Abstract

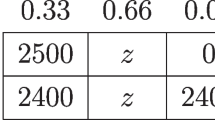

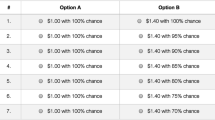

We present a new experimental evidence of how framing affects decisions in the context of a lottery choice experiment for measuring risk aversion. We investigate framing effects by replicating the Holt and Laury’s (Am. Econ. Rev. 92:1644–1655, 2002) procedure for measuring risk aversion under various frames. We first examine treatments where participants are confronted with the 10 decisions to be made either simultaneously or sequentially. The second treatment variable is the order of appearance of the ten lottery pairs. Probabilities of winning are ranked either in increasing, decreasing, or in random order. Lastly, payoffs were increased by a factor of ten in additional treatments. The rate of inconsistencies was significantly higher in sequential than in simultaneous treatment, in increasing and random than in decreasing treatment. Both experience and salient incentives induce a dramatic decrease in inconsistent behaviors. On the other hand, risk aversion was significantly higher in sequential than in simultaneous treatment, in decreasing and random than in increasing treatment, in high than in low payoff condition. These findings suggest that subjects use available information which has no value for normative theories, like throwing a glance at the whole connected set of pairwise choices before making each decision in a connected set of lottery pairs.

Similar content being viewed by others

References

Allais, M. (1953). Le comportement de l’homme rationnel devant le risque: critique des postulats et axiomes de l’ecole américaine. Econometrica, 21, 503–546.

Blavatskyy, P. R. (2007). Stochastic expected utility theory. Journal of Risk and Uncertainty, 34, 259–286.

Blavatskyy, P. R. (2010). A model of probabilistic choice satisfying first-order stochastic dominance. Management Science, 57, 542–548.

Camerer, C. (1989). An experimental test of several generalized utility theories. Journal of Risk and Uncertainty, 2, 61–104.

Chew, S., Epstein, L., & Segal, U. (1991). Mixture symmetry and quadratic utility. Econometrica, 59, 139–163.

Fechner, G. (1860). Elements of psychophysics. New York: Holt, Rinehart and Winston.

Fischbacher, U. (2007). z-Tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10(2), 171–178.

Harrison, G. W., Johnson, E., McInnes, M. M., & Rutström, E. E. (2005). Risk aversion and incentive effects: comment. American Economic Review, 95, 897–901.

Hey, J. D., & Orme, C. (1994). Investigating generalizations of expected utility theory using experimental data. Econometrica, 62, 1291–1326.

Holt, C. A., & Laury, S. K. (2002). Risk aversion and incentive effects. American Economic Review, 92, 1644–1655.

Kahneman, D., & Tversky, A. (1984). Choices, values, and frames. American Psychologist, 39(4), 341–350.

Laury, S. K. (2005). Pay one or pay all: random selection of one choice for payment. Andrew Young School of Policy Studies Research Paper Series, No. 06-13.

Loomes, G. (2005). Modelling the stochastic component of ehaviour in experiments: some issues for the interpretation of data. Experimental Economics, 8, 301–323.

Loomes, G., & Sugden, R. (1998). Testing different stochastic specifications of risky choice. Economica, 65, 581–598.

Loomes, G., Moffatt, P.G., & Sugden, R. (2002). Microeconometric test of alternative stochastic theories of risky choice. Journal of Risk and Uncertainty, 24, 103–130.

Masclet, D., Colombier, N., Denant-Boemont, L., & Loheac, Y. (2009). Group and individual risk preferences: a lottery-choice experiment with self-employed and salaried workers. Journal of Economic Behavior and Organization, 70, 470–484.

Starmer, C. (2000). Developments in non-expected utility theory: the hunt for a descriptive theory of choice under risk. Journal of Economic Literature, 38, 332–382.

Starmer, Ch., & Sugden, R. (1989). Probability and juxtaposition effects: an experimental investigation of the common ratio effect. Journal of Risk and Uncertainty, 2, 159–178.

Tversky, A., & Kahneman, D. (1981). The framing of decision and the psychology of choice. Science, 211, 453–458.

Tversky, A., & Kahneman, D. (1986). Rational choice and the framing of decisions. Journal of Business, 59, 251–278.

Wu, G. (1994). An empirical test of ordinal independence. Journal of Risk and Uncertainty, 9, 39–60.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Lévy-Garboua, L., Maafi, H., Masclet, D. et al. Risk aversion and framing effects. Exp Econ 15, 128–144 (2012). https://doi.org/10.1007/s10683-011-9293-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-011-9293-5