Abstract

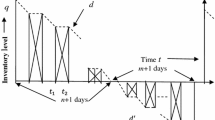

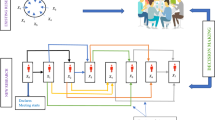

An intuitionistic fuzzy economic order quantity (EOQ) inventory model with backlogging is investigated using the score functions for the member and non-membership functions. The demand rate is varying with selling price and promotional effort (PE). A crisp model is formulated first. Then, intuitionistic fuzzy set and score function (or net membership function) are applied in the proposed model, considering selling price and PE as fuzzy numbers. To obtain the best inventory policy, ranking index method has been adopted, showing that the score function can maintain the ranking rule also. Moreover, optimization is made under the general fuzzy optimal (GFO) and intuitionistic fuzzy optimal (IFO) policy. Finally, a graphical illustration, numerical examples with sensitivity analysis and conclusion is made to justify the model.

Similar content being viewed by others

References

Arcelus, F. J., Pakkala, T. P. M., & Srinivasan, G. (2006). On the interaction between retailers inventory policies and manufacturer trade deals in response to supply-uncertainty occurrences. Annals of Operations Research, 143, 45–58.

Atanassov, K. (1986). Intuitionistic fuzzy sets and system. Fuzzy Sets and Systems, 20, 87–96.

Bellman, R. E., & Zadeh, L. A. (1970). Decision making in a fuzzy environment. Management Science, 17, B141–B164.

Cárdenas-Barrón, L. E. (2007). Optimizing inventory decisions in a multi-stage multi-customer supply chain: a note. Transportation Research. Part E, Logistics and Transportation Review, 43, 647–654.

Cárdenas-Barrón, L. E., Wee, H. M., & Blos, M. F. (2011). Solving the vendor–buyer integrated inventory system with arithmetic–geometric inequality. Mathematical and Computer Modelling, 53, 991–997.

Cárdenas-Barrón, L. E., Teng, J. T., Treviño-Garza, G., Wee, H. M., & Lou, K. R. (2012a). An improved algorithm and solution on an integrated production-inventory model in a three-layer supply chain. International Journal of Production Economics, 136, 384–388.

Cárdenas-Barrón, L. E., Treviño-Garza, G., & Wee, H. M. (2012b). A simple and better algorithm to solve the vendor managed inventory control system of multi-product multi-constraint economic order quantity model. Expert Systems with Applications, 39, 3888–3895.

Cárdenas-Barrón, L. E., Taleizadeh, A. A., & Treviño-Garza, G. (2012c). An improved solution to replenishment lot size problem with discontinuous issuing policy and rework, and the multi-delivery policy into economic production lot size problem with partial rework. Expert Systems with Applications, 39, 13540–13546.

Chen, S. M., & Tan, J. M. (1994). Handling multi criteria fuzzy decision making problems based on vague set theory. Fuzzy Sets and Systems, 67, 163–172.

Dabois, D., Gottwald, S., Hajek, P., Kacprzyk, J., & Prade, H. (2005). Terminological difficulties in fuzzy set theory, the case of “Intuitionistic fuzzy sets”. Fuzzy Sets and Systems, 156, 485–491.

Dalen, V. D. (2002). Intuitionistic logic, handbook of philosophical logic (Vol. 5, pp. 1–114). Dordrecht: Kluwer.

De, S. K., Kundu, P. K., & Goswami, A. (2003). An economic production quantity inventory model involving fuzzy demand rate and fuzzy deterioration rate. Journal of Applied Mathematics and Computing, 12, 251–260.

De, S. K., Kundu, P. K., & Goswami, A. (2008). Economic ordering policy of deteriorated items with shortage and fuzzy cost coefficients for vendor and buyer. Int. J. Fuzzy Systems and Rough Systems, 1, 69–76.

Dymova, L., & Sevastjanov, P. (2011). Operations on intuitionistic fuzzy values in multiple criteria decision making. In Scientific Research of the Institute of Mathematics and Computer Science (Vol. 1, pp. 41–48).

Gallego, G., & Hu, H. (2004). Optimal policies for Production/Inventory systems with finite capacity and Markov-modulated demand and supply processes. Annals of Operations Research, 126, 21–41.

Ganesan, K., & Veeramani, P. (2006). Fuzzy linear programs with trapezoidal fuzzy numbers. Annals of Operations Research, 143, 305–315.

Ghosh, S. K., & Chaudhuri, K. S. (2006). An EOQ model with a quadratic demand, time proportional deterioration and shortages in all cycles. International Journal of Systems Science, 37, 663–672.

Goyal, S. K., & Gunasekaran, A. (1995). An integrated production-inventory-marketing model for deteriorating items. Computers & Industrial Engineering, 28, 755–762.

Ioannou, G., Prastacos, G., & Skintzi, G. (2004). Inventory positioning in multiple product supply chains. Annals of Operations Research, 126, 195–213.

Kabiran, A., & Olafsson, S. (2011). Continuous optimization via simulation using golden region search. European Journal of Operational Research, 208, 19–27.

Kalpakam, S., & Shanthi, S. (2006). A continuous review perishable system with renewal demands. Annals of Operations Research, 143, 211–225.

Kao, C., & Hsu, W. K. (2002). Lot size reorder point inventory model with fuzzy demands. Computers & Mathematics with Applications, 43, 1291–1302.

Kaufmann, A., & Gupta, M. (1988). Fuzzy mathematical models in engineering and management science. Amsterdam: North Holland.

Krieg, G. N., & Kuhn, H. (2004). Analysis of multi-product kanban systems with state-dependent setups and lost sales. Annals of Operations Research, 125, 141–166.

Kumar, R. S., De, S. K., & Goswami, A. (2012). Fuzzy EOQ models with ramp type demand rate, partial backlogging and time dependent deterioration rate. International Journal of Mathematics in Operational Research, 4, 473–502.

Lee, H. M., & Yao, J. S. (1999). Economic order quantity in fuzzy sense for inventory without back order model. Fuzzy Sets and Systems, 105, 13–31.

Mahapatra, G. S., & Roy, T. K. (2009). Reliability evaluation using triangular intuitionistic fuzzy numbers arithmetic operations. International Journal of Computational and Mathematical Sciences, 3, 225–232.

Mishra, S., & Ghosh, A. (2006). Interactive fuzzy programming approach to bi-level quadratic fractional programming problems. Annals of Operations Research, 143, 251–263.

Montero, J., Gomez, D., & Bustince, H. (2007). On the relevance of some families of fuzzy sets. Fuzzy Sets and Systems, 158, 2429–2442.

Sana, S. S. (2011a). An EOQ model of homogeneous products while demand is salesmen’s initiatives and stock sensitive. Computers & Mathematics with Applications, 62, 577–587.

Saleh, M., Oliva, R., Kampmann, C. E., & Davidson, P. I. (2010). A comprehensive analytical approach for policy analysis of system dynamic models. European Journal of Operational Research, 203, 673–683.

Sana, S. S. (2011b). An EOQ model for salesmen’s initiatives, stock and price sensitive demand of similar products—a dynamical system. Applied Mathematics and Computation, 218, 3277–3288.

Sana, S. S. (2012). The EOQ model—a dynamical system. Applied Mathematics and Computation, 218, 8736–8749.

Sana, S. S. (2010). Demand influenced by enterprises’ initiatives—a multi-item EOQ model of deteriorating and ameliorating items. Mathematical and Computer Modelling, 52, 284–302.

Sana, S. S., & Chaudhuri, K. S. (2008). An inventory model for stock with advertising sensitive demand. IMA Journal of Management Mathematics, 19, 51–62.

Sarkar, B., & Sarkar, S. (2013). An improved inventory model with partial backlogging, time varying deterioration and stock-dependent demand. Economic Modelling, 30, 924–932.

Takeuti, G., & Tinani, S. (1984). Intuitionistic fuzzy logic and intuitionistic fuzzy set theory. The Journal of Symbolic Logic, 49, 851–866.

Vojosevic, M., Petrovic, D., & Petrovic, R. (1996). EOQ formula when inventory cost is fuzzy. International Journal of Production Economics, 45, 499–504.

Wu, K., & Yao, J. S. (2003). Fuzzy inventory with backorder for fuzzy order quantity and fuzzy shortage quantity. European Journal of Operational Research, 150, 320–352.

Xie, J., & Neyret, A. (2009). Co-op advertising and pricing models in manufacturer–retailer supply chain. Computers & Industrial Engineering, 56, 1375–1385.

Xie, J., & Wei, J. C. (2009). Coordinating advertising and pricing in a manufacturer–retailer channel. European Journal of Operational Research, 197, 785–791.

Yager, R. R. (1981). A procedure for ordering fuzzy subsets of the unit interval. Information Sciences, 24, 143–161.

Yao, J. S., Chang, S. C., & Su, J. S. (2000). Fuzzy inventory without backorder for fuzzy order quantity and fuzzy total demand quantity. Computers & Operations Research, 27, 935–962.

Zadeh, L. A. (1965). Fuzzy sets. Information and Control, 8, 338–356.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Here, we shall show that the score (net membership) function follows Yager’s (1981) ranking index method.

We have

(i)

Letting \(\rho_{1} ' = \rho_{1}\), \(\rho_{3} ' = \rho_{3}\), in fuzzy sense, we get

Hence the proof.

Let \(d_{2} = \frac{\tau\rho}{1+\rho}\) then \(\rho= \frac{\tau}{\tau- d_{2}}\).

(ii) So, the net membership is given by

Here, \(\frac{ [ \frac{\tau}{ ( \tau- d_{2} )} - ( 1+ \rho_{1} ) ]}{\rho_{2} - \rho_{1}} - \frac{ [ ( 1+ \rho_{2} ) - \frac{\tau}{ ( \tau- d_{2} )} ]}{ \rho_{2} - \rho_{1} '} \geq\alpha\) and \(\frac{ [ ( 1+ \rho_{2} ) - \frac{\tau}{ ( \tau- d_{2} )} ]}{\rho_{3} - \rho_{2}} - \frac{ [ \frac{\tau}{ ( \tau- d_{2} )} - ( 1+ \rho_{3} ' ) ]}{\rho_{3} ' - \rho_{2}} \geq\alpha\), after a little bit calculation, we have

Therefore,

where

Now, the indexed value is

To have a fuzzy value, we have \(\rho_{1} ' \rightarrow \rho_{1}\) and \(\rho_{3} ' \rightarrow \rho_{3}\) those provide

Therefore, from above, we have

The crisp value of d 2 is

where

and

Thus

Proceeding this way we can prove the other IFS as well. Hence the Yager’s Ranking method can be applied on net membership function also. This completes the proof.

Rights and permissions

About this article

Cite this article

De, S.K., Sana, S.S. Backlogging EOQ model for promotional effort and selling price sensitive demand- an intuitionistic fuzzy approach. Ann Oper Res 233, 57–76 (2015). https://doi.org/10.1007/s10479-013-1476-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-013-1476-3