Abstract

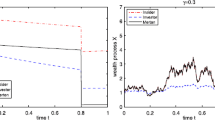

We consider a financial market with a stock exposed to a counterparty risk inducing a jump in the price, and which can still be traded after this default time. The jump represents a loss or gain of the asset value at the default of the counterparty. We use a default-density modelling approach, and address in this incomplete market context the problem of expected utility maximization from terminal wealth. We show how this problem can be suitably decomposed in two optimization problems in a default-free framework: an after-default utility maximization and a global before-default optimization problem involving the former one. These two optimization problems are solved explicitly, respectively, by duality and dynamic programming approaches, and provide a detailed description of the optimal strategy. We give some numerical results illustrating the impact of counterparty risk and the loss or gain given default on optimal trading strategies, in particular with respect to the Merton portfolio selection problem. For example, this explains how an investor can take advantage of a large loss of the asset value at default in extreme situations as observed during the financial crisis.

Similar content being viewed by others

References

Ankirchner, S., Blanchet-Scalliet, C., Eyraud-Loisel, A.: Credit risk premia and quadratic BSDEs with a single jump. Preprint arXiv:0907.1221 (2009)

Blanchet-Scalliet, C., El Karoui, N., Jeanblanc, M., Martellini, L.: Optimal investment decisions when time-horizon is uncertain. J. Math. Econ. 44, 1100–1113 (2008)

Bouchard, B., Pham, H.: Wealth-path dependent utility maximization in incomplete markets. Finance Stoch. 8, 579–603 (2004)

Brigo, D., Capponi, A.: Bilateral counterparty risk valuation with stochastic dynamical models and application to credit default swaps. Preprint arXiv:0812.3705v4 (2009)

Collin-Dufresne, P., Hugonnier, J.: Pricing and hedging in the presence of extraneous risks. Stoch. Process. Appl. 117, 742–765 (2007)

El Karoui, N., Jeanblanc, M., Jiao, Y.: What happens after a default: The conditional density approach. Stoch. Process. Appl. 120, 1011–1032 (2010)

El Karoui, N., Quenez, M.-C.: Dynamic programming and pricing of contingent claims in an incomplete market. SIAM J. Control Optim. 33, 29–66 (1995)

Jacod, J.: Grossissements de filtrations: exemples et applications. In: Jeulin, Th., Yor, M. (eds.) Séminaire de Calcul Stochastique (1982/1983). Lecture Notes in Mathematics, vol. 1118, pp. 15–35. Springer, Berlin (1985)

Jarrow, R., Yu, F.: Counterparty risk and the pricing of defaultable securities. J. Finance 56, 1765–1799 (2001)

Jeanblanc, M., Le Cam, Y.: Progressive enlargement of filtration with initial times. Stoch. Process. Appl. 119, 2523–2543 (2009)

Jeulin, T.: Semi-Martingales et Grossissement d’une Filtration. Lecture Notes in Mathematics, vol. 833. Springer, Berlin (1980)

Kramkov, D., Schachermayer, W.: The asymptotic elasticity of utility functions and optimal investment in incomplete markets. Ann. Appl. Probab. 9, 904–950 (1999)

Lim, T., Quenez, M.C.: Utility maximization in incomplete markets with default. Preprint available from http://hal.archives-ouvertes.fr/hal-00342531/en/ (2008)

Morlais, M.A.: Utility maximization in a jump market model. Stochastics 81, 1–27 (2009)

Sircar, R., Zariphopoulou, T.: Utility valuation of multiname credit derivatives and application to CDOs. Quant. Finance 2, 195–208 (2010)

Wagner, D.H.: Survey of measurable selection theorems: an update. In: Kölzow, D. (ed.) Measure Theory Oberwolfach 1979 Proceedings. Lecture Notes in Mathematics, vol. 794, pp. 176–219. Springer, Berlin (1980)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Jiao, Y., Pham, H. Optimal investment with counterparty risk: a default-density model approach. Finance Stoch 15, 725–753 (2011). https://doi.org/10.1007/s00780-010-0140-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00780-010-0140-x

Keywords

- Counterparty risk

- Contagious loss or gain

- Density of default time

- Optimal investment

- Duality

- Dynamic programming

- Backward stochastic differential equation (BSDE)