Abstract

The literature finds that pure price cap regulation (PCR) is a high-powered regulatory regime because it elicits the first-best level of cost-reducing effort. Conversely, the regulated firm underinvests in cost-reducing effort under PCR with earnings sharing. These findings, while standard in the literature, do not consider the strategic behavior of the regulator ex post. When the regulator controls competitive entry and the Hope standard applies the regulated firm is no longer the residual claimant for its efficiency gains even under pure PCR. The findings of the literature are reversed in this setting. The power of the regulatory regime may be higher under PCR with earnings sharing than under pure PCR. In fact, over a wide range of welfare weights, equilibrium investment in cost-reducing effort is zero under pure PCR. This may explain why the empirical evidence on the efficiency gains from PCR falls short of an unequivocal validation of the theory.

Similar content being viewed by others

Notes

See Federal Power Commission vs. Hope Natural Gas Co., 320 U.S. 591, 603, 605 (1944).

Braeutigam and Panzar (1993, p. 194) recognized the possibility that regulatory appropriation under PCR may enjoy legal protection. Specifically, regulators can appeal to the Hope standard for the authority to appropriate “excess returns” under PCR. The Federal Communications Commission (2001, p. 13) invoked these very arguments in contending that its rate methodology for unbundled network elements was not confiscatory because “the incumbents have continued to enjoy generous returns, on both their interstate and intrastate activities, in the years since they were required to lease network elements at rates based on forward-looking costs.” See Weisman (2019). In Verizon (2002, p. 489), the Supreme Court characterized the FCC’s approach as “novel rate setting designed to give aspiring competitors every possible incentive to enter local retail telephone markets, short of confiscating the incumbents’ property.” I am grateful to Timothy Tardiff for calling this passage to my attention.

Lehman and Weisman (2000a) and Onemli (2010) provide empirical evidence that in implementing the 1996 Telecommunications Act regulators in states with price cap regulation set markedly lower lease rates for unbundled network elements than regulators in states operating under some form of earnings regulation. A noteworthy case in point involves the Texas Public Utilities Commission. The Commission observed on the public record that since Southwestern Bell had freely elected into PCR, the company would have little or no recourse to the Commission if reducing the regulated prices for network inputs that Southwestern Bell is required to supply to its rivals should result in an earnings deficiency for the company. See Texas Public Utility Commission (1997) and Weisman (2019, pp. 181–182).

It is noteworthy that PCR with earnings sharing enjoyed a relatively short tenure in the U.S. telecommunications industry (Sappington and Weisman 2010) and was never employed in the telecommunications sector in Canada. This may be somewhat surprising given that PCR with earnings sharing can generate higher levels of economic welfare than pure PCR (Schmalensee 1989; Lyon 1996).

These shared earnings may be used to effect various forms of redistribution (Posner 1971). In the telecommunications industry, these shared earnings represent another source of benefits to consumers as they are used to finance bill credits, rate refunds and infrastructure improvements (Sappington and Weisman 1996a, Chapter 3). From this perspective, shared earnings are akin to “consumer dividends” that regulators distribute to their constituency.

Note that \( - C_{e} = - c_{e} \times Q(p) > 0. \) The “Arrow Effect” recognizes that investment in cost-reducing effort increases with output, ceteris paribus (Arrow 1962).

The profit function is strictly concave in e since \( {{{\kern 1pt} d^{2} \hat{\Uppi }} \mathord{\left/ \right. \kern-0pt} {de^{2} }} = - C_{ee} - \psi^{\prime\prime}(e) < 0. \) See previous note.

It is common to define the power of the regulatory regime as the fraction of earnings awarded to the regulated firm (Laffont and Tirole 1993, pp. 11, 41, 53 and 80).

This is the case because the actual incremental costs served, in part, as a litmus test on the reasonableness of the cost estimates generated by the FCC’s TELRIC (total element long-run incremental cost) methodology (Lehman and Weisman 2000b, chapter 6). In some jurisdictions (e.g., Canada), these input prices were initially set on the basis of incremental cost and then adjusted annually by a productivity offset.

It is important to note that a rational, long-lived regulator would refrain from expropriation due to its long-term, adverse impact on industry productivity growth. However, short regulatory tenures, coupled with common political pressures for immediate gains for consumers, can render expropriation rational behavior. This conclusion may change in a dynamic setting when both adverse selection and moral hazard are present. See Lewis and Sappington (1997).

The FCC’s (1995) price cap plan for interstate access services allowed the Regional Bell Operating Companies to choose between sharing and non-sharing regulatory regimes. The companies could “buy-down” the amount of ex post earnings sharing by agreeing to a higher ex ante X factor or productivity offset (Bernstein and Sappington 1999). Note, however, that ACE policies may render this tradeoff non-existent because the regulator is able to ratchet up the effective X factor ex post. In other cases, regulated firms may be able to buy down the degree of earnings sharing with infrastructure commitments and other perquisites desirable to the regulator. For example, SBC (now AT&T) committed to infrastructure upgrades in rural areas to address “digital-divide” concerns of regulators to precipitate the transition from PCR with earnings sharing to pure PCR.

\( \frac{{d^{2} W}}{{da^{2} }} = [p'(a)]^{2} Q_{p} [2s\omega_{2} + 2(1 - s)\omega_{3} - \omega_{1} ] < 0 \Rightarrow \)\( \omega_{1} < 2[s\omega_{2} + (1 - s)\omega_{3} ] \Rightarrow {\kern 1pt} \,s > \frac{{\omega_{1} - 2\omega_{3} }}{{2(\omega_{2} - \omega_{3} )}}. \)

An interior solution and a non-binding Hope constraint imply \(s > \,\,\frac{{\omega_{1} - \omega_{3} }}{{\omega_{2} - \omega_{3} }} > \frac{{\omega_{1} - 2\omega_{3} }}{{2(\omega_{2} - \omega_{3} )}}.\) See previous note.

A binding nonnegativity constraint represents a degenerate case because the regulator would rationally have opted to increase the price cap at the outset of the regulatory regime and extracted concessions from the regulated firm for doing so. Therefore, it is assumed that the welfare weights are such that the nonnegativity constraint is non-binding.

Note that \( {\kern 1pt} s < 1 \Rightarrow \omega_{1} - \omega_{3} < \omega_{2} - \omega_{3} \Rightarrow \omega_{1} < \omega_{2} . \) Hence, consumer surplus is weighted less than shared profits.

A standard assumption in the literature is that \( \omega_{1} > \omega_{3} {\kern 1pt} \) (Armstrong and Sappington 2004, 2007). There is evidence from the U.S. telecommunications industry to suggest that \( \omega_{2} > \omega_{3} {\kern 1pt} \) and \( \omega_{2} > \omega_{1} \) (Weisman 2016). Moreover, the realization of positive profits under a stipulated earnings sharing rule may enable inferences to be drawn as to the relative magnitude of the regulator’s welfare weights. See Besanko and Spulber (1990, 1993) for a related discussion in the context of antitrust wherein the decision to merge under a specified merger rule can reveal cost information.

Even under pure PCR (s = 0) and \( {\kern 1pt} \omega_{3} = 1{\kern 1pt} \) (i.e., full regulatory capture), the regulator optimally increases entry accommodation (reduces price) in response to cost reductions \( {\kern 1pt} (c_{e} \, < 0) \) when \( p(a*) \le \bar{p}\, \) so that \( \rho < 1 \).

It is noteworthy that when the regulator maximizes total economic welfare \( (\omega_{1} = \omega_{3} {\kern 1pt} = \raise.5ex\hbox{$\scriptstyle 1$}\kern-.1em/ \kern-.15em\lower.25ex\hbox{$\scriptstyle 2$} ){\kern 1pt} \) under pure PCR \( (s = 0){\kern 1pt} \), the Hope constraint binds in (3) which implies that \( \phi > 0{\kern 1pt} \) and \( e_{3}^{*} = 0{\kern 1pt} \, \Rightarrow {\kern 1pt} {\kern 1pt} \rho (e_{3}^{*} ) = 0. \)

The assumption that \( \varepsilon \approx 0 \) permits the comparison of cost-reducing effort levels across different regulatory regimes since Q* is largely invariant to changes in \( p. \) See note 6 supra.

In the special case of \(\omega_{3} = 0,\, (4)\,{\text{reduces\,to}}\,\hat{s} = \frac{{ - \omega_{1} \pm \sqrt {\omega_{1} (2\omega_{2} - \omega_{1} )} }}{{ - 2\omega_{2} }}\) .

A “small” increase in s when s is initially small implies that the regulated firm continues to retain a large share of its efficiency gains which, in turn, encourages investment in cost-reducing innovation. In addition, when s is small, the regulator sets a relatively low price since it receives only a small share of the regulated firm’s incremental earnings. With a low price, demand is relatively inelastic. This implies that the increase in price that results from a “small” increase in s would not have a pronounced effect in reducing output which, in turn, tempers the Arrow Effect.

For relatively large values of s, the net effect of increasing s as discussed in the previous note is reversed. The regulated firm retains an even smaller share of its efficiency gains from cost-reducing innovation and this negative effect on investment in cost-reducing innovation dominates.

This approach posits that the regulated firm has secured the property right to select the earnings sharing rule. This framework is consistent with the evidence that regulated firms were able to “buy-down” the degree of earnings sharing with investment in infrastructure modernization, bill credits and rate refunds. See note 11 supra and note 24 infra.

There is evidence to suggest that the local exchange carriers in the United States employed infrastructure upgrades to “buy out” of earnings sharing regimes. For example, Greenstein et al. (1995) report significantly higher investment under pure PCR than under PCR with earnings sharing. The outstanding question is whether this higher investment was mandated as the entry fee for pure PCR or was motivated by the stronger incentives under pure PCR (Kridel et al. 1996; Sappington and Weisman 1996b). See note 11 supra.

Proposition 1 implies the Hope constraint is non-binding when \( 1 > s > \frac{{\omega_{1} - \omega_{3} }}{{\omega_{2} - \omega_{3} }} \Rightarrow \omega_{1} - \omega_{3} < \omega_{2} - \omega_{3} \Rightarrow \omega_{2} > \omega_{1} \).

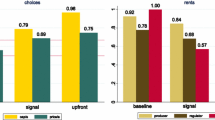

The {b, d} combinations yield a total of four sets of numerical simulations. The simulations for b = 1 and d = ½ are reported in this section. The supplemental simulations for the other three two-tuple combinations are available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3456230.

The simulations were conducted with MATLAB and assume that the regulator sets the welfare-maximizing price directly rather than indirectly through accommodative entry. This is equivalent to assuming that \( p'(a) = 1. \)

Note that \( e_{1}^{*} \) and \( e_{2}^{*} \) are computed on the basis of \( Q^{*} \) = 12 corresponding to \( \bar{p} \) = 12, whereas \( \,e_{3}^{*} \, \) is computed on the basis of \( p* < 12 \Rightarrow Q(p*) > 12. \) This approach may understate the relative differences in the effective power of the regulatory regimes unless demand is perfectly inelastic \( (\varepsilon = 0). \) It is readily shown that each additional unit of output increases \( e_{1}^{*} \) and \( e_{2}^{*} \, \) by \( \tfrac{1}{4}\, \) and \( \tfrac{1 - s}{4}{\kern 1pt} \) units, respectively.

Earnings sharing (s > 0) can elicit positive profits when the welfare weight on shared earnings \( (\omega_{2} ) \) exceeds that on consumer surplus \( {\kern 1pt} (\omega_{1} ). \) See notes 5, 11 and 16 supra. As Sappington and Weisman (1996a, p. 334) observe:

Political support for a policy can be garnered when consumers benefit financially in direct, visible ways precisely when the regulated firm benefits, as is the case under earnings-sharing plans. Widespread political support for a policy can ensure its long-term survival and thus a continued flow of benefits to all parties. A sustained flow of moderate gains can often serve all parties better than can a short–lived spurt of particularly large gains.

MATLAB was used to generate the closed-form expressions for the equilibrium profile {p*, s*, e*}. These expressions are quite long and therefore not included here but are available upon request from the author.

It follows directly from Lemma 2(i) that \( \frac{{ - d^{2} a}}{{ded\omega_{1} }} + \frac{{d^{2} a}}{{ded\omega {}_{2}}} < 0. \)

I am grateful to an anonymous referee for raising this intriguing possibility.

References

Ai, C., & Sappington, D. E. M. (2002). The impact of state incentive regulation on the U.S. Telecommunications Industry. Journal of Regulatory Economics,22(2), 133–160.

Armstrong, M., & Sappington, D. E. M. (2004). Toward a synthesis of models of regulatory policy design with limited information. Journal of Regulatory Economics,26(1), 5–21.

Armstrong, M., & Sappington, D. E. M. (2007). Recent developments in the theory of regulation. In M. Armstrong & R. H. Porter (Eds.), Handbook of industrial organization, Chapter 27 (pp. 1557–1700). Amsterdam: Elsevier.

Arrow, K. J. (1962). Economic welfare and the allocation of resources for invention. In The rate and direction of economic activity, The National Bureau of Economic Research (pp. 609–626). Princeton N.J.: Princeton University Press.

Bernstein, J. I., & Sappington, D. E. M. (1999). Setting the X factor in price-cap regulation plans. Journal of Regulatory Economics,16(1), 5–25.

Besanko, D., & Spulber, D. F. (1990). Are treble damages neutral?” Sequential equilibrium and private antitrust enforcement. American Economic Review,80(4), 870–877.

Besanko, D., & Spulber, D. F. (April 1993). Contested mergers and equilibrium antitrust policy. Journal of Law Economics and Organization,9(1), 1–29.

Braeutigam, R., & Panzar, J. C. (1989). Diversification incentives under ‘price-based and ‘cost-based’ regulation. Rand Journal of Economics,20, 373–391.

Braeutigam, R., & Panzar, J. C. (1993). Effects of the change from rate-of-return to price-cap regulation. The American Economic Review, Papers and Proceedings,83(2), 191–198.

Brennan, T. J. (1989). Regulating by capping prices. Journal of Regulatory Economics,1, 133–147.

Cabral, L. M. B., & Riordan, M. H. (1989). Incentives for cost reduction under price cap regulation. Journal of Regulatory Economics,1, 93–102.

Federal Communications Commission. (1995). CC Docket No. 91-41, LEC Price Cap Performance Review, April 7.

Federal Communications Commission. (2001, June). Brief in Verizon et al v. FCC et al. Case No. 00511.

Federal Power Commission vs. Hope Natural Gas Co., 320 U.S. 591. (1944).

Greenstein, S., McMaster, S., & Spiller, P. (1995). The effect of incentive regulation on infrastructure modernization: Local exchange companies’ deployment of digital technology. Journal of Economics and Management Strategy,4(2), 187–236.

Kahn, A. E., Tardiff, T. J., & Weisman, D. L. (1999). The 1996 Telecommunications Act at three years: An economic evaluation of its implementation by the FCC. Information Economics and Policy,11, 319–365.

Kridel, D. J., Sappington, D. E. M., & Weisman, D. L. (1996). The effects of incentive regulation in the telecommunications industry: A survey. Journal of Regulatory Economics,9(3), 269–306.

Laffont, J.-J., & Tirole, J. (1993). A theory of incentives in procurement and regulation. Cambridge, MA: The MIT Press.

Laffont, J.-J., & Tirole, J. (2000). Competition in telecommunications. Cambridge, MA: MIT Press.

Lehman, D. E., & Weisman, D. L. (2000a). The political economy of price cap regulation. Review of Industrial Organization,16, 343–356.

Lehman, D. E., & Weisman, D. L. (2000b). The Telecommunications Act of 1996: The “costs” of managed competition. Norwell, MA: Kluwer Academic Publishers.

Lewis, T. R., & Sappington, D.E. M. (1997). Penalizing success in dynamic incentive contracts: No good deed goes unpunished. Rand Journal of Economics,28(2), 346–358.

Lyon, T. P. (1996). A model of sliding scale regulation. Journal of Regulatory Economics,9(3), 227–247.

Onemli, B. (2010). Three essays on regulatory economics. Ph.D. Thesis, Kansas State University.

Posner, R. A. (1971). Taxation by regulation. Bell Journal of Economics,2, 22–50.

Resende, M. (2000). Regulatory regimes and efficiency in U.S. Local Telephony. Oxford Economic Papers,52(3), 447–470.

Robinson, G. O., & Nachbar, T. B. (2008). Communications regulation. St. Paul MN: Thomson/West.

Robinson, G. O., & Weisman, D. L. (2008). Designing competition policy for telecommunications. The Review of Network Economics,7(4), 509–546.

Sappington, D. E. M. (2002). Price regulation. In M. Cave, S. Majumdar, & I. Vogelsang (Eds.), Handbook of telecommunications economics Chapter 7 (pp. 225–293). Amsterdam: North-Holland.

Sappington, D. E. M., & Weisman, D. L. (1996a). Designing incentive regulation for the telecommunications industry. Cambridge MA: MIT Press.

Sappington, D. E. M., & Weisman, D. L. (1996b). Potential pitfalls in empirical investigations of the effects of incentive regulation plans in the telecommunications industry. Information Economics and Policy,8(2), 125–140.

Sappington, D. E. M., & Weisman, D. L. (2010). Price cap regulation: What have we learned from twenty-five years of experience in the telecommunications industry? Journal of Regulatory Economics,38, 227–257.

Sappington, D. E. M., & Weisman, D. L. (2012). Regulating regulators in transitionally competitive markets. Journal of Regulatory Economics,41, 19–40.

Sappington, D. E. M., & Weisman, D. L. (2016). The disparate adoption of price cap regulation in the U.S. Telecommunications and Electricity Sectors. Journal of Regulatory Economics,49(2), 250–264.

Schmalensee, R. (1989). Good regulatory regimes. Rand Journal of Economics,20(3), 417–436.

Shleifer, A. (1985). A theory of yardstick competition. Rand Journal of Economics,16(3), 319–327.

Telecommunications Act of 1996, Pub. LA. No. 104-104, 110 Stat. 56 (1996).

Texas Public Utility Commission, Open Meeting, Agenda Item No. 1, Docket Nos. 16189, 16196, 16226, 16285, 16290, 16455, 17065, June 18, 1997.

Vasington, P. B. (2003). “Incentive regulation in practice: A Massachusetts case study. Review of Network Economics,2(4), 451–465.

Verizon et al. v. FCC et al. (2002). Supreme Court of the United States, Case No. 00511, May 13, 2002.

Weisman, D. L. (1993). superior regulatory regimes in theory and practice. Journal of Regulatory Economics,5(4), 355–366.

Weisman, D. L. (1994). Why less may be more under price-cap regulation. Journal of Regulatory Economics,6, 339–362.

Weisman, D. L. (2016). What do regulators value? The BE Journal of Economic Analysis and Policy. https://doi.org/10.1515/bejeap-2016-0106.

Weisman, D. L. (2019). Regulatory takings without confiscatory returns. Yale Journal on Regulation Bulletin,36, 170–195.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

I am grateful to Soheil Nadimi for expert research assistance. I also wish to thank an anonymous referee and the editor for extremely helpful comments and suggested revisions that substantially improved the manuscript.

Appendix: Proofs of Lemmas and Propositions

Appendix: Proofs of Lemmas and Propositions

Proof of Proposition 1

Setting \( \phi = \nu = 0\, \) in (3) and solving for \( p(a*){\kern 1pt} {\kern 1pt} - c\, \) yields

\( p(a*){\kern 1pt} - c > 0 \Rightarrow \Uppi > 0 \Rightarrow \)\( \frac{{\omega_{1} }}{{w_{2} s + \omega_{2} (1 - s)}} < 1 \) in (A1) since \( Q_{p} < 0. \) Solving for \( s \) yields\( \,s > \frac{{\omega_{1} - \omega_{3} }}{{\omega_{2} - \omega_{3} }} > 0\, \) when \( \omega_{2} > \omega_{1} > \omega_{3} \ge 0. \) □

Proof of Lemma 1

Totally differentiating (3) with respect to \( s{\kern 1pt} \) with \( \phi = \nu = 0 \) and rearranging terms yields

since \( \;\Delta = \frac{{d^{2} W}}{{da^{2} }} < 0{\kern 1pt} \) by Assumption 1. □

Proof of Lemma 2

For part (i), totally differentiate (3) with respect to e with \( \phi = \nu = 0.{\kern 1pt} \) Rearranging terms yields

since \( Q_{p} c_{e} p'(a) < 0 \) and \( \Delta = \frac{{d^{2} W}}{{da^{2} }} < 0 \) by Assumption 1.

For part (ii), totally differentiate (A3) with respect to s to obtain

when \( {\kern 1pt} \omega_{2} > \omega_{3} \; \Rightarrow \)\( \frac{{d^{2} p^{*} }}{deds} > 0.\; \) □

Proof of Lemma 3

\( \,s < \frac{{\omega_{1} - \omega_{3} }}{{\omega_{2} - \omega_{3} }} \Rightarrow \phi > 0{\kern 1pt} {\kern 1pt} \) by Proposition 1. The first-order necessary condition for e in [FP-EX-1] is given by

by complementary slackness since \( \psi '(e) > 0\;\forall e > 0. \) □

Proof of Lemma 4

The Lagrangian for [FP-EX-2] is given by

Differentiating (A5) with respect to a and assuming an interior solution yields

The first term in (A6) is negative \( \forall s < 1. \) This implies that \( \lambda < 0 \) since \( \frac{{d^{2} W}}{{da^{2} }} < 0 \) by Assumption 1. The necessary first-order condition for e in (A5) is given by

Since \( \lambda < 0 \) and \( \frac{da*}{de} > 0{\kern 1pt} \) by Lemma 2(i), \( {\kern 1pt} \lambda \left[ {\frac{da*}{de}} \right] < 0. \) It follows that

for any given \( {\kern 1pt} Q. \) Hence, \( e_{3}^{*} < e_{2}^{*} \) when \( \varepsilon \) is “small.” □

Proof of Proposition 2

The profit-maximizing level of effort \( (e_{3}^{*} ) \) in [FP-EX-2] is defined implicitly by

Substituting \( a*{\kern 1pt} \) into the regulated firm’s profit function, we obtain

The necessary first-order condition for e is given by

When \( p(a*) \ge c,\, \) it is sufficient for an interior solution that

Substituting for \( \frac{da*}{de} \) upon appeal to Assumption 1 and Lemma 2(i) and simplifying yields

Given that \( c_{e} < 0 \) and \( \psi '(0) \approx 0, \) it suffices to show that

The inequality in (A14) is satisfied when \( \omega_{1} < s\omega_{2} + (1 - s)\omega_{3} \Rightarrow \,s > \frac{{\omega_{1} - \omega_{3} }}{{\omega_{2} - \omega_{3} }} \Rightarrow p(a*)\,\, > c\, \) from (A1) and Proposition 1. □

Proof of Proposition 3

Assuming an interior solution, the necessary first-order condition for \( e_{3}^{*} \) is given by

Applying the Implicit Function Theorem to (A16),

where \( F_{s} = \frac{{\partial^{2} \hat{\Uppi }}}{\partial e\partial s}\, \) and \( F_{e} = \frac{{\partial^{2} \hat{\Uppi }}}{{\partial e^{2} }} < 0\, \) by strict concavity. Rearranging terms and simplifying yields

Letting \( s \to 1{\kern 1pt} \) in (A18) yields

since \( p'(a)\frac{da}{de} - c_{e} = c_{e} \left[ {\frac{{s\omega_{2} + (1 - s)\omega_{3} }}{{2s\omega_{2} + 2(1 - s)\omega_{3} - \omega_{1} }} - 1} \right]\,\; > 0\, \) when \( \omega_{1} < s\omega_{2} + (1 - s)\omega_{3} \, \) and \( \frac{dQ}{dp}\frac{da}{de}p'(a) > 0\, \) upon appeal to Lemma 2(i). This completes the proof of part (i).

To prove part (ii), let \( \frac{dQ}{dP} \to 0\, \) in (A18) and recall that \( - F_{e} > 0{\kern 1pt} \) which implies that

Substituting \( \frac{da}{de}\; \) and \( \frac{{d^{2} a}}{deds}\; \) from Lemma 2(i) and 2(ii), respectively, (A20) is positive when

Multiply (A21) through by \( [2s\omega_{2} + 2(1 - s)\omega_{3} - \omega_{1} ]^{2} \) and rearranging terms yields

Simplifying (A22) and setting the resulting expression equal to zero yields the quadratic function

Applying the quadratic formula to (A23) and simplifying yields the upper bound for s

Factoring out the term \( (\omega_{2} \, - \omega_{3} )\, \) in (A24) and simplifying yields (4) in Proposition 3(ii). □

Proof of Lemma 5

The Lagrangian expression associated with [FP-EN-1] is given by

Differentiating (A25) with respect to a and assuming an interior solution yields

The first term in (A26) is negative \( \forall s < 1. \)\( \frac{{d^{2} W}}{{da^{2} }} < 0 \) by Assumption 1. This implies that \( \lambda_{1} < 0. \) Differentiating (A25) with respect to s yields

Suppose now that \( \lambda_{2} > 0 \Rightarrow s* = 1\, \) and \( \lambda_{3} = 0. \) This implies from (A26) that

\( \lambda_{1} \left[ {\frac{da*}{ds}} \right] = 0 \Rightarrow \lambda_{1} = 0\, \) since \( \left[ {\frac{da*}{ds}} \right] < 0\, \) by Lemma 1. But if \( \lambda_{1} = 0 \), then from (A27) we have that \( - [R(p) - C(Q(p),e)] - \lambda_{2} < 0 \) which implies that \( s* = 0 \) by complementary slackness, which contradicts \( \lambda_{2} > 0 \) and \( s* = 1 \Rightarrow s* < 1. \) Combining this result with Proposition 1 implies that

□

Proof of Lemma 6

Lemma 5 implies that \( \phi = 0{\kern 1pt} {\kern 1pt} \) at \( {\kern 1pt} s{\kern 1pt} *.{\kern 1pt} \) The necessary first-order condition for e in (A25) is given by

\( \lambda_{1} < 0 \) by Lemma 5 and \( \frac{da*}{de} > 0 \) by Lemma 2(i) \( \Rightarrow \lambda_{1} \left[ {\frac{da*}{de}} \right] < 0. \) It follows that

when \( \varepsilon \approx 0{\kern 1pt} \, \) which implies that \( e_{3}^{*} < e_{2}^{*} \). □

Proof of Proposition 4

The proof of part (i) is virtually identical to the proof of Proposition 2 with s* replacing s upon appeal to Lemma 5. The proof of part (ii) follows directly from Proposition 1 and Lemma 5. □

Rights and permissions

About this article

Cite this article

Weisman, D.L. The power of regulatory regimes reexamined. J Regul Econ 56, 125–148 (2019). https://doi.org/10.1007/s11149-019-09392-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-019-09392-x