Abstract

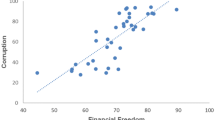

This paper investigates the effects of national culture on firm risk-taking, using a comprehensive dataset covering 50,000 firms in 400 industries in 51 countries. Risk-taking is found to be higher for domestic firms in countries with low uncertainty aversion, low tolerance for hierarchical relationships, and high individualism. Domestic firms in such countries tend to take substantially more risk in industries which are more informationally opaque (e.g., finance, mining, oil refinery, IT). Risk-taking by foreign firms is best explained by the cultural norms of their country of origin. These results hold even after controlling for legal constraints, insurance safety nets, and economic development.

Similar content being viewed by others

Notes

In general, commodity industries (biofuels, metal products, non-ferrous metals) are riskier and more opaque than other industries because they adopt more complicated production methods and organization structures and incur more intensive R&D expenditures which may cost more than the end benefits (Huang 2008).

117,000 IBM local employees of marketing and customer service positions from 66 countries around the world.

The “comparative management” literature argues in favor of the “convergence hypothesis,” which implies that management philosophies and practices around the world would eventually become more and more alike as societies tend to become more exposed to the same products and ideas (see Kerr et al. 1960; Lomax and Berkowitz 1972).

Accordingly, the United States is excluded from cross-country regressions.

Setting all outliers to a specified percentile of the data.

Japan is a highly uncertainty averse country, whereas the USA scores low in uncertainty aversion.

References

Acemoglu, D., & Zilibotti, F. (1997). Was Prometheus unbound by chance? Risk, diversification, and growth. Journal of Political Economy, 105(4), 709–751.

Acharya, V. V., Amihud, Y., & Litov, L. (2010). Creditor rights and corporate risk-taking. Journal of Financial Economics, 102, 150–166.

Altunbas, Y., Gambacorta, L., & Marques-Ibanez, D. (2010) Does Monetary Policy Affect Bank Risk-Taking? Bank for International Settlements Working Paper, 298.

Ball, R. (2001). Individualism, collectivism, and economic development. Annals of the American Academy of Political and Social Science, 573, 57–84.

Beraho, E. K., & Elisu, R. (2010). Influence of country culture on bankruptcy and insolvency legal reform management. International Journal of Management and Information Systems, 14(2), 39–49.

Brandenburg, R. G. (1964). Research and development project selection. Unpublished dissertation, Cornell University.

Breuer, W., Riesener, M., & Salzmann, A. J. (2011). Risk aversion vs. individualism: What drives risk taking in household finance? Available at SSRN: http://ssrn.com/abstract=1956777.

Chui, A. C. W., Titman, S., & Wei, K. C. J. (2010). Individualism and momentum around the world. Journal of Finance, 65, 361–392.

Claessens, S., Djankov, S., & Nenova, T. (2000). Corporate risk around the world. Washington, DC: World Bank, Financial Sector Vice Presidency, Financial Sector Strategy and Policy Group.

Cooper, R. G. (1981). An empirically derived new product project selection model. IEEE Transactions on Engineering Management EM, 28(3), 54.

Cox, L. A. (2010). Managing R&D and risky projects. Operations Research and Management Science, Wiley.

Das, T. K., & Teng, B.-S. (2004). The risk-based view of trust: A conceptual framework. Journal of Business and Psychology, 19(1), 85–116.

De Nicolò, G. (2000). Size, charter value and risk in banking: An international perspective. IFC Discussion Paper No. 689. Washington, DC: Board of Governors of the Federal Reserve.

De Nicolò, G., Dell’Ariccia, G., Laeven, L., & Valencia F. (2010). Monetary policy and bank risk-taking. IMF Staff Position Note 10/09, International Monetary Fund.

Djankov, S., Hart, O., McLiesh, C., & Shleifer, A. (2008). Debt enforcement around the world. Journal of Political Economy, 116(6), 1105–1149.

Doidge, C., Andrew Karolyi, G., & Stulz, R. M. (2007). Why do countries matter so much for corporate governance? Journal of Financial Economics, 86, 1–39.

Durnev, A., Morck, R., & Yeung, B. (2004). Value enhancing capital budgeting and firm-specific stock returns variation. Journal of Finance, 59(1), 65–106.

Efrat, R. (2002). Global trends in personal bankruptcy. American Bankruptcy Law Journal, 76, 81–110.

European Media and Marketing Survey (1995, 1997, 1999). A research survey of print media readership and TV audience levels within the upscale consumer group in Europe (EU, Switzerland and Norway). Amsterdam: Inter/View International.

Garson, G. D. (2012). Hierarchical linear modeling. Thousand Oaks, CA: SAGE Publications, Inc.

Getz, K. A., & Volkema, R. J. (2001). Culture, perceived corruption, and economics. A model of predictors and outcomes. Business and Society, 40(1), 7–30.

Giordani, P., & Zamparelli, L. (2011). On robust asymmetric equilibria in asymmetric R&D-driven growth economies. Decisions in Economics and Finance, Springer, 34(1), 67–84.

Glaeser, E. L., La Porta, R., Lopez-De-Silanes, F., & Shleifer, A. (2004). Do institutions cause growth? Working paper No. W10568. National Bureau of Economic Research.

Glaeser, E. L., & Shleifer, A. (2002). Legal origins. Quarterly Journal of Economics, 117, 1193–1229.

Graham, J. R., Harvey, C. R., & Puri, M. (2010). Managerial attitudes and corporate actions. Available at SSRN: http://ssrn.com/abstract=1432641.

Graham, J. R., Huang, H., & Harvey, C. (2009). Investor competence, trading frequency, and home bias. Management Science, 55(7), 1094–1106.

Griffin, D. W., Li, K., Yue, H., & Zhao, L. (2012). How does culture influence corporate risk-taking? Available at SSRN: http://ssrn.com/abstract=2021550 or doi:10.2139/ssrn.2021550.

Grinblatt, M., & Keloharju, M. (2009). Sensation seeking, overconfidence, and trading activity. Journal of Finance American Finance Association, 64(2), 549–578.

Growiec, K., & Growiec, J. (2011). Trusting only whom you know, knowing only whom you trust: The joint impact of social capital and trust on individuals’ economic performance and happiness in CEE countries. National Bank of Poland Working Papers 94, National Bank of Poland, Economic Institute.

Guay, W. (1999). The sensitivity of CEO wealth to equity risk: An analysis of the magnitude and determinants. Journal of Financial Economics, 53, 43–71.

Guiso, L., Sapienza, P., & Zingales, L. (2006). Does culture affect economic outcomes? Journal of Economic Perspectives, AEA, 20(2), 23–48.

Halek, M., & Eisenhauer, J. G. (2001). Demography of risk aversion. Journal of Risk and Insurance, 68, 1–24.

Helmreich, R. L., & Merritt, A. C. (1998). Culture at work in aviation and medicine: National, organizational, and professional influences. Aldershot: Ashgate.

Herger, N., Hodler, R., & Lobsiger, M. (2008). What determines financial development? Culture, institutions or trade. Review of World Economics (Weltwirtschaftliches Archiv), 144(3), 558–587.

Hilary, G., & Hui, K. W. (2009). Does religion matter in corporate decision making in America? Journal of Financial Economics, 93, 455–473.

Hofstede, G. (1984). Culture’s consequences: International differences in work-related values. Newbury Park, CA: Sage.

Hofstede, G. H. (2001). Culture’s consequences: Comparing values, behaviors, institutions, and organizations across nations (2nd ed.). Thousand Oaks, CA: Sage.

Hofstede, G., Hofstede, G. J., & Minkov, M. (2010). Cultures and organizations: Software of the mind (3rd ed.). New York: McGraw-Hill.

Hope, O.-K. (2003). Firm-level disclosures and the relative roles of culture and legal origin. Journal of International Financial Management and Accounting, 14, 218–248.

Hoppe, M. H. (1990). A comparative study of country elites: International differences in work-related values and learning and their implications for management training and development. Unpublished doctoral dissertation, University of North Carolina at Chapel Hill.

Hoppe, R. (2007). Applied cultural theory: Tool for policy analysis. In F. Fischer, G. J. Miller, & M. S. Sidney (Eds.), Handbook of public policy analysis (pp. 289–308). Boca Raton, FL: CRC Press.

Houston, J. F., Lin, C., Lin, P., Mae. Y. (2010). Creditor rights, information sharing, and bank risk taking. Journal of Financial Economics, 96, 485–512.

Hsee, C. K., & Weber, E. U. (1999). Cross-national differences in risk preference and lay predictions. Journal of Behavioral Decision Making, 12, 165–179.

Huang, R. R. (2008). Tolerance for uncertainty and the growth of informationally opaque industries. Journal of Development Economics, 87(2), 333–353.

Husted, B. W. (1999). Wealth, culture, and corruption. Journal of International Business Studies, 30(2), 339–359.

Joglekar, P., & Paterson, M. (1986). A closer look at the returns and risks of pharmaceutical R&D. Journal of Health Economics, 5, 153–177.

John, K., Litov, L., & Yeung, B. (2008). Corporate governance and risk-taking. Journal of Finance, 63, 1679–1728.

Kanagaretnam, K., Lim, C. Y., & Lobo, G. J. (2011). Effects of national culture on earnings quality of banks. Journal of International Business Studies, 42(6), 853–874.

Kerr, C., Dunlop, J. T., Harbison, F. H., & Myers, C. A. (1960). Industrialism and industrial man. Cambridge, MA: Harvard University Press.

Kirca, A. H., Tamer Cavusgil, S., Tomas, G., & Hult, M. (2009). The effects of national culture on market orientation: Conceptual framework and research propositions. International Business Review, 18(2), 111–118.

Kwok, C. C. Y., & Tadesse, S. (2006). National culture and financial systems. Journal of International Business Studies, 37, 227–247.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. W. (1997). Legal determinants of external finance. Journal of Finance, 52, 1131–1150.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. W. (1998). Law and finance. Journal of Political Economy, 106, 1113–1155.

Laeven, L., & Levine, R. (2009). Bank governance, regulation and risk taking. Journal of Financial Economics, 93, 259–275.

Lee, S. M., & Peterson, S. J. (2000). Culture, entrepreneurial orientation, and global competitiveness. Journal of World Business, 35(4), 401–416.

Lehnert, T., Frijn, B., Gilbert, A., & Tourani-Rad, A. (2011). Cultural values, CEO risk aversion and corporate takeovers. LSF Research Working Paper Series 11-01, Luxembourg School of Finance, University of Luxembourg.

Li, J., & Harrison, J. R. (2008). National culture and the composition and leadership structure of boards of directors. Corporate Governance: An International Review, 16(5), 375–385.

Li, Y., & Zahra, S. (2012). Formal institutions, culture, and venture capital activity: A cross-country analysis. Journal of Business Venturing, 27(1), 95–111.

Licht, A. N., Goldschmidt, C., & Schwartz, S. H. (2005). Culture, law, and corporate governance. International Review of Law and Economics, 25, 229–255.

Lomax, A., & Berkowitz, N. (1972). The evolutionary taxonomy of culture. Science, 177(4045), 228–239.

Low, A. (2009). Managerial risk-taking behavior and equity-based compensation. Journal of Financial Economics, 92, 470–490.

McSweeney, B. (2000). The fallacy of national culture identification. 6th interdisciplinary perspectives on accounting conference, Manchester, UK.

Morgan, D. P. (2002). Rating banks: Risk and uncertainty in an opaque industry. American Economic Review, 92(4), 874–888.

Nash, R. C., Patel, A., & Bryan, S. (2012). Culture and CEO compensation. Available at SSRN: http://ssrn.com/abstract=2023530.

Paligorova, T. (2010). Corporate risk-taking and ownership structure. Working Paper No. 2010-3, Bank of Canada.

Pan, C. H., & Statman, M. (2009) Beyond risk tolerance,regret, overconfidence, and other investor propensities. SCU Leavey School of Business Research Paper, No. 10-05.

Pryor, F. L. (2005). National values and economic growth. American Journal of Economics and Sociology, 64, 451–483.

Radebaugh, L., Gray, S., & Black, E. (2006). International accounting and multinational enterprises (6th ed.). Hoboken, NJ: John Wiley and Sons.

Rajan, R. (2005). Has financial development made the world riskier? In Proceedings of the Jackson Hole conference organized by the Kansas City Fed.

Rajan, R., & Zingales, L. (1998). Financial dependence and growth. American Economic Review, 88, 559–586.

Raz, J. (1979). The authority of law. Oxford: Oxford University Press.

Robertson, C. J., & Watson, A. (2004). Corruption and change: The impact of foreign direct investment. Strategic Management Journal, 25, 385–396.

Schwartz, S. H. (1992). Universals in the content and structure of values: Theoretical advances and empirical tests in 20 countries. Advances in Experimental Social Psychology, 25, 1–65.

Schwartz, S. H. (1994). Beyond individualism/collectivism: New cultural dimensions of values. In U. Kim, H. C. Triandis, C. Kagitcibasi, S. Choi, & G. Yoon (Eds.), Individualism and collectivism: Theory, method and applications (pp. 85–119). Thousands Oaks, CA: Sage.

Shackman, G. (2009). The global social change research project. Retrived from http://gsociology.icaap.org, February 2012.

Smith, C. W., & Stulz, R. M. (1985). The determinants of firms’ hedging policies. Journal of Financial Economics, 7, 117–161.

Søndergaard, M. (1994). Hofstede’s consequences: A study of reviews, citations and replications. Organization Studies, 15(3), 447.

Stulz, R. M., & Williamson, R. (2003). Culture, openness, and finance. Journal of Financial Economics, 70(3), 313–349.

Tse, D., Lee, K., Vertinsky, I., & Wehrung, D. (1988). Does culture matter? A cross-cultural study of executives’ choice, decisiveness, and risk adjustment in international marketing. Journal of Marketing, 52, 181–195.

Van den Steen, E. (2004). Rational overoptimism (and other biases). American Economic Review, 94(4), 1141–1151.

Whyte, W. F. (1963). Culture, industrial relations, and economic development: The case of Peru. Industrial and Labor Relations Review, 16, 583–594.

Acknowledgments

I have benefited especially from detailed discussions with Stijn Claessens and Luc Laeven. I am grateful to Mohsan Bilal for his extensive help with the data. I would like to thank George Akerlof, Christopher Baum, John Beshears, Nathan Nunn, Lev Ratnovski, Fabian Valencia, and Francis Vitek in particular, and participants in the 17th International Conference on Cultural Economics for their interesting comments on the topic, and useful and valuable suggestions on this paper. The views expressed in this Working Paper are those of the author(s) and do not necessarily represent those of the IMF or IMF policy. This paper is the winner of the President Prize for the best graduate student paper presented at the ACEI’s 17th International Conference on Cultural Economics in Kyoto, Japan.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Data sources and definitions

Variable | Description | Sources |

|---|---|---|

Country-specific data | ||

Uncertainty aversion | Uncertainty aversion indicator—UAI. Higher values reflect higher national uncertainty aversion | Hofstede (2001) |

Individualism | Individualism indicator—IDV. Higher values reflect higher national individualism | Hofstede (2001) |

Power distance | Power distance—PDI. Higher values reflect higher national power distance | Hofstede (2001) |

Masculinity | Masculinity—MAS. Higher values reflect higher national masculinity | Hofstede (2001) |

Religion | Religion | Shackman (2009) |

Legal origin | Legal origin variable separating countries into: French, German, Scandinavian, Socialist, and British legal origin | Glaeser and Shleifer (2002) |

Rule of law | Captures perceptions of the extent to which agents have confidence in and abide by the rules of society, and in particular the quality of contract enforcement, property rights, the police, and the courts, as well as the likelihood of crime and violence | Worldwide Governance Indicators, World Bank |

Control of corruption | Captures perceptions of the extent to which public power is exercised for private gain, including both petty and grand forms of corruption, as well as “capture” of the state by elites and private interests | Worldwide Governance Indicators, World Bank |

Corruption | Alternative measure of the corruption level | Transparency International |

Regulatory quality | Captures perceptions of the ability of the government to formulate and implement sound policies and regulations that permit and promote private sector development | Worldwide Governance Indicators, World Bank |

Government effectiveness | Captures perceptions of the quality of public services, the quality of the civil service and the degree of its independence from political pressures, the quality of policy formulation and implementation, and the credibility of the government’s commitment to such policies | Worldwide Governance Indicators, World Bank |

Voice and accountability | Reflects perceptions of the extent to which a country’s citizens are able to participate in selecting their government, as well as freedom of expression, freedom of association, and a free media | Worldwide Governance Indicators, World Bank |

Political stability | Captures perceptions of the likelihood that the government will be destabilized or overthrown by unconstitutional or violent means, including politically motivated violence and terrorism | Worldwide Governance Indicators, World Bank |

Formal institution index | Index of quality of formal institutions, calculated by the formula: Formal institutions = [rule of law × 0.4248 + government effectiveness × 0.4198 + control of corruption × 0.4187 + regulatory quality × 0.4093 + political stability × 0.3954 + accountability × 0.3797] | Li and Zahra (2012); Author’s calculations |

Creditor rights | An index aggregating creditor rights, following La Porta et al. (1997, 1998). The index ranges from 0 (weak creditor rights) to 4 (strong creditor rights) | |

Property rights | Index of property rights in 2004 | The Heritage Foundation, http://www.heritage.org/Index/ |

Legal protect. of minority shareholders (shareholder rights) | An index measuring the legal protection of minority shareholders against expropriation by corporate insiders. Named the anti-self-dealing index in Djankov et al. (2008) | Djankov et al. (2008) |

Disclosure requirements index | ||

Efficiency of debt enforcement | Variable “Case A Efficiency” | Djankov et al. (2008) |

Enforceability of contracts | Index measuring enforceability of contracts | Djankov et al. (2008) |

Bankruptcy costs | Assessment of the efficiency of bankruptcy law. Scale from 0 to 6, where higher scores indicate higher compliance | Worldwide Governance Indicators, World Bank |

Propensity to file for bankruptcy | Index calculated as the inverse of bankruptcy costs | Author’s calculations |

Economic development | GDP per capita | International Finance Statistics |

Industry-level data | ||

SIC Classification | 2, 3, and 4 letter standard industrial classification | US Department of Labor |

Stock price informativeness | 1-R2 of regressing firm’s returns on industry-specific returns and market-specific returns simultaneously | Author’s calculations |

Industry opacity | ln (1- R2/R2) | Author’s calculations |

Industry diversification | Index that measures the diversity of industrial activities | Author’s calculations |

Industry concentration | Herfindahl index which measures the amount of competition among firms within an industry | Author’s calculations |

Industry competition | The inverse of industry concentration | Author’s calculations |

Concentration in highly opaque industries | Herfindahl index which measures the amount of competition among firms within opaque industries (industries whose informational opacity is higher than 3.5) | Author’s calculations |

Concentration in less opaque industries | Herfindahl index which measures the amount of competition among firms in less opaque industries (industries whose informational opacity is lower than 3.5) | Author’s calculations |

Firm-level data | ||

All firm-level data | All firm-level data | CVU Database constructed by the Macro-Finance Research Unit at the IMF (original data from Datastream, Worldscope, Bankscope) |

Z-score | (Return on assets + capital-asset ratio)/standard deviation of return on assets | Author’s calculations |

z-score | ln(Z-score) | Author’s calculations |

σ (ROA) | Standard deviation of return on assets | Author’s calculations |

R&D expenditures | Expenditures on research and development divided by total firm market share | CVU |

Firm size | Log of total assets, where total assets is the sum of fixes and current assets | CVU |

Firm leverage | Leverage, which is defined as the ratio of total liabilities (current and noncurrent liabilities) to total assets | CVU |

Profitability | Profitability, measured as the firm’s return on assets (ROA) and calculated as the ratio of earnings (EBIT) to total assets | CVU |

Sales growth | Sales growth, calculated as the annual logarithmic growth of sales | CVU |

Dependence on external finance | Dependence on external finance, proxied by the Rajan–Zingales index (Rajan and Zingales 1998) | CVU |

Appendix 2: Summary statistics tables

Rights and permissions

About this article

Cite this article

Mihet, R. Effects of culture on firm risk-taking: a cross-country and cross-industry analysis. J Cult Econ 37, 109–151 (2013). https://doi.org/10.1007/s10824-012-9186-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10824-012-9186-2