Abstract

Almost $4 trillion dollars of wealth is currently held by families with a life expectancy of less than 10 years. When that wealth is inherited, will it be retained or spent quickly? Results from the NLSY79, a longitudinal survey covering people in their 20s, 30s, and 40s suggest roughly half of all money inherited is saved and the other half spent or lost investing. These spending and saving decisions are made by a concentrated group with about one-fifth of all families getting an inheritance and about one-seventh expecting to receive an inheritance. Suggestions to increase savings from inheritances are discussed.

Similar content being viewed by others

Notes

In 2007 the estate tax was paid by the estates of 17,416 deceased individuals and raised $26 billion out of the $2.6 trillion of federal revenue, which is about 1% of federal income.

In 2001 the maximum tax rate was 50%. This rate was steadily lowered over time with a rate of 46% in 2006 and then 45% in 2007, 2008 and 2009. For 2010 to 2012 the rate is 35%. In 2006, 2007 and 2008 the exemption amount was $2 million. In 2009 the exemption was $3 million. For 2010 to 2012 the amount is $5 million.

For example, assume two people each earned $10 million during their lifetime. If the first person consumed all of his earnings, there would be no inheritance taxes since there is no estate. If the second person saved half his earnings then his heirs are taxed on $5 million. By taxing the second person, who consumed less, the government penalizes savings.

While winners might not save their prizes, they were happier 2 years after winning than non-winners (Gardner and Oswald 2007).

Research by Waldkirch et al. (2004) suggested many individuals follow the spending and saving habits of their parents, even after adjusting for income differences.

Contributions made by someone else, such as company matches to a defined contribution plan, are not included in the model since the NLSY79 data set does not track this information.

The SCF is comprised of two samples; a random cross-section and an over-sample with very high income. Using the survey weights ensures the over-sample’s responses do not bias the results and enables this research’s tables and graphs to be interpreted as national figures.

The SCF tracks up to four inheritances. Most U.S. families (75.8% in 2007) report just one inheritance.

Havens and Schervish (2003) estimated that 60% of transferred wealth goes to heirs and 40% to charity, taxes, and estate settlement expenses.

Respondents who are confused by the term total market value are told the following definition. “Market value is defined as how much the respondent would reasonably expect someone else to pay if the item(s) were sold today in its/their present condition: not the original price paid for the item(s).”

In the 1996 and 1998 surveys the questions asked if the respondent received money in 1995 and 1997. Because the surveys were biennial in 1996 and 1998, respondents were not directly asked about inheritances in 1994 and 1996.

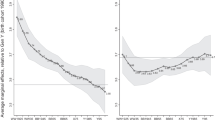

Graphically, the data suggest the savings-inheritance relationship was very different when low amounts are inherited compared to high. To search for the best place for a structural break a series of rolling Chow tests were used. The Chow tests reached their highest point of significance (F = 3.92) slightly above $10,000.

References

Alessie, R., & Kapteyn, A. (2001). New data for understanding saving. Oxford Review of Economic Policy, 17(1), 55–69.

Allison, P. (1995). Survival analysis using the SAS system, a practical guide. Cary: SAS Institute.

Arias, E. (2007). United States life tables, 2004. National Vital Statistics Reports 56(9).

Arrondel, L., & Masson, A. (2001). Family transfers involving three generations. The Scandinavian Journal of Economics, 103(3), 415–443.

Behrman, J. R., & Rosenzweig, M. R. (2004). Parental allocations to children: New evidence on bequest differences among siblings. Review of Economics and Statistics, 86(2), 637–640.

Browning, M., & Lusardi, A. (1996). Household saving: Micro theories and micro facts. Journal of Economic Literature, 34(4), 1797–1855.

Bucks, B., Kennickell, A., & Moore, K. (2006). Recent changes in U.S. family finances: Evidence from the 2001 and 2004 survey of consumer finances. Federal Reserve Bulletin, 92(February), A1–A38.

Canterbery, E. R., & Nosari, E. J. (1985). The forbes four hundred: The determinants of super-wealth. Southern Economic Journal, 51(4), 1073–1083.

Caputo, R. K. (2002). Adult daughters as parental caregivers: Rational actors versus rational agents. Journal of Family and Economic Issues, 23(1), 27–50.

Chan, K.-B. (2010). Father, son, wife, husband: Philanthropy as exchange and balance. Journal of Family and Economic Issues, 31(3), 387–395.

Clotfelter, C. T., & Cook, P. J. (1990). On the economics of state lotteries. Journal of Economic Perspectives, 4(4), 105–119.

Coleman, M., & Ganong, L. H. (1998). Attitudes toward inheritance following divorce and remarriage. Journal of Family and Economic Issues, 19(4), 289–314.

Collins, J. M. (2007). Exploring the design of financial counseling for mortgage borrowers in default. Journal of Family and Economic Issues, 28(2), 207–226.

Davies, S. (2011). What motivates gifts? Intra-family transfers in rural Malawi. Journal of Family and Economic Issues, 32(3), 473–492.

Dunn, T. A., & Phillips, J. W. (1997). The timing and division of parental transfers to children. Economics Letters, 54(2), 135–137.

Gardner, J., & Oswald, A. J. (2007). Money and mental wellbeing: A longitudinal study of medium-sized lottery wins. Journal of Health Economics, 26(1), 49–60.

Goetting, M., & Martin, P. (2001). Characteristics of older adults with written wills. Journal of Family and Economic Issues, 22(3), 243–264.

Gouskova, E., Chiteji, N., & Stafford, F. (2010). Pension participation: Do parents transmit time preference? Journal of Family and Economic Issues, 31(2), 138–150.

Hankins, S., Hoekstra, M., & Skiba, P. (2009). The ticket to easy street? The financial consequences of winning the lottery. University of Pittsburgh, Department of Economics, Working Papers, p. 344.

Havens, J., & Schervish, P. (2003). Why the $41 trillion wealth transfer estimate is still valid: A review of challenges and questions. Journal of Gift Planning, 7(1), 11–15. 47-50.

Hayhoe, C., & Stevenson, M. (2007). Financial attitudes and inter vivos resource transfers from older parents to adult children. Journal of Family and Economic Issues, 28(1), 123–135.

Holtz-Eakin, D., Joulfaian, D., & Rosen, H. S. (1993). The Carnegie conjecture: Some empirical evidence. Quarterly Journal of Economics, 108(2), 413–435.

Hube, K. (2006, Jan 23). Money matters; No, thanks: Sometimes, refusing a windfall can be a wise move; Here’s how to do it. The Wall Street Journal.

Hurd, M. (1989). Mortality risk and bequests. Econometrica, 57(4), 779–813.

Hurd, M., & Smith, J. (2002). Expected bequests and their distribution. Cambridge, MA: National Bureau of Economic Research, NBER Working Papers: 9142.

Imbens, G., Rubin, D., & Sacerdote, B. (2001). Estimating the effect of unearned income on labor earnings, savings, and consumption: Evidence from a survey of lottery players. The American Economic Review, 91(4), 778–794.

Jacobson, D., Raub, B., & Johnson, B. (2007). The estate tax: Ninety years and counting. SOI Bulletin, 27(1), 118–128.

Jianakoplos, N. A., Menchik, P. L., & Irvine, F. O. (1996). Saving behavior of older households: Rate-of-return, precautionary and inheritance effects. Economics Letters, 50(1), 111–120.

Johnson, B., Wahl, J., & Kalambokidis, L. (2005). The mismeasure of man’s well-being: Refining realized income measures with wealth, portfolio, and mortality information. In: Proceedings: 97th annual conference on Taxation (pp. 111–119). Washington, D.C.: National Tax Association.

Joulfaian, D. (2006). Inheritance and saving. Cambridge, MA: National Bureau of Economic Research, NBER Working Papers: 12569.

Joulfaian, D., & Wilhelm, M. O. (1994). Inheritance and labor supply. The Journal of Human Resources, 29(4), 1205–1234.

Kao, Y. E., Hong, G.-S., & Widdows, R. (1997). Bequest expectations: Evidence from the 1989 survey of consumer finances. Journal of Family and Economic Issues, 18(4), 357–377.

Kennickell, A., & Woodburn, R. L. (1999). Consistent weight design for the 1989, 1992 and 1995 SCFs and the distribution of wealth. Review of Income and Wealth, 45(2), 193–216.

Keynes, J. M. (1936). The general theory of employment, interest and money. London: MacMillan.

Kotlikoff, L. J., Munnell, A. H., & Sunden, A. (2003). The impact of gifts and bequests on aggregate saving and capital accumulation: Comment. In: A. Munnell & A. Sunden (Eds.), Death and dollars: The role of gifts and bequests in America (pp. 339–344): Washington, D.C.: Brookings Institution Press.

Kotlikoff, L. J., & Summers, L. H. (1981). The role of intergenerational transfers in aggregate capital accumulation. The Journal of Political Economy, 89(4), 706–732.

Laitner, J. (2002). Wealth inequality and altruistic bequests. The American Economic Review, 92(2), 270–273.

Light, A., & McGarry, K. (2004). Why parents play favorites: Explanations for unequal bequests. The American Economic Review, 94(5), 1669–1681.

MacDonald, M., & Koh, S.-K. (2003). Consistent motives for inter-family transfers: Simple altruism. Journal of Family and Economic Issues, 24(1), 73–97.

Mill, J. S. (1848). Principles of political economy with some of their applications to social philosophy. London: John Parker.

Modigliani, F. (1986). Life cycle, individual thrift, and the wealth of nations. The American Economic Review, 76(3), 297–313.

Moorman, D. C., & Garasky, S. (2008). Consumer debt repayment behavior as a precursor to bankruptcy. Journal of Family and Economic Issues, 29(2), 219–233.

Mulligan, C. B. (1999). Galton versus the human capital approach to inheritance. The Journal of Political Economy, 107(6), S184–S224.

Pabilonia, S. W. (2001). Evidence on youth employment, earnings, and parental transfers in the National Longitudinal Survey of Youth 1997. The Journal of Human Resources, 36(4), 795–822.

Ponthiere, G. (2011). Mortality, family and lifestyles. Journal of Family and Economic Issues, 32(2), 175–190.

Stum, M. S. (2000). Families and inheritance decisions: Examining non-titled property transfers. Journal of Family and Economic Issues, 21(2), 177–202.

Tachibanaki, T. (1994). Savings and bequests (pp. 1–13). Ann Arbor: University of Michigan Press.

United States Congress. (2001). Economic growth and tax relief reconciliation act of 2001, 107-16 115 Statute 38.

United States Congress. (2010). Tax relief, unemployment insurance reauthorization, and job creation act of 2010, H.R. 4853 101-802.

Waldkirch, A., Ng, S., & Cox, D. (2004). Intergenerational linkages in consumption behavior. The Journal of Human Resources, 39(2), 355–381.

Warneryd, K.-E. (1999). The psychology of saving: A study on economic psychology. Cheltenham, U.K.: Edward Elgar.

Wall Street Journal. (2010, Sept. 20). What Should We Do With The Estate Tax? Editorial, p. R1.

Wolff, E. N. (1999). Wealth accumulation by age cohort in the U.S., 1962–1992: The role of savings, capital gains and intergenerational transfers. Geneva Papers on Risk and Insurance: Issues and Practice, 24(1), 27–49.

Worthy, S. L., Jonkman, J., & Blinn-Pike, L. (2010). Sensation-seeking, risk-taking, and problematic financial behaviors of college students. Journal of Family and Economic Issues, 31(2), 161–170.

Yilmazer, T. (2008). Saving for children’s college education: An empirical analysis of the trade-off between the quality and quantity of children. Journal of Family and Economic Issues, 29(2), 307–324.

Zagorsky, J. L. (1999). Young baby boomers’ wealth. Review of Income and Wealth, 45(2), 135–156.

Zagorsky, J. L. (2007). Do you have to be smart to be rich? The impact of IQ on wealth, income and financial distress. Intelligence, 35(5), 489–501.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Zagorsky, J.L. Do People Save or Spend Their Inheritances? Understanding What Happens to Inherited Wealth. J Fam Econ Iss 34, 64–76 (2013). https://doi.org/10.1007/s10834-012-9299-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-012-9299-y