Abstract

This paper analyzes the Quantity-Flexibility (QF) contract, under which the buyer provides to the supplier information about expected future orders for the predetermined horizon and the supplier, in return, provides the buyer with the flexibility to adjust future orders later. Under this scheme, the flexibility profile of the contract can be perceived by the buyer as a form of customer service, by which the supplier commits to fulfil the buyer’s maximum likely order at the cost of the supplier’s inventory risk. The simulation results show that the benefit of the contract to either party clearly depends on the flexibility profile of the contract. For the supplier, there exists a trade-off between customer service level and inventory risk associated with the flexibility profile. However, for the buyer, the flexibility demonstrates a principle of diminishing returns, which is contrary to the general notion that buyers always prefer more order quantity flexibility. In fact, greater flexibility does not always translate into better customer service to buyers.

Similar content being viewed by others

References

Agrawal S, Sengupta RN, Shanker K (2009) Impact of information sharing and lead time on bullwhip effect and on-hand inventory. Eur J Oper Res 192:576–593

Alwan LC, Liu JJ, Yao DQ (2008) Forecast facilitated lot-for-lot ordering in the presence of autocorrelated demand. Comput Ind Eng 54:840–850

Bassok Y, Anupindi R (2008) Analysis of supply contracts with commitments and flexibility. Naval Res Logist 55:459–477

Chen YF, Drezner Z, Ryan JK, Simchi-Levi D (2000) Quantifying the bullwhip effect in a simple supply chain: the impact of forecasting, lead times, and information. Manage Sci 46(3):436–443

Chopra S, Meindl P (2001) Supply chain management. Prentice-Hall, Upper Saddle River, NJ

Coppini M, Rossignoli C, Rossi T, Strozzi F (2009) Bullwhip effect and inventory oscillations analysis using the beer game model. Int J Prod Res 99999:1. doi:10.1080/00207540902896204

Croson R, Donohue K (2006) Behavioral causes of the bullwhip effect and the observed value of inventory information. Manage Sci 52(3):323–336

Das DK, Abdel-Malek L (2003) Modeling the flexibility of order quantities and lead-times in supply chains. Int J Prod Econ 85:171–181

Giannoccaro I, Pontrandolfo P (2004) Supply chain coordination by revenue sharing contracts. Int J Prod Econ 89:131–139

Lee HL, Padmanabhan V, Whang S (1997) Information distortion in a supply chain: the bullwhip effect. Manage Sci 43:546–558

Lee HL, So KC, Tang CS (2000) The value of information sharing in a two-level supply chain. Manage Sci 46:626–643

Lian Z, Deshmukh A (2009) Analysis of supply contracts with quantity flexibility. Eur J Oper Res 196:526–533

Lian Z, Liu L, Zhu SX (2010) Rolling-horizon replenishment: policies and performance analysis. Naval Res Logist 57(6):489–502

McCarthy TM, Davis DF, Golicic SL, Mentzer JT (2006) The evolution of sales forecasting management: a 20-year longitudinal study of forecasting practices. J Forecast 25:303–324

Rong Y, Shen ZM, Snyder LV (2008) The impact of ordering behavior on order-quantity variability: a study of forward and reverse bullwhip effects. Flex Serv Manuf J 20:95–124

Sterman JD (1989) Modeling managerial behavior: misperceptions of feedback in a dynamic decision making experiment. Manage Sci 35(3):321–339

Stevenson M, Spring M (2007) Flexibility from a supply chain perspective. Int J Operat Prod Manag 27(7):685–713

Subramanian V (2004) A computational framework for studying decentralized supply chain dynamics. Dissertation. Purdue University

Tibben-Lembke RS (2004) N-period contracts with ordering constraints and total minimum commitments. Eur J Oper Res 156(2):353–374

Tsay AA, Lovejoy WS (1999) Quantity flexibility contracts and supply chain performance. Manuf Serv Operat Manag 1(2):89–111

Walsh PM, Williams PA, Heavey C (2008) Investigation of rolling horizon flexibility contracts in a supply chain under highly variable stochastic demand. IMA J Manag Math 19:117–135

Wang CX (2002) A general framework of supply chain contract models. Supply chain management. Int J 7(5):302–310

Wright D, Yuan X (2008) Mitigating the bullwhip effect by ordering policies and forecasting methods. Int J Prod Econ 113:587–597

Zipkin PH (2000) Foundations of inventory management. McGraw-Hill, New York

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

In the new models, both the retailer and the manufacture in Model 1 of Fig. 2 now employ an optimal ordering model based on an adaptive OUT inventory policy, respectively. In Model 2, the retailer now employs the adaptive OUT inventory policy and the EWMA, and enters into a QF contract with the manufacturer. Therefore, both the retailer and the manufacturer apply the QF scheme to estimate their current orders, and only the retailer applies the scheme to estimate its future orders in the chosen rolling-horizons. More detailed equations for the new models are provided below.

Assume that the values of τ, φ and \( \sigma_{\varepsilon } \) of an AR(1) process are known to the retailer. Let OUTR (t) denote an order-up-to level of the retailer in period t and mR (t) and vR (t) denote the conditional expectation and the conditional variance of the total demand over the lead time, respectively. Then the optimal order-up-to level, OUTR* (t), that minimizes the total expected inventory holding and backorder costs can be found as follows (Lee et al. 1997, 2000):

where \( {\text{m}}^{{\text{R}}} ({\text{t)}} = {\text{Exp}}\left[ {\sum\nolimits_{{{\text{i = 1}}}}^{{{\text{od}} + {\text{sd}}}} {{\text{D}}({\text{t + i}}){\text{|D}}({\text{t}})} } \right] \), \( {\text{v}}^{{\text{R}}} ({\text{t)}} = {\text{Var}}\left[ {\sum\nolimits_{{{\text{i = 1}}}}^{{{\text{od}} + {\text{sd}}}} {{\text{D}}({\text{t + i}}){\text{|D}}({\text{t}})} } \right] \), \( {\text{K}}^{\text{R}} = \Upphi^{ - 1} \left[ {{\frac{{{\text{Backorder\_cost}}}}{{{\text{Backorder\_cost }} + {\text{ Holding\_cost}}}}}} \right] \) (Φ: Standard Normal dist. func.)

Then, according to Lee et al. (2000) and Agrawal et al. (2009), the retailer replenishes the demand during period t plus the change being made in the order-up-to levels as follows:

and the resulting optimal order quantity of the retailer is given by

where φ is a correlation coefficient in the AR(1) process

Likewise, with the following similar notations for the manufacturer, OUTM(t), mM(t) and vM(t), the optimal order-up-to level, OUTM*(t), that minimizes the total expected inventory holding and penalty costs can be found as follows (Lee et al. 2000):

where \( {\text{K}}^{\text{M}} = \Upphi^{ - 1} \left[ {\frac{{{\text{Penalty\_cost}}}}{{{\text{Penalty\_cost }} + {\text{ Holding\_cost}}}}} \right]\)

Then the manufacturer replenishes the order from the retailer plus the change being made in the order-up-to levels as follows (Lee et al. 2000; Agrawal et al. 2009):

and the resulting optimal order quantity of the manufacturer is given by

Now, in Model 2, the retailer uses the EWMA in Eq. 25 for forecasting demands of the chosen rolling horizons.

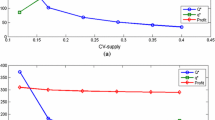

Simulations are conducted with the same settings specified in the Sect. 4.1, and the resulting outcomes are shown in Figs. 7, 8, 9 and Table 3.

Figure 7 shows the Bullwhip effects in the new models. We can see that they are overall mitigated compared to the outcomes in Fig. 3, although the order variance ratios of the manufacturer still vary widely with the flexibility rate: the higher the flexibility rate, the higher the order variance ratio of the manufacturer. However, one thing to note is that the dashed line (no QF contract case) in Fig. 7 now exists right below the case of the flexibility rate 25%, while that in Fig. 3 exists below the case of the flexibility rate 100%. This implies that the manufacturer in the new models may request much smaller flexibility rate when entering into the QF contract with the retailer.

Figure 8 shows the average fill rates in the new models. The main difference from the outcomes in Fig. 6 is that no QF contract case provides a quite high fill rate as it is. Therefore, from the perspective of the customer service level only, the retailer might not be interested in entering into the QF contract. However, the retailer eventually needs to make the decision after taking into account the cost performances as well, as will be explained below.

Both Table 3 and Fig. 9 show cost performances of the retailer and the manufacturer in the new models. They show that both the retailer’s and the manufacturer’s cost performances have improved with the new ordering model, in both the QF contract and no QF contract cases, compared to the outcomes in Table 1 and Fig. 5. Another thing to note is that the resulting feasible contract range is now from 25% to 30%, which is smaller than that in Table 1 and Fig. 5. This is because the lower flexibility bound of the feasible contract range for the retailer has increased and the upper one of that for the manufacturer has decreased. Other than the abovementioned differences, major findings and implications remain the same.

Rights and permissions

About this article

Cite this article

Kim, WS. Order quantity flexibility as a form of customer service in a supply chain contract model. Flex Serv Manuf J 23, 290–315 (2011). https://doi.org/10.1007/s10696-011-9085-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10696-011-9085-4