Abstract

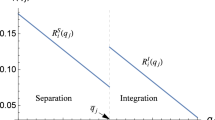

We identify circumstances under which a firm with a first-mover advantage may get leapfrogged by a follower. At the market stage we assume a Stackelberg structure, i.e. the leader commits to a quantity and the follower reacts to it. We allow the owners of both firms to select the internal organization and the production technology before quantities are set. That is, leader and follower can additionally use two commitment strategies alternatively or in combination: investing in R&D and delegating quantity decisions to managers. Despite the symmetry of options for the two firms, we find that there is a unique equilibrium in which both firms invest in process R&D, only the follower delegates, and the follower can overcome the first-mover advantage of the quantity leader and obtain a higher profit than the leader. Our analysis reveals that there are some important differences between the two commitment devices “cost-reducing R&Dt” and “delegation to managers”.

Similar content being viewed by others

References

Amir R and Stepanova A (2006). Second-mover advantage and price leadership in Bertrand Duopoly. Games Econ Behav 55: 1–20

Bagwell K (1995). Commitment and observability in games. Games Econ Behav 8: 271–280

Basu K (1995). Stackelberg equilibrium in oligopoly: an explanation based on managerial incentives. Econ Lett 49: 459–464

Besanko D, Dranove D, Shanley M, Schaefer S (2007) Economics of strategy, 4th edn. Wiley, New York

Bonatti A, Martina R (2007) Multi-stage games with sequential choices and the second-mover advantage, working paper

Brander JA and Lewis TR (1986). Oligopoly and financial structure: the limited liability effect. Am Econ Rev 76(5): 956–970

Brander JA and Spencer BJ (1983). Strategic commitment with R&D: the symmetric case. Bell J Econ 14(1): 225–235

Bulow JI, Geanakoplos JD and Klemperer PI (1985). Multimarket oligopoly: strategic substitutes and complements. J Polit Econ 93(3): 488–511

Chen M-J and MacMillan IC (1992). Nonresponse and delayed response to competitive moves: the roles of competitor dependence and action irreversibility. Acad Manag J 35(3): 539–570

Cho D-S, Kim D-J and Rhee DK (1998). Latecomer strategies: evidence from the semiconductor industry in Japan and Korea. Organ Sci 9(4): 489–505

Cottrell T and Sick G (2002). Real options and follower strategies: the loss of real option value to first-mover advantage. Eng Econ 47(3): 232–263

De Bondt R and Henriques I (1995). Strategic investments with asymmetric spillovers. Can J Econ 28(3): 656–674

Dixit A (1979). A model of Duopoly suggesting a theory of entry barriers. Bell J Econ 10(1): 20–32

Dixit A (1980). The role of investment in entry-deterrence. Econ J 90: 95–106

Dixon H (1985). Strategic investment in an industry with a competitive product market. J Ind Econ 32(4): 483–499

Dowrick S (1986). von Stackelberg and Cournot duopoly: choosing roles. Rand J Econ 17(2): 251–260

Hamilton J and Slutsky S (1990). Endogeous timing in Duopoly games: Stackelberg or Cournot equilibria. Games Econ Behav 2: 29–46

Fershtman C (1985). Managerial incentives as a strategic variable in duopolistic environment. Int J Ind Organ 3: 245–253

Fershtman C and Judd KL (1987). Equilibrium incentives in oligopoly. Am Econ Rev 77: 927–940

Fershtman C, Judd KL (1990) Strategic incentive manipulation in Rivalrous Agency, working paper

Fershtman C, Judd KL and Kalai E (1991). Observable contracts: strategic delegation and cooperation. Int Econ Rev 32(3): 551–559

Gal-Or E (1985). First mover and second mover advantages. Int Econ Rev 26(3): 649–653

Goel RK (1990). Innovation, market structure and welfare: a Stackelberg model. Q Rev Econ Bus 30(1): 40–54

Hamilton JH and Slutsky SM (1990). Endogenous timing in Duopoly games: Stackelberg or Cournot equilibria. Games Econ Behav 2: 29–46

Henkel J (2002). The 1.5th mover advantage. Rand J Econ 33(1): 156–170

Jansen T, Van Lier A and Van Witteloostuijn A (2007). A note on strategic delegation: the market share case. Int J Ind Organ 25: 531–539

Kerin RA, Varadarajan PR and Peterson RA (1992). First-mover advantage: a synthesis, conceptual framwork, and research propositions. J Mark 56: 33–52

Kopel M and Riegler C (2006a). R&D in a strategic delegation game revisited: a note. Manag Dec Econ 27(7): 605–612

Kopel M, Riegler C (2006b) Delegation in an R&D Game with spillovers (forthcoming). In: Cellini R, Lambertini L (eds) The economics of innovation: incentives, cooperation, and R&D policy

Kopel M, Löffler C (2007) Endogenous timing and strategic managerial incentives in a Duopoly game, working paper

Kräkel M (2004). R&D spillovers and strategic delegation in oligopolistic contests. Manag Dec Econ 25: 147–156

Lambertini L (2000a). Extended games played by managerial firms. Jpn Econ Rev 51(2): 274–283

Lambertini L (2000b). Strategic delegation and the shape of market competition. Scott J Polit Econ 47(5): 550–570

Lambertini L, Primavera G (2000) Delegation versus cost-reducing R&D in a Cournot Duopoly. Working paper, University of Bologna

Lambertini L and Rossini G (1998). Capital commitment and Cournot competition with labour-managed and profit-maximizing firms. Aust Econ Pap 37(1): 14–21

Lieberman MB and Montgomery DB (1988). First-mover advantages. Strat Manag J 9: 41–58

Lieberman MB and Montgomery DB (1998). First-mover (dis)advantages: retrospective and link with the resource-based view. Strat Manag J 19: 1111–1125

Liu Z (2005). Stackelberg leadership with demand uncertainty. Manag Dec Econ 26: 345–350

Löffler C (2008) Strategische Selbstbindung und Zeitführerschaft. Doctoral thesis, Vienna University of technology. Deutscher Universitätsverlag, Wiesbaden (forthcoming)

Lyandres E (2006). Caital structure and interaction among firms in output markets: theory and evidence. J Bus 79(5): 2381–2421

Maggi G (1999). The value of commitment with imperfect observability and private information. Rand J Econ 30(4): 555–574

Neven DJ (1989). Strategic entry deterrence: recent developments in the economics of industry. J Econ Surv 3(3): 213–233

Ohnishi K (2001) Lifetime employment contract and strategic entry deterrence: Cournot and Bertrand outcomes. Aust Econ Pap 40:30–43

Okuguchi K (1999). Cournot and Stackelberg Duopolies revisited. Jpn Econ Rev 50(3): 363–367

Polo M and Tedeschi P (1992). Managerial contracts collusion and mergers. Ricerche Economiche XLVI(3-4): 281–302

Polo M and Tedeschi P (2000). Delegation games and side contracting. Res Econ 54: 101–116

Roberts D, Ihlwan M, Rowley I, Edmondson G (2005) GM and VW: How not to Succeed in China. BusinessWeek 9 May, pp 22–23

Schelling TC (1960) Strategy of conflict. Harvard University Press, Cambridge

Schelling TC (2006) Strategies of comittment. Harvard University Press, Cambridge

Sklivas SD (1987). The strategic choice of managerial incentives. Rand J Econ 18: 452–458

Stalter K (2002) Moving first on a winning idea doesn’t ensure first-place finish. Pioneers and pitfalls. Investor’s Business Daily, 7 October 2002

Suarez F, Lanzolla G (2005) The half-truth of first-mover advantage. Harvard Bus Rev 83(4):121–127

Tellis GJ and Golder PN (2001). Will and vision: How latecomers grow to dominate markets. McGraw-Hill, New York

The Economist (2006) Germany’s export champions. The problem with solid engineering, 18 May 2006

Vardy F (2004). The value of commitment in Stackelberg games with observation costs. Games Econ Behav 49: 374–400

Vickers J (1985). Delegation and the theory of the firm. Econ J Suppl 95: 138–147

von Stackelberg H (1934) Marktform und Gleichgewicht, Wien

Wanzenried G (2003). Capital market decisions and output market competition under demand uncertainty. Int J Ind Organ 21: 171–200

Ware R (1984). Sunk costs and strategic commitment: a proposed three-stage equilibrium. Econ J 94: 370–378

Weissmann A (2007) Austrian airlines provides link to the future for Iraq. Travelweekly, 6 February 2007

Wiethaus L (2005) Excess absorptive capacity and the persistence of monopoly. Working paper, University of Hamburg, Department of Economics

Zhang J and Zhang Z (1997). R&D in a strategic delegation game. Manag Dec Econ 18: 391–398

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kopel, M., Löffler, C. Commitment, first-mover-, and second-mover advantage. J Econ 94, 143–166 (2008). https://doi.org/10.1007/s00712-008-0004-4

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-008-0004-4