Abstract

This paper studies empirically the relationship between the sources of knowledge, innovation and productivity in Knowledge Intensive Business Services using French micro data and sheds some new light on the production of knowledge and on effects of innovative output on firm productivity. Both an innovation function and a production function augmented with dummy endogenous innovation are estimated. Three estimators which control for endogeneity of the dummy innovation are employed: the first is a maximum likelihood estimator of the equations’ system while the other two are built in the instrumental variables framework. These estimators give useful complementary information because of the usual efficiency-robustness tradeoff comparing system-equations and single-equation estimators. We find that innovation is frequent in Knowledge Intensive Business Services and has a strong and positive effect on productivity. As in manufacturing, the main determinant of innovation is formal knowledge resulting from R&D or from acquisitions of equipment, patents or licenses.

Similar content being viewed by others

Notes

Heckman (1978) proposes a model where both effects are admitted simultaneously.

In the CIS3 questionnaire the only available proxy for human capital is the number of employees having obtaining at least a level of education corresponding to a high school diploma.

Angrist and Krueger (2001) suggest this approach by using the Kelejian’s results (Kelejian 1971) according to whom, in two-stage least squares, consistency of the second-stage estimates does not turn on getting the first-stage functional form right. Moreover, Wooldridge (2002) indicates that when the endogenous variable is discrete, the IV-2SLS estimator can be used as it is still consistent.

Mairesse and Mohnen (2005) merging CIS 3 data with the French R&D survey find that only two percent of R&D firms in the annual survey declare to be non innovator in CIS3.

The imputation is performed by using the predicted probabilities obtained from such regressions using 0.5 as a discriminatory threshold.

We also apply the usual ML probit estimator. The results are very similar and are available on request from the authors.

Bound et al. (1995) show that if the correlation between the instruments and the endogenous explanatory variable is weak, then ever a small correlation between the instruments and the error term can produce a large inconsistency of the IV estimator.

It is worth to mention that asymptotically, increasing the number of instruments make increase the precision of the IV estimates and even in finite sample, adding (non-weak) instruments can help to reduces the standard errors of the estimates.

For a given number of instruments we report the combinations which provide the higher partial F.

References

Abramovsky L, Griffith R (2006) Outsourcing and offshoring of business services: the role of ICT. J Eur Econ Assoc 4(2–3):594–601

Aghion P, Howitt P (1998) Endogenous growth theory. MIT University Press, Cambridge

Amiti M, Wei SJ (2005) Fear of service outsourcing. Is it justified? Econ Policy, April pp 307–347

Amiti M, Wei SJ (2006) Service offshoring and productivity: evidence from the United States. NBER Working Paper, January, No. 11926

Angrist J, Krueger A (2001) Instrumental variables and the search for identification: from supply and demand to natural experiments. J Econ Perspect 69–85

Baumol WJ (1967) Macroeconomics of unbalanced growth: the anatomy of urban crisis. Am Econ Rev 57:415–426

Baumol WJ, Batey-Blackman SA, Wolff EN (1985) Unbalanced growth revisited: asymptotic stagnancy and new evidence. Am Econ Rev 75:806–817

Benavente JM (2006) The role of research and innovation in promoting productivity in Chile. Econ Innov New Technol 15:301–315

Blackorby C, Knox Lovell CA, Thursby C (1976) Extended hicks neutral technical change. Econ J 86:845–852

Bound J, Jaeger DA, Baker R (1995) Problems with instrumental variables estimation when the correlation between the instruments and the endogeneous explanatory variable is weak. J Am Stat Assoc 90:443–450

Broersma L, McGuckin RH, Timmer MP (2003) The impact of computers on productivity in the trade sector: explorations with Dutch microdata. De Econ 151(1):53–79

Broersma L, van Ark B (2007) ICT, business services and labour productivity growth. Econ Innov New Technol 16(6):433–449

Chudnovsky D, Lopez A, Pupato G (2006) Innovation and productivity in developing countries: a study of Argentine manufacturing firms behavior (1992–2001). Res Policy 35:266–288

Cohen WM, Levinthal DA (1989) Innovation and learning: the two faces of R&D. Econ J 99:569–596

Crépon B, Duguet E, et Mairesse J (1998) Research investment, innovation and productivity: an econometric analysis. Econ Innov New Technol 7:115–158

Den Hertog P (2000) Knowledge-intensive business services as co-producers of innovation. Int J Innov Manag 4(4):491–528

Duguet E (2006) Innovation height, spillovers and TFP growth at the firm level: evidence from French manufacturing. Econ Innov New Technol 15:415–442

Falk M, Koebel B (2002) Outsourcing, imports and labour demand. Scand J Econ 104(4):567–586

Feenstra RC, Hanson GH (1996) Globalizaton, outsourcing and wage inequality. Am Econ Rev 86(2):240–245

Girma S, Görg H (2004) Outsourcing, foreign ownership and productivity: evidence from UK establishment level data. Rev Int Econ 12(5):817–832

Goldman S, Uzawa H (1964) A note on separability in demand analysis. Econometrica 32:387–398

Griffith R, Huergo E, Mairesse J, Peters B (2006) Innovation and productivity across four euroopean countries. Oxf Rev Econ Policy 22(4):483–498

Griliches Z (1979) Issues in assessing the contribution of R&D to productivity growth. Bell J Econ 92–116

Griliches Z, Mairesse J (1983) Comparing productivity growth: an exploration of French and US industrial and firm data. Eur Econ Rev Elsevier 21(1–2):89–119

Hahn J, Hausman J (2003) Weak instruments: diagnosis and cures in empirical econometrics. Am Econ Rev 932:118–125

Hall B, Mairesse J (2006) Empirical studies of innovation in the knowledge driven economy: introduction. Econ Innov New Technol 154/5:289–299

Heckman J (1978) Dummy endogenous variables in a simultaneous equation system. Econometrica 46:931–959

Hill P (1999) Tangibles, intangibles and services: a new taxonomy for the classification of output. Can J Econ 32:426–446

Janz N, Lööf H, Peters B (2004) Innovation and productivity in German and Swedish manufacturing firms: is there a common story? Probl Perspect Manag 2:184–204

Jefferson G, Huamao B, Xiaojing G, Xiaoyun Y (2006) R&D performance in Chinese industry. Econ Innov New Technol, 154/5. 345–366; Special Issue On Empirical Studies of Innovation in the Knowledge Driven Economy

Kelejian HH (1971) Two-stage least squares and econometric systems linear in parameters but nonlinear in the endogenous variables. J Am Stat Assoc 66:373–374

Koch A, Strotmann H (2008) Absorptive capacity and innovation in the knowledge intensive business sector. Econ Innov New Technol 17(6):511–531

Klomp L, Van Leeuwen G (2001) Linking innovation and firm performance: a new approach. Int J Econ Bus 83:343–364

Leontief W (1947) Introduction to the internal structure of functional relationships. Econometrica 15:361–373

Licht G, Moch D (1999) Innovation and information technology in services. Can J Econ 32(2):363–383

Lööf H, Heshmati A (2002) Knowledge capital and performance heterogeneity: a firm-level innovation study. Int J Prod Econ 761:61–85

Lööf H, Heshmati A (2006) On the relationship between innovation and performance: a sensitivity analysis. Econ Innov New Technol 15:317–344

Lööf H, Heshmati A, Asplund R, Näs SO (2003) Innovation and performance in manufacturing industries: a comparison of the Nordic countries. Int J Manag Res 2:5–36

Maddala GS (1983) Limited-dependent and qualitative variables in econometrics. Cambridge University Press, Cambridge

Mairesse J, Mohnen P (2005) The importance of R&D for innovation: a reassessment using French survey data. J Technol Transf 30(1–2):183–197

Mairesse J, Robin S (2008) Innovation and productivity: a firm-level analysisfor French manufacturing and services using CIS3 and CIS4 data (1998–2000 and 2002–2004), Unpublished paper

Masso J, Vahter P (2008) Technological innovation and productivity in late-transition Estonia: econometric evidence from innovation surveys. Eur J Dev Res 20(2):240–261

Minisian J (1962) Research and development, production functions and rates of returns. Am Econ Rev 492:80–85

Miozzo M, Grimshaw DP (2006) Knowledge intensive business services. Edward Elgar, Cheltenham

Mohnen P, Mairesse J (2002) Accounting for innovation and measuring innovativeness : an illustrative framework and an application. Am Econ Rev Pap Proc 92(2):226–230

Muller E, Zenker A (2001) Business services as actors of knowledge transformation: the role of KIBS in regional and national innovation systems. Res Policy 30:1501–1516

OECD (2000) The service economy. Paris

OECD (2005) Promoting innovation in services, STI Working-Paper 2004/4

OECD STAN (2003) OECD structural analysis statistics database

Ornaghi C (2006) Spillovers in product and process innovation: evidence from manufacturing firm. Int J Ind Org 24, 349–380

Pagan A (1984) Econometric issues in the analysis of regressions with generated regressors. Int Econ Rev 25:221–247

Pagan A (1986) Two stage and related estimators and their applications. Rev Econ Stud 53:517–538

Pakes P, Griliches Z (1984). Patents and R&D at the firm level: a first look. In: Griliches Z (ed) R&D, patents, and productivity. Chicago University Press, Chicago, pp 55–71

Parisi ML, Schiantarelli F, Sembenelli A (2006) Productivity, innovation and R&D: micro evidence for Italy. Eur Econ Rev 50:2037–2061

Pilat D, Wölfl D (2005) Measuring the interaction between manufacturing and services. OECD DSTI 2005/5

Rodriguez M, Camacho JA (2008) Are KIBS more than intermediate inputs? An examination into their R&D diffuser role in Europe. Int J Serv Technol Manag 10(2–4):254–272

Schmookler JA (1962) Economic sources of inventive activity. J Econ Hist 22:1–10

Schumpeter JA (1912) Theory of economic development. Harvard University Press, Cambridge

Soete L, Miozzo M (2001) Internationalization of services: a technological perspective. Technol Forecast Soc Chang 67:159–185

Staiger D, Stock JH (1997) Instrumental variables regression with weak instruments. Econometrica 65:557–586

Tidd J, Bessant J, Pavitt K (1997) Managing innovations: integrating technological, market and organizational change. Wiley, Chichester

Triplett JE, Bosworth BP (2003) Productivity measurement issues in services industries: Baumol’s Disease has been cured. Fed Reserv Bank N Y Econ Policy Rev 9(3):23–33

Van Leeuwen G, Klomp L (2006) On the contribution of innovation to multi-factor productivity growth. Econ Innov New Technol, Taylor Francis J 15(4–5):367–390

Vaona A, Pianta M (2008) Firm size and innovation in European manufacturing. Small Bus Econ 30:283–299

Wakelin K (2001) Productivity growth and R&D expenditure in UK manufacturing firms. Res Policy 30:1079–1090

White H (1980) A heteroskedasticity consistent covariance matrix estimator and a direct test of heteroskedasticity. Econometrica 48:817-838

White H (1982) Maximum likelihood estimation of misspecified models. Econometrica 50:1–25

Wieser R (2005) Research and development productivity and spillovers: empirical evidence at the firm level. J Econ Surv 19(4):587–621

Wölfl A (2005) The service economy in OECD countries. OECD STI wp 2005/3

Wooldridge JM (2002) Econometric analysis of cross section and panel data. MIT Press, Cambridge

Acknowledgments

We thank Pierre Blanchard, Bertrand Koebel, Jean-Philippe Lesne, Claude Mathieu, Pierre Mohnen, Stéphane Robin, Patrick Sevestre, two anonymous referees and an associate editor of this review for useful comments. Any remaining errors are ours.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix: the data

1.1 Industry coverage of French CIS

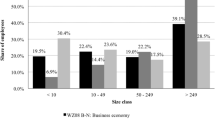

The first Community Innovation Survey, CIS1, was carried out in 1991 on the basis of first version of the Oslo Manual and covers only the manufacturing sector. Services have been included since the second wave of the survey, CIS2 which covers several non-personal market services (NACE 60, 61, 62, 64.2) and business services (NACE 72, 74.2), while CIS3 covers only computer and related activities (NACE 72), other business activities (NACE 74.2, 74.3) and post and telecommunications (NACE 64). For the estimation of the model using CIS3 data, the empirical delimitation of KIBS is thus: computer and related activities (NACE 72), Architectural and engineering activities (NACE 74.2), checking and analyses techniques (NACE 74.3) and telecommunications (NACE 64.2). The inclusion of telecommunications—which is not strictly speaking a business activity—is related to the technological and innovative contents of such activities (see Table 7).

1.2 Variable definitions

1.2.1 Innovation

Five estimations of the innovation function are performed corresponding to the different definitions of innovation:

-

I1: Binary variable (yes/no) for any kind of innovation (“either” innovation);

-

I2: Binary variable (yes/no) for product innovation;

-

I3: Binary variable (yes/no) for process innovation;

-

I4: Binary variable (yes/no) for technological innovation;

-

I5: Binary variable (yes/no) for non technological innovation.

The French CIS3 questionnaire does not contain any direct question relating to the introduction of a technological or a non technological innovation in the same way as it does for product and process innovation. However, when a firm introduces a product or a process innovation it has to declare whether this innovation is technologically new. We use this information to build technological and non technological innovation indicators.

1.2.2 Knowledge inputs

The CIS3 survey provides several variables that we label knowledge inputs:

with:

-

r1: R&D internal activity (yes/no) “All creative work undertaken within your enterprise on a systematic basis in order to increase the stock of knowledge, and the use of this stock of knowledge to devise new applications, such as new and improved products (goods/ services) and processes (including software research”;

-

r2: R&D external subcontracted activity (yes/no) “Same activities as above, but performed by other companies (including other enterprises within the group) or other public orprivate research organisations”;

-

r3: Other expenditures associated with knowledge acquisition (patents, licenses, training, etc.) (yes/no) “Advanced machinery, computer hardware specifically purchased to implement new or significantly improved products (goods/services) and/or processes. Purchase of rights to use patents and non-patented inventions, licenses, know-how, trademarks, software and other types of knowledge from others for use in your enterprise’s innovations. Internal or external training for your personnel directly aimed at the development and/or introduction of innovations”;

-

k1: Internal sources of knowledge (at firm level) (yes/no) “Within the enterprise”;

-

k2: Internal sources of knowledge (at corporate level) (yes/no) “Other enterprises within the enterprise group”;

-

k3: External sources of knowledge, linked to the market (suppliers, customers, competitors) (yes/no) “Suppliers of equipment, materials, components or software, Clients or customers, Competitors and other enterprises from the same industry”;

-

k4: External sources of knowledge, issued from Public research (yes/no) “Universities or other higher education institutes, Government or private non-profit research institutes”;

-

k5: Other External sources of knowledge (Conferences, Articles, Meetings) (yes/no) “Professional conferences, meetings, journals, Fairs, exhibitions”;

-

c: Cooperation for innovation (yes/no) “Innovation co-operation means active participation in joint R&D and other innovation projects with other organisations (either other enterprises or noncommercial institutions). It does not necessarily imply that both partners derive immediate commercial benefit from the venture. Pure contracting out of work, where there is no active collaboration, is not regarded as co-operation. Did your enterprise have any co-operation arrangements on innovation activities with other enterprises or institutions during 1998–2000?”;

-

p: Public fundings for innovation (yes/no) “Public funding includes financial support in terms of grants and loans, including a subsidy element, and loan guarantees. Ordinary payments for orders of public customers shall not be included. Did your enterprise receive any public financial support for innovation activities during the period 1998–2000?”.

1.2.3 Absorptive capacity factors

Absorptive capacity factors:

with:

-

l96: the size of the firm measured through the number of employees in 1996;

-

τ1: the demand pull effect (yes/no) “For your enterprise, the introduction of an innovation is determined by the market pull”;

-

τ2: the technology push effect (yes/no) “For your enterprise, the introduction of an innovation is determined by advances in technological knowledge”;

-

τ3: the non-technological knowledge push effect “For your enterprise, the introduction of an innovation is determined by advances in non technological knowledge”;

-

m : the market level of the firm (region, country, Europe, international) “What is your enterprise’s most significant market?”;

-

o change of the status or organization of the firm (yes/no) “Creation, mergers, functional out-sourcing or new management methods implementation” ;

-

s: the industry affiliation of the firm, according to the three digit NACE classification.

Using both kinds of inputs, our vector z = (z 1 , z 2 ) of inputs is defined as:

1.2.4 Production function

-

y: value added;

-

l: number of employees;

-

c: investments in physical capital.

Missing values due to the filter: some robustness checks

The CIS3 French questionnaire is structured in such a way that the firms that have not engaged into an innovative project (having innovated, having introduced organisational change or having ongoing or abandoned innovation activities) over the period have not to answer to a number of questions, typically relating to the inputs of innovation as R&D, machinery, internal and external sources of knowledge, etc. In our sample about 1/3 of all firms have missing values due to the filter for many relevant variables.

We deal with this issue by imputing the missing values. This is done by using probit regression with sample selection to estimate the likelihood of using R&D or another source of knowledge. As explanatory variables we use firm-specific variables available for all firms, such as size, sectoral dummies, affiliation with a corporation, export rate and market level. The imputation of non responses is performed by using the predicted probabilities obtained from such regressions using 0.5 as a discriminatory threshold (see also Sect. 5.3).

In order to provide some robustness checks, alternative approaches have been followed. Firstly, imputation has been done by assuming that firms which do not innovate also do not use any sources of knowledge. A possible limitation of such approach is that it could not be appropriate for inputs other than R&D as the acquisition of machinery, equipments, software or other external sources of knowledge: it seems a very strong and unrealistic assumption to consider that these inputs are absent in firms which have not engaged into an innovative project.

Secondly, another way to deal with this problem is to estimate the model only on the sub-sample of firms which have an innovative project, and hence are asked the questions about R&D and other inputs. A first drawback of this approach is that it introduces a quite severe selection bias. Secondly, the large majority of firms engaged into an innovative project successfully innovate. This implies that there are very few 0s in the innovation function and in this case it cannot be estimated in a straightforward way.

Many non reported estimates (available upon request) have been performed. First, we adopt the quite common practice of inputting zero values for the innovation inputs as long as the firm declared that it was not engaged into an innovative project. While the estimated coefficient of internal R&D is comparable both in terms of magnitude and significance compared with that obtained in our preferred estimates in Table 2, the estimated coefficient of other inputs as external R&D, machinery, equipment, software become in many cases non significant and this could be due to the underling assumption of such imputation.

Secondly, the innovation function has been estimated on the subsample of firms engaged into an innovative activity using both the usual probit and the scobit methods. In both cases we obtain non satisfactory results: almost all innovation inputs do not significantly affect the propensity to innovate in the probit regression while in the estimation of the scobit regression, in many cases the Newton-Raphson algorithm does not converge. When it does, we find a non significant effect of external R&D and other external sources of knowledge.

This analysis suggest that among such different strategies to deal with the filter of the CIS questionnaire, that adopted in this paper provides the more credible and satisfactory results.

2.1 The choice of instruments and sensitivity analysis

The choice of the instruments is crucial because is related with the size of the finite sample bias and with the precision of the IV estimates (Bound et al. 1995; Staiger and Stock 1997; Hann and Hausmann 2003). With respect to the bias of the IV-2SLS estimator, it has been shown that it decreases as the sample size increases, as the multiple correlation between the instruments and the endogenous explanatory variable increases, and as the degree of over-identification (the number of instruments) decreasesFootnote 7. Consequently, it is important to avoid the use of instruments weakly correlated with the endogenous variable. Moreover the use of “weak instruments” is likely to produces estimates with large standard errorsFootnote 8.

These results and the relative small size of our sample suggest to use a small number of “strong instruments”. The instruments used in our preferred estimates (Table 4) have been chosen as follows: first, we run a OLS regression d on \({\ln}\, x_{1},\ldots,\ln\, x_{m},z_{1},\ldots,z_{l}\) and use the backward selection algorithm to exclude the weak instruments across the z 1,…, z l . We choose a quite high level of significance, that is 0, 001.

It can be interesting to check the sensitivity of the estimated coefficient of innovation on the choice of the instruments’ set. Various estimates are provided in Table 8 which is organised as follows. Regression (i) reproduces our preferred estimates which have been carried out by selecting the instruments as described above. Regressions (ii) to (ix) use other set of instruments ranging from a minimum of 3 to a maximum of 7 instruments Footnote 9.

These results shows a very robust picture: in all cases both the magnitude of the estimated coefficient and the significance level are stable across the different specifications. Moreover, in all cases the instruments are found to be orthogonal to the error process.

In particular the coefficients of innovation tout court, product innovation and technological innovation are very stable, always significant and are estimated at about 0.2, 0.25 and 0.25, respectively. It is also worth noting that even if the first-step results indicate high correlated instruments for the three kinds of innovation, such correlation decreases passing from a broad definition of innovation (innovation tout court) to a narrow definition of innovation.

At the opposite, the coefficients of process innovation and non technological innovation are non significant in almost all specifications. The parameter associated to non technological innovation presents a high variability ranging from 0.32 to 0.55.

Rights and permissions

About this article

Cite this article

Musolesi, A., Huiban, JP. Innovation and productivity in knowledge intensive business services. J Prod Anal 34, 63–81 (2010). https://doi.org/10.1007/s11123-009-0163-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11123-009-0163-5