Abstract

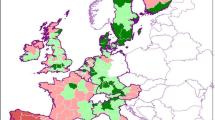

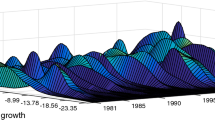

We analyse regional business cycle synchronization in the Euro Area, using gross value added in 53 NUTS 1 regions for a period of 30 years (1975–2005), detrended by Hodrick–Prescott and the Christiano–Fitzgerald filters. We conclude that, on average, synchronization has increased for the period considered with exceptions during the eighties and the beginning of the nineties. Still, the correlation of the business cycle in some regions with the benchmark remained low or even decreased. Our findings also support the hypothesis of the existence of a ‘national border’ effect.

Similar content being viewed by others

Notes

See Appendix for a detailed list of the regions and the codes assigned to them.

For a critique, we refer to Den Haan (2000).

For instance, Artis and Zhang (1997, 1999) break their sample in two intervals corresponding with the period before and after the start of the ERM and conclude that business cycles have become more synchronized during the ERM phase. However, Inklaar and De Haan (2001) dispute this finding. See also Fatás (1997).

These conditions are similar to the “beta” and “sigma” convergence concepts used in the economic growth literature.

This measure is called STRESS (standardized residual sum of squares).

The region of Berlin (DE3) has been excluded from the graph because it was very far away from the others (four points).

Regulation 1059/2003 of the European Parliament and the Council, of 26 May 2003 on the establishment of a common classification of territorial units for statistics (NUTS).

References

Altavilla C (2004) Do EMU members share the same business cycle? J Common Mark Stud 42:869–898

Artis M (2003) Is there a European business cycle? CESifo Working Paper No. 1053

Artis M, Zhang W (1997) International business cycles and the ERM: is there a European business cycle? Int J Financ Econ 2:1–16

Artis M, Zhang W (1998) Core and periphery in EMU: A cluster analysis. EUI Working Paper No. 98/37

Artis M, Zhang W (1999) Further evidence on the international business cycle and the ERM: is there a European business cycle? Oxf Econ Pap 51:120–132

Barrios S, De Lucio Fernandez JJ (2003) Economic integration and regional business cycles: evidence from the Iberian regions. Oxf Bull Econ Stat 65:497–515

Barrios S, Brülhart M, Elliot R, Sensier M (2002) A tale of two cycles: co-fluctuations between UK regions and the Euro Zone. Centre for Growth and Business Cycle Research (University of Manchester), Discussion Paper No. 003

Belke A, Heine J (2006) Specialization patterns and the synchronicity of regional employment cycles in Europe. Int Econ Econ Policy 3:91–104

Camacho M, Perez-Quiros G, Saiz L (2006) Are European business cycles close enough to be just one? J Econ Dyn Control 30:1687–1706

Christiano L, Fitzgerald TJ (2003) The band pass filter. Int Econ Rev 44:435–465

Clark T, van Wincoop E (1999) Borders and business cycles. Federal Reserve Bank of Kansas City, Working Paper No. RWP-99-07

Darvas Z, Rose AK, Szapáry G (2007) Fiscal divergence and business cycle synchronization: Irresponsibility is idiosyncratic. In: Frankel JA, Pissarides C (eds) NBER international seminar on macroeconomics. MIT Press, Cambridge, MA

De Haan J, Inklaar RC, Jong-A-Pin RM (2008) Will business cycles in the Euro area converge? A critical survey of empirical research. J Econ Surv 22:234–273

De Grauwe P, Vanhaverbeke W (1993) Is Europe and optimum currency area? Evidence from regional data. In: Masson P, Taylor M (eds) Policy issues in the operation of currency unions. Cambridge University Press, Cambridge, pp 111–129

Den Haan W (2000) The comovement between output and prices. J Monet Econ 46:3–30

Fatás A (1997) EMU: Countries or regions? Lessons from the EMS Experience. Eur Econ Rev 41:743–751

Frankel J, Rose A (1998) The endogeneity of the optimum currency area criteria. Econ J 108:1009–1025

Hodrick RJ, Prescott EC (1997) Postwar US business cycles: an empirical investigation. Journal of Money, Credit, and Banking 29:1–16

Inklaar R, De Haan J (2001) Is there really a European business cycle? A comment. Oxf Econ Pap 53:215–220

Inklaar R, Jong-A-Pin RM, De Haan J (2008) Trade and business cycle synchronization in OECD countries A re-examination. Eur Econ Rev (in press)

Kalemli-Ozcan S, Sørensen BE, Yosha O (2001) Economic integration, industrial specialization, and the asymmetry of macroeconomic fluctuations. J Int Econ 55:107–137

Krugman P (1991) Geography and trade. MIT Press, Cambridge, MA

Krugman P (1993) Lessons of Massachusetts for EMU. In: Torres F, Giavazzi F (eds) Adjustment and growth in the European monetary union. Cambridge University Press, Cambridge, pp 241–269

Massmann M, Mitchell J (2004) Reconsidering the evidence: are Euro Area business cycles converging? Journal of Business Cycle Measurement and Analysis 1:275–307

Massmann M, Mitchell J, Wheale M (2003) Business cycles and turning points: a survey of statistical techniques. Natl Inst Econ Rev, No. 183

Ravn M, Uhlig H (2002) On adjusting the HP-filter for the frequency of observations. Rev Econ Stat 84:371–375

Trichet J-C (2001) The Euro after two years. J Common Mark Stud 39:1–13

Author information

Authors and Affiliations

Corresponding author

Appendix: List of regions and codes

Appendix: List of regions and codes

The “Nomenclature of territorial Units for Statistics (NUTS)” subdivides the economic territory of the Member States into smaller units for statistical purposes, as defined in Decision 91/450/EEC. The classification is hierarchical and based on a population threshold. Therefore, NUTS do not necessarily coincide with existing administrative units.Footnote 9

Although statistical analysis has been substantially simplified, the NUTS classification has changed over time which makes obtaining long and homogeneous series difficult.

1.1 List of regions and codes used for the empirical analysis (NUTS1)

Rights and permissions

About this article

Cite this article

Montoya, L.A., de Haan, J. Regional business cycle synchronization in Europe?. Int Econ Econ Policy 5, 123–137 (2008). https://doi.org/10.1007/s10368-008-0106-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10368-008-0106-z