Abstract

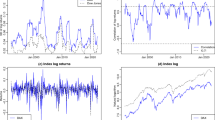

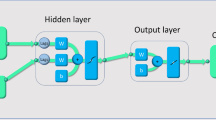

This study presents evidence of an asymmetrical quadratic effect from financial asset return on volatility. The relationships between the two variables are quadratic for both positive and negative returns and systematically different in the two regimes. The convex relations are observed showing that extreme shocks have a diminishing marginal impact on volatility. A threshold quadratic model under GARCH framework is developed to capture the effect and applied to major stock indices. The empirical outcomes of quadratic regressions and in-sample estimations significantly confirm the asymmetrical quadratic behavior. With application of S&P500 series, both diagnoses of in-sample estimations and evaluations of out-of-sample forecasts verify the proposed specification as a valid alternative volatility modeling.

Similar content being viewed by others

References

Andersen T. G. (1994) Stochastic autoregressive volatility: A framework for volatility modeling. Mathematical Finance 4: 75–102

Baillie R. T., Bollerslev T., Mikkelsen H. O. (1996) Fractionally integrated generalized autoregressive conditional heteroscedasticity. Journal of Econometrics 74: 3–30

Bakshi G., Ju N., Ou-Yang H. (2006) Estimation of continuous-time models with an application to equity volatility dynamics. Journal of Financial Economics 82: 227–249

Bauwens L., Laurent S., Rombouts J. (2006) Multivariate GARCH models: A survey. Journal of Applied Econometrics 21: 79–109

Bekaert G., Wu G. (2000) Asymmetric volatility and risk in equity markets. Review of Financial Studies 13: 1–42

Berkes I., Horvath L., Kokoszka P. (2003) GARCH processes: Structure and estimation. Bernoulli 9: 201–227

Blair B., Poon S., Taylor S. J. (2001) Forecasting S&P100 volatility: The incremental information content of implied volatilities and high frequency index returns. Journal of Econometrics 105: 5–26

Bollerslev T. (1986) Generalized autoregressive conditional heteroscedasticity. Journal of Econometrics 31: 307–328

Bollerslev T. (1987) A conditionally heteroskedastic time series model for speculative prices and rates of return. Review of Economics and Statistics 69: 542–547

Bollerslev T., Ghysels E. (1996) Periodic autoregressive conditional heteroscedasticity. Journal of Business and Economic Statistics 14: 139–151

Bollerslev T., Chou R. Y., Kroner K. F. (1992) ARCH modeling in finance: A review of the theory and empirical evidences. Journal of Econometrics 52: 5–59

Carnero M. A., Peña D., Ruiz E. (2007) Effects of outliers on the identification and estimation of the GARCH models. Journal of Time Series Analysis 28: 471–497

Charles A. (2008) Forecasting volatility with outliers in GARCH models. Journal of Forecasting 27: 551–565

Chiarella C., To T.-D. (2006) The multifactor nature of the volatility of futures markets. Computational Economics 27: 163–183

Enders W. (2004) Applied econometric time series. Wiley Series in Probability and Statistics. Wiley, New York, NY

Engle R. F. (1982) Autoregressive conditional heteroskedasticity with estimates of the variance of UK inflation. Econometrica 50: 987–1008

Engle R. F., Bollerslev T. (1986) Modelling the persistence of conditional variance. Econometric Review 5: 1–50

Engle R. F., Ng V. K. (1993) Measuring and testing the impact of news on volatility. Journal of Finance 48: 1749–1778

Eraker B., Johannes M., Polson N. (2003) The impact of jumps in volatility and returns. Journal of Finance 58: 1269–1300

Fama E. F. (1965) The behavior of stock market prices. Journal of Business 38: 34–105

Francq C., Zakoian J. M. (2004) Maximum likelihood estimation of pure GARCH and ARMA-GARCH processes. Bernoulli 10: 605–637

Franses P. H., van Dijk D. (1996) Forecasting stock market volatility using (non-linear) GARCH models. Journal of Forecasting 15: 229–235

Gilli M., Kellezi E. (2006) An application of extreme value theory for measuring financial risk. Computational Economics 27: 207–228

Glosten L. R., Jagannathan R., Runkle D. E. (1993) On the relation between the expected value and the volatility of the normal excess return on stocks. Journal of Finance 48: 1779–1801

Haas M., Mittnik S., Paolella M. S. (2004) A new approach to Markov-switching GARCH models. Journal of Financial Econometrics 2: 493–530

Hsieh D. (1989) Modeling heteroskedasticity in daily foreign exchange rates. Journal of Business and Economic Statistics 7: 307–317

Laurent S. (2004) Analytical derivatives of the APARCH model. Computational Economics 24: 51–57

Ling S., McAleer M. (2002) Stationarity and the existence of moments of a family of GARCH processes. Journal of Econometrics 106: 109–117

Lopez J. (2001) Evaluating the predictive accuracy of volatility models. Journal of Forecasting 20: 87–109

Nelson D. B. (1991) Conditional heteroskedasticity in asset returns: A new approach. Econometrica 59: 347–370

Rabemananjara R., Zakoian J. M. (1993) Threshold ARCH models and asymmetries in volatility. Journal of Applied Econometrics 8: 31–49

Ramsey J. B. (1969) Tests for specification errors in classical linear least-squares analysis. Journal of the Royal Statistical Association (Series B) 71: 350–371

Sentana E. (1995) Quadratic ARCH models. Review of Economic Studies 62: 639–661

Thiel H. (1966) Applied economic forecasting. Rand McNally, Chicago, IL

van Dijk D., Franses P. H., Lucas A. (2002) Testing for ARCH in the presence of additive outliers. Journal of Applied Econometrics 14: 539–562

Yu J. (2005) On leverage in a stochastic volatility model. Journal of Econometrics 127: 165–178

Zakoian J. M. (1994) Threshold heteroscedastic models. Journal of Economic Dynamics and Control 18: 931–995

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Huang, A.Y. Volatility Modeling by Asymmetrical Quadratic Effect with Diminishing Marginal Impact. Comput Econ 37, 301–330 (2011). https://doi.org/10.1007/s10614-011-9254-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-011-9254-2