hires other people in her firm. This would be the case for someone reentering wage employment in a managerial position.

Additionally, the relationship between the started firm and the former employer-firm should be important, especially in terms of industry (see above). If the firm that the entrepreneur was hired in is in the same industry as the new start-up, more work tasks are likely to be similar and to require more similar skills and human capital.

By developing this framework for analyzing effects on wages in employment after entrepreneurship by education level, we have been able to tease out some likely effects. First, we expect the duration of the treatment (running a firm) to be positively related to the wage penalty. Further, we expect the general effect to be larger for highly educated individuals. Second, the expected wage penalty is expected to be smaller for a limited liability firm than for a sole trader, especially for highly educated individuals. Third, if the entrepreneur and the new firm hire employees, we expect the wage penalty to be smaller, and again, this limiting effect should be stronger for highly educated individuals. Last, we expect industry relatedness to diminish the wage penalty, especially for highly educated workers.

The rest of this paper is devoted to shedding light on these questions and testing the general prediction of the developed framework. We also aim to test each of these hypotheses and especially highlight the intervening effects of education.

4 Data, selection, and empirical strategy

4.1 Data

Our analysis uses information on the population of Swedish individuals and firms provided by Statistics Sweden (SCB) at yearly frequency. We can match the individual data to business register data, providing us with a wide range of individual and firm characteristics across the time period of 1994 to 2018. Below follows a detailed description of our sample of exiting entrepreneurs and their control groups, the empirical strategy, and in particular our method of addressing the selection issues that we face.

4.2 Former entrepreneurs (treatment groups)

To evaluate the earnings returns to entrepreneurship experience, we compare the yearly earnings of former entrepreneurs to those of a group of individuals with no such entrepreneurial experience. We identify an entrepreneur as an owner of a business (either a sole proprietorship or an incorporated business). An individual is encoded as an entrepreneur if more than half of her income comes from a firm that she owns.Footnote 5 The labor market status of an individual is recorded in November of each year. We are able to observe changes in labor market status on a yearly basis only, which means that we might systematically exclude labor market and entrepreneurship periods with a duration of less than a year. Following the three-period framework that we outlined in the previous section, the empirical setting also has three periods: i) pretreatment, ii) treatment and iii) posttreatment periods. We use the term treatment to refer to when individuals enter and are entrepreneurs, and the pretreatment period is the time in employment before entry into entrepreneurship. Our main emphasis is on the posttreatment period, when the entrepreneurs exit entrepreneurship and return to wage employment.

The population of former entrepreneurs is defined as all individuals who exit entrepreneurship into regular wage employment between 2006 and 2010. Individuals are allowed to enter entrepreneurship at different points in time, which means that the duration of the experience (or the treatment) may vary between individuals. That individuals differ in timing and length of treatment duration also means that the observed duration of the posttreatment years varies. We collapse the entrepreneurship spell to one data point to which we then assign the value zero, which means our event years are defined as normalized years relative to the entrepreneurship spell. We include information about the individuals for twelve consecutive years before they exit entrepreneurship, and we include information covering nine years after the exit, which are the posttreatment years.

We exclude individuals who have multiple spells of entrepreneurial experience. This means that we analyze the effects of the first spell that an individual has as an entrepreneur. We also exclude those who continue as wage employees in a firm that they used to own. These are individuals whose firm is acquired with the entrepreneur continuing to work in the firm as an employee. We further exclude entrepreneurs who enter unemployment. Appendix Table 6 shows the descriptive statistics for our sample of entrepreneurs who exit compared to those whom we exclude under the above restrictions.

As outlined in the previous sections, we have two separate treatment groups based on their level of education attainment: high and low. Highly educated individuals are those with three or more years of tertiary education, while individuals with low education have fewer years. To exclude possible impacts on earnings that stem from obtaining a higher formal education after the treatment period, we exclude individuals whose educational attainment changes during the nine-year window after their exit.

Entrepreneurs who exit are unlikely to be a random selection of entrepreneurs. To show how the exiting entrepreneurs are different from those who do not exit we provide descriptive statistics for our full sample of exiting entrepreneurs versus individuals who continue in entrepreneurship in two consecutive years in Table 1. Individual- and firm-level characteristics are all measured in the pre-exit year when all individuals are still engaged in entrepreneurship.

The descriptive statistics in Table 1 show that there are some differences in observable individual characteristics between those entrepreneurs who stay and those who exit. Exiting entrepreneurs have lower earnings on average but receive more capital income, are slightly younger, are more often males, and have been in entrepreneurship for a shorter time period. However, the individual-level characteristic differences are fairly small, whereas the differences are more pronounced with regard to what kind of firms the entrepreneurs run. Those who exit are more likely to run a sole proprietorship than an incorporated business and have worse-performing firms in terms of both the number of employees and financial performance. Although those who exit have worse-performing firms on average, these firms still report positive financial performance, and they are not only micro-firms.

When comparing the two educational groups, we observe a substantial difference in the types of firms that the entrepreneurs run. Highly educated entrepreneurs have larger firms that are more successful. The less educated entrepreneurs earn less, are more often male, live outside of the metropolitan regions, and have somewhat longer experience in entrepreneurship. Less-educated entrepreneurs are approximately three times more numerous.

In general, we do find some observable differences across those who exit and those who continue. However, it is important to note that those who exit are worse performing but do have a positive financial performance even the year before exit. Table 1 also highlights the importance of differentiating between the two educational groups, as the higher educated entrepreneurs for example have systematically better performing businesses.

4.3 Control groups

The control groups are constructed from individuals who have not been entrepreneurs during their careers but who change employers within the same exit window of 2006 and 2010. By using these as a control group, we avoid the issue of tenure. This makes the control and treatment groups more similar, as both sets of workers change their place of work, and the bias arising from job switching per se is minimized. This also means that we exclude individuals who were entrepreneurs at any time from 1994 to 2018. In addition, the control group includes only individuals who change employers between two consecutive years between the pretreatment and treatment years. This means that the control group is employed at least the year before and during the treatment period. We use information on these individuals for twelve years before and nine years after the exit window.Footnote 6 The control groups are also divided based on education level under the same criteria as those applied to the treatment group.

4.4 Empirical design

We cannot directly compare the former entrepreneurs and the control groups: they are likely to be different because selection into treatment is not random. Thus, the counterfactual mean of the treatment group is not directly observable. Our empirical strategy is contingent on two assumptions: i) that matching individuals with a control group pretreatment minimizes the bias arising from selection into entrepreneurship and ii) that the dynamic difference-and-difference framework with individual and firm fixed effects with leads and lags controls for the rest of the bias arising from, for example, sorting into firms.

We match the former entrepreneurs with their control groups using coarsened exact matching (CEM) (Iacus et al., 2011). We rely on the k-to-k solution, in which we use the same number of individuals in the treatment and control groups as the observations are reduced within each stratum with random picks of control individuals.Footnote 7 We match individuals based on the exact pretreatment and exit years so that the labor market transitions are made in the same years. We ensure that individuals change employers in the same year, and we also match the duration of entrepreneurship experience with the duration of years in employment in the control group. This is to ensure that individuals in the control group are not unemployed or out of the labor force while the entrepreneurs are running their business and the entrepreneurship spell is appropriately linked with the employment spell. Beyond the timing issues, we also match on observed individual characteristics, including individuals’ earnings, age, gender, foreign background, and local labor market (LLMFootnote 8) region of residence. We also control for differences between the former entrepreneurs and the control group in unobservable dimensions of individual characteristics. We estimate an individual fixed effect in a wage equation in a panel encompassing the pretreatment period to capture the time-invariant individual-specific effect following Abowd et al. (1999), in what is commonly known as the AKM specification.Footnote 9 This purged individual fixed effect captures cognitive ability as well as other characteristics that are time-invariant.Footnote 10

In Appendix Table 7, we provide the matching information and detailed information on the coarsening. The matching lowers the overall multivariate imbalance, especially that of individual covariate multivariate imbalances, which measure the difference between the treatment and control groups. Approximately 9.3% of the entrepreneurs (or 3,370 individuals) are not matched, leaving us with 36,000 individuals in our empirical estimation who exit from entrepreneurship inside the window of 2006 to 2010. Table 8 in the Appendix shows the descriptive statistics of the matched and nonmatched entrepreneurs. Individuals who reside in nonmetropolitan areas are older and have higher unobserved ability and are overrepresented among the nonmatched individuals at both educational levels.

After matching, we estimate the following equation, which can be regarded as a dynamic difference-in-difference model with heterogeneous treatment years standardized to zero:

The outcome variable is the natural logarithm of the yearly earnings \({w}_{it}\) for individual i in year t. \({{\varvec{T}}}_{i(s=0)}\) is the treatment period, which we have collapsed to one data point indicating the spell in entrepreneurship or employment or the period after a change of employers for the control group. \({\tau }_{1}\) is therefore collinear to \({\lambda }_{s}^{All}\) when s = 0. \({\tau }_{2}\) estimates the average treatment effect for the entrepreneurs (E). As we measure yearly earnings in treatment as an average across various durations of time, these treatment coefficients should be interpreted cautiously. Our focus is on the posttreatment time period (\({{\varvec{P}}{\varvec{o}}{\varvec{s}}{\varvec{t}}}_{it+s}\)). This variable takes on value 1 when the individuals re-enter regular wage employment (or change employer for individuals in the control group), i.e., when the treatment period is over. \({\delta }_{1}\) estimates the average posttreatment effect overall, whereas the \({\delta }_{2}\) coefficient is for entrepreneurs specifically. The \({\delta }_{2}\) term is our main interest, and provided that we adequately control for selection, it can be interpreted as capturing a causal effect.

We also include a full set of event dummies, i.e., leads and lags that are common to both the treatment and control groups (\({\lambda }_{s}^{All}\)), as well as year dummies (\({\partial }_{m}\)). Furthermore, \({{\varvec{X}}}_{it}^{\mathrm{^{\prime}}}\) is a vector of covariates at the individual and firm levels that influence earnings. We include individual fixed effects \({\gamma }_{i}\) and control for firm-specific wage determinants with firm fixed effect \({\gamma }_{j}\), which captures the sorting of individuals into firms. We also control for the current labor market region in which the individual lives, denoted as \({\gamma }_{l}\).Footnote 11\({\varepsilon }_{it}\) is the conventional error term clustered at the firm level.

Our identification relies on the fact that we can control for any confounding differences between the control and treatment groups pre-treatment using the CEM matching technique. This should control for observed and unobserved differences which the within-variation estimation fails to account for. Including the individual fixed effects (\({\gamma }_{i}\) term) means that the identified effect is estimated using individual variation over time rather than between individual variation. Also including a full set of leads and lags and showing that the common pre-trends assumption holds gives us confidence in that we can control for any anticipatory labor supply effects pre-entrepreneurship. However, the exit of individuals from entrepreneurship is a nonrandom process and one inherent assumption we make is that it can be equated with a wage job-change and that all entrepreneurship exits are homogenous. However, exit routes can be diverse and some may be voluntary whereas others are pushed out from the market. This inherent nonrandom exit process involves a potential threat to our identification strategy which may result in some bias in our estimations. The direction of the bias is not obviously clear.

4.5 Descriptive statistics

Our outcome variable is individual yearly earnings. We have information on the gross yearly income of the individuals measured in Swedish krona (SEK), including both labor employee income and labor income from an owned business. The values are deflated to 2016 price levels; thus, we measure real earnings. We graph the average natural logarithm of the earnings variable for the former entrepreneurs and their respective control groups in Fig. 2 to evaluate unconditional earnings and their potential pre-trends.

The earnings for the pre-entrepreneurship time period follow fairly similar trends for both the highly educated and less educated former entrepreneurs and their control groups. Both the treatment and control groups seem to have a slightly decreasing trend in the earnings growth rates as they approach the treatment (event year equal to zero). The parallel trends assumptions seem to hold relatively well for both the highly educated and less educated individuals.

Descriptive statistics of the estimation sample of former entrepreneurs and their respective control groups are presented in Table 2, differentiating between highly and less educated individuals. Appendix Table 9 provides further information on the distribution of individuals in our sample based on which year they enter treatment and how many posttreatment observations for the individuals are considered.

As noted above, less educated individuals are more numerous than highly educated individuals; further, the descriptive statistics reveal interesting differences between the two groups. Less-educated individuals more often live outside of metropolitan areas and have substantially lower average earnings, indicating lower productivity, which is also shown by the difference in the AKM fixed effects. They are also on average a few years younger, more often male, and work in smaller firms. The average firm size is relatively large for all individuals but hides considerable variation and is skewed upwards by the largest firms, making the average value high. Notably, less educated former entrepreneurs have more experience as employers and display more exits where the firm closes down due to mergers or acquisitions. Highly educated individuals are more active in high-technology industries and more likely to re-enter entrepreneurship. However, the main message from the descriptive table is the inherent similarities between the former entrepreneurs and their control groups.

5 Results

5.1 Baseline results

As mentioned, we estimate Eq. 1 separately for high and low levels of educational attainment. The results are presented in Tables 3 and 4. We include the firm and individual fixed effects stepwise in columns one to three, and in the first two, we include a treatment group dummy (Entrepreneur). Column three is our main and preferred specification with a full set of fixed effects with CEM k-to-k matching. We present estimates with CEM matching with weights for reference in column four. Column five includes estimates for the whole sample, where both highly educated and less educated individuals are included.

The treatment coefficient (\({\tau }_{1}\)) estimates the average earnings for the control group in treatment, while the interaction term indicates the treatment effect for entrepreneurs. As mentioned previously, these treatment effects should be interpreted cautiously, as in many cases, we have collapsed multiple years to one data point. The main emphasis is on the interaction term of the posttreatment dummy and the dummy indicating whether the individual is an entrepreneur (\({\delta }_{2}\)).

The results indicate that during the entrepreneurship experience, highly educated individuals earn on average 5.4% less than those in wage employment. These findings are not uniform when we compare across the matching procedures. Our empirical strategy does not allow us to clearly evaluate these earnings, and thus rigorous inferences cannot be made. The posttreatment earnings, however, are our main outcome of interest, and the results show in general earnings losses of approximately 6.8% in wage employment after the entrepreneurship spell. This means that highly educated individuals experience a penalty from their entrepreneurship experience. This result is robust to the alternative matching technique. The findings also suggest that highly educated former entrepreneurs experience a higher wage penalty than the overall population of former entrepreneurs.

Next, we estimate our baseline equation for less educated individuals. We run stepwise estimations like those above in columns one to three, add the alternative matching procedure in column four, and provide the results for a full sample of both educational levels in column five. The results are presented in Table 4.

We find that less educated entrepreneurs earn 2.1% less in the posttreatment years (based on column 3). In the absence of firm and individual fixed effects, these losses would be underestimated, as shown by columns one and two. The findings indicate that less educated individuals experience lower penalties after a spell of entrepreneurship than do highly educated individuals. The results for the posttreatment interaction with the entrepreneur dummy are also similar between the two matching procedures, showing that our results are not sensitive to the choice of matching procedure.

The included control variables for both the highly educated and less educated individuals are of the expected sign and magnitude for all but the schooling variable. The within variation in the years of schooling is too small to estimate the earnings premium associated with obtaining more years of education, especially for the less educated group. The individual fixed effect captures years of education in our case, and it does not vary across time. There are considerable differences in the magnitudes of the control variable coefficients across the education groups. The fit of the model is greatly improved for both highly educated and less educated individuals when we add firm and individual fixed effects; with these, we capture a large share of the earnings variation.

According to our findings, entrepreneurship is a self-employment form that leads individuals to lose earnings when they re-enter wage employment. The baseline results indicate that entrepreneurship experience is monetarily detrimental at every point in the career of the individuals afterward; however, we find a differential impact of entrepreneurship experience on earnings for individuals with higher and lower education levels. The results indicate that individuals lose more of their specific human capital in entrepreneurship if they are highly educated and that this results in permanent earnings losses. The results are similar to those of Amit et al. (1995) and Campbell et al. (2012), where star entrepreneurs have a higher opportunity cost of entering entrepreneurship because of the higher cost of lost wages. Our results imply that the opportunity cost for high-skilled entrepreneurs is not limited to the entrepreneurial entry decision and that the opportunity costs have long-lasting effects even post-entrepreneurship. Conversely, we find limited and smaller effects of such depreciation for entrepreneurs with low education levels, implying that their opportunity cost in wage employment is smaller.

5.2 Dynamic returns

Instead of separately estimating the treatment effect (\({\tau }_{1})\) and an average posttreatment effect (\({\delta }_{1}\)) and their interactions with the treatment groups (\({\tau }_{1}\) and \({\delta }_{1}\)) in equation one, we can estimate a model with a full set of lead and lag dummies with interaction terms. This means that we modify our baseline equation as follows:

In this specification, the \({\lambda }_{s}^{Entre}\) terms are the treatment dummies for the entrepreneurs, which vary over the entire event horizon. This enables us to evaluate post-entrepreneurship earnings in a dynamic setting. We normalize the first year to our base.Footnote 12 The point estimates of \({\lambda }_{s}^{Entre}\) and their 95% confidence intervals from estimating Eq. 2 separately for highly and less educated individuals are presented in Figs. 3 and 4.

Figure 3 shows that highly educated former entrepreneurs experience a large penalty, especially in the first year when they become wage employees. This effect decreases and stays relatively stable after this, with an average earnings loss of approximately 5%. This means that earnings losses are permanent for highly educated individuals who try out entrepreneurship. The average posttreatment effect from Eq. 1 masks some important variation in the earnings dynamics in wage employment.

The earnings trajectory for less educated individuals who try out entrepreneurship in Fig. 4 looks different than the earnings dynamics of highly educated entrepreneurs. The dynamic effects reveal that the average posttreatment effect is driven entirely by entry earnings, i.e., the first year in wage employment. After this first year, there is no significant earnings difference with the control group. In this dynamic setting, we find no long-lasting effects of the entrepreneurship experience.

The results from the dynamic estimations show that in the first year, entrepreneurs earn significantly less than the control group. However, for less educated individuals, this drop in earnings is temporary, whereas highly educated individuals experience earnings losses even after nine years in wage employment. This corroborates our theoretical underpinnings, where we show that the skill losses from entrepreneurial experience are lower for less educated individuals. However, these earnings differences are only present in the first year of employment, which might be a result of other factors, such as measurement error or divergent employment outcomes, which we turn to in the next section.

5.3 Robustness

We conduct several robustness checks to validate our results with respect to our sample of exiting entrepreneurs and post-entrepreneurship employment outcomes.Footnote 13 First, we have a large share of exiting entrepreneurs who re-enter entrepreneurship in the posttreatment time period. We exclude these individuals from our estimations, as this group of entrepreneurs might be causing a downward bias in the estimates due to their lower entrepreneurial earnings. Second, exclusion of the re-entries might not be sufficient to account for hybrid entrepreneurs, i.e., those who run a business and are simultaneously wage employed. We have information on the secondary income source, and therefore, in an alternative estimation, we exclude those entrepreneurs who, during their posttreatment time period, have a secondary entrepreneurial income. By excluding re-entries and hybrid entrepreneurs, we should be including only true exits in a more conservative sample. Third, there might be systematic differences in entry into public employment between the entrepreneurs and the control group. Especially in Sweden, wages in the public sector are highly compressed, whereas there is more room for wages to convey productivity in the private sector. Even if in our main estimation we include firm fixed effects, which should account for much of this sorting, in a separate estimation, we also exclude the public sector to evaluate whether our results are sensitive to this sample selection. Estimations from the abovementioned three separate sample restrictions are presented in Table 10 in the Appendix. The results show some variation in the posttreatment coefficient, but the results are largely very robust.

The large earnings losses, especially the first year in wage employment, could be driven by either true earnings losses in the first year or a potentially uneven distribution of the transitions from entrepreneurship, which would thus cause entrepreneurship earnings to drive the large negative earnings difference. This might drive the results particularly since we measure yearly earnings and cannot distinguish part-time work. We have access to a subsample of individuals with information on monthly earnings based on the employment contract and the percentage working full time. This sample consists of 50% of the private sector and the entire public sector, but the coverage across years is lower for our main earnings variable. We utilize these data to run the same estimations as in Eqs. 1 and 2 to evaluate whether our main results are robust to the inclusion of observed full-time workers only and how much of the first-year earnings drop can be accounted for by part-time work and the transitions from entrepreneurship to wage employment. The results of this exercise are presented in Appendix Table 11 and Figs. 5 and 6. The results show that the earnings drop in the first year can be largely accounted for when we use monthly wages instead of yearly earnings for the estimation. For less educated entrepreneurs, this drop and the entirety of the posttreatment earnings losses disappear, which leads us to conclude that we find no robust evidence of entrepreneurship experience resulting in any significant earnings losses in wage employment. For the highly educated, the earnings loss in the first year decreases to approximately 5%. These results are the most conservative, and our findings of significant and persistent earnings losses for the highly educated can be confirmed.

6 Mechanisms

To distinguish the mechanisms outlined in Section 3, we run our estimations based on equation one with a triple difference-in-difference framework where we interact the treatment and posttreatment effects on the entrepreneurs with the various measures of entrepreneurial experience. This is done to evaluate what characteristics of entrepreneurial experience can explain the earnings of entrepreneurs in later wage employment.

We outline four possible mechanisms that could impact the lack of use of individuals' strongest skill during entrepreneurship in Table 5. First, and most importantly, we interact the posttreatment effects with the duration of the entrepreneurial spell measured in years (columns one and six). This measures how the size of the depreciation is a function of time. Second, we proxy the complexity of the firm with two different measures. We include a dummy indicating whether the entrepreneurs’ firm is a sole proprietorship instead of an incorporated firm, and we distinguish entrepreneurs active in high-technology industries based on the Eurostat two-digit industry code definition of high-technology manufacturing industries and knowledge-intensive services. The results are presented in columns two, three, seven, and eight. Third, we differentiate between entrepreneurs who employ individuals during their experience, which measures the potential of the entrepreneur to use her specific skill in entrepreneurship after she hires individuals to conduct other tasks in her firm. Last, we evaluate industry experience, where we assess whether the entrepreneur was active in the same industry as that of posttreatment employment based on two-digit industrial codes of the firms. We do this to test whether the depreciation of the specific skills of individuals is a function of industry-specific human capital.

The findings suggest a higher rate of depreciation per year for highly educated entrepreneurs. This is evidence that the slope in Fig. 1 is indeed steeper for less educated entrepreneurs. The opportunity cost associated with entrepreneurship is approximately 1% higher for each year spent in entrepreneurship, further confirming the argument of Amit et al. (1995) and Campbell et al. (2012). This negative impact of longer spells in entrepreneurship provides strong evidence of the depreciation of skills that are useful as wage employees and the way that this depreciation differs among educational groups. However, we also find a negative earnings difference when we control for years of entrepreneurial experience, which suggests that all entrepreneurs are affected, not only the ones with the longest experiences.

The results show no relationship between the complexity of the entrepreneurial firm and the impact on the post-entrepreneurship earnings of highly educated individuals. Conversely, for less educated entrepreneurs, the earnings losses disappear with the increase in the complexity of the firm. This finding means that the higher opportunity cost for higher-skilled individuals cannot be diminished by the use of more cognitive abilities (Levine & Rubinstein, 2016) but that less skilled individuals with more cognitive abilities deployed in incorporated businesses and those with greater technological complexity gain from this in later employment.

In both educational groups, entrepreneurs with employer experience have lower earnings losses, i.e., a positive coefficient of the triple diff-in-diff coefficient. This suggests that skills depreciate less when the entrepreneur hires employees in her venture. Potentially, this arises because the entrepreneur can distribute different tasks to the employees while using her own strongest skill, as she no longer has to complete as many tasks herself, i.e., is not a solo entrepreneur who carries out all tasks alone (Astebro et al., 2011). This effect, together with the length of the experience, is the only mechanism that we find to be similar in both education groups. The decreases in the earnings losses are even of the same magnitude, implying that both groups benefit from distributing some tasks to other employees.

We find evidence to confirm that human capital depreciates less for those who continue in the same industry post-entrepreneurship, but this is found only for highly educated ones. This effect is large in magnitude, implying that industry-specific skills are especially important for highly educated individuals, which is in line with the findings of Kaiser and Malchow-Møller (2011), but we cannot confirm that the earnings losses are completely driven by industry switching. Such effects cannot be found for less educated entrepreneurs, which may imply a relationship with industry-specific human capital and the attained education, which less educated individuals lack.

The findings in Table 5 corroborate some of our proposed mechanisms. They also highlight yet again the diverse impact that entrepreneurial experience has on the post-entrepreneurship earnings of these two different educational groups. The extent to which individuals find that skills valuable in employment depreciate in entrepreneurship depends on several experience metrics. This comes as no surprise, as being an entrepreneur involves heterogeneous experiences. We also show that estimating such earnings equations without taking these differences into account would mask the heterogeneous effects for different levels of education.

The main mechanisms that seem to be at play for highly educated employee’s post-entrepreneurship wages seem to be the opportunity cost of their human capital. The length of the experience predicts a larger loss in wages and there is a large premium on industry experience. However, employer experience which may predict managerial experience or function as a signal of success to the market may lessen some of these opportunity costs, but not fully. For the lower educated employees, there is evidence of less of an opportunity cost and potentially a relative upgrading of their skills that are more valuable in the labor market than basic labor market experience from regular employment. These mechanisms are in line with our theoretical underpinnings and expectations.

7 Conclusions

In this study, we investigate how individuals' earnings are affected by having been an entrepreneur and how these earnings trajectories differ between educational groups. In the analysis, we control for non-randomness in entry probability by matching observable characteristics and unobserved ability pre-entry and utilize the longitudinal nature of our data to include a full set of fixed effects in a dynamic difference-in-difference framework. Our results show that a spell of entrepreneurship leads to a decrease in earnings in comparison to the wages of those with regular wage employment experience. The evidence points to entrepreneurship experience having a persistent effect on the earnings of highly educated individuals, whereas we find limited support for this effect on less educated individuals. We pinpoint a few alternative mechanisms that explain this difference. In general, our paper also shows the divergent effect that entrepreneurship has on earnings in later employment.

Do our results imply that individuals do not acquire any knowledge from entrepreneurship? The results show that in comparison with wage employment experience, former entrepreneurs earn less in their post-entrepreneurship careers. This does not necessarily mean that individuals do not gain human capital during their experience. The result implies that in regular wage employment, this entrepreneurship experience is not compensated. We cannot tell whether this is due to some form of discrimination or actual loss of productivity. Earnings also do not capture knowledge spillovers or nonpecuniary benefits from the entrepreneurial experience. Other potential explanations to our findings may for example be a difference in seniority, a shortage in beneficial network externalities peculiar to employment, and lack of skills acquired from on-the-job training that employees possibly participate in. All of these may be considered costs incurred when in entrepreneurship that the employers can impose on wages when hiring the former entrepreneurs.

Importantly, we cannot fully distinguish between the entrepreneurs who exit voluntarily or those who are pushed out from the market. The resulting differences in for example reservation wages when finding employment may have the potential to influence our results. When interpreting our results, one should also keep in mind that our identification comes from the comparison between individuals that exit entrepreneurship and job switchers. Even though there are successes among those that exit from entrepreneurship it may well be the case that on average those that remain in entrepreneurship may be regarded as more successful. This is true at least in the sense that we know that they were not forced out from the market, and these stayers are not part of the identification of the effects. We urge future studies to look more closely into if different exit routes from entrepreneurship matter for the following labor market outcomes.

Should public policy encourage individuals to enter entrepreneurship? We show that individuals with limited skills fare well in the labor market after they eventually exit entrepreneurship and return to wage employment. The potential loss for these individuals may mainly be foregone income during the entrepreneurial experience. However, highly educated individuals who venture into entrepreneurship are subject to persistent earnings losses. This means that the cost associated with entrepreneurship is not internalized only while they are running the firm. As a large share of entrepreneurs eventually fail or exit for other reasons, the would-be entrepreneur should at least be made aware of such costs in the design of incentive schemes to help individuals try entrepreneurship as an alternative to wage employment. However, in the absence of market failures, the earnings losses that we find are reasonable if entrepreneurs lose some of the skills that employers value. In this paper, all focus is on the impact for individuals who exit entrepreneurship which means that we do not say anything about individuals who continue in entrepreneurship. For some individuals selling off their company and going back to employment may be a successful and planned exit, but this type of entrepreneurial success is often described as a business failure. Future work should evaluate and extent the impacts of diverse exit routes on post entrepreneurship outcomes. This type of research is warranted since the way of exit may have important implications for policy.

Data Availability

The dataset analyzed during the current study are not publicly available due to them being protected by the Swedish Secrecy Act. The data can however be obtained from Statistics Sweden. Information about this process is provided through this link https://www.scb.se/en/services/guidance-for-researchers-and-universities/

Notes

At the firm level there is considerable heterogeneity when it comes to survival, for example, firms that are especially innovative or high-growth are more likely to stay active longer (Colombelli et al. 2016; Cefis and Marsili 2019; Ugur and Vivarelli 2021). There also are numerous of firm-level characteristics that define the growth firms and especially high-growth firms (Mogos et al. 2021). There is also evidence that entrepreneurship responds to business cycles (e.g., Sanchis Llopis et al. 2015) and to the underlying institutional quality e.g. (Hanoteau and Vial 2020).

Kaiser & Müller (2015) show that start-up teams are homogenous in terms of their human capital attributes and that individuals are likely to cooperate with individuals like themselves. This means that differentiating between firms based on workforce education will likely give similar results as differentiating individuals based on education.

The decision to become an entrepreneur, however, can be seen as riskier than being an employee because the individual can be exposed to financial losses and there might be significant stigma attached to a possible failure. As shown by Blanchflower and Oswald (1998), for example, the decision to enter entrepreneurship differs between individuals by background, such as ability, experience and family situation. However, both high- and low-wage income earners, as well as highly and less educated individuals, choose to become self-employed (Blanchflower 2000; Poschke 2013). Hamilton (2000) and Moskowitz and Vissing-Jørgensen (2002) discuss that the decision to enter self-employment is influenced by the returns to both capital and human capital.

If an individual potentially falls in a different year’s control group, i.e., changes employers more than once within the window 2006 to 2010, we duplicate these individuals.

We provide results from CEM matching with weights as a comparison.

Sweden is divided into 60 local labor markets by Growth Analysis (Tillväxtverket), which is a governmental authority. The local labor markets are constructed to capture municipalities with large cross-border commuting flows.

The earnings estimate closely follows Abowd et al.'s (1999) and Card et al.'s (2013) framework: \({ln(w}_{it})={\alpha }_{i}+{\boldsymbol{X}}_{it}^{\text{'}}\beta +{\gamma }_{j(i,t)}+{\gamma }_{t}+{\varepsilon }_{it}$$.$${\alpha }_{i}\) is the individual fixed effect, which we refer to as unobserved ability. \(\gamma_{j(i,t)}\;\;\mathrm a\mathrm n\mathrm d\;\;\gamma_t\) are firm and year fixed effects, respectively. Following Card et al. (2013), \(\boldsymbol X_{it}^\text{'}\) includes time-varying individual-level control variables, which include age squared, age cubed together with interactions with the education categories and the year dummies as well as age squared, and age cubed. We estimate the model separately for men and women, and to make the individual fixed effects comparable across the two groups, we normalize them. For more detailed information, please contact the authors.

Many have used this individual fixed effect to measure unobserved ability (Bender et al., 2018; Bombardini et al., 2019; Cornelissen et al., 2017), but not much is known about what exactly it captures. An exception to this is Butschek and Sauermann (2019), who show that the obtained individual fixed effect shows a correlation with cognitive test scores of approximately 40%. We include the fixed effect, as previous studies have found bimodal entry into entrepreneurship (Andersson Joona & Wadensjö, 2013; Astebro et al., 2011), and this further controls for the ability of individuals beyond education. We are the first in the context of post-entrepreneurship earnings to also control for ability.

Our results are robust to including industry-year fixed effects. These are included in order to test for a potential impact from the financial crisis that occurred during our sample period (and had the potential to hit different industries differently). These fixed effects also control for other industry-time specific shocks such as variations in foreign demand or automation issues that might not be economy wide. The results of these specifications can be requested from the authors.

If we instead normalize the year before treatment as our base, we find similar treatment and posttreatment results. However, the pretreatment coefficients show a positive earnings gap between the treatment and control groups. These coefficients, however, do not show any divergent trend. The results of these estimations can be retrieved from the authors upon request.

We also evaluate the potential impact of the 2008 financial crisis on our sample of exiting entrepreneurs. We estimate triple difference-in-difference models, similar to those in Section 6, where we differentiate between exit in 2009 and 2010 and exit in other years. These results show no different posttreatment effects between the two groups of exits, implying that there is no inherent difference between crisis and noncrisis exits. To save space, we do not report these results. They are available from the authors upon request.

References

Abowd JM, Kramarz F, Margolis DN (1999) High wage workers and high wage firms. Econometrica 67(2):251–333

Amit R, Muller E, Cockburn I (1995) Opportunity costs and entrepreneurial activity. J Bus Ventur 10(2):95–106. https://doi.org/10.1016/0883-9026(94)00017-O

Andersson Joona P, Wadensjö E (2013) The best and the brightest or the least successful? Self-employment entry among male wage-earners in Sweden. Small Bus Econ 40(1):155–172. https://doi.org/10.1007/s11187-011-9365-0

Astebro T, Chen J (2014) The entrepreneurial earnings puzzle: Mismeasurement or real? J Bus Ventur 29(1):88–105

Astebro T, Chen J, Thompson P (2011) Stars and misfits: Self-employment and labor market frictions. Manage Sci 57(11):1999–2017

Baird, D. G., & Morrison, E. R. (2005). Serial Entrepreneurs and Small Business Bankruptcies. Columbia Law Review (8), 2310–2368. Retrieved from https://heinonline.org/HOL/P?h=hein.journals/clr105&i=2360

Baptista R, Lima F, Preto MT (2012) How former business owners fare in the labor market? Job assignment and earnings. Eur Econ Rev 56(2):263–276

Becker GS (1962) Investment in human capital: A theoretical analysis. J Polit Econ 70(5, Part 2):9–49

Becker GS (1964) Human Capital: A Theoretical and Empirical Analysis, With Special Reference to Education. National Bureau of Economic Research, New York

Bender S, Bloom N, Card D, Reenen JV, Wolter S (2018) Management Practices, Workforce Selection, and Productivity. J Law Econ 36(S1):S371–S409. https://doi.org/10.1086/694107

Benz M, Frey BS (2008) Being Independent is a Great Thing: Subjective Evaluations of Self-Employment and Hierarchy. Economica 75(298):362–383. https://doi.org/10.1111/j.1468-0335.2007.00594.x

Blanchflower DG (2000) Self-employment in OECD countries. Labour Econ 7(5):471–505

Blanchflower DG, Oswald AJ (1998) What makes an entrepreneur? J Law Econ 16(1):26–60

Bombardini M, Orefice G, Tito MD (2019) Does exporting improve matching? Evidence from French employer-employee data. J Int Econ 117:229–241. https://doi.org/10.1016/j.jinteco.2018.11.001

Bruce D, Schuetze HJ (2004) The labor market consequences of experience in self-employment. Labour Econ 11(5):575–598

Butschek S, Sauermann J (2019) Can estimated AKM individual effects approximate cognitive ability. Stockholm University

Campbell BA (2013) Earnings effects of entrepreneurial experience: Evidence from the semiconductor industry. Manage Sci 59(2):286–304

Campbell BA, Ganco M, Franco AM, Agarwal R (2012) Who leaves, where to, and why worry? employee mobility, entrepreneurship and effects on source firm performance. Strateg Manag J 33(1):65–87. https://doi.org/10.1002/smj.943

Card D, Heining J, Kline P (2013) Workplace Heterogeneity and the Rise of West German Wage Inequality*. Q J Econ 128(3):967–1015. https://doi.org/10.1093/qje/qjt006

Cefis E, Marsili O (2019) Good times, bad times: innovation and survival over the business cycle. Ind Corp Chang 28(3):565–587

Colombelli A, Krafft J, Vivarelli M (2016) To be born is not enough: the key role of innovative start-ups. Small Bus Econ 47(2):277–291

Couch KA, Placzek DW (2010) Earnings Losses of Displaced Workers Revisited. Am Econ Rev 100(1):572–589

Cornelissen T, Dustmann C, Schönberg U (2017) Peer Effects in the Workplace. American Economic Review 107(2):425–456. https://doi.org/10.1257/aer.20141300

Daly M (2015) The long term returns of attempting self-employment with regular employment as a fall back option. Labour Econ 35:26–52

Edin P-A, Gustavsson M (2008) Time out of work and skill depreciation. Industr Labor Relat Rev 61(2):163–180

Evans DS, Leighton LS (1989) Some Empirical Aspects of Entrepreneurship. Am Econ Rev 79(3):519–535

Ferber MA, Waldfogel J (1998) Long-Term Consequences of Nontraditional Employment. Monthly Lab Rev 121:3

Gimeno J, Folta TB, Cooper AC, Woo CY (1997) Survival of the fittest? Entrepreneurial human capital and the persistence of underperforming firms. Admin Sci Quarterly, 750–783

Hamilton BH (2000) Does entrepreneurship pay? An empirical analysis of the returns to self-employment. J Polit Econ 108(3):604–631

Hanoteau J, Vial V (2020) Institutional quality, conforming and evasive entrepreneurship. Eurasian Bus Rev 10(1):97–121

Hessels J, Grilo I, Thurik R, van der Zwan P (2011) Entrepreneurial exit and entrepreneurial engagement. J Evol Econ 21(3):447–471

Hyytinen A, Rouvinen P (2008) The labour market consequences of self-employment spells: European evidence. Labour Econ 15(2):246–271

Iacus SM, King G, Porro G (2011) Causal inference without balance checking: Coarsened exact matching. Polit Anal mpr013

Jacobson LS, LaLonde RJ, Sullivan DG (1993) Earnings Losses of Displaced Workers. Am Econ Rev 83(4):685–709

Kaiser U, Malchow-Møller N (2011) Is self-employment really a bad experience?: The effects of previous self-employment on subsequent wage-employment wages. J Bus Ventur 26(5):572–588

Kaiser U, Müller B (2015) Skill heterogeneity in startups and its development over time. Small Bus Econ 45(4):787–804

Koellinger PD, Mell JN, Pohl I, Roessler C, Treffers T (2015) Self-employed But Looking: A Labour Market Experiment. Economica 82(325):137–161. https://doi.org/10.1111/ecca.12115

Kuhn PJ, Schuetze HJ (2001) Self-employment dynamics and self-employment trends: a study of Canadian men and women, 1982–1998. Canadian Journal of Economics/revue Canadienne D’économique 34(3):760–784

Lazear E (2004) Balanced skills and entrepreneurship. Am Econ Rev 94(2):208–211

Lazear E (2005) Entrepreneurship. J Law Econ 23(4):649–680. https://doi.org/10.1086/491605

Levine R, Rubinstein Y (2016) Smart and Illicit: Who Becomes an Entrepreneur and Do They Earn More?*. Q J Econ 132(2):963–1018. https://doi.org/10.1093/qje/qjw044

Luzzi A, Sasson A (2015) Individual entrepreneurial exit and earnings in subsequent paid employment. Entrepreneur Theory Pract

Mahieu J, Melillo F, Reichstein T, Thompson P (2019) Shooting stars? Uncertainty in hiring entrepreneurs. Strategic Entrepreneur J. doi:https://doi.org/10.1002/sej.1339

Manso G (2016) Experimentation and the Returns to Entrepreneurship. The Review of Financial Studies 29(9):2319–2340. https://doi.org/10.1093/rfs/hhw019

Mogos S, Davis A, Baptista R (2021) High and Sustainable Growth: Persistence, Volatility, and Survival of High Growth Firms. Eurasian Bus Rev 11(1):135–161. https://doi.org/10.1007/s40821-020-00161-x

Moskowitz TJ, Vissing-Jørgensen A (2002) The returns to entrepreneurial investment: A private equity premium puzzle? Am Econ Rev 92(4):745–778

Parker SC (2018) The economics of entrepreneurship: Cambridge University Press

Pissarides CA, Weber G (1989) An expenditure-based estimate of Britain’s black economy. J Public Econ 39(1):17–32. https://doi.org/10.1016/0047-2727(89)90052-2