Abstract

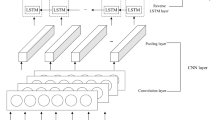

Stock market is a dynamic and volatile market that is considered as time series data. The growth of financial data exposed the computational efficiency of the conventional systems. This paper proposed a hybrid deep learning model based on Long Short- Term Memory (LSTM) and Artificial Bee Colony (ABC) algorithm. ABC is best fit for hyper parameter selection for deep LSTM models and maintains the equilibrium of exploitation and exploration issues. Handling a large volume of multidimensional reviews from social media is a major challenge. This paper evolves the multiple aspects of market sentiments and uses the reliable Big data platform Hadoop ecosystem and its services to compute sentiment polarity index. The ABC-LSTM hybrid model is validated with other core and hybrid models with evolutionary algorithms as Differential Evolution (DE) and Genetic Algorithm (GA). For the experiments, 10 years of historical datasets and social media reviews of IT sector funds Apple Inc. (AAPL), Microsoft corporation (MSFT) and Intel corporation (INTL) from NASDAQ GS, an American stock exchange are considered to validate hybrid forecasting models. Proposed algorithm ABC-LSTM is used to tune the hyperparameters (window size, LSTM units, dropout probability, epochs, batch size and learning rate) and evaluated through Root Mean Square Error (RMSE) and Mean Absolute Percentage Error (MAPE) as loss function. Performance analysis proves that with sentiment polarity, ABC optimized LSTM obtains improved forecasting accuracy over its counterpart models.

Similar content being viewed by others

References

Ariyo, A. A., Adewumi, A. O., & Ayo, C. K. (2014, March). Stock price prediction using the ARIMA model. In 2014 UKSim-AMSS 16th International Conference on Computer Modelling and Simulation (pp. 106-112). IEEE.

Bisoi R, Dash PK, Parida AK (2019) Hybrid Variational mode decomposition and evolutionary robust kernel extreme learning machine for stock price and movement prediction on daily basis. Appl Soft Comput 74:652–678

Box GE, Jenkins GM, Reinsel GC, Ljung GM (2015) Time series analysis: forecasting and control. John Wiley & Sons

Chang PC, Wang YW, Yang WN (2004) An investigation of the hybrid forecasting models for stock price variation in Taiwan. Journal of the Chinese Institute of Industrial Engineers 21(4):358–368

Chen AS, Leung MT, Daouk H (2003) Application of neural networks to an emerging financial market: forecasting and trading the Taiwan stock index. Comput Oper Res 30(6):901–923

Dwivedi RK, Aggarwal M, Keshari SK, Kumar A (2019) Sentiment analysis and feature extraction using rule-based model (RBM), In International Conference on Innovative Computing and Communications (pp. 57–63). Springer, Singapore

Engle R (2001) GARCH 101:the use of ARCH/GARCH models in applied econometrics. J Econ Perspect 15(4):157–168

Fischer T, Krauss C (2018) Deep learning with long short-term memory networks for financial market predictions. Eur J Oper Res 270(2):654–669

Fu TC (2011) A review on time series data mining. Eng Appl Artif Intell 24(1):164–181

Göçken M, Özçalıcı M, Boru A, Dosdoğru AT (2016) Integrating metaheuristics and artificial neural networks for improved stock price prediction. Expert Syst Appl 44:320–331

Göçken M, Özçalıcı M, Boru A, Dosdoğru AT (2019) Stock price prediction using hybrid soft computing models incorporating parameter tuning and input variable selection. Neural Comput & Applic 31(2):577–592

Guresen E, Kayakutlu G, Daim TU (2011) Using artificial neural network models in stock market index prediction. Expert Syst Appl 38(8):10389–10397

Ha I, Back B, Ahn B (2015) MapReduce functions to analyze sentiment information from social big data. Int J Distributed Sensor Netw 11(6):417502

Hiransha M, Gopalakrishnan EA, Menon VK, Soman KP (2018) NSE stock market prediction using deep-learning models. Procedia computer science 132:1351–1362

Hochreiter S, Schmidhuber J (1997) Long short-term memory. Neural Comput 9(8):1735–1780

Hsieh TJ, Hsiao HF, Yeh WC (2011) Forecasting stock markets using wavelet transforms and recurrent neural networks: an integrated system based on artificial bee colony algorithm. Appl Soft Comput 11(2):2510–2525

Huang F, Zhang X, Zhao Z, Xu J, Li Z (2019) Image–text sentiment analysis via deep multimodal attentive fusion. Knowl-Based Syst 167:26–37

Jin Z, Yang Y, Liu Y (2019) Stock closing price prediction based on sentiment analysis and LSTM. Neural Comput & Applic, 1-17.

Karaboga D (2005) An idea based on honeybee swarm for numerical optimization (Vol. 200, pp. 1-10). Technical report-tr06, Erciyes university, engineering faculty, computer engineering department.

Karaboga D, Ozturk C (2009) Neural networks training by artificial bee colony algorithm on pattern classification. Neural Network World 19(3):279

Karaboga D, Gorkemli B, Ozturk C, Karaboga N (2014) A comprehensive survey: artificial bee colony (ABC) algorithm and applications. Artif Intell Rev 42(1):21–57

Karathanasopoulos, A., Sovan, M., Chun Lo, C., Zaremba, A., & Osman, M. (2019). Ensemble models in forecasting financial markets. J Comput Finan, Forthcoming

Kumar R, Gupta A, Mishra A Design of Ensemble Learning Model to diagnose malaria disease using convolutional neural network. In International Conference on Innovative Computing and Communications (pp. 1165-1176). Springer. Singapore.

Kusuma RMI, Ho TT, Kao WC, Ou YY, Hua KL (2019) Using deep learning neural networks and candlestick chart representation to predict stock market. arXiv preprint arXiv:1903.12258.

Marmer V (2008) Nonlinearity, nonstationarity, and spurious forecasts. J Econ 142(1):1–27

Mernik M, Liu SH, Karaboga D, Črepinšek M (2015) On clarifying misconceptions when comparing variants of the artificial bee Colony algorithm by offering a new implementation. Inf Sci 291:115–127

Nikfarjam A, Emadzadeh E, Muthaiyah S (2010, February) Text mining approaches for stock market prediction. In 2010 The 2nd international conference on computer and automation engineering (ICCAE) (Vol. 4, pp. 256-260). IEEE.

Radha S, Thenmozhi M (2006) Forecasting short term interest rates using ARMA, ARMA-GARCH and ARMA-EGARCH models. In Indian Institute of Capital Markets 9th Capital Markets Conference Paper.

Rodrigues AP, Chiplunkar NN (2018) Real-time twitter data analysis using Hadoop ecosystem. Cogent Eng 5(1):1534519

Ruan Y, Durresi A, Alfantoukh L (2018) Using twitter trust network for stock market analysis. Knowl-Based Syst 145:207–218

Singh R, Srivastava S (2017) Stock prediction using deep learning. Multimed Tools Appl 76(18):18569–18584

Skuza M, Romanowski A (2015, September). Sentiment analysis of twitter data within big data distributed environment for stock prediction. In 2015 Federated Conference on Computer Science and Information Systems (FedCSIS) (pp. 1349-1354). IEEE.

Wang W (2018) A big data framework for stock price forecasting using fuzzy time series. Multimed Tools Appl 77(8):10123–10134

Wang L, Zeng Y, Chen T (2015) Back propagation neural network with adaptive differential evolution algorithm for time series forecasting. Expert Syst Appl 42(2):855–863

Wei LY, Cheng CH (2012) A hybrid recurrent neural networks model based on synthesis features to forecast the Taiwan stock market. Int J Innov Comput Inf Control 8(8):5559–5571

Xu J, Li Z, Huang F, Li C, Philip SY (2020) Social image sentiment analysis by exploiting multimodal content and heterogeneous relations. IEEE Trans Industr Inform

Yang F, Chen Z, Li J, Tang L (2019) A novel hybrid stock selection method with stock prediction. Appl Soft Comput 80:820–831

Yang R, Yu L, Zhao Y, Yu H, Xu G, Wu Y, Liu Z (2020) Big data analytics for financial market volatility forecast based on support vector machine. Int J Inf Manag 50:452–462

Zhou F, Zhou HM, Yang Z, Yang L (2019) EMD2FNN: A strategy combining empirical mode decomposition and factorization machine based neural network for stock market trend prediction. Expert Syst Appl 115:136–151

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Kumar, R., Kumar, P. & Kumar, Y. Integrating big data driven sentiments polarity and ABC-optimized LSTM for time series forecasting. Multimed Tools Appl 81, 34595–34614 (2022). https://doi.org/10.1007/s11042-021-11029-1

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11042-021-11029-1