Abstract

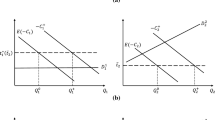

This paper investigates the optimal subsidy for activities abating emission in a mixed market, where the state-owned public firm competes against private firms. First, we consider the case, where the government uses only the abatement subsidy as a policy instrument. We derive a formula of the optimal abatement subsidy under general assumptions. We then examine the privatization policy and compare the abatement subsidy policy to the emission tax policy under a special case, which is analytically tractable. Next, we consider several combinations of tax and subsidy. It is shown that the first-best outcome is achieved under the combined policies.

Similar content being viewed by others

Notes

Traditionally, many authors have studied environmental policy in imperfect markets. The studies on the emission tax include Buchanan (1969), Barnett (1980), Lee (1975), and Misolek (1980). Conrad (1993, 1996) studies the effect of the abatement subsidy for oligopolistic industries under intra-industry trade. For a comprehensive argument on this issue, see Baumol and Oates (1988).

Matsumura (1998) is a pioneering work on partial privatization.

We focus on the interior solution. The second-order conditions are also satisfied. The Hessian of the public firm’s objective is given as \(H =\left(\begin{array}{ll} - 1- \alpha & \gamma\\ \gamma & -1 \end{array}\right).\) The Hessian H is a negative definite if and only if 1 + α − γ2 > 0.

See Table 1 of De Fraja and Delbono (1989).

This result is analytically the same as the equilibrium outcomes in the following game. In the first stage, the government decides whether or not private firms should be abolished; all firms choose variables in the second stage. Moreover, it is known that the “public monopoly” occasionally occurs in the equilibrium of mixed oligopoly models. For example, the private firms are inactive when there is no pollution and all firms have the same linear cost function.

References

Baumol WJ, Oates WE (1988) The theory of environmental policy, 2nd edn. Cambridge University Press, Cambridge

Bárcena-Ruiz JC, Garzón MB (2006) Mixed oligopoly and environmental policy. Span Econ Rev 8:139–160

Barnett AH (1980) The Pigouvian tax rule under monopoly. Am Econ Rev 70:1037–1041

Buchanan JM (1969) External diseconomies, corrective taxes, and market structure. Am Econ Rev 59:174–177

Cato S (2008) Privatization and the environment. Econ Bull 12(19):1–10

Cato S (2010) Emission taxes and optimal refunding schemes with endogenous market structure. Environ Resour Econ 46:275–280

Conrad K (1993) Taxes and subsidies for pollution-intensive industries as trade policy. J Environ Econ Manag 25:121–135

Conrad K (1996) Optimal environmental policy for oligopolistic industries under intra-industry trade. In: Carraro C, Katsoulacos YS, Xepapadeas A (eds) Environmental policy and market structure. Springer, Berlin, pp 65–83

De Fraja G, Delbono F (1989) Alternative strategies of public enterprise in oligopoly. Oxf Econ Pap 41:302–311

Kato K (2006) Can allowing to trade permits enhance welfare in mixed oligopoly? J Econ 88:263–283

Kato K (2010) Emission quota versus emission tax in a mixed duopoly. Environ Econ Policy Stud. doi:10.1007/s10018-010-0003-x

Katsoulacos Y, Xepapadeas A (1995) Environmental policy under oligopoly with endogenous market structure. Scand J Econ 97:411–420

Lee DR (1975) Efficiency of pollution and market structure. J Environ Econ Manag 2:69–72

Matsumura T (1998) Partial privatization in mixed oligopoly. J Public Econ 70:473–483

Misolek WS (1980) Effluent of taxation in monopoly markets. J Environ Econ Manag 7:103–107

Naito T, Ogawa H (2009) Direct versus indirect environmental regulation in a partially privatized mixed duopoly. Environ Econ Policy Stud 10:87–100

Ohori S (2006a) Optimal environmental tax and level of privatization in an international duopoly. J Regul Econ 29:225–233

Ohori S (2006b) Trade liberalization, consumption externalities and the environment: a mixed duopoly approach. Econ Bull 17(5):1–9

White MD (1996) Mixed oligopoly, privatization and subsidization. Econ Lett 53:189–195

Acknowledgments

I am grateful to two anonymous referees for their constructive comments and suggestions. I also thank Akifumi Isihara, Katsuhito Iwai, Toshihiro Matsumura, and Shigeru Matsumoto for their helpful conversation and comments. This paper was financially supported by Grant-in-Aids for Young Scientists (B) from the Japan Society for the Promotion of Science and the Ministry of Education, Culture, Sports, Science and Technology.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

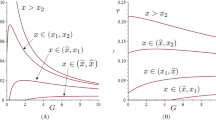

In this section, we consider the case where the government employs only an abatement subsidy. We show that in both regimes, (1) the output of each private firm is non-decreasing in s, and (2) the abatement of each private firm is increasing in s.

We assume that \(P^{\prime}(Q) +qP^{\prime\prime}(Q)<0.\) This guarantees the stability of equilibrium: under the assumption, each firm’s best reply is downward sloping. We also assume that \(D^{\prime\prime} \ge 0.\)

First, we consider the case of the mixed oligopoly. Define

where

We also define the following:

The second-order condition of the public firm implies

We assume that \(\Uppi_{aq}^{0}<0.\)

From Eqs. 1–4, by using the implicit function theorem, we can obtain the following:

where

We can check that |K| < 0.

-

(1)

$$ {\frac{{\hbox{d}} q_{1}^{*}}{{\hbox{d}} s}}= {\frac{ -C_{aq}^{1}\{ \Uppi_{qq}^{0}\Uppi_{aa}^{0} -(\Uppi_{aq}^{0})^{2}\} + D^{\prime\prime} e_{q}^{0} e_{a}^{1}(P^{\prime}+q_{1}P^{\prime\prime})\Uppi_{aa}^{0} - D^{\prime\prime}e_{a}^{0} e_{a}^{1}(P^{\prime}+q_{1}P^{\prime\prime})\Uppi_{aq}^{0}}{|K|}} \le 0. $$(33)

The equality holds if and only if C aq = 0 and \(D^{\prime\prime}=0.\)

-

(2)

$$ {\frac{{\hbox{d}} a_{1}^{*}}{{\hbox{d}} s}}={\frac{J \{\Uppi_{qq}^{0}\Uppi_{aa}^{0}-(\Uppi_{aq}^{0})^{2}\} + (P^{\prime}+q_{1}P^{\prime\prime})\{(nP^{\prime} - D^{\prime\prime} e_{q}^{0} e_{q}^{1})\Uppi_{aa}^{0} - (D^{\prime}e_{a}^{0} e_{q}^{1})\Uppi_{aq}^{0}\}}{|K|}}>0. $$(34)

Next, we consider the case of the private oligopoly. The equilibrium conditions are as follows:

By using the implicit function theorem, we obtain the following:

where

We can check that |L| > 0.

-

(1)

$$ {\frac{{\hbox{d}} q_{1}^{*}}{{\hbox{d}} s}}=- {\frac{ C_{aq}}{|L|}} \le 0. $$(38)

The equality holds if and only if C aq = 0.

-

(2)

$$ {\frac{{\hbox{d}} a_{1}^{*}}{{\hbox{d}} s}}=- {\frac{s \{(n+1)P^{\prime\prime}q +(n+2)P^{\prime} -C_{qq}\}}{|L|}}>0. $$(39)

About this article

Cite this article

Cato, S. Environmental policy in a mixed market: abatement subsidies and emission taxes. Environ Econ Policy Stud 13, 283–301 (2011). https://doi.org/10.1007/s10018-011-0017-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-011-0017-z