Abstract

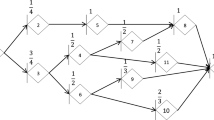

The risks and uncertainties inherent in most enterprise resources planning (ERP) investment projects are vast. Decision making in multistage ERP projects investment is also complex, due mainly to the uncertainties involved and the various managerial and/or physical constraints to be enforced. This paper tackles the problem using a real-option analysis framework, and applies multistage stochastic integer programming in formulating an analytical model whose solution will yield optimum or near-optimum investment decisions for ERP projects. Traditionally, such decision problems were tackled using lattice simulation or finite difference methods to compute the value of simple real options. However, these approaches are incapable of dealing with the more complex compound real options, and their use is thus limited to simple real-option analysis. Multistage stochastic integer programming is particularly suitable for sequential decision making under uncertainty, and is used in this paper and to find near-optimal strategies for complex decision problems. Compared with the traditional approaches, multistage stochastic integer programming is a much more powerful tool in evaluating such compound real options. This paper describes the proposed real-option analysis model and uses an example case study to demonstrate the effectiveness of the proposed approach.

Similar content being viewed by others

References

Alesii, G. (2005). VaR in real options analysis. Review of Financial Economics, 14(3–4), 189–208.

Alvarez, L. H. R., & Stenbacka, R. (2001). Adoption of uncertain multi-stage technology projects: a real options approach. Journal of Mathematical Economics, 35(1), 71–97.

Benaroch, M., & Kauffman, R. J. (1999). A case for using real options pricing analysis to evaluate information technology project investments. Information Systems Research, 10(2), 70–86.

Benaroch, M., & Kauffman, R. J. (2000). Justifying electronic banking network expansion using real options analysis. MIS Quarterly, 24(2), 197–225.

Benaroch, M. (2001). Option-based management of technology investment risk. IEEE Transactions on Engineering Management, 48(4), 428–444.

Benaroch, M. (2002). Managing information technology investment risk: a real options perspective. Journal of Management Information Systems, 19(2), 43–84.

Birge, J. R. (1985). Decomposition and partitioning methods for multistage stochastic linear programs. Operations Research, 33(5), 989–1007.

Birge, J. R. (1997). Stochastic programming computation and applications. Journal on Computing, 9(2), 111–133.

Black, F., & Scholes, M. (1973). The pricing of options and corporate liabilities. The Journal of Political Economy, 81(2), 637–654.

Brandão, L. E., & Dyer, J. S. (2005). Decision analysis and real options: a discrete time approach to real option valuation. Annals of Operations Research, 135(1), 21–39.

Dempster, M. A. H., & Ye, J. J. (1996). Generalized Bellman-Hamilton-Jacobi optimality conditions for a control problem with a boundary condition. Applied Mathematics and Optimization, 33(3), 211–255.

Dempster, M. A. H., & Thompson, R. T. (1999). EVPI-based importance sampling solution procedures for multistage stochastic linear programmes on parallel MIMD architectures. Annals of Operations Research, 90(0), 161–184.

Duku-Kaakyire, A., & Nanang, D. M. (2004). Application of real options theory to forestry investment analysis. Forest Policy and Economics, 6(6), 539–552.

Escudero, L. F., Garín, A., Merino, M., & Pérez, G. (2007). A two-stage stochastic integer programming approach as a mixture of branch-and-fix coordination and benders decomposition schemes. Annals of Operations Research, 152(1), 395–420.

Grenadier, S. R., & Wang, N. (2005). Investment timing, agency and information. Journal of Financial Economics, 75(3), 493–533.

Grenadier, S. R., & Weiss, A. M. (1997). Investment in technological innovations: an option pricing approach. Journal of Financial Economics, 44(3), 397–416.

Hochstrasser, B. (1990). Evaluating IT investments—matching techniques to projects. Journal of Information Technology, 5(4), 215–221.

Ifinedo, P., & Nahar, N. (2007). ERP systems success: an empirical analysis of how two organizational stakeholder groups prioritize and evaluate relevant measures. Enterprise Information Systems, 1(1), 25–48.

Kalafut, P. C., & Low, J. (2001). The value creation index: quantifying intangible value. Strategy and Leadership, 29(5), 9–15.

Kumar, R. L. (1995). An options view of investments in expansion-flexible manufacturing systems. International Journal of Production Economics, 38(2), 281–291.

Kumar, R. L. (1996). A note on project risk and option values of investments in information technologies. Journal of Management Information Systems, 13(1), 187–193.

Kumar, R. L. (2002). Managing risks in IT projects: an options perspective. Information & Management, 40(1), 63–74.

MacLean, L., Zhao, Y., & Ziemba, W. (2003). A process control approach to investment risk. In IEEE international conference on computational intelligence for financial engineering, Hong Kong.

Martzoukos, S. H. (2000). Real options with random controls and the value of learning. Annals of Operations Research, 99(1–4), 305–323.

Minasny, B., & McBratney, A. B. (2006). A conditioned Latin hypercube method for sampling in the presence of ancillary information. Computers & Geosciences, 32(9), 1378–1388.

Olson, D. L., & Zhao, F. (2007). CIOs perspectives of critical success factors in ERP upgrade projects. Enterprise Information Systems, 1(1), 129–138.

Palomino, M. A., & Whitley, E. A. (2007). The effects of national culture on ERP implementation: a study of Colombia and Switzerland. Enterprise Information Systems, 1(3), 301–325.

Pflug, G. C. (2001). Scenario tree generation for multiperiod financial optimization by optimal discretization. Mathematical Programming, 89(2), 251–271.

Premkumar, G., Ramamurthy, K., & Nilakanta, S. (1994). Implementation of electronic data interchange: an innovation diffusion perspective. Journal of Management Information Systems, 11(2), 157–186.

Sarkar, P., & Kassapoglou, C. (2001). An ROI-based Strategy for implementation of existing and emerging technologies in helicopter manufacturing. IEEE Transactions on Engineering Management, 48, 414–427.

Sarkar, S. (2003). The effect of mean reversion on investment under uncertainty. Journal of Economic Dynamics and Control, 28(2), 377–396.

Schwartz, E. S., & Zozaya-Gorostiza, C. (2003). Investment under uncertainty in information technology: acquisition and development projects. Management Science, 49(1), 57–70.

Taudes, A. (1998). Software growth options. Journal of Management Information Systems, 15(1), 165–185.

Taudes, A., Feurstein, M., & Mild, A. (2000). Options analysis of software platform decisions: a case study. MIS Quarterly, 24(2), 227–243.

Trigeorgis, L. (1993). The nature of option interactions and the valuation of investments with multiple real options. Journal of Financial and Quantitative Analysis, 28(1), 1–20.

Yeo, K. T., & Qiu, F. (2003). The value of management flexibility-a real option approach to investment evaluation. International Journal of Project Management, 21(4), 243–250.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Wu, F., Li, H.Z., Chu, L.K. et al. An approach to the valuation and decision of ERP investment projects based on real options. Ann Oper Res 168, 181–203 (2009). https://doi.org/10.1007/s10479-008-0365-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-008-0365-7