Abstract

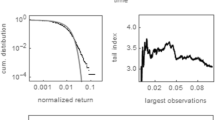

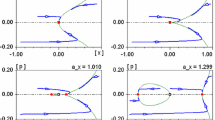

The behavioral origins of the stylized facts of financial returns have been addressed in a growing body of agent-based models of financial markets. While the traditional efficient market viewpoint explains all statistical properties of returns by similar features of the news arrival process, the more recent behavioral finance models explain them as imprints of universal patterns of interaction in these markets. In this paper we contribute to this literature by introducing a very simple agent-based model in which the ubiquitous stylized facts (fat tails, volatility clustering) are emergent properties of the interaction among traders. The simplicity of the model allows us to estimate the underlying parameters, since it is possible to derive a closed form solution for the distribution of returns. We show that the tail shape characterizing the fatness of the unconditional distribution of returns can be directly derived from some structural variables that govern the traders’ interactions, namely the herding propensity and the autonomous switching tendency.

Similar content being viewed by others

References

Aït-Sahalia, Y. (2002). Maximum-likelihood estimation of discretely-sampled diffusion: A closed-form approximation approach. Econometrica, 70, 223–262.

Alfarano, S. and Lux, T. (2003). A minimal noise traders model with realistic time series properties. http://www.bwl.uni-kiel.de/Ordnung+Wettbewerbspolitik/ewp/ewp.html, Working paper, University of Kiel.

Alfarano, S., Lux, T. and Wagner, F. (2004). Time-variation of higher moments in financial market with heterogeneous agents: An analytical approach. Work in progress, University of Kiel.

Aoki, M. (1996). New Approaches to Macroeconomic Modeling: Evolutionary Stochastic Dynamics, Multiple Equilibria, and Externalities as Field Effects, Cambridge University Press, Cambridge.

Beja, A. and Goldman, M.B. (1980). On the dynamic behavior of prices in disequilibrium. Journal of Finance, 35, 235–248.

Black, F. and Scholes, M. (1973). The pricing of options and corporate liabilities. Journal of Political Economy, 81, 637–653.

Brock, W.A. and Hommes, C.H. (1997). A rational route to randomness. Econometrica, 65, 1059–1095.

Cont, R. and Bouchaud, J.P. (2000). Herd behaviour and aggregate fluctuations in financial markets. Macroeconomic Dynamics, 4, 170–196.

Costantini, D. and Garibaldi, U. (1997). A probabilistic foundation of elementary particle statistics. Studies in History and Philosophy of Science Part B: Studies in History and Philosophy of Modern Physics, 28, 483–506.

De Jong, F., Drost, F.C. and Werker, B.J.M. (2001). A jump-diffusion model for exchange rates in a target zone. Statistica Neerlandica, 55, 270–300.

De Long, B.J., Shleifer, A., Summers, L.H. and Waldmann, R.J. (1990). Noise trade risk in financial markets. Journal of Political Economy, 98, 703–738.

De Vries, C.G. (1994). Stylized facts of nominal exchange rate returns. In F. van der Ploeg (ed.), The Handbook of International Macroeconomics, pp. 348–389. Blackwell, Oxford.

Elerian, O., Sidhartha, C. and Shephard, N. (2000). Likelihood inference for discretely observed nonlinear diffusions. Econometrica, 69, 959–994.

Genon-Catalot, V., Jeantheau, T. and Laredo, C. (1999). Parameter estimation for discretely observed stochastic volatility models. Bernoulli, 5, 855–872.

Gilli, M. and Winker, P. (2003). A global optimization heuristic for estimating agent based models. Computational Statistics and Data Analysis, 42, 299–312.

Gopikrishnan, P., Meyer, M., Amaral, L.A.N. and Stanley, H.E. (1998). Inverse cubic law for the distribution of stock price variations. European Physics Journal B, 3, 139–140.

Hill, B.M. (1975). A simple general approach to inference about the tail of a distribution. Annals of Statistics, 3, 1163–1173.

Kearns, P. and Pagan, A.R. (1997). Estimating the density tail index for financial time series. Review of Economics and Statistics, 79, 171–175.

Kessler, M. and Sørensen, M. (1999). Estimating equations based on eigenfunctions for a discretely observed diffusion process. Bernoulli, 5, 299–314.

Kirman, A. (1991). Epidemics of opinion and speculative bubbles in financial markets. In M. P. Taylor (ed.), Money and Financial Markets, pp. 354–368. Blackwell, Cambridge.

Kirman, A. (1993). Ants, rationality, and recruitment. Quarterly Journal of Economics, 108, 137–156.

Kirman, A. and Teyssiére, G. (2002). Microeconomic models for long memory in the volatility of financial time series. Studies in Nonlinear Dynamics & Econometics, 5, 137–156.

LeBaron, B. (2000). Agent based computational finance: Suggested readings and early research. Journal of Economic Dynamics and Control, 24, 679–702.

Lobato, I.N. and Savin, N.E. (1998). Real and spurious long-memory properties of stock market data. Journal of Business and Economics Statistics, 16, 261–283.

Lux, T. (1996). The stable Paretian hypothesis and the frequency of large returns: An examination of major German stocks. Applied Financial Economics, 6, 463–475.

Lux, T. and Ausloos, M. (2002). Market fluctuations I: Scaling, multiscaling and their possible origins. In A. Bunde, J. Kropp, and H. J. Schellnhuber (eds.), Theories of Disaster—Scaling Laws Governing Weather, Body, and Stock Market Dynamics, 373–409. Springer, Berlin Heidelberg.

Lux, T. and Marchesi, M. (1999). Scaling and criticality in a stochastic multi-agent model of a financial market. Nature, 397, 498–500.

Lux, T. and Marchesi, M. (2000). Volatility clustering in financial markets: A micro-simulation of interacting agents. International Journal of Theoretical and Applied Finance, 3, 67–702.

Mandelbrot, B. (1963). The variation of certain speculative prices. Journal of Business, 35, 394–419.

Pagan, A. (1996). The econometrics of financial markets. Journal of Empirical Finance, 3, 15– 102.

Stegenborg Larsen, K. and Sørensen, M. (2003). Diffusion models for exchange rates in a target zone. http://www.math.ku.dk/michael/target.pdf.

van Kampen, N.G. (1992). Stochastic processes in Physics and Chemistry, revised edn. North Holland, Amsterdam.

Vigfusson, R. (1997). Switching between chartists and fundamentalists: A Markov regime-switching approach. International Journal of Finance and Economics, 2, 291–305.

Wagner, F. (2003). Volatility cluster and herding. Physica A, 322, 607–619.

Weiland, T. (1985). On the unique numerical solution of Maxwellian eigenvalue problems in three dimensions. Particle Accelerators, 17, 227–242.

Westerhoff, F.H. and Reitz, S. (2003). Nonlinearities and cyclical behavior: The role of chartists and fundamentalists. Studies in Nonlinear Dynamics and Econometrics, 7.

Youssefmir, M. and Huberman, A. (1997). Clustered volatility in multiagent dynamics. Journal of Economic Behavior and Organization, 32, 101–118.

Zinn-Justin, J. (1989). Quantum Field Theory and Critical Phenomena. Clarendon Press, Oxford.

Author information

Authors and Affiliations

Corresponding author

Additional information

JEL classifications: G12; C61

Earlier versions of this paper have been presented at the 11th Symposium of the Society of Nonlinear Dynamics and Econometrics, Florence, March 2003, the 8th Spring Meeting of Young Economists, Leuven, April 2003, the 8th Workshop on Economics with Heterogeneous Interacting Agents, Kiel, May 2003, the 27th congress of Associazione per la Matematica Applicata alle Scienze Economiche e Sociali, Cagliari, September 2003; research seminars at the Department of Econometrics, University of Geneva, March 2003, and at the Department of Physics, University of Cagliari, May 2003, and have gained considerably from comments by many participants in these events.

Rights and permissions

About this article

Cite this article

Alfarano, S., Lux, T. & Wagner, F. Estimation of Agent-Based Models: The Case of an Asymmetric Herding Model. Comput Econ 26, 19–49 (2005). https://doi.org/10.1007/s10614-005-6415-1

Accepted:

Issue Date:

DOI: https://doi.org/10.1007/s10614-005-6415-1