Abstract

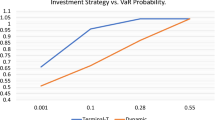

Most dynamic programming methods deployed in the portfolio choice literature involve recursions on an approximated value function. The simulation-based method proposed recently by Brandt, Goyal, Santa-Clara, and Stroud (Review of Financial Studies, 18, 831–873, 2005), relies instead on recursive uses of approximated optimal portfolio weights. We examine the relative numerical performance of these two approaches. We show that when portfolio weights are constrained by short sale restrictions for example, iterating on optimized portfolio weights leads to superior results. Value function iterations result in a lower variance but disproportionately higher bias of the solution, especially when risk aversion is high and the investment horizon is long.

Similar content being viewed by others

References

Balduzzi P., Lynch A.W. (1999). Transaction costs and predictability: some utility cost calculations. Journal of Financial Economics 52:47–78

Barberis N. (2000) Investing for the long run when returns are predictable. Journal of Finance 55:225–264

van Binsbergen, J.H., Brandt, M.W. (2006) Optimal asset allocation in asset liability management. Working Paper, Duke University.

Brandt, M. W. (2005). Portfolio choice problems. In Y. Ait-Sahalia, & L. P. Hansen, (Eds.), Handbook of Financial Econometrics, forthcoming.

Brandt M.W., Goyal A., Santa-Clara P., Stroud J.R. (2005). A simulation approach to dynamic portfolio choice with an application to learning about return predictability. Review of Financial Studies 18:831–873

Cochrane J.H. (1989). The sensitivity of tests of the intertemporal allocation of consumption to near-rational alternatives. American Economic Review 79:319–337

Dammon R.M., Spatt C.S., Zhang H.H. (2001). Optimal consumption and investment with capital gains taxes. Review of Financial Studies 14:583–616

Newey W.K., West K.D. (1987). A simple, positive definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica 55:703–708

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

van Binsbergen, J.H., Brandt, M.W. Solving dynamic portfolio choice problems by recursing on optimized portfolio weights or on the value function?. Comput Econ 29, 355–367 (2007). https://doi.org/10.1007/s10614-006-9073-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-006-9073-z