Summary.

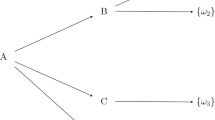

We prove the existence of equilibrium in a continuous-time finance model; our results include the case of dynamically incomplete markets as well as dynamically complete markets. In addition, we derive explicitly the stochastic process describing securities prices. The price process depends on the risk-aversion characteristics of the utility function, as well as on the presence of additional sources of wealth (including endowments and other securities). With a single stock, zero endowment in the terminal period, and Constant Relative Risk Aversion (CRRA) utility, the price process is geometric Brownian motion; in essentially any other situation, the price process is not a geometric Brownian motion.

Similar content being viewed by others

Author information

Authors and Affiliations

Corresponding author

Additional information

JEL Classification Numbers:

D52.

This paper is part of my Dissertation (UC Berkeley). I am very grateful to my advisor Professor Robert M. Anderson. I also would like to thank Steve Evans, Roger Purves, Jacob Sagi, Chris Shannon and the participants of the 2002 NBER General Equilibrium Conference at the University of Minnesota (Minneapolis) for very helpful discussions and comments. This work was supported by Grant SES-9710424 from the National Science Foundation.

Rights and permissions

About this article

Cite this article

Raimondo, R.C. Market clearing, utility functions, and securities prices. Economic Theory 25, 265–285 (2005). https://doi.org/10.1007/s00199-003-0445-5

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/s00199-003-0445-5