Abstract

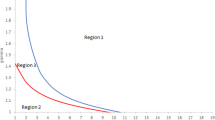

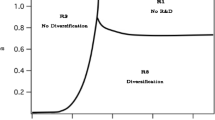

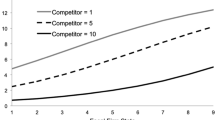

Intuition suggests that in markets with consumer lock-in (‘brand loyalty’), firms with a large customer base earn higher profits. We show for a homogeneous goods duopoly that the intuition can be misleading, as the intensity of price competition depends on the initial market split. We derive mixed-strategy equilibria, and show that competition is often most intense when the market is split evenly. As a result, firms coordinate on an asymmetric split when consumers are not yet attached to firms. We also allow for asymmetric costs, and analyze when firms with a larger customer base are more eager to innovate.

Similar content being viewed by others

Notes

An alternative explanation is incomplete information among consumers about different products available in a market, that can induce ‘customer loyalty’ or ‘brand loyalty’. Gabszewicz et al. (1992) assume that brand loyalty arises when an effort is required by consumers in order to learn how to use a new product. Chioveanu (2008) assumes that ‘persuasive advertising’ induces ‘brand loyalty in consumers who would otherwise buy the cheapest alternative on the market’.

In the patent race literature, two main effects have been identified that can often be used to explain differences in firms’ efforts to obtain an innovation: an ‘efficiency’ and a ‘replacement’ effect (see Gilbert and Newbery 1982; Reinganum 1983). In our model, demand depends only on which firm charges the lower price. Innovations can, therefore, affect profits through the cost-savings they induce, through changes in the intensity of price competition, and through changes in the endogenous probability of gaining or losing market shares.

In contrast, Joshi and Vonortas (2001) show that initial asymmetries in the stocks of technological knowledge may disappear over time, using a dynamic duopoly game with R&D.

The monopoly price, thus, equals 1. Prices above 1 can be eliminated from the strategy space without loss of generality. Hence, all consumers buy, and the aggregate demand equals 1 in each period.

This means that switching costs exceed the reservation price.

In a model with incomplete information and search, Stahl (1989) assumes that some consumers (the ‘costless searchers’) can discover the lowest price at no cost. These consumers are similar to those in our model that can switch the supplier at no cost. Stahl (1989) argues that “Any model that cannot accommodate costless searchers as well as costly searchers is seriously deficient” (p. 701). Although the assumption of two types of consumers in our model (high vs. no switching costs) is somewhat artificial, it allows to us highlight the frictions that can occur in markets characterized by a high degree of consumer lock-in.

For example, consumers may be locked-in also due to a lack of knowledge (e.g. about the existence of the other supplier or about product characteristics). The size of a firm’s customer base may, then, also be related to advertising efforts in the first period. The second period of such a model would still coincide with this model, but results for the first period would differ. See also Butters (1977), Varian (1980), and Roy (2000).

The only exception are possible differences in marginal costs, but these do not affect the structure of demand.

For technical reasons, we assume here that past market shares are bounded away from zero: \(n\in ( {0,1})\). For \(n=0\) (or \(n=1)\), pure strategy equilibria can sometimes exist. However, as illustrated in the Proof of Proposition 3, mixed strategy equilibria that yield the same outcome (profits, market shares) typically co-exist. Related results have been presented by Varian (1980), Narasimhan (1988), Baye et al. (1992), and Kocas and Kiyak (2006).

Note, that the event \(p_1 =p_2 \) occurs with zero probability (Proposition 1). The restriction \(p_1 \equiv p<1\) is needed since the competitor may charge the monopoly price with positive probability. The indifference condition must, therefore, hold for prices arbitrarily close to 1, but it does not have to be fulfilled at \(p=1\).

This follows from Proposition 2 since \(c_2 l( 1)\) is equivalent to \(\nu 1\). See also the Proof of Proposition 3.

We, thus, follow Klemperer (1987). If consumers learn their type already in period 1, then those without switching costs choose the cheaper supplier in each period, while those with high switching costs may choose the expensive supplier in period 1 if this firm has a lower expected price in period 2. Overall, the trade-offs that firms face would be similar as in our model, but details would be different, because in period 2, it matters not only how large a firm’s customer base is, but also how many of these consumers face switching costs. This fraction may be different for the two firms.

If \(\rho \) approaches zero, the expected profits also converge to zero, but the V-shape is maintained.

This holds roughly for \(\rho >0.65\).

This depends on the characteristics of the market. Klemperer (1987) shows that if most consumers are forward-looking, and stay in the market for two periods, they anticipate that a firm with a large market share in period 1 will charge a higher price in period 2. This effect can make demand more inelastic already in period 1, compared to a market without switching costs.

When consumers are forward-looking, the effect is even more pronounced (Schmidt 2010).

If this firm charges a higher (expected) price in period 2 when its market share in period 1 increases, then not all consumers may switch (depending on the exact price differential). See the Proof of Proposition 4.

We assume consumers and firms discount future utility/profits at the same rate.

By symmetry, another set of equilibria exists where the indices of the two firms are reversed.

The result of Proposition 5 holds both for the limit \(\rho \rightarrow 1\), and for equality \(( {\rho =1})\). The proof refers to the latter case (\(\rho =1\); see the Appendix).

Process innovations can easily be accomodated in our modeling framework, whereas product innovations would require more substantial changes in the setup. Furthermore, process innovations may be more relevant when analyzing the relation between ex-ante firm size and R&D activity. For example, Cohen and Klepper (1996a) argue that “Product innovations may be expected to yield greater returns from licensing and to spawn more rapid growth in output than process innovations. As a consequence, the returns to product innovation should depend less on ex ante firm size than the returns to process innovation” (p. 233).

Whether the probability of obtaining an innovation is sufficiently small to neglect the possibility that both firms (simultaneously) innovate, depends on the structure of innovation costs. We do not model these costs explicitly here, and merely assume that they increase sharply enough in innovation efforts.

Since marginal costs before the innovation are normalized to zero, this does not imply that the innovating firm produces at negative marginal cost.

\(S_i \) is the smallest closed set of prices \(p\) whose complement has a probability of zero.

Note, that \(h( 1)=1\), and see also the Proof of Lemma 1.

The expression for \(F_1 ( p)\) is not defined for \(p=c_2 \), but this is not a contradiction because \(\underline{p}\) converges to \(c_2 \) only in the limit as \(n\rightarrow 1\).

The mixed strategy equilibrium, thus, converges to an equilibrium where firm 1 chooses \(p=c_2 \) with probability one, while firm 2 randomizes over the interval \([c_2 ,1]\). For \(n=1\), there exists also a pure strategy equilibrium with \(p_1 =p_2 =c_2 \). Firm 1’s profit is, then, \(\pi _1 =nc_2 =c_2 \), firm 2’s profit is \(\pi _2 =(1-n)c_2 =0\). Firm 1’s best deviation is \(p_1 =1\). This yields \(\pi _1 =1\cdot l(n)\). The deviation is not profitable since \(c_2 l(1)\).

For \(q_1 =q_1^{\min } \), firm 1 is indifferent between deviating to a higher price (best deviation: \(q_1^{dev} =q_2 +\lambda )\) and charging the equilibrium price \(q_1 \). Therefore, for equilibrium prices above \(q_1^{\min } \), firm 1 strictly prefers the equilibrium outcome. Hence, if a firm benefits from a local deviation at the highest (candidate) equilibrium prices, then it must be firm 2.

References

Baye MR, Kovenock D, de Vries CG (1992) It takes two to tango: equilibria in a model of sales. Games Econ Behav 4:493–510

Beggs A, Klemperer PD (1992) Multiperiod competition with switching costs. Econometrica 60:651–666

Budd C, Harris C, Vickers J (1993) A model of the evolution of duopoly: does the asymmetry between firms tend to increase or decrease? Rev Econ Stud 60:543–573

Butters GR (1977) Equilibrium distributions of sales and advertising prices. Rev Econ Stud 44:465–491

Ceccagnoli M (2005) Firm heterogeneity, imitation, and the incentives for cost reducing R&D effort. J Ind Econ 53:83–100

Chioveanu I (2008) Advertising, brand loyalty and pricing. Games Econ Behav 64:68–80

Cohen WM, Klepper S (1992) The anatomy of industry R&D intensity distributions. Am Econ Rev 82:773–799

Cohen WM, Klepper S (1996a) Firm size and the nature of innovation within industries: the case of process and product R&D. Rev Econ Stat 78:232–243

Cohen WM, Klepper S (1996b) A reprise of size and R&D. Econ J 106:925–951

Gabszewicz J, Pepall L, Thisse J-F (1992) Sequential entry with brand loyalty caused by consumer learning-by-using. J Ind Econ 40:397–416

Gilbert RJ, Newbery DMG (1982) Preemptive patenting and the persistence of monopoly power. Am Econ Rev 72:514–526

Joshi S, Vonortas NS (2001) Convergence to symmetry in dynamic strategic models of R&D: the undiscounted case. J Econ Dyn Control 25:1881–1897

Klemperer PD (1987) The competitiveness of markets with switching costs. Rand J Econ 18:138–150

Klemperer PD (1995) Competition when consumers have switching costs: an overview with applications to industrial organization, macroeconomics, and international trade. Rev Econ Stud 62:515–539

Klette TJ, Kortum S (2004) Innovating firms and aggregate innovation. J Polit Econ 112:986–1018

Kocas C, Kiyak T (2006) Theory and evidence on pricing by asymmetric oligopolies. Int J Ind Organ 24:83–105

Lach S (2002) Existence and persistence of price dispersion: an empirical analysis. Rev Econ Stat 84:433–444

Lewis M (2008) Price dispersion and competition with differentiated sellers. J Ind Econ 56:654–678

Narasimhan C (1988) Competitive promotional strategies. J Bus 61:427–449

Roy S (2000) Strategic segmentation of a market. Int J Ind Organ 18:1279–1290

Reinganum J (1983) Uncertain innovation and the persistence of monopoly. Am Econ Rev 73:741–748

Schmidt RC (2010) On the value of a large customer base in markets with switching costs. J Ind Econ 58:627–641

Stahl DO (1989) Oligopolistic pricing with sequential consumer search. Am Econ Rev 79:700–712

Varian HR (1980) A model of sales. Am Econ Rev 70:651–659

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Proposition 1

Let \(F_i ( p)\equiv \Pr [ {P_i <p}]\), where \(P_i \) is the random variable from which \(p\) is drawn. Under this convention, \(1-F_i ( 1)\) is the probability mass at 1. Let \(S_i \) be the support of \(F_i (.)\).Footnote 27

To show the first claim (“there exists no pure strategy equilibrium”), note first that since each firm has a positive customer base (\(0<n<1)\), all prices above marginal cost yield positive profit. Suppose both firms charge an identical price \(p\in (\max \{ {c_1 ,c_2 }\},1]\). This can not be an equilibrium because each firm would benefit from marginally undercutting \(p\), which leads to a discontinuous rise in demand. If both firms choose \(p=\max \{ {c_1 ,c_2 }\}\), the profit of the less efficient firm is zero. This can not be an equilibrium since a deviation to a higher price yields positive profit. If \(p_1 \ne p_2 \) and \(p_1 ,p_2 \in [\max \{ {c_1 ,c_2 }\},1)\), the high-price firm would benefit from deviating to the monopoly price, as this deviation does not affect the firm’s demand. It can not be an equilibrium for one firm to choose the monopoly price, and for the other to marginally undercut this price, as the high-price firm would benefit from matching the lower price. It can not be an equilibrium for one firm to choose the monopoly price, and for the other to undercut this price more than marginally, as the low-price firm would benefit from deviating to a higher price.

To show the second claim (“the price distribution functions \(F_i (p)\) have the same support, namely the convex set from \(\underline{p}\in ( {\max \{ {c_1 ,c_2 }\},1})\) to 1”), suppose \(S_i \ne S_j \quad ( {j\ne i})\). Hence, for \(i=1\) or \(i=2\), there is a price \(\tilde{p}<1\) with \(\tilde{p}\in S_i\) but \(\tilde{p}\notin S_j \). This can not be an equilibrium. Since \(\bar{S}_j \) is open, there exists a price \(p>\tilde{p}\) with \(p\notin S_j \) that yields the same expected demand to firm \(i\) as \(\tilde{p}\) but a higher profit. This holds if \(p\) is above the maximum of \(S_j \) (if the maximum is below 1), below the minimum of \(S_j \), or within some intermediate range that is not part of \(S_j \) when \(S_j \) is not convex. Therefore, \(S_1 =S_2 \equiv S\). The maximum of \(S\) must be the monopoly price 1, because otherwise, each firm would benefit from deviating to the monopoly price. This yields the same demand as the maximum of \(S\) but a higher profit. \(\underline{p}\) must be greater than \(\max \{ {c_1 ,c_2 }\}\), because \(p=\underline{p}\) yields zero profit to the inefficient firm. \(\underline{p}\) is smaller than 1 since (as shown above), there is no pure strategy equilibrium. Furthermore, \(S\) is convex. Suppose to the contrary that there is an intermediate range that is not part of \(S\). Firm \(i\)’s expected demand would be constant over this range, but its expected profit would be increasing. Therefore, expected profit would be higher in the upper interval of \(S\). The lower interval can, thus, not be part of a mixed strategy equilibrium.

To show the third claim (“at most one of the distribution functions comprises a mass point, and if so, it is located at the monopoly price 1”), suppose both firms attach positive probability mass to some identical price level \(p\) in \(S=[\underline{p},1]\). Each firm would, then, benefit from shifting its mass point to a price marginally below \(p\) because this leads to a discontinuous rise in expected demand. Strategies containing a single mass point at some price \(p\) in the interval \((\underline{p},1)\) can not be an equilibrium since the competitor’s expected demand (and, thus, profit) would fall discontinuously at \(p\). There can be no equilibrium where the distribution function of one firm contains a mass point at \(p=\underline{p}\) as the competitor’s expected profit would be larger at prices marginally below \(\underline{p}\) than at prices above \(\underline{p}\), but prices below \(\underline{p}\) are not within the support. \(\square \)

Proof of Corollary 1

It suffices to show that the three claims of Proposition 1 hold also for \(n=1\) when \(c_1 =c_2 =0\) (corresponding results for \(n=0\) follow by symmetry). Hence, we consider the case where firm 2 does not have a positive customer base in period 2.

To show the first claim (“there exists no pure strategy equilibrium”), suppose to the contrary that a pure strategy equilibrium exists with \(p_1 =p_2 \equiv p\) and \(0<p\le 1\). This can not be an equilibrium because firm 2 would benefit from marginally undercutting \(p\). The case where \(p\le 0\) can not occur in equilibrium either, because firm 1 would earn non-positive profit and, thus, benefits from deviating to the monopoly price. Asymmetric pure-strategy equilibria where \(p_1 <p_2 \le 1\) can not occur because firm 2 benefits from undercutting \(p_1 \) if \(p_1 >0\). If \(p_1 \le 0\), firm 1 would deviate to the monopoly price. Under \(p_2 <p_1 \le 1\), firm 2 would benefit from charging some \(p_2 ^{\prime }\) with \(p_2 <p_2 ^\prime <p_1 \).

Given \(c_1 =c_2 =0\), the second claim becomes: “The distribution functions \(F_i ( p)\) have the same support, the convex set from \(\underline{p}\in ( {0,1})\) to 1”. To show this claim, suppose \(S_1 \ne S_2 \). Considering some price \(\tilde{p}\) with \(\tilde{p}\in S_1\) but \(\tilde{p}\notin S_2 \), the arguments in the Proof of Proposition 1 remain valid (considering deviations by firm 1). Such price \(\tilde{p}\) can, thus, not exist in equilibrium. However, for cases where \(\tilde{p}\in S_2 \) but \(\tilde{p}\notin S_1 \), some of the arguments fail, so we must reconsider these cases. If the maximum of \(S_2 \) lies above the maximum of \(S_1 \), then prices \(p_2 \) above this maximum yield a profit of zero to firm 2. Since the minimum of \(S_1 \) is clearly positive, undercutting this minimum would yield a positive profit and is, thus, profitable. Prices \(\tilde{p}\in S_2 \), where \(\tilde{p}\) is in some intermediate range that is not part of \(S_1 \), can not exist in equilibrium either, because firm 2’s expected profit would be increasing in prices \(p_2 \) within this range. Finally, also for prices below the minimum of \(S_1 \), firm 2’s profit is increasing, so they can not be chosen in equilibrium with positive probability. Therefore, \(S_1 =S_2 \equiv S\). The remaining arguments in the proof of Proposition 1 remain valid, so \(S\) must be a convex set from \(\underline{p}\in ({0,1})\) to 1.

The arguments for the third claim (“at most one distribution function has a mass point, and if so, it is located at \(p=1\)”) also remain unchanged. \(\square \)

Proof of Lemma 1

Consider the case \(F_1 ( 1)<1\) and \(F_2 ( 1)=1\) (see the main text). Hence, we have \(F_2 ( 1)>F_1 ( 1)\). Using (4), this yields the condition: \(h( n)-\frac{\pi _1 }{1-c_1 }>h( {1-n})-\frac{\pi _2 }{1-c_2 }\). Use (6) to replace \(\pi _2 \) by \(h( {1-n})( {\frac{\pi _1 }{h(n)}-\Delta c})\). Then use (5) to replace \(\pi _1 \) by \((\underline{p}-c_1)h(n)\). This yields (after rearranging): \((1-\underline{p})((1-c_2 )h(n)-(1-c_1)h(1-n))>0\). Since \(\underline{p}<1\), this is fulfilled iff:

Since \(c_{1,2} <1\) and \(h( .)\) is strictly increasing, the left-hand-side is strictly increasing, and the right-hand-side is decreasing in \(n\). It follows immediately that there is at most one single value for \(n\) (\(\nu )\) in the interval \([ {0,1}]\) that fulfills (14) [this yields condition (7)]. If \(n>\nu \), (14) is clearly fulfilled and the case \(F_1 ( 1)<1\) and \(F_2 ( 1)=1\) is obtained. If \(n<\nu \), the condition is violated and the case \(F_1 (1)=1\) and \(F_2 (1)<1\) is obtained (to see this, replace all \(>\) in the above proof by \(<\)). For \(\Delta c=0\), (7) simplifies to \(h( \nu )=h( {1-\nu })\). Since \(h(.)\) is increasing, this requires that \(\nu =1-\nu \Leftrightarrow \nu =1/2\). To show that \(\nu \) is decreasing in \(c_1 \) and increasing in \(c_2 \), differentiate (7) w.r.t. \(c_1\) (resp. \(c_2\)), and solve for \(d\nu /dc_1 \) (resp. \(d\nu /dc_2 )\). This is smaller (greater) than zero for all \(\nu \in [ {1/2,1}]\). \(\square \)

Proof of Proposition 2

The claim that for \(\Delta c>0\), the distribution function of the less efficient firm (firm 2) f.o.s. dominates firm 1’s if \(n<\nu \) is shown first. First order stochastic dominance of firm 2’s over firm 1’s price distribution function requires that \(F_1 ( p) F_2 ( p)\) holds for all \(p\in [\underline{p},1]\), with strict inequality for some \(p\) for strict dominance. Since \(\Delta c>0\), we can normalize \(c_1 \) to zero for an ease of notation (without loss of generality), hence, \(c_2 =\Delta c\). Using (4), the condition \(F_1 ( p)>F_2 ( p)\) (for strict dominance) can be written as:

Use (6) to replace \(\pi _2 \) by \(h( {1-n})( {\pi _1 /h( n)-\Delta c})\), and (5) to replace \(\pi _1 \) by \(\underline{p}h(n)\). This yields: \((p-\underline{p})({ph(1-n)-(p-\Delta c)h(n)})>0\). For \(p>\underline{p}\), this is equivalent to: \(ph({1-n})-( {p-\Delta c})h( n)>0\). The left-hand side is decreasing in \(p\) if the first derivative is smaller or equal to zero: \(h(1-n)-h(n)\le 0 \Leftrightarrow h( n) h( {1-n})\). Since \(h( .)\) is strictly increasing, this is equivalent to \(n 1/2\). Therefore, if the condition is fulfilled for \(p=1\), it must also be fulfilled for all other prices in the interval \((\underline{p},1]\). Given that \(n 1/2\), the condition can, thus, be rewritten as (using \(p=1)\): \(h( {1-n})-( {1-\Delta c})h( n)>0\). By Lemma 1, this is equivalent to \(n<\nu \). If \(n<1/2\), then \(h( {1-n})>h( n)\). Since \(p>\Delta c=c_2 \), the condition is, thus, fulfilled. To show the first claim (f.o.s. dominance of the distribution function of the firm with the larger customer base when \(\Delta c=0)\), note that the above proof already covers the case where \(n<1/2\). For \(n 1/2\), replace all \(>\) above by \(\le \) to show that firm 1’s price distribution function f.o.s. dominates firm 2’s.\(\square \)

Proof of Proposition 3

Using (2), \(c_2 l(1)\) can be written as \(c_2 1-h(0)\). This is equivalent to \(\nu 1\), as can be confirmed using (7).Footnote 28 To show that firm 1 conducts limit pricing, it must be shown that \(F_1 ( p)\rightarrow 1 \quad \forall p>c_2 \) when \(n\rightarrow 1\), so firm 1 chooses \(p=c_2 \) with probability 1. Using (2), (4), and (8), one obtains (note, that since \(\nu 1\), we always have \(F_1 ( 1)=1)\):Footnote 29

For \(n\rightarrow 1\), this converges to 1 \(\forall p>c_2 \).Footnote 30 \(\square \)

Proof of Proposition 4

Without loss of generality, we assume that firms coordinate on an equilibrium where firm 1 serves at least half of the market in period 1, hence, \(n 1/2\). In order to derive the expected prices \(E[p_i \vert n]\) in period 2, the density functions \(f_i (p)\equiv F_i ^{\prime }(p)\), \(i=1,2\) are needed. It is convenient to rewrite \(F_1 (p)\) and \(F_2 (p)\) as follows [using (4)]:

where \(\mu \equiv 1-F_1 (1)\) is the probability mass that firm 1 attaches to the monopoly price. \(\mu \) and \(\underline{p}\) depend on the initial market split \(n\) via the function \(h(.)\). Using (2), we obtain:

Using (17), we obtain for the density functions:

where \(\beta _1 \equiv (1-\mu )\underline{p}/(1-\underline{p})\), and \(\beta _2 \equiv \underline{p}/(1-\underline{p})\).

The expected prices in period 2 are given by: \(E[ {p_i \vert n}]=\int \nolimits _{\underline{p}}^1 {p\cdot f_i ( p)dp}\). Using (18) and (19), we obtain after evaluating the integral:

This yields for the difference in expected prices [see (12)]:

Using (9) and (2), we can replace \(\mu \) and \(\underline{p}\) using the parameters \(\rho \) and \(n\). For \(n=1\), we obtain: \(\mu =\underline{p}=\rho \). If \(\rho \) is sufficiently small, firm 1’s profit in period 2 is a V-shaped function of \(n\). We construct an asymmetric equilibrium candidate that yields that highest industry profit in period 2. This requires that \(n=1\), hence, firm 1 serves the entire market demand in period 1. To coordinate on this outcome, the equilibrium prices in period 1 (\(q_1 \) and \(q_2\)) must fulfill the following conditions. First of all, \(\Delta q\) must be such that consumers are indifferent between the two firms in period 1 for \(n=1\). Otherwise, consumers would switch to the firm with the higher price in period 1 (firm 2), or firm 1 would deviate to a higher price without losing any demand. Furthermore, \(q_1 \) and \(q_2 \) must be such that if firm 2 deviates to \(q_2^{dev} =q_1 -\lambda \) (the highest price where all consumers switch to firm 2—this is firm 2’s best deviation, see below), then its expected profit must not exceed the profit under the equilibrium prices \(q_1 \) and \(q_2 \). Imposing equality, this condition can be used to derive the highest equilibrium price \(q_1^{\max } \) (local deviations by less than \(\lambda \) must also be unprofitable, see below). To derive the lowest sustainable equilibrium price \(q_1^{\min } \), \(q_1 \) and \(q_2 \) must be such that if firm 1 deviates to \(q_1^{dev} =q_2 +\lambda \) (lowest price where all consumers switch to firm 2—this is firm 1’s best deviation), then firm 1’s expected profit is as high as in the equilibrium.

The first condition (consumers are indifferent between the two firms in period 1) yields for the difference between prices in period 1 [using (12) with equality, and (21)]:

To apply the second condition (firm 2 does not benefit from deviating to \(q_2^{dev} =q_1 -\lambda )\), use (8), (9), and (2) to find firm 2’s equilibrium profit (for \(n=1\)): \(\pi _2 =\delta (1-\rho )\rho \), and firm 2’s profit when deviating: \(\pi _2^{dev} =q_1 -\lambda +\delta \rho \). Using (22), the condition \(\pi _2 =\pi _2^{dev} \) yields the highest sustainable equilibrium price: \(q_1^{\max } =-\delta \rho ^2\kappa \), where \(\kappa \equiv \frac{\rho }{1-\rho }\ln (\frac{1}{\rho })\) as shown in the Proposition. To apply the third condition (firm 1 does not benefit from deviating to \(q_1^{dev} =q_2 +\lambda )\), use (8), (9), and (2) to find firm 1’s equilibrium profit for \(n=1: \pi _1 =q_1 +\delta \rho \), and firm 1’s profit when deviating: \(\pi _1^{dev} =\delta (1-\rho )\rho \). Using (22), the condition \(\pi _1 =\pi _1^{dev} \) yields the lowest sustainable equilibrium price \(q_1^{\min } =-\delta \rho ^2\). Hence, the range of equilibrium candidates entails prices \(q_1 \in [{-\delta \rho ^2,-\delta \rho ^2\kappa }]\) as shown in the Proposition.

To complete the proof, we must rule out local deviations. These are deviations by less than \(\lambda \) that yield outcomes where both firms face positive demand in period 1. The difficulty is that a closed-form expression for firm 1’s demand in period 1 (\(n)\) as a function of the price differential \(\Delta q\) can not be obtained. The relation is implicitly defined by (12) and (21) [together with (18), (9) and (2)]. Nevertheless, we can show that if \(\rho \) is sufficiently small, firm 1’s best deviation from the equilibrium price in period 1 \((q_1)\) is given by \(q_1^{dev} =q_2 +\lambda \), and firm 2’s best deviation is \(q_2^{dev} =q_1 -\lambda \). For the sake of brevity, we only sketch the proof for the highest sustainable equilibrium prices in period 1: \(q_1 =q_1^{\max } \) and \(q_2 =q_1 +\lambda \). By construction, for \(q_1 =q_1^{\max } \), only firm 2 may have an incentive to deviate.Footnote 31 Therefore, it suffices to rule out local deviations towards lower prices by firm 2. Firm 2’s profit when deviating is given by [using (8)]:

Using (9) and (2), we can replace the expression \(\frac{h( {1-n})l( n)}{h( n)}\) by \(\frac{\rho n-\rho ^2n^2}{1-\rho +\rho n}\). It is easy to show that a deviation by firm 2 to match firm 1’s equilibrium price (\(q_2^{dev} =q_1 \), hence, \(n^{dev}=1/2)\) is never profitable (for any \(\rho \)). However, a local deviation towards prices marginally below \(q_2 \) can be profitable. In this case, \(\pi _2^{dev} ( {q_1 ,q_2^{dev} })\) has a local maximum in the range \(q_2^{dev} \in ( {q_1 ,q_2 })\). A necessary condition for this is that the derivative \( \frac{d\pi _2^{dev} ( {q_1 ,q_2^{dev} })}{dq_2^{dev}}|_{q_2^{dev} =q_2} \) is negative, which implies that firm 2 benefits from lowering its price marginally below the equilibrium price \(q_2\). The derivative is given by [using (23), and after rearranging]:

The advantage of this approach is that the relation \(n( {\Delta q})\) does not need to be determined. It suffices to determine whether the right-hand side of (24) is smaller or greater than zero. The value of \(\rho \) where the sign of (24) switches is the critical value indicated in the Proposition. Below the critical \(\rho \), firm 1’s highest equilibrium price is given by \(q_1^{\max } =-\delta \rho ^2\kappa \) (see the derivation above). Above the critical \(\rho \), the highest sustainable price is determined by setting (24) equal to zero. At this point, the derivative \(\frac{dn}{dq_2^{dev} }\) drops out, because it is different from zero at the position \(q_2^{dev} =q_2\) (considering deviations towards lower prices). Hence, the critical \(\rho \) is implicitly defined by the following condition [using (24)]:

Using \(q_2 =q_1 +\lambda \) and \(q_1 =q_1^{\max } =-\delta \rho ^2\kappa \), where \(\kappa =\frac{\rho }{1-\rho }\ln (\frac{1}{\rho })\), (25) yields:

This condition implicitly defines the critical \(\rho \). The numerical solution yields: \(\rho ^{crit}\cong 0.441\). For \(\rho >\rho ^{crit}\), the highest sustainable equilibrium price for firm 2 is given by [using (24)]:

and firm 1’s maximum price in equilibrium is \(q_1^{\max } =q_2^{\max } -\lambda \).

Following similar steps as above, it can be shown that for sufficiently low values of \(\rho \), also firm 1 has no incentive to deviate locally towards higher prices, starting from the lowest sustainable equilibrium price \(q_1^{\min }\).\(\square \)

Proof of Proposition 5

When \(\rho =1\), each firm is a monopolist with respect to its own customer base in period 2, hence: \(p_1 =p_2 =1\). Therefore, in period 1, consumers always choose the supplier that charges the lower price (if both firms charge the same price, consumers randomize). Hence, firm \(i\)’s demand in period 1 is:

and firm \(i\)’s aggregated profit is: \(\pi _i =D_{i,0} q_i +\delta D_{i,0} =( {q_i +\delta })D_{i,0} \). This is a standard Bertrand game when prices are normalized to \(-\delta \). Hence, the unique pure-strategy equilibrium outcome in period 1 entails: \(q_1 =q_2 =-\delta \), and aggregated profits over both periods are zero.\(\square \)

Proof of Proposition 6

The incentives to invest in a marginal innovation are given by (13). Since firm 1 is the firm with the larger customer base \(( {n 1/2})\) and \(c_1 =c_2 =0\), it holds initially that \(n \nu =1/2\). If firm 2 innovates, then \(n>\nu \) still holds after the innovation, because \(\nu \) increases in \(c_2 \) (see Lemma 1). Therefore, firm 2’s incentive to innovate is always given by \(h({1-n})\chi \). Firm 1’s incentive to innovate is given by \(l( n)\chi _1 +h( n)\chi _2 \), where \(\chi _1 +\chi _2 \equiv \chi \) and \(\chi _1 \) is such that if firm 1 would obtain a cost reduction of this magnitude, then the condition \(n=\nu \) holds exactly. Hence, \(\chi _2 =0\) if firm 1 innovates and \(n \nu \) still holds after the innovation. In this case, firm 1’s total incentive to innovate is higher than firm 2’s if \(l( n)>h( {1-n})\), which is equivalent to \(l(n)=\rho n>1/2\). This proves the first claim. If \(\rho n<1/2\), then firm 2 has a higher incentive to obtain a marginal innovation. However, if the innovation induces a sufficiently large cost reduction, then the term \(h( n)\chi _2 \) dominates firm 1’s incentives to innovate, so that \(l( n)\chi _1 +h( n)\chi _2 >h({1-n})\chi \) holds. Hence, firm 1 has higher incentives to obtain a sufficiently large innovation.\(\square \)

Rights and permissions

About this article

Cite this article

Schmidt, R.C. Price competition and innovation in markets with brand loyalty. J Econ 109, 147–173 (2013). https://doi.org/10.1007/s00712-012-0296-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-012-0296-2