Abstract

The previous literature provides a highly ambiguous picture on the impact of trade and investment agreements on FDI. Most empirical studies ignore the actual content of BITs and RTAs, treating them as “black boxes”, despite the diversity of investment provisions constituting the essence of these agreements. We overcome this serious limitation by analyzing the impact of modalities on the admission of FDI and dispute settlement mechanisms in both RTAs and BITs on bilateral FDI flows between 1978 and 2004. We find that FDI reacts positively to RTAs only if they offer liberal admission rules. Dispute settlement provisions play a minor role. While RTAs without strong investment provisions may even discourage FDI, the reactions to BITs are less discriminate with foreign investors responding favourably to the mere existence of BITs.

Similar content being viewed by others

Notes

Please note that goods and services notifications are counted separately.

By “liberalization commitments” we refer to the application of national treatment to the pre-establishment phase of FDI, to which we interchangeably refer to as the admission or market access phase. National treatment essentially involves non-discrimination between foreign and national investors/investments.

Note that the effectiveness of various post-establishment obligations (e.g., lawful expropriation, minimum standard of treatment, transfer of funds) depends to a great extent on strict and binding ISDS provisions.

This situation may change with the implementation of the Lisbon Treaty that transfers the competency for FDI from the member states to the European Union Commission.

A number of agreements include not only a NT provision, but also an obligation of “market access”, modelled on Article XVI of the GATS. This article also regulates entry conditions by prohibiting certain types of restrictions, essentially quantitative restrictions that hamper competition, whether discriminatory or not (e.g., limits on the number of suppliers). Such an obligation is more relevant for services sectors, where monopolies or exclusive rights can be more prevalent. It overlaps with the NT obligation, which captures all quantitative restrictions that are discriminatory.

See Roy et al. (2007) for examples.

A second annex is for “future non-conforming” measures, where parties indicate sectors or policy areas where they wish to reserve the right to maintain existing restrictions or introduce new ones. However, the presumption is that these are exceptions, and the first annex, on existing non-conforming measures, is more important.

This is often referred to as the ratchet mechanism of negative-list agreements.

Adams et al. (2003) develop a liberalization index for non-merchandise trade provisions. While investment provisions are part of this index, it includes an array of non-investment issues, e.g., procurement, competition, movement of natural persons, and intellectual property.

More precisely, gravity models are shown to suffer from built-in biases of “normal” trade patterns—downward for relatively remote countries, and upwards for countries closer by—unless bilateral distances are weighted by the size of the trading partners. We are most grateful to an anonymous reviewer for alerting us to Polak’s (1996) contribution. The built-in biases may be less serious in gravity models on FDI, compared to gravity models on trade, considering that the impact of distance on FDI is widely believed to be ambiguous: Similar to trade, FDI tends to be discouraged by distance-related transaction costs. On the other hand, FDI may increase with distance to the extent that trade with remote locations is replaced by FDI. All the same, we follow the reviewer’s suggestion and account for distance relative to the host country’s size (see below).

Blonigen et al. (2007: 1309) note that the gravity model “is arguably the most widely used empirical specification of FDI.”

The fixed-effect approach might result in less efficient coefficient estimates, compared to using the explicit multilateral resistance terms. Yet, Feenstra (2004: 161–162) considers the fixed-effect approach to be the preferred empirical method due to its computational simplicity.

See also Egger (2000: 29) who argued in a panel setting of trade flows that “the proper econometric specification of the gravity equation in most applications would be one of fixed country and time effects.”

This is for agreements that, for example, have a NT obligation that is limited to post-establishment, or a NT obligation covering pre-establishment but that is devoid of legal effect, e.g., by being subject to “domestic laws and regulations” or simply hortatory. In additional regressions, we allow for parameter heterogeneity and use dummy variables for each NT modality in RTAs (see below).

Note that we take the natural log of GDP, DiffGDPpc and Inflation.

See also Feenstra (1999) in this context, who notes that choices on where to undertake FDI depend on access to the local market and cost conditions.

Specifically, Henisz (2000: 334) argues that stricter constraints on the executive branch reduce political hazards for foreign investors, notably the “threat of opportunistic expropriation by the government.” We prefer the index developed by Henisz over other institutional indicators such as the International Country Risk Guide (ICRG). However, we perform a robustness test in Section 4 below and replace PolCon by the ICRG’s index on the investment profile of the host country (InvestProfile). In contrast to various subjective and more specific measures such as corruption perceptions indices, Henisz offers a broadly defined measure of political hazards based on objective criteria such as the number of independent branches of government and the extent of political alignment across branches. In this way, Henisz (2000: 334–5) captures “the feasibility of policy change by the host-country government which either directly—seizure of assets—or indirectly—adverse changes in taxes, regulations or other agreements—diminishes the multinational enterprise’s expected return on assets.”

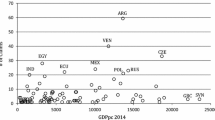

Note that the number of pairs is slightly less than 2,324 (28 source countries times 83 host countries). This is because some countries (e.g., Argentina and Venezuela) are included among source and host countries.

For a broader survey of the political economy of trade policy, see Rodrik (1995).

Most recent empirical contributions to this strand of the literature employ non-parametric matching techniques to account for endogeneity and identify the treatment effects of RTAs on the volume of member countries’ bilateral trade (Baier and Bergstrand 2009) and, respectively, on the structure of trade (Egger et al. 2008).

We always used country-pair fixed effects, as a Hausman test indicated that this model would be the preferred choice in comparison to the random effects model.

As noted in the concluding section, this limitation of the present analysis should be addressed in future research.

Since the ICRG measure is available since 1984, we lose the first two periods (1978–1980 and 1981–1983) and some 100 hundred country pairs without data. Hence, we use PolCon for all following regressions.

We thank an anonymous reviewer for suggesting this informative modification.

We focus on RTA- and BIT-related variables in the following. Note that all subsequent estimations include host-year dummies, in addition to the other dimensions of fixed effects. As a result, the evidence for the control variables is essentially as shown before in columns (5)–(7) of Table 1.

RTAs (and also BITs) without pre-consent or no investor-state procedure altogether are coded as zero.

We also tested for possible interaction effects between RTAs with more liberal NT provisions and RTAs with stronger ISDS provisions. One could have expected that RTAs combining both types of provisions have a greater impact on FDI flows than those that did not. In other words, the effect of liberal admission rules could have been reinforced by better ex-post protection, and vice versa. However, we did not find evidence supporting this hypothesis; results are not shown for the sake of brevity.

Yackee (2009) does not cover BITs concluded by several of our source countries; examples include: Chile, Ireland, Rep. of Korea, Mexico, New Zealand, Portugal, Thailand and Turkey. Furthermore, Yackee’s coding is available only for BITs ratified up to 2002.

See also Berger et al. (2011) for ambiguous effects of ISDS provisions in BITs.

For example, Bangladesh and Japan may have ratified a BIT with each other that provides for admission rights. Bangladesh may also have signed an agreement with a third country, say Mexico, where it did not provide for NT as regards admission, but has committed to grant Mexico MFN as regards admission of foreign investments. In other words, by granting a certain level of treatment for admission to Japanese investors, Bangladesh is bound to extend the same treatment to Mexican investors by virtue of the MFN clause in the Mexico-Bangladesh agreement.

However, the table with detailed results on the coefficients of all variables is available on request.

Comparisons of the quantitative impact of the variables would require the calculation of marginal effects for the PPML case. We refrain from doing so for the sake of brevity.

Note that the GMM estimations, too, include all dimensions of fixed effects. In the IV regressions, we treat all variables as endogenous. Obviously, this does not apply to the different dimensions of the fixed effects and time dummies.

Note also that Openness sometimes enters significantly negative, which is not particularly plausible and conflicts sharply with the notion of vertical FDI.

The long-run effect results from dividing the coefficients on BIT and RTA by one minus the coefficient on the lagged dependent variable. Recall, however, that the inclusion of fixed effects renders the parameter values less informative.

References

Adams R, Dee P, Gali J, McGuire G (2003) The trade and investment effects of preferential trading arrangements—old and new evidence. Productivity Commission Staff Working Paper. Canberra

Adlung R, Molinuevo M (2008) Bilateralism in services trade: is there fire behind the (BIT-)smoke? J Int Econ Law 11(2):365–409

Allee T, Peinhardt C (2010) Delegating differences: bilateral investment treaties and bargaining over dispute resolution provisions. Int Stud Q 54(1):1–26

Anderson JE, van Wincoop E (2003) Gravity with gravitas: a solution to the border puzzle. Am Econ Rev 93(1):170–192

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error component models. J Econ 68(1):29–51

Baier SL, Bergstrand JH (2004) The economic determinants of free trade agreements. J Int Econ 64(1):29–63

Baier SL, Bergstrand JH (2007) Do free trade agreements actually increase members’ international trade? J Int Econ 71(1):72–95

Baier SL, Bergstrand JH (2009) Estimating the effects of free trade agreements on international trade flows using matching econometrics. J Int Econ 77(1):63–76

Baier SL, Bergstrand JH (2010) Approximating general equilibrium impacts of trade liberalizations using the gravity equation: applications to NAFTA and the European economic area. In: van Bergeijk PAG, Brakman S (eds) The gravity model in international trade: advances and applications. Cambridge University Press, Cambridge, pp 88–134

Baldwin R (2008) Big-think regionalism: a critical survey. NBER working paper 14056. National Bureau of Economic Research, Cambridge

Berger A, Busse M, Nunnenkamp P, Roy M (2011) More stringent BITs, less ambiguous effects on FDI? Not a bit! Econ Lett 112(3):270–272

Bergstrand JH, Egger P (2007) A knowledge-and-physical-capital model of international trade flows, foreign direct investment, and multinational enterprises. J Int Econ 73(2):278–308

Blonigen BA, Davies RB, Waddell GR, Naughton HT (2007) FDI in space: spatial auto gressive relationships in foreign direct investment. European Economic Review 51(5):1303-1325

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87(1):115–143

Busse M, Königer J, Nunnenkamp P (2010) FDI promotion through bilateral investment treaties: more than a bit? Rev World Econ 146(1):147–177

Büthe T, Milner HV (2008) The politics of foreign direct investment into developing countries: increasing FDI through international trade agreements? Am J Polit Sci 52(4):741–762

Büthe T, Milner HV (2009) Bilateral investment treaties and foreign direct investment: a political analysis. In: Sauvant KP, Sachs LE (eds) The effect of treaties on foreign direct investment: bilateral investment treaties, double taxation treaties, and investment flows. Oxford University Press, Oxford, pp 171–224

Deardorff A (1998) Determinants of bilateral trade: does gravity work in a neo-classical world. In: Frankel J (ed) Regionalization in the world economy. University of Chicago Press, Chicago, pp 7–22

Dee P, Gali J (2003) The trade and investment effects of preferential trading arrangements. National Bureau of Economic Research. Working Paper 10160. Cambridge

Egger P (2000) A note on the proper econometric specification of the gravity equation. Econ Lett 66(1):25–31

Egger H, Egger P, Greenaway D (2008) The trade structure effects of endogenous regional trade agreements. J Int Econ 74(2):278–298

Feenstra RC (1999) Facts and fallacies about foreign direct investment. In: Feldstein M (ed) International capital flows. University of Chicago Press, Chicago, pp 331–350

Feenstra RC (2004) Advanced international trade: theory and evidence. Princeton University Press, Princeton

Guzman AT (1998) Why LDCs sign treaties that hurt them: explaining the popularity of bilateral investment treaties. Va J Int Law 38(639):640–688

Hallward-Driemeier M (2003) Do bilateral investment treaties attract foreign direct investment? Only a bit … and they could bite. World Bank Policy Research Working Paper 3121. Washington

Henisz W (2000) The institutional environment for multinational investment. J Law Econ Organ 16(2):334–364

Lesher M, Miroudot S (2007) The economic impact of investment provisions in regional trade agreements. Aussenwirtschaft 62(2):193–232

Magee CS (2003) Endogenous preferential trade agreements: an empirical analysis. Contrib Econ Anal Pol 2(1): article 15

Marchetti J, Roy M (2008) Services liberalization in the WTO and in PTAs. In: Marchetti J, Roy M (eds) Opening markets for trade in services: countries and sectors in bilateral and WTO negotiations. Cambridge University Press and WTO, Cambridge, pp 61–112

Miroudot S (2009) Economic impact of investment provisions in Asian RTAs. In: Chaisse J, Gugler P (eds) Expansion of trade and FDI in Asia. Routledge, London, pp 186–211

Mutti J, Grubert H (2004) Empirical asymmetries in foreign direct investment and taxation. J Int Econ 62(2):337–358

Neumayer E, Spess L (2005) Do bilateral investment treaties increase foreign direct investment to developing countries? World Dev 33(10):1567–1585

Polak J (1996) Is APEC a natural regional trading bloc? A critique of the ‘gravity model’ of international trade. World Econ 19(5):533–543

Portes R, Rey H (2005) The determinants of cross-border equity flows. J Int Econ 65(2):269–296

PRS Group (2011) International country risk guide: political risk (Table 3b). http://www.icrgonline.com/default.aspx

Reinhart CM, Rogoff KS (2004) The modern history of exchange rate arrangements: a reinterpretation. Q J Econ 119(1):1–48

Rodrik D (1995) Political economy of trade policy. In: Grossman GM, Rogoff K (eds) Handbook of international economics, vol. III. Elsevier, Amsterdam, pp 1457–1494

Roy M, Marchetti J, Lim H (2007) Services liberalization in the new generation of preferential trade agreements: how much further than the GATS? World Trade Rev 6(2):155–192

Santos Silva JMC, Tenreyro S (2006) The log of gravity. Rev Econ Stat 88(4):641–658

Sauvant KP, Sachs LE (eds) (2009) The effect of treaties on foreign direct investment: bilateral investment treaties, double taxation treaties, and investment flows. Oxford University Press, Oxford

Shatz HJ (2003) Gravity, education, and economic development in a multinational affiliate location. J Int Trade Econ Dev 12(2):117–150

Tobin J, Rose-Ackerman S (2005) Foreign direct investment and the business environment in developing countries: the impact of bilateral investment treaties. Yale Center for Law, Economics, and Public Policy. Working Paper. New Haven, Conn

Tobin J, Rose-Ackerman S (2006) When BITs have some bite: the political-economic environment for bilateral investment treaties. http://www.law.yale.edu/documents/pdf/When_BITs_Have_Some_Bite.doc

UNCTAD (2009) The role of international investment agreements in attracting foreign direct investment to developing countries. UNCTAD Series on International Investment Policies for Development. New York and Geneva (United Nations)

UNCTAD (2011) World investment report 2011. Non-equity modes of international production and development. New York and Geneva (United Nations)

Vernon R (1971) Sovereignty at bay: the multinational spread of U.S. enterprises. Basic Books, New York

Wälde T (2005) The “umbrella” clause in investment arbitration: a comment on original intentions and recent cases. J World Invest Trade 6(2):183–236

Warin T, Wunnava P, Janicki H (2009) Testing Mundell’s intuition of endogenous OCA theory. Rev Int Econ 17(1):74–86

Yackee J (2007) Conceptual difficulties in the empirical study of bilateral investment treaties. University of Wisconsin Law School. Legal Studies Research Paper 1053

Yackee J (2009) Do BITs really work? Revisiting the empirical link between investment treaties and foreign direct investment. In: Sauvant KP, Sachs LE (eds) The effect of treaties on foreign direct investment: bilateral investment treaties, double taxation treaties, and investment flows. Oxford University Press, Oxford, pp 379–394

Author information

Authors and Affiliations

Corresponding author

Additional information

Acknowledgements

We are most grateful to Jayson Webb Yackee for sharing his coding of ISDS in BITs with us. We also thanks two anonymous reviewers for constructive critism and helpful suggestions.

Appendices

Appendix A

Appendix B

Appendix C

Appendix D

Rights and permissions

About this article

Cite this article

Berger, A., Busse, M., Nunnenkamp, P. et al. Do trade and investment agreements lead to more FDI? Accounting for key provisions inside the black box. Int Econ Econ Policy 10, 247–275 (2013). https://doi.org/10.1007/s10368-012-0207-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10368-012-0207-6

Keywords

- Foreign direct investment

- Bilateral investment treaties

- Regional trade agreements

- Admission rules

- Investor-state dispute settlement