Abstract

The novel coronavirus (COVID-19) epidemic represents a major challenge for the world economy. While a detailed longer-term diffusion path of the new virus cannot be anticipated for individual countries, one may anticipate international supply shocks and declining GDP growth in many OECD countries and China in 2020; and one should expect falling asset prices in Asia, the United States and the European Union plus the United Kingdom – except for the price of risk-free government bonds. In the course of 2020/21 the US, the EU and the UK, as well as other countries, will face both an increasing number of infected patients as well as a higher case fatality ratio. Health care expenditures in the US could increase more than in the Eurozone and the EU in the medium term, a development that undermines the international competitiveness of the United States. The analysis suggests that per capita income is a positive function of the effective trade openness and of the new Global Health Security Index indicator from the NTI/Johns Hopkins University. A rising health care-GDP ratio in the US is equivalent to a rising US export tariff. As regards the coronavirus challenge, the ratio of acute care beds to the elderly in OECD countries shows considerable variation. Due to international tourism contraction alone, output growth in the Eurozone, the US and China can be expected to fall by about 1.6% in 2020. The COVID-19 challenge for the US Trump Administration is a serious one, since the lack of experts in the Administration will become more apparent in such a systemic stress situation – and this might well affect the November 2020 US presidential election which, in turn, would itself have considerable impacts on the UK and the EU27 as well as EU-UK trade negotiations. Integrating the health care sector into macroeconomics, which should include growth analysis, is an important task. The role of health quality - and health insurance coverage - for endogenous time horizons and economic welfare, respectively, is emphasized.

Similar content being viewed by others

1 Introduction

The novel coronavirus (for short COVID-19, or COrona VIrus Disease 2019) epidemic which started at the end of 2019 in the Wuhan area of China has, within three months, affected about 90,000 people worldwide of which approximately 3000 have died. The number of countries reporting infections has increased rapidly and the high case fatality rate has caused many individuals, firms and governments to react in various ways in order to try to limit the spread of the virus. In the EU and the US, this has included imposing quarantine on people who have recently returned from abroad – for example, from China – or who have participated in certain social events (such as the carnival celebrations in western Germany in late February, where in one location alone, the city of Heinsberg which is close to Düsseldorf, many people seem to have contracted the virus) in which individuals who have tested positive for COVID-19 had also participated and who have been on the radar of health authorities. Many firms in Germany and France have encouraged employees to practice home office and thus have tried to minimize infection risks within the company; other countries, including the US, have followed in March 2020. Such adjustment measures in firms, while pragmatic, will go along with reduced labor productivity and innovation, but at least a lot of important work can still be done remotely. The authorities imposed a so-called “lockdown” in Italy in mid-March and other EU countries have followed with similar measures in order to slow down the spreading of the coronavirus.

In car factories – for example Volkswagen – workers have raised the question of why production should continue meaning that workers are exposed to a spreading infection while white collar workers are sitting at home with the family following the government-imposed restrictions in many western OECD countries in mid-March, namely to avoid situations with many people congregating in the same area. Problems with lack of intermediate products supplied from abroad could thus slow down industrial production as much as workers’ fear of the propagation of the coronavirus and the spread infection at the factory floor, respectively. To the extent that regulations have been imposed to close hotels and restaurants both domestic and international tourism are extremely restricted in the first and second quarter of 2020. Thus the question arises which macroeconomic effects one has to anticipate and how the effectively massive epidemic test of the health system and the hospital sector, respectively, will cause in the many countries affected.

The first part of this contribution is an introduction and an overview of key issues. The basic idea of the whole contribution is to argue that a broader and deeper analytical link between macroeconomic approaches and health system analysis seems to be adequate; indeed required if one is to largely understand the unique medium- and long-term effects of the coronavirus shock – or of similar future shocks. Moreover, some new key indicators for the capacity of the hospital sector in the coronavirus pandemic are presented for OECD countries. The usefulness of the recently available Global Security Health Index is emphasized and analytical findings of the augmented Mundell tradables/non-tradables model are presented along with a simple modified Solow growth model which includes the health insurance coverage ratio as a critical variable in the context of an approach with an epidemic shock. A crucial aspect of this contribution is to emphasize established analytical positive links between health and productivity and output growth, respectively – generally emphasized by, amongst others, Mushkin (1962), Hsiao (2000) and for the case of China by the empirical findings of Li and Huang (2009). The subsequent analysis is based on knowledge available at March 24, but the theoretical approaches highlighted and developed here should be useful beyond changes in the CORVID-19 statistics.

1.1 Some key figures on the pandemic

COVID-19 is spreading worldwide and on March 11, 2020, the World Health Organization (WHO) defined the international epidemic to be of a global nature: COVID-19 was by that date officially regarded as a pandemic. With 104 countries affected, about 420,000 people infected and nearly 19,000 fatalities (for an overview see the map of the WHO as of March 25, 2020Footnote 1 and tables in Appendix 1 Tables 7 and 8). As of mid-March, 146 countries were affected, 154,000 people had been infected and 5700 fatalities had been recorded. In absolute terms, the number of infections was very high in China with 81,048 cases, followed by Italy (21,157), Iran (12,729), Republic of Korea (8162), Spain (5753), France (4469), Germany (3795), US (1678), Switzerland (1359) and the UK (1144). Given the nature of the pandemic, the picture quickly changes: For March 23, 2020, the WHO reported 81,601 cases in China which is roughly a stagnation, but Italy already had recorded 59,138, Spain 28,572, Germany 24,774 and France 15,821 cases. The age distribution of coronavirus-related deaths for China shows that the elderly have, not surprisingly, a higher mortality than the average. One economic implication is that, on the one hand, the effective labor force should be negatively affected by COVID-19. On the other hand, there is an unclear effect on retired persons and the overall death rate as the shut-down of firms improves the overall air quality and thus could reduce the number of people falling ill from non-coronavirus diseases (Fenz and Kharas 2020). With hospitals facing full capacity utilization in acute care capacities, the survival rate of other inpatients and outpatients with serious illnesses (non COVID-19) could fall. As regards the WHO figures, one may note that the oft-cited figures published by the Johns Hopkins University differ due to the broader statistical coverage by the latter.

The only country in the top seven countries where the apparent e-function type related expansion was different – starting from the day when 100 infections had been reported – was the Republic of Korea where broad testing and strict quarantine measures had been applied. Another country with a rather low number of infections reported was Taiwan (with less than 50 confirmed cases by March 9, 2020) where government relied on a ready emergency plan built upon the previous experience of the SARS epidemic and shut down all air travelling with China early on.

The pandemic could bring a minor recession for OECD countries and China or several quarters of much reduced output in industry and the services sector. International tourism will be very modest in 2020 and might not recover before the second half of 2021. In a normal recession, tourism – representing a large economic sector in many countries – is usually not much affected. A lack of vacation time in turn and the stress from the threat of the pandemic might also depress considerable strata of society for some time so that productivity could decline strongly for many months. As PSA, Renault, Fiat-Chrysler, Volkswagen and other EU car producers have announced on March 16 that production in several plants will be shut down for several months in Europe a deep recession cannot be excluded, as there could be a unique overlap of declining manufacturing output and services sector contraction, including tourism. There is also the risk that the normal chain of payments could be interrupted as firms or households face serious liquidity constraints – and firms or banks’ solvency constraints - if the economic crisis deepens. A deepening economic crisis will make it more difficult to bolster the resources allocated to the health sector. The hospital sector is obviously crucial to the response to the coronavirus epidemic and here the indicators are critical for many countries, including many EU countries, namely when acute care beds relative to the elderly population are considered (see subsequent sections). This contribution brings together macroeconomic and health system aspects in a somewhat unusual way, but this perspective could be useful for the analysis of the coronavirus epidemic (Map 1).

An epidemic typically starts with a small diffusion of the number of people infected, after a few months or quarters there will be a peak as counter measures by government as well as individuals - and physicians in the health system - have been implemented. After the peak has been reached, the number of infected will gradually fall. From this perspective, the macroeconomic effects in a first stage of an epidemic should be rather modest, followed by a peak of negative output shocks – finally followed by a potentially enhanced economic upswing as postponed investment and consumption in the private sector could increase. Both mortality and morbidity statistics published should affect aggregate demand on the one hand, but also aggregate supply on the other hand as there will be less people working in factories and offices in an epidemic period. Of particular relevance for the control of the spatial spreading of COVID-19 are measures which effectively impose a quarantine on those who are infected; and for many other people, the authorities could impose restrictions on mobility at the regional, the national and the global level. Many people, including tourists and business people, will be eager to reduce their level of international travel, particularly to regions/countries with high infection problems. From this perspective, China – where COVID-19 started in late 2019 – has a specific problem, but one should also notice that China has had growing numbers of visitors, including business people, and tourists in the two decades after 1990 (see Appendix Fig. 9).

A pandemic like COVID-19 is a crucial shock to most national health systems in countries with a high number of infections and is also a shock to the world economy. Given the fact that health care expenditures relative to gross domestic product in industrialized countries are between 8 and 18% in 2019, it seems crucial to link health care expenditure analysis to the more traditional macroeconomic analysis. Indeed, there is a lack of such analysis as has already been noted by Gerdtham and Jonsson (2000) in their classical health care analysis contribution “International Comparison of Health Expenditure: Theory, Data and Econometric Analysis” in the Handbook of Health Economics. The coronavirus shock to the world economy is a case where indeed an overlap of macroeconomic analysis and health care analysis indeed makes a lot of sense. To the extent that the COVID-19 shock reduces real income for several quarters in many countries, one should also see a medium term decline of health care expenditures (after the short-term transitory peak determined by the epidemic) since the demand for health care rises over-proportionately with real income.

The statistics on China’s regional incidence of COVID-19 infections show that two provinces are primarily affected which suggests that the drastic quarantine measures imposed by the national and regional authorities seem to have been effective. As regards the EU, Italy is a hotspot with more than 7000 confirmed cases at the end of the first week of March. The US Center for Disease Control was reporting eleven fatalities in the US on March 7, 2020, while the WHO) were documenting no COVID-19 related deaths in the United States on the same day (the WHO figures were subsequently updated in the following days).

On March 24, the WHO had already registered a total of 42,164 coronavirus infections in the United States, including 10,591 new infections and 471 fatalities. New York seemed to be a regional hot spot and on March 24 the Trump Administration declared that visitors to New York should undergo 14 days in self-isolation. Given the fact that New York had 64 million US visitors plus 14 million foreign visitors plus an unknow number of New York people who visited friends or business colleagues and other institutions in the US, and indeed outside the US, the New York cluster indeed stands for a crucial challenge. Assuming that 500,000 US visitors had been in New York as visitors in the two weeks prior to March 24, about half a million US citizens should go into quarantine and the roughly 100,000 foreign visitors who had visited New York in the same period should also followed the advice for a self-imposed quarantine. However, these people apparently have not been contacted although airlines could have been mobilized to track foreign visitors and to alert them about the need for self-quarantine. This is an example of how poorly organized the world economy is in facing the challenge of a pandemic and how negligent authorities in the US and outside the US have dealt with the fact that New York is a coronavirus hot spot. While the very nature of a pandemic calls for global economic cooperation, it seems that such cooperation is at a premium in 2020; to what extent political populism contributes to this problem could be an important aspect in future research.

1.2 Early assessments of the coronavirus Epidemic’s economic effects

As regards the economic impact of COVID-19 in various countries, one may point out that it is not only direct and indirect channels into the real economy which will be relevant, but changes in income expectations which will (this includes digital news channels – e.g. the diffusion of COVID-19 related information in the internet) affect the behavior of investors and consumers as well as policymakers. Psychological effects on the demand side could play a strong role in the current epidemic and negative effects on the aggregate demand side could overlap with supply-side disturbances from international problems in the delivery of intermediate inputs. Liquidity problems on the side of firms could also contribute to an economic slowdown, moreover liquidity problems of major banks might occur in many countries so that output decline in OECD countries as well as in China and other countries could be considerable. In early March 2020, McKibbin and Fernando (2020) have presented a macro model with various scenarios for the world economy which show a large range of negative possible real GDP outcomes in the context of the COVID-19 challenge, including a major international recession.

The Interim Economic Assessment of the OECD (2020) from March 2, 2020 has argued that global output growth could decline to a low rate of 2.4%, down from the 2.9% of 2019 – but in 2021, the output growth would rise to 3.3% in the world economy (see following Table 1). The interim assessment of the OECD (2020) showed in March only slight negative effects on output in 2020 and 2021, respectively; the peak of the infection was assumed to be in the first quarter 2020. In a special simulation case with a peak only in the second half of 2020, a stronger output decline is shown, namely −1.75% relative to the baseline; North America records −1.5% Table 1.

At the end of the first quarter of 2020, it is still too early to fully assess the output decline from the coronavirus shock, but the order of magnitude for western OECD countries could come close to the output decline related to the Transatlantic Banking Crisis. The type of shock represented by the coronavirus pandemic is normally not considered in standard macroeconomic simulations – hence the combined effect of a shutdown of the tourism sector and the hospitality sector plus the automotive sector plus other services (say, a barber shop closed for several weeks as a consequence of epidemic-related government regulations – with no relative price adjustment able to bring about a new market equilibrium in the short term) first have to appear on the analytical radar of simulation expert groups. The duration of the demand effect is rather uncertain in the early stage of the pandemic, but even once the duration becomes clear after a few months there could be serious balance sheet effects on companies with limited working capital and short-term debt maturities – hence, even a temporary closure of firms can have serious effects in some economic sectors. It is thus not clear that after a few months of the temporary shutdown of many firms, one could more or less reset the whole economy and continue output expansion on the old level of the growth path. Since the pandemic shock affects nearly all countries of the world economy there is also an unusual global synchronization of the shock and the big fiscal packages considered in the US, the EU, the UK and in other countries clearly imply a medium-term rise of debt-GDP ratios in OECD countries and many newly industrialized countries. Developing countries without much room to maneuver will need strong support by the IMF, the World Bank and regional multilateral banks. The coronavirus pandemic thus is a challenge that requires a multilateral response. Multilateralism, however, is not the favored approach of the Trump Administration with its emphasis on bilateralism. By implication, there will be a lack of US leadership in this international economic crisis that in turn also could raise doubts about standard open economy simulation results.

In a typical DSGE macro model the strong output decline after the initial epidemic shock is followed by a later output increase where part of the initial output loss is compensated by higher output growth in the following quarters. As long as the coronavirus challenge can be overcome in a medical sense by autumn 2020, postponed consumption and investment should be useful to contribute to a new economic upswing in 2021 and beyond; an adequate mix of monetary policy and fiscal policy can contribute to overcoming the incipient recession. To the extent that China, the US, the EU27 plus the UK and Japan adopt similar expansionary policy, there will be international spillover effects on the one hand which reinforces the upswing. However, quantitative easing (QE) which normally brings about a nominal and real devaluation, and a decline of the interest rate, will not bring much output expansion through the real devaluation impulse if several big countries adopt similar QE policies.

As regards the UK, it is, however, clear that the expansionary policy mix adopted in spring 2020 means that there is not much room to maneuver for a strong fiscal and monetary impulse to cushion the BREXIT shock. The UK in turn faces sharper problems in the health system post-BREXIT – as of February 1, 2020; the UK’s access to special medical programs of the EU are no longer available and the number of foreign workers in the UK National Health Service (NHS) has declined in the period 2016–2019. This is a problem in a period in which demand stress on intensive care in the NHS hospital system will increase. The number of hospital beds per inhabitant in the UK is rather low by an international comparison amongst OECD countries, at the same time, one may point out that Italy, Spain and France had recorded high number of COVID-19 infections in March 2020.

By mid-March 2020, the European Central Bank, the Bank of England and the US Federal Reserve System had all reduced interest rates or adopted – as with the ECB which was already operating at a zero interest rate level – more favorable conditions for banks to get central bank loans. It is not clear that monetary policy is suitable to counter-balance the negative effects of the COVID-19 pandemic whose economic disturbance is largely a supply-side disturbance (shocks to international production networks) and liquidity problems of many firms as well as some aggregate demand weakening. Fiscal expansion packages had also been adopted in the US, the UK and some leading EU countries by mid-March 2020. The European Commission (2020) emphasized that a consistent expansionary policy mix could help to stabilize the EU in a situation in which supply-shocks and demand shocks – including a negative shock from China in the first quarter of 2020 - as well as liquidity problems of firms were overlapping. One may add that the EU and the EU countries, respectively, had been passive in seeking restrictions on air travel to and from China in February and March 2020 which probably was not helpful in containing the spreading of the epidemic to Europe; by contrast the US imposed flight travelling restrictions with China in February.

While China and other countries in Asia are facing the epidemic as a crucial challenge for the health system and the political as well as the economic system Western Europe and the United States try to anticipate the spreading of the virus and to develop an adequate response in health policy, economic policy and in the field of international cooperation. As regards China, the province of Hubei (with the epidemic center of Wuhan) was very strongly affected by COVID-19 and the Chinese authorities have largely closed down production in the region, but schools and universities across the whole region have also undertaken quarantine measures. Authorities in China have closed down production in several regions which implies that firms in Europe, the US and Asia face a shortage of intermediate inputs from China; negative demand effects in China and in other countries could also be observed. Sales of cars fell in February 2020 by about 80% compared to the previous month before which clearly indicates a case of a strong negative sectoral demand shock.

One key intermediate export of China are computer chips which are imported by companies in the US, Europe, Asia, Latin America, Australia and Africa. The first sector facing a reduction in production after Chinese export slowdown will be computer and mobile phone producers as well as producers of modern screens. In a second round of supply-chain transmissions, digital service providers would obviously have to slow down planned expansion of such services and this in turn would reduce productivity growth in OECD countries and Newly Industrialized Countries. If Chinese firms can restore production capacity rather quickly, the negative supply-side effects for other countries should be rather modest, but if there is a second wave of COVID-19 in China, the global supply side shock of COVID-19 could be rather big. Taking into account the digital productivity slow-down in the world economy this shock would come on top of sectoral declines in tourism and logistics.

As regards the response from International Organizations and multinational firms to the COVID-19 outbreak in China, they typically recalled international personnel located in Beijing (and other Chinese centers) home in early and mid-February. European, American as well as Japanese firms in many cases followed the example of international organizations; those coming back to EU28 countries or the US were expected to implement a 14 days self-isolation in home quarantine.

While many observers of the COVID-19 epidemic – and politicians in the US, the EU and China/Japan/Republic of Korea - raise questions related to national health system challenges, there is not much awareness that the novel coronavirus with its potential as a worldwide epidemic (a pandemic) concerns a global public evil; and fighting the virus in these and other countries stands for a global public good. It is obvious that fighting a global public evil requires cooperation among the leading economies and in the relevant international organizations (e.g. the World Health Organization, the International Monetary Fund, the World Bank, UNHCR – in the case of refugees). In this perspective, the fact that the world’s global technological leader, the United States, is governed by the Trump Administration which refutes multilateralism might become a serious problem. Fighting a pandemic is a global public good and if there are considerable political free rider problems, or simply political inconsistencies and inefficiencies in major OECD countries, the fight against the global epidemic will be not really successful. This in turn implies that many more lives could be lost than in the case of efficient and effective global cooperation.

The fact that the world economy is facing the challenge of COVID-19 as a global problem in early 2020 could mean that the world economy is facing an instability problem, namely to the extent that the output decline in 2020/21 will seriously affect more than one half of the world economy: The disease emerged in China, standing for about 17.5% of world real income and thus a bit more than the US and the EU28 with each representing 16.5% in 2018 (PPP figures according to the World Bank). If national and international epidemic shocks translate into a serious economic slowdown in China in 2020, it will automatically have major negative international spillovers to the EU and the US and from these two actors there will be a strong negative repercussion effect on China. In short, a COVID-19 pandemic in the new world economy of triadic interdependency EU-US-China, requires enhanced international cooperation and multilateralism; but the Trump Administration is emphasizing bilateralism which means that the efficiency of OECD countries+China fiscal/monetary policy cannot be efficient. This in turn makes fighting the pandemic more difficult since an economic downturn in the global North would undermine economic stability and prosperity in the global South which implies that the problem of insufficient resources in the health sector of developing countries would be reinforced. The very nature of a pandemic is, however, such that the South of the world economy could be directly affected by the COVID-19 shock, and relatively poor countries – with rather weak public health systems – could face massive problems in dealing with the health care challenges as well as with the economic effects from this shock.

If the G20 countries would, in the end, face a simultaneous COVID-19 problem – outside China the peak of the pandemic may still be expected to occur only in summer 2020 (and possibly a second wave in autumn 2020 or thereafter) – there could be a global recession, as the G20 stands for 81% of global GDP. If the diffusion of COVID-19 can be stopped rather quickly, there is no major reason to worry with respect to the output and job development in the world economy, but if the pandemic should go on until 2021 or even beyond, there could emerge a very serious global stability problem. Given the pandemic and the likely size of the economic shock in sectors such as tourism and logistics – plus economic multiplier effects - policymakers should potentially be rather concerned in North America, Europa, Asia and other regions of the world economy.

Moreover, as regards the EU27/Eurozone and the US it will be interesting to take a closer look at the one sector which is directly exposed to the pandemic, namely the health care sector. The size and characteristic of that sector in the EU and the US clearly justifies the argument that this is a systemically relevant sector. To the extent that the health care sector and the economy – with health insurance linked to firms in the US – are characterized by inefficiencies, the COVID-19 challenge will reveal those inefficiencies to a considerable extent.

If there is a person with a suspected infection, a test is typically necessary and if the result of that test is positive, the respective person must stay in quarantine at home or go to hospital. If patients exhibit a serious reaction to COVID-19, they will typically be taken care of as in-patients in hospitals where strict quarantine conditions and protective measures for the people working there are necessary. The US Congress has appropriated an extra $8 billion in early March to increase the health care budget in the context of COVID-19 cases. Italy has introduced an additional package to the value of €7 billion in an extra budget on March 5, 2020, in order to fight the challenge posed by the virus. Additional fiscal packages were adopted in mid-March in the US, Germany, France and Italy.

The very high mortality rate in Italy in early 2020 suggests that the number of infected people in Italy has been underestimated. This raises questions about the quality of the Italian health system and health policy in Italy, respectively. On March 9, 2020, the Italian government imposed a lockdown on the whole country, while Austria a week later had signaled that it wants to restrict free travel between Italy and Austria (which are both Schengen area countries).

By March 17, most EU countries had imposed new border control measures which were supposed to control and restrict travelling of people across borders in the EU as a means to reduce the corona virus infection rate. However, an economically serious side effect was that long queues of trucks at many borders soon occurred which inevitably was bound to undermine just-in-time production in the automotive industry in most EU countries. It is quite unclear why the new border controls were not installed in such a way that the supply-side chains in the EU single market were not seriously disrupted: The avoidable massive slow-down of truck-based logistics in the EU amounts to a grave delivery risk for automotive firms whose temporary closing is thereby caused (plus the impulse of reduced demand). This part of the economic recession risk facing the EU should and could have been avoided by coordinated efficient policies of EU countries. There is a high probability that this effect will bring a higher economic burden related to the COVID-19 crisis for the EU countries compared to the United States where such problems do not exist.

Employees of firms in many countries have cancelled planned meetings in Italy and tourism in Italy is also bound to suffer considerably in 2020. As regards German and French car producers, as well as producers of machinery and equipment in Germany and France, firms in both countries partly rely on intermediate inputs from Italy so that distortions of relevant production in Italy will also slow down industrial output in Germany and France. This situation will, of course, encourage firms to seek alternative intermediate product suppliers. As regards a comparison of the US and the EU, European firms are more dependent on international intermediate inputs than firms in the US (Welfens and Irawan 2014). A general problem for the US, the EU, China and all other countries with novel coronavirus problems is that vaccination against the COVID-19 will probably not be available at short notice.

International investors have responded to the COVID-19 shock: Stock market prices have declined steeply in mid-March and are likely to further fall in the medium term. The very fact that there is a pandemic means that almost all countries in the world economy will face similar problems: Supply-side distortions, demand shocks and liquidity problems faced by firms and millions of self-employed. This makes the corona virus economic crisis potentially worse than the 2008/09 Transatlantic Banking Crisis. However, due to many reforms in banking regulation and institutional innovations undertaken since that crisis, the western world is better prepared for an international shock than it was in late 2008. Moreover, there is some probability that once the infection wave can be stopped – after a few quarters (or possibly after two years) – there will be a quick economic recovery. The potential for supply disruptions is, however, considerable since global value-added chains have strongly evolved in certain sectors since the 1990s.

As regards the US, the Eurozone/UK and China, there is one specific distinction concerning the western world (e.g. US+Eurozone+UK + Switzerland) versus China, namely that safe haven effects can be expected in a period of an international epidemic – indeed in favor of the US and main Eurozone countries such as Germany, France, the Netherlands and Austria; plus the UK and Switzerland. These countries should benefit from lower nominal and real interest rates, but should also face a nominal and real appreciation of the currency.

The following section considers the SARS experience briefly and emphasizes that certain characteristics of the health systems of the US and EU countries have crucial macroeconomic effects that have thus far not been thoroughly considered in Economics. Section 3 considers a cross country regression with the Global Health Security Index as an explanatory variable for per capita GDP. Section 4 is devoted to theoretical macroeconomic aspects of the COVID-19 epidemic, while Section 5 considers some financial market aspects. Section 6 briefly considers political economy aspects in the western world, while Section 7 provides a growth modelling approach which looks at more long-term issues of an epidemic. The final section considers implications for policymakers. The following analysis puts the analytical focus on some new theoretical perspectives which should be useful for the understanding of the coronavirus related economic dynamics and potential policy responses.

2 Economic disruptions: Tourism sector shock and other key epidemic aspects

The travel and tourism sector will be negatively affected by the COVID-19 pandemic; this sector stood for 10.4% of global GDP and 319 million jobs in 2018 (WTTC 2019). If the global tourist sector declines by 30% in 2020, global output growth would decline by 1.2 points compared to forecasts - and expectations - of 2019 and 96 million jobs would be lost as a direct effect. By March 6, 2020, the airline Lufthansa had decided to cancel 7000 flights scheduled for 2020 which is about 50% of all flights: With a strong focus on flights to China, Republic of Korea, Italy and Iran which all are countries with high number of infections. Air France and other EU carriers adopted similar restrictions.

The share of tourism in national output in selected countries is shown in the following table. Countries with a high share of tourism in national output should expect high output growth dampening effects. However, one should not overlook the aspect that French people, for example, who would normally go on vacation abroad will instead book a vacation within France – thus replacing part of the normally large incoming international tourist groups from many countries. Hence popular tourist destination countries have some opportunities to adjust for the declining international tourism. The internet creates many opportunities to substitute international visits of business people. Trade fair events can also partly be organized as a virtual event if necessary. However, it is useful to consider scenarios of a contraction of international tourism value-added by 20%, 40% and 50% (see following table). For Germany, France, Italy (and the UK), a 50% decline brings a GDP decline of about 1%; for Italy, this would imply a recession in 2020. The decline of expenditures in tourism broadly defined – including entertainment (restaurants etc.) – would raise the negative output effect furthermore. As regards tourism receipts relative to GDP in EU countries, Switzerland and Turkey, high figures were in Bulgaria (6.8%), Estonia (5.8%), Greece (8.7%), Spain (5.7%), Croatia (18.4%), Cyprus (13.9%), Luxembourg (7.0%), Malta (12.7%), Portugal (8.3%), Slovenia (5.9%), Switzerland (3.9%) and Turkey (50% according to Eurostat, see Appendix 3 Table 9); as regards the statistics on Turkey, one may assume that the figure is doubtful. It is clear that countries such as Greece, Cyprus, Malta and Portugal might face new problems as a consequence of a dramatic decline in tourism expenditures in the context of a coronavirus pandemic, the same applies to Turkey.

There are two countries which could have strong improvements in the current account balance from the net effect of COVID-19 on receipts and expenditures in tourism. In 2018, German expenditures stood at €80.9 billion, while receipts were €36.4 billion (balance -€44.5 billion), so that a relatively strong decline of international tourist expenditures – with additional substitution effects in favor of higher domestic tourism expenditures – should reinforce the current account balance of the Eurozone. A similar effect could be expected in the UK which had a net balance of -€17.3 billion in 2018 (for more details, see table in Appendix 3 Table 9). For the US, a 50% contraction of international tourism would bring about an output decline of 0.6% as a direct effect. As the subsequent table shows, there are many small countries which would face serious output contractions in the case of a 50% decline of international tourism: There is a group of countries who could have an output decline of over 10%, and for the Lebanon, which at the beginning of 2020 was already in an unstable fiscal and economic situation, the projected output decline would be −7.67%; for Jordan the output decline expected is 7.37%, followed by Cyprus, Thailand and Malta with −6.91%, −6.46% and − 6.43%, respectively. The output decline for Croatia would be 9.90%, for Portugal 5.01%, for Greece 4.95% and for Spain 2.86%; thus there is a risk that the Euro Crisis could return (for more countries, see following Table 2 and Appendix 4 Table 10).

It should be noted that domestic tourism was still possible in Western Europe in the first half of March 2020. However, from about March 15 on, the lockdowns imposed in many EU countries effectively eliminated the option of domestic tourism for several weeks. Hence the whole tourism sector is facing an almost 100% shutdown for at least a few months.

Historically, there were previous cases of international epidemics (pandemic is a worldwide epidemic), such as the Spanish influenza in 1918/1919, the Asian influenza in 1957 and the Hong Kong influenza in 1968 (Kilbourne 2006). In the severe Spanish influenza, between 30 and 60 million people succumbed to the disease worldwide. Bell and Lewis (2004, p. 159) argue that no firm conclusions have been achieved on the long run effects of international epidemics.

The authorities have focused on reducing the number of, or avoiding the holding of, public events with many people as well as the interaction of many people in any given place - in the Wuhan area, factories and workplaces were closed over several weeks. In many countries, quarantine was imposed on people who have returned from China and on people who have shown COVID-19 symptoms. The infection typically brings respiratory problems and the elderly in many of the countries affected indeed seem to face a rather high mortality rate. As COVID-19 affects the lungs of the infected, regions/countries with bad air quality and high shares of smokers should go along with a relatively high mortality rate; weak environmental policy thus could translate into particularly serious COVID-19 problems. This coronavirus is, however, not the first epidemic of the early twenty-first century. In 2003, SARS (or Severe Acute Respiratory Syndrome) – the outbreak of which was also traced back to China - was the first international epidemic of the century, followed by MERS (Middle East Respiratory Syndrome) which mainly affected some countries in the Middle East.

With the outbreak of COVID-19, the world economy is clearly facing transitorily lower economic growth in 2020 than had been projected in autumn 2019 (based, for example, on the IMF World Economic Outlook). The IMF has declared on March 4 (IMF 2020) that it will make an additional $50 billion in funding available to member countries fighting the coronavirus with particular funding reserved for rather poor countries.

In the EU and the Eurozone, respectively, Italy – actually Northern Italy - had been most affected by COVID-19 by the end of February 2020. It is not fully clear why Italy in particular is facing so many cases of infections and a relatively high mortality rate. Looking at health system quality indicators thus seems to be useful and the subsequently discussed indicator of the NTI/Johns Hopkins University study – the Global Health Security Index (https://www.ghsindex.org/wp-content/uploads/2019/10/2019-Global-Health-Security-Index.pdf) - is considered to be an adequate aggregate indicator with several useful sub-indicators: The aggregate index has a clear focus on epidemic risks and the quality of the respective national health system; the indicator shows a large variation across countries in the EU, the OECD and G20 countries, respectively. There are some links between this indicator and macroeconomic development, including the following:

A high score in the Global Health Security Index could be interpreted as a quality signal by foreign investors for whom often high quality health provision for managers in the host country, as well as a good health system for the workers employed in the subsidiary abroad, are important aspects to consider in the context of international investment and locational choice for greenfield investment projects or international M&As.

Not only does the quality of the respective health system matter but also the efficiency of the health system and hence cost aspects – indirectly visible in tax rates and social security contribution rates – of production. Countries with rather inefficient health systems have a specific problem in cost competitiveness; certainly in labor intensive industries. The United States has, somewhat surprisingly, some specific problems in this field that have gone almost unnoticed by most international macroeconomists for many years. In the context of the COVID-19 epidemic, which had already reached the US in late February 2020, the inefficiencies of the US health system could become visible again.

For the health systems of the respective countries and regions, respectively, the coronavirus epidemic is a particular challenge; as in any epidemic scenario, there are particular risks that physicians and nursing personnel could be infected, and hospitals as well as nursing and care institutions for the elderly are potential hot spots in terms of infection risk. Special clothing, masks and disinfection measures should typically protect the life of physicians and nursing personnel. At the same time, there are standard plans and approaches of protection and treatment aimed at controlling infections (quarantines of affected individuals of a few weeks being one of the standard measures) and the spreading of the virus. However, with masks and other protective devices in stock in only limited numbers, an international spreading of the virus can quickly lead to shortages; for example, at the beginning of March 2020, the French government seized all available stocks of medical masks nationally and forbade the exporting of masks in the fear of having an under-supply of masks if such medical goods would be exported in considerable number. In Germany, authorities imposed similar restrictions in the first week of March.

Epidemics can have grave negative consequences on local, national or international demand. In the case of the SARS epidemic, for example, tourism in Hong Kong reduced by 90% in two months in the first quarter of 2003. A study on the case of a serious epidemic in the US by the US Congressional Budget Office (CBO 2005) thus also assumes considerable negative demand effects from an epidemic which, of course, would affect many people and which would also have a certain fatality rate. In a similar EU-related simulation study on the macro effects of an epidemic, Jonung and Roeger (2006) adopt a similar analytical approach, but also assume a permanent negative shock to population growth (−0.75%).

As regards the preparedness of countries to deal with the present coronavirus epidemic, it is interesting to consider the results of the analysis of the NTI/Johns Hopkins University (2019) – for more GHS Index rankings, see Appendix 5 Table 11 - which shows various elements of preparedness of countries to deal with an epidemic. The leading country in the relevant Global Health Security Index, according to this study is the US, with a No. 1 ranking in the aggregated overall indicator, other OECD countries and some Newly Industrialized Countries are also in the group of leading countries. The UK and the Netherlands are ranked No. 2 and No. 3, respectively, in the aggregate Health Security Indicator, France is ranked No. 11, and Germany No. 14 in the aggregate indicator. Developing countries typically have low rankings in the overall indicator and the sub-indicators. Thailand stands out among the Newly Industrialized Countries with a favorable position in the aggregate indicator (No. 6) and in some sub-indicators. In the aggregated indicator, China is ranked No. 51, India is on No. 57; while the Russian Federation occupies 63rd position, Romania and Bulgaria are No. 60 and 61, respectively – even further behind is, surprisingly, Luxembourg (No. 67). Clearly, few economic experts are thus far aware of these critical rankings in the Global Health Security Index first published in late 2019; rankings which highlighted certain weak points in the European Union.

As of early March 2020, it is obvious that international tourism and passenger air transportation are negatively affected by the coronavirus epidemic. Given the fact that more than 50% of global trade is trade in intermediate products, there are also shocks to international supply chains. Moreover, trade fairs and sports events have been cancelled so that also hotels, restaurant and other related services have been negatively affected. As several countries/regions have closed schools and universities, the education system is also negatively affected. It is clear that the closing of production facilities in several regions of Asia will lead to distortions in terms of Asia-EU and Asia-US supply chains so that there is a supply shock to firms in the tradables sector in the EU and the US, respectively.

With firms in the services sector starting to lay off workers, and with a more pessimistic economic perception on the part of households and investors, aggregate demand is slowing down in spring 2020 on the one hand, on the other hand the demand in the non-tradables sector (services) in particular can be expected to fall. The main effect of the epidemic thus is:

A negative supply shock in the tradables sector in the short and medium term

A negative demand shock in the tradables sector and in the non-tradables sector (the negative demand shock in the non-tradables sector might dominate initially, partially due to a sharp contraction of demand in tourism and entertainment) in the short term; once a vaccination becomes available in OECD countries and G20 countries, respectively, demand growth should become positive again.

A negative aggregate international demand shock in the medium term which could stem from both reduced consumption and investment postponement effects – with many countries generating parallel negative spillover effects in neighboring countries and with main trading partners, respectively; China is a top trading partner of both the US and many EU countries, thus the outbreak of COVID-19 in China has affected very many OECD countries.

The analytical perspective on the macroeconomics of the COVID-19 is straightforward and shown subsequently in this paper. Basically, as regards policy responses, one may want to consider three aspects:

The supply-side response of government in the health system; for example, governments buying extra quantities of medical equipment and medicines which should drive up prices in the respective sectors.

Monetary policy, which mainly concerns the US, the Eurozone, the UK and China. In a small open economy, an expansionary monetary policy under fixed exchange rate would be not effective; only fiscal policy would work – and it could work if government can finance some deficit spending with a clear focus on the non-tradable sector (e.g. construction activities for infrastructure).

Fiscal policy, which mainly concerns the US, EU countries, the UK and China plus other Asian countries exposed to the virus shock; Thailand, for example, normally has a rather high number of Chinese tourists and business people visiting every year, but with the problem of COVID-19 in China, these visits will decline dramatically and Thailand could decide to adopt an expansionary fiscal policy. A similar logic could hold for other ASEAN countries as well. To the extent that certain countries in Asia are effectively fixing the exchange rate vis-à-vis the US dollar, a macro analysis in a fixed exchange rate system would be adequate.

In a significant policy step, the US Federal Reserve System reduced the interest rate in early March 2020 by 0.5 percentage points; followed by another interest rate reduction by 1 percentage point only about a week later. It is not clear that expansionary monetary policy is adequate to cope with a negative supply-side shock. The US interest rate reduction will stimulate aggregate demand in the US and, in this context, could also stimulate net exports of goods and services through a real depreciation of the currency. At the same time, the associated real appreciation of the Euro will dampen aggregate demand in the Eurozone; and a similar argument will hold with respect to China whose currency appreciation would dampen China’s GDP. The dampening of output in both China and the Eurozone will dampen US aggregate output through a dampening effect on US net exports.

In the Eurozone, the European Central Bank (ECB) does not have considerable room to maneuver and possibly welcomes the FED’s interest rate reduction (plus potential new quantitative easing measures in the US) since this will also reduce the interest rate in the Eurozone. Given the fact that in the US, the UK and the Eurozone interest rates are already very low, there is some risk that a reversal interest rate effect will occur (Brunnermeier and Koby 2018) which could dampen aggregate output as a reduction of the interest rate brings a reduction of banks’ profits from the deposit business which could compensate the valuation gains the banks experience with high interest legacy bonds in the banks’ balance sheets. The ability of banks to extend loans could critically depend on net-worth – once this constraint becomes binding – and hence lower central bank interest rates would bring about a decline of loans to firms and the real economy, respectively; traditional monetary policy is no longer expansionary. As regards the ECB, it still has some room to maneuver despite a zero central bank interest rate (and negative deposit rates for banks) as the ECB could step up quantitative easing – with the potential problem of having to go above the current upper limit of 1/3rd of outstanding government bonds – and it could also give more long term conditional loans to banks at favorable interest rates, namely under the condition that banks would extend more loans to firms. It is, however, not fully clear what the medium-term purpose of such a measure should be if this would raise the excess supply of the tradables sector in the Eurozone and the EU, respectively – there is some risk that this would depress the global level of tradables prices, a development which, in turn, could destabilize the world economy in the medium term.

Expansionary fiscal policy could also be considered in the US, the EU (the EU countries) and China. Given the interdependency of the US, the EU and China, fiscal policy coordination would be adequate, but it is unclear what institution could/should be the platform to achieve this type of coordination. The US-Sino trade conflict has at least been moderated somewhat through the US-China trade agreement in early February 2020 so that some bilateral coordination of fiscal policies of the US and China is not excluded. Some coordination between the US and the EU countries could take place via the OECD, but given the competence gap in the Trump Administration in the Treasury, this might be difficult to achieve: The Trump Administration could fill only about 3000 of the roughly 4000 political appointee roles which became vacant at the end of the previous Obama Administration, which means that the Trump Administration suffers from a lack of about 1000 experts in key fields (Welfens 2019) – and the Treasury is a key institution exposed here. The G20 as a coordination platform is rather excessive and overly complex, so that one might consider the OECD’s outreach program, which includes China and India, to be a reserved but nevertheless effective platform for international policy coordination.

3 SARS experience and health system aspects of the COVID-19 epidemic

In 2003, China/Hong Kong experienced the SARS epidemic in the second quarter, which reduced output in the third quarter considerably in Hong Kong as well as in parts of mainland China. This incident has motivated several researchers to look into the macroeconomic effects of an epidemic where production losses due to the illness of workers/managers and death among the workforce were one key element of analysis. The SARS epidemic was over relatively fast and did not become a major shock to the world economy; not least since China at the time represented only 4% of world GDP. Döhrn (2020) has estimated that China’s decline of real income was 2.4% in the first quarter of 2020. This negative income effect will negatively affect the US, the Eurozone, the UK and other countries. The international diffusion of COVID-19 may be expected to be large: Those infected with the respiratory disease SARS could be rather easily identified, while people infected with the novel coronavirus often show no visible symptoms of the disease.

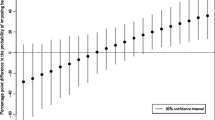

One key challenge with an epidemic concerns the burden for the health system and hospitals, respectively. If the personnel in the health system and the capacities of hospitals approach critical limits rather quickly in an epidemic setting, the mortality figures will rise quickly. From this perspective, it is quite important in every epidemic scenario that health policy measures help to postpone the peak of infections and thereby to bring down the level of stress on hospitals to a manageable level. Ideally, health policy shifts the peak from M1 to M2 on the time axis and in this context adequate testing and broad quarantines are often crucial (see following Fig. 1).

World Health Organization map of the 2019 Coronavirus Spreading Worldwide (as of March 25, 2020) Source: Map extracted from https://experience.arcgis.com/experience/685d0ace521648f8a5beeeee1b9125cd (last accessed 26.03.2020)

It is also noteworthy that of those infected with COVID-19, circa 80% of patients recover with relatively mild symptoms, while 14% have serious illness-related complications and about 6% face critical illness (ECDC 2020). The latter effect can be expected particularly in the age group above 65. From this perspective, the median age of countries is of interest: The higher the median age in the respective society is, and the higher the share of elderly people in a country considered, the higher the risk of a high morbidity. From the perspective of morbidity, Japan, Germany, Italy, Spain with a rather high share of elderly people could face more problems than, for example, France, the UK or the US (see following Table 3).

While it is clear that an epidemic could to some extent contribute to a rise of the overall health expenditure-GDP ratio as the number of inpatients in hospitals is rising – and output will transitorily fall – one cannot rule out that this ratio is almost constant (or could even fall); the latter case occurs if the incidence of morbidity is rather high for groups with underlying conditions and in the older age brackets so that elderly patients infected with COVID-19 could die rather suddenly and will not experience the normal two last years of life. In these last two years, in the United States, 30% of life time health expenditures occur (DPE 2016). If infected elderly patients die one year earlier than expected, the health expenditure during the last two years of life of the elderly affected would be cut by about half. Only broad statistical analysis in the future will shed more light on these aspects.

As regards the length of the time period of the infection, it is clear that China was the starting point and might return to full production by mid-2020, but the geographic spreading of the epidemic – with a certain number of patients travelling from various countries for business or tourist or family trips to China – will see time lags in the eruption and development of the epidemic. It seems that Portugal, for example, was affected rather late in Europe and also some countries in Latin America could be affected with a considerable delay so that the infection peak in parts of Europa and Latin America could be at least a quarter after the peak in China. As regards the diffusion of the epidemic in the EU – outside Italy – it is possible that travelling between Italy and several neighboring countries (and between China and EU countries, including Italy) has brought a critical number of imported infections which will not make it possible to easily control the epidemic. However, as the SARS epidemic has shown, a single infected tourist coming to Italy could have created the critical number of infected people in Italy. More research is needed to identify the sources of the epidemic in Italy. In the general public discussion, many people are likely to consider it plausible that immigrants are to be blamed – hence the epidemic could become a driver for populist debates in Europe or the US (and elsewhere).

It is not clear whether or not in autumn 2020/winter 2021 a second wave of the pandemic could start. Hence, it is still not clear whether there will be only a short-term one-off negative economic effect in most OECD countries and China as well as other countries; in this context both the financial sector and the real economy could be affected. In some cases, infections might also concern members of parliament or governments in various countries which in turn could made political decision-making more complex. The legal system of the countries concerned might in turn face a wave of liability and litigation cases in the context of epidemic with many novel legal questions faced in many countries.

As regards forecasts of international epidemic incidence, a group of researchers at the Johns Hopkins University has suggested an interesting approach which is mainly based on international and national air traffic passenger links (Gardner et al. 2020). According to this forecast, from late January 2020 the United States would be expected to be a country – with many air traffic links to China – that could face a serious challenge in the context of the epidemic. It is not fully clear whether or not the Trump Administration has considered this research and its implications. In talks with the leading insurance companies on March 10 (and in the days before), the Trump Administration has negotiated that the costs of testing for the novel coronavirus would largely be covered by these companies. However, with 13% of the population without health insurance coverage, there is some specific US health care problem since people who are uninsured might turn to physicians rather late or not at all, if they have symptoms that resemble COVID-19. Illegal immigrants also might become a problem in the fight against the epidemic in the US. An apparent gap in terms of US health management is the lack of testing in February 2020 as pointed out in the international comparison of the US, the Republic of Korea and China (Meyer and Madrigal 2020).

Illness of the workforce as well as death reduce the effective labor input in the macroeconomic production function (and in the production function of individual firms affected by such cases in the respective workforce). Jonung and Roeger (2006), in particular, focused on the effects of a pandemic on tourism and trade as two sectors significantly affected by an epidemic shock abroad – with the potential of an international transmission of the disease; the main insights from this study were that while a pandemic would take a large toll in terms of human suffering, it would not be likely to be a major threat to the EU economy. Typically, output would face a short-term decline but thereafter it would recover rather quickly. A crucial element of an epidemic shock in the first quarter of 2006 – the scenario considered - would be the negative effect on the tourism and entertainment sectors that accounted for 4.4% in the EU25 and also in the US. If one would assume an 80% output decline in demand, the output decline would be 3.5% of GDP in the next quarter and, for the whole year, the aggregate demand effect would translate into a real GDP dampening of 0.5%. However, in the following year, GDP would increase by one percentage point more than in the baseline scenario. Clearly, within the EU, southern countries/countries in the Mediterranean area could be assumed to be particularly affected by the epidemic shock since the share of tourism and entertainment in these countries would be relatively large. In the Jonung and Roeger (2006) approach, about 2/3rds of the European output shock is supply-induced while 1/3rd is demand induced. The key finding of the authors thus is that a strong output reduction – relative to the business-as-usual case – will occur in an epidemic, but part of the dip in output will be recovered the following year.

At the same time, one might add that Germany would be particularly negatively affected because of its relatively high export-GDP ratio (relative to the country size). An output dampening effect on Italy, Spain, France and Germany would be an economically relevant output dampening effect for the whole of the Eurozone and the EU, respectively. Given the size of the Eurozone, a dampening on Eurozone output would translate into a dampening effect on US exports and output, respectively; and the same applies to a dampening effect on Chinese exports and real GDP. One may also note that the authors did not consider the role of rising costs in the health system. Such costs could indeed be considerable and since health costs in the US, Germany/France (Western Europe; read: Eurozone) and China differ considerably, one should indeed consider the effects of an international epidemic shock on the relative health care costs and the implications for the respective trade balances and current account positions, respectively.

As regards the US and the Eurozone, it is useful to consider some key aspects of the respective health care systems; for simplicity, the Eurozone will be considered here only as the sum of Germany and France – occasionally as Germany, France and Italy. The main differences between the US and Germany are as follows:

The health care expenditure-GDP ratio is 18% in the USA (for 2018), but only 12% in Germany and France, while life expectancy in the Eurozone is clearly higher and infant mortality lower than in the US (for more see Appendix 6 Fig. 10). Disregarding certain fields of medical excellence in the US, one cannot overlook that the US health system is partly inefficient. It is quite strange that the number of gynecologists per women in the US is only one half that of the corresponding number for Germany. Moreover, an average clinical surgery in the US will cost three times as much as in the US (Göpffarth 2012, p. 30).

If health care in the US is on average 35% more expensive than health care in Germany/France, there is a serious macroeconomic implication: Assuming that the share of US profits in US gross domestic product is 1/3rd - as is often assumed for western OECD countries – US exporters have a health cost related disadvantage vis-à-vis the Eurozone (Germany/France/Italy/Spain/Netherlands for simplicity) of (2/3rds) of 6% = 4%; inefficiencies in the US health system effectively amount to a 4% export tax. Indeed, in the US, health insurance for workers and employees is typically related – outside of Medicare for those aged 65 years and over, and the poor strata which get Medicare from government – to having a job so that the inefficiencies of the US health care system is equivalent to an export tax of the US of 4% (the health care-GDP ratio and the health insurance contribution rate, respectively, will raise the reservation wage in labor markets). The Trump Administration’s debate about an excessive US trade balance deficit thus should start with taking stock of the inefficiencies of the US health care system and – related to this – the apparently enormous lobbying power of part of the US health sector and the lack of price transparency and competition in the hospital sector. By contrast, the health system of Singapore relies on a strict benchmarking of hospitals in Singapore, regardless whether those are private or publicly organized (for an overview of the Singaporean health system in comparison to the US, see US Commerical Service 2015).

An epidemic affecting all major OECD countries would raise the health care expenditure cost relative to GDP in the US and in the Eurozone, namely through higher expenditures on the one hand and a lower GDP which will reduce due to a rising illness rate of the workforce. If there were to be a full-blown US (or EU) COVID-19 epidemic, hospital costs would increase strongly. As regards the United States, this could mean that the US comparative disadvantage in labor-intensive sectors – effectively also representing high health care costs – would further be reinforced and hence the US trade balance deficit-GDP ratio and the current account deficit-GDP ratio would rise.

Health system reforms can, of course, not be designed and implemented in the short run, but there is no doubt that such reforms should be carefully considered in the EU and even more so in the US. The stress impulse from the COVID-19 epidemic reveals these problems.

It is rather surprising that the enormous US lead in health expenditures relative to GDP – or to life expectancy years – has gone relatively unnoticed over decades in macroeconomic analysis: The US spends 1/3rd more than Western Europe, but has a lower life expectancy and a higher infant mortality rate which is a real puzzle for the US health system and is part of the US weakness in international competitiveness in the production and export of goods, respectively. Within the OECD, every member country could benefit by learning something from every other member country; thus comparative system analysis should remain an important and useful field of International Economics - which it has not been since the end of the Cold War.

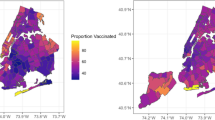

As regards the findings of the Johns Hopkins University with regard to its global health security indicator (NTI/Johns Hopkins University 2019) about preparedness for dealing epidemics, it is noteworthy that with respect to pillar 4, namely sufficient & robust health system to treat the sick & protect health workers, many EU countries have a rather modest ranking and are ranked in the middle group of the 195 countries considered in the Global Health Security Index: Ireland (ranked 41), Luxembourg, Slovakia, Greece, Czech Republic, Italy, Romania, Hungary, Lithuania – and, in the weakest group, Estonia (behind South Africa) which is astonishing and not really acceptable as a status for an EU country. This at least points to the problem that the EU so far has not sufficiently considered a minimum level of health system quality as a requirement for EU membership; indeed including such a quality requirement in the Copenhagen Criteria II (an updated version of the Copenhagen Criteria) should be considered in the medium term by the European Parliament, the Commission and the Council as well as the EU member countries. There is considerable variation amongst OECD countries, plus China and Singapore (see following Figs. 2 and 3). Explaining the GHS index position of individual countries is an interesting question.

The Global Health Security Index Overall Score, Selected Countries, 2019. Source: Own representation based on data from NTI/Johns Hopkins University (2019)

As regards the Global Health Security Index, it is remarkable that Russia, China, Italy and Spain have rather weak positions in the aggregated overall index as the above graph shows. However, even some high per capita income countries – Singapore and Switzerland – are not showing a strong position. Taking a look at the number of infections in early March 2020, China, Iran and Italy were leading countries, in terms of mortality the US had a much higher ranking than in the comparative number of infections; this points to a large number of non-identified infections in the United States. Weak points in the US health system could explain this.

It is clear that an international epidemic poses serious risks to the world economy. The ability for firms in all countries to rely rationally on an international division of labor and knowledge is clearly undermined and put at risk if a large number of countries do not achieve high quality indicator marks in the Global Health Security Index.

4 Cross country regression results with the GHS Indicator and trade and FDI intensity

As regards the quality of the health care system, it is important to understand the link between the quality indicator Global Health Security index and real per capita income. The relevance of the Global Health Security Index for economic analysis is crucial in two ways:

The index presents the respective country’s position in a key field of health care

The index could be used as a health system-related proxy for the effective labor input available in production, possibly including foreign experts and managers flying into the country in order to provide certain services for the production of goods and services which are not fully covered in the statistics, but which play a key role for subsidiaries producing abroad: The higher the ranking in the GHS, the higher the willingness of such experts and managers to temporarily work in the country concerned and to the extent that the GHS index is a proxy for the quality of the health system, one may also assume that the effective use of the workforce could be reflected here (more healthy workers contributing to value-added). Other variables which could explain per capita GDP could be considered in a cross-country regression and the results are straightforward as shown subsequently.

A useful descriptive analysis is to focus on a scatter plot of the per capita GDP figures and the Global Health Security index which shows that both data series are positively correlated (see subsequent figure). The reasons for such correlation have to be identified: Higher per capita income will generally go along with a higher demand for health care services, and better health – based on a better quality of the health system (as proxied by the GHS index) – should contribute in various ways to a higher per capita real GDP (e.g. positive supply-side effects of better health on potential output). The sub-indices with a particular focus on the epidemic absorption quality of the respective health system could also be analyzed for specific research interests.

Subsequently, at first (Figs. 4, 5, and 6) a scatter plot for a linear relation of real GDP per capita (PPP) and the GHS index (total score) for all 161 countries is considered: The US is below the average relationship for all countries; here, Luxemburg and Qatar may be considered to be clear outliers. One could also consider the relationship between the log of the GDP per capita and the GHS index, the idea could be to take into account implicitly that real per capita income and health stands for a non-linear relationship (assuming certain linear properties of the construction of the GHS index). Relative to per capita income, the United States and the United Kingdom – and even more so the Republic of Korea, Thailand and Brazil - stand for an above-average GHS index position, while Germany and Japan, for example, have a below-average GHS score. We get an interesting finding when the overall group of countries are split into a high income group – defined as OECD plus ASEAN plus China – and a low income group (“other countries” in the subsequent figures). With this sample split, we can see that quality of the US health system position again is below that of the high income group average relationship; while Brazil is better than the average relationship would suggest. More interestingly, the high income group shows a much higher per capita level than the poor countries while the slopes for both groups of countries are rather similar. This raises the question of whether or not the quality of the health sector itself has an impact on per capita income which itself raises complex issues. Nevertheless, it is interesting to consider a rather simple regression subsequently which will focus on explaining per capita income through key economic variables, including trade intensity (implicitly standing for specialization gains and higher innovation intensity associated with a more open economy).

Global Health Security Index, Overall Score, Selected Countries, 2019. Source: Own representation based on data from NTI/Johns Hopkins University (2019)

A simple cross country regression for explaining per capita real GDP (purchasing power parity figures) through the GHS index, the true trade openness and the foreign direct intensity – for 174 countries – shows a good regression fit for this simple approach based on 2018 figures; true openness is a measure for trade intensity corrected for the size of the economy (small countries, proxied here by GDP relative to the average GDP in the sample of countries) and the variable thus reflects both the international division of labor and effective import competition. The true FDI intensity (FDI inflows and FDI outflows) is a similar variable for foreign direct investment; in addition, the true FDI inflow intensity was included. However, neither of the FDI variables were significant.

The regression (Table 4), which included the true FDI inflow variable, explains 44.6% of the variation of real per capita GDP across countries and both the GHS index and the true trade openness variable are significant at the 1% level. The coefficient of the true trade openness is about three times as big as that of the GHS indicator. If one takes logs of the real per capita GDP figure, the coefficients are better to interpret, namely as a semi-elasticity and the adjusted R2 rises slightly to 46.7; note that in this variant, the true inward FDI variable was dropped and only the true FDI intensity is used. Once longer time series for the GHS index would be available, panel data analysis with this indicator will become possible so that one could shed more light on the link between health system quality and economic welfare.

An important policy conclusion to be drawn here is that the IMF, the OECD, the EU, the World Bank and other institutions, which try to support economic growth in the world economy through specific programs for member countries or partner countries, should pay more attention to the quality of the health system of the recipient countries.

4.1 US and EU health system problems

As regards the US, one should also not overlook that the case of a serious illness in the family is the most important risk factor for a middle class family to fall from this position into poverty. Case and Deaton (2020) have analyzed the problem of death from despair/suicides - and the issue of the opioid crisis - in the US and have shown that in Western Europe, only Scotland has a suicide rate that is similar to the high rate in the US. The share of uninsured Americans has reduced under the Obama Administration, but under the Trump Administration it has increased from a share of 11% to 13% in 2019.