Summary.

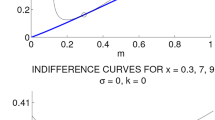

We consider the problem of efficient insurance contracts when the cost structure includes a fixed cost per claim. We prove existence of efficient insurance contracts and that the indemnity function in such contracts is non-decreasing in the damage. We further show that either there is no insurance, or the indemnity is positive for all losses, or efficient insurance contracts have a unique jump. We study variants of the model and provide a generalization to the case of non expected utilities. Our results are then applied to Townsend's model of deterministic auditing.

Similar content being viewed by others

Author information

Authors and Affiliations

Additional information

Received: November 8, 2000; revised version: March 12, 2002

RID="*"

ID="*" We are grateful to F. Salanié for pointing out an error in the previous version of the paper and for suggesting Proposition 6 to us.

Correspondence to: R.-A. Dana

Rights and permissions

About this article

Cite this article

Carlier, G., Dana, RA. Pareto efficient insurance contracts when the insurer's cost function is discontinuous. Econ Theory 21, 871–893 (2003). https://doi.org/10.1007/s00199-002-0281-z

Issue Date:

DOI: https://doi.org/10.1007/s00199-002-0281-z