Abstract

We study reallocation rules in the context of a one-good economy consisting of agents with single-peaked preferences and individual endowments. A rule is bribe-proof if no group of agents can compensate one of its subgroups to misrepresent their characteristics (preferences or endowments) in order that each agent is better off after an appropriate redistribution of what the rule reallocates to the group, adjusted by the resource surplus or deficit they all engage in by misreporting endowments. First, we characterize all bribe-proof rules as the class of efficient, (preference and endowment) strategy-proof and weakly replacement monotonic rules, extending the result due to Massó and Neme (Games Econ Behav 61: 331–343, 2007) to our broader framework. Second, we present a full description of the family of bribe-proof rules that in addition are individually rational and peak-only. Finally, we provide two further characterizations of the uniform reallocation rule involving bribe-proofness.

Similar content being viewed by others

Notes

In the model with a social endowment instead of individual ones, an explicit treatment of agents voluntary participation is done by Bergantiños et al. (2012). In that paper agents are characterized by intervals of acceptable amounts and can opt not to be part of the division problem.

The dummy property requires that if an agents endowment coincides with her preferences peak, then the rule should assign to the agent her own endowment. Our weak version only applies when both the endowment and the preferences peak of the agent are zero.

Bribe-proofness actually implies group strategy-proofness, which means that no coalition can gain by misrepresentation of their characteristics.

We can always “embed” an allocation problem \((R,\Omega )\) consisting of a profile of preferences \(R \in \mathcal {R}^N\) and a social endowment \(\Omega \in \mathbb {R}_{+}\) into a reallocation problem \((R, \omega ) \in \mathcal {E}^N\) by assigning to each agent an individual endowment consisting of an equal part of the social endowment, i.e., \(\omega _i:= \frac{\Omega }{n}\) for each \(i \in N.\) From this perspective our model generalizes the one with a social endowment.

In the model with a social endowment \(\Omega \in \mathbb {R}_+\), replacement monotonicity requires that for each \(e=(R, \Omega ) \in \mathcal {R}^{N}\times \mathbb {R}_+ ,\) \(i \in N\) and \(R_i^{\prime }\in \mathcal {R},\) if \(e^{\prime }=(R_i',R_{-i},\Omega )\) and \(f_i(e^{\prime }) \ge f_i(e),\) then \(f_j(e^{\prime }) \le f_j(e)\) for each \(j \ne i.\)

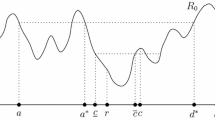

Formally, a rule \(f\) is peak-only if, for each pair \(e=(R,\omega ),\) \(e'=(R',\omega ) \in \mathcal {E}^N,\) whenever \(p(R)=p(R^{\prime })\) we have \(f(e)=f(e^{\prime }).\) This requirement is necessary since it is easy to adapt examples of bribe-proof rules that are not peak-only from Massó and Neme’s setting to ours.

Here the notation \(\varvec{g^t}\) denotes \(g\) composed with itself \(t\) times.

Although bribe-proof rules are own peak-only by Lemma 1, they are not peak-only in general. Example 2 in Massó and Neme (2003) shows this fact in the model with a social endowment. This example can be easily adapted to our model.

The uniform reallocation rule is actually replacement monotonic, since the “weak” part of the definition (concerning the cases in which the agent whose characteristics are being replaced is assigned her peak) is never used in the proof.

This is an adaptation of the example discussed by Massó and Neme (2007) in their Final Remarks section. The actual description of the rule \(f\) is omitted, but it is a straightforward generalization of theirs.

See Thomson (2010).

Roughly speaking, in models with a social endowment, consistency demands of a rule that the proposed allocation at a given economy coincides with the allocation the rule would propose at any smaller economy obtained after that a subset of agents, agreeing with the amounts the rule has assigned to them, leave the society taking with them their assigned amounts.

References

Atlamaz M, Klaus B (2007) Endowment strategy-proofness in an exchange market with indivisible goods. Soc Choice Welf 28:1–18

Barberà S, Jackson M, Neme A (1997) Strategy-proof allotment rules. Games Econ Behav 18:1–21

Bergantiños G, Massó J, Neme A (2012) The division problem with voluntary participation. Soc Choice Welf 38:371–406

Ching S (1992) A simple characterization of the uniform rule. Econ Lett 40:57–60

Herrero C (2002) General allocation problems with single-peaked preferences: path-independence and related topics. Span Econ Rev 4:19–40

Hurwicz L (1972) On informationally decentralized systems. In: McGuire CB, Radner R (eds) Decision and organization. North-Holland, Amsterdam, pp 297–336

Klaus B (1997) The characterisation of the uniform reallocation rule without Pareto optimality. In: Parthasarathy T et al (eds) Game theoretical applications to economics and operations research. Kluwer, Alphen aan den Rijn, pp 239–255

Klaus B, Peters H, Storcken T (1997) Reallocation of an infinitely divisible good. Econ Theory 10:305–333

Klaus B, Peters H, Storcken T (1998) Strategy-proof division with single-peaked preferences and individual endowments. Soc Choice Welf 15:297–311

Mas-Colell A (1992) Equilibrium theory with possibly satiated preferences. In: Majumdar M (ed) Equilibrium and dynamics: essays in honor of David Gale. Macmillan, London, pp 201–213

Massó J, Neme A (2003) Bribe-proof rules in the division problem. UFAE and IAE Working paper no 571.03

Massó J, Neme A (2007) Bribe-proof rules in the division problem. Games Econ Behav 61:331–343

Postlewaite A (1979) Manipulation via endowments. Rev Econ Stud 46:255–262

Schummer J (2000) Manipulation through bribes. J Econ Theory 91:180–198

Thomson W (1995) Axiomatic analysis of generalized economies with single-peaked preferences. Mimeo, New York

Thomson W (1997) The replacement principle in economies with single-peaked preferences. J Econ Theory 76:145–168

Thomson W (2008) Borrowing-proofness. Mimeo, University of Rochester

Thomson W (2010) Consistent allocation rules. Mimeo, University of Rochester

Thomson W (2011) Fair allocation rules. In: Arrow K, Sen A, Suzumura K (eds) The handbook of social choice and welfare. North-Holland, Amsterdam, pp 393–506

Acknowledgments

I would like to thank Alejandro Neme for his guidance and patience. I also would like to thank the anonymous referees, Gustavo Bergantiños, Marcelo Fernández, Andrew Mackenzie, Jordi Massó and specially William Thomson for helpful and detailed comments. Of course, all errors are my own. This work is partially supported by Universidad Nacional de San Luis, through grant 319502, and by Consejo Nacional de Investigaciones Científicas y Técnicas (CONICET), through grant PIP 112-200801-00655.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bonifacio, A.G. Bribe-proof reallocation with single-peaked preferences. Soc Choice Welf 44, 617–638 (2015). https://doi.org/10.1007/s00355-014-0849-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00355-014-0849-0