Abstract

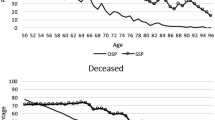

Using data from the Health and Retirement Study, we assess the accuracy of subjective beliefs about mortality and objectively estimated probabilities for individuals in the same sample. Overall, subjective beliefs and objective probabilities are very close. However, there are differences conditional on behaviors, with current smokers being relatively optimistic and never smokers relatively pessimistic in their assessments. In the aggregate, individuals accurately predict longevity, but at the individual level, subjective beliefs provide information in addition to the estimated objective probabilities in predicting actual events, which may arise from the effect of past or anticipated decisions on these beliefs.

Similar content being viewed by others

Notes

Previous studies have examined the relationship between subjective beliefs and realizations—e.g., mortality (e.g., Hamermesh 1985), health insurance, job loss, and criminal victimization (e.g., Dominitz and Manski 1997), retirement (e.g., Bernheim 1989, 1990; Benitez-Silva and Dwyer 2005), and weekly earnings (e.g., Dominitz 1998). The nature of expectations has also been examined in macroeconomic contexts (e.g., Turnovsky 1970; Urich and Wachtel 1984; Keane and Runkle 1990, 1992; Carroll 2003). There is also a growing literature using data on subjective expectations in the analysis of various economic decisions, e.g., earnings expectations and job search (Lancaster and Chesher 1983), Social Security expectations and retirement savings (Dominitz et al. 2002), consumption expectations and consumption in retirement (Hurd and Rohwedder 2003), mortality expectations, and consumption and bequests (Gan et al. 2004), job loss expectations and consumption (Stephens 2004), retirement and mortality expectations and savings and retirement (van der Klaauw and Wolpin 2005).

The two step estimator of Rust and Phelan (1997) is only valid under the assumption that there is no unobserved heterogeneity. There is also work, in which the objective probability measure incorporates unobserved individual heterogeneity (η i ), with the assumption that \( p_{{it}} = \widehat{p}_{t} {\left( {X_{{it}} ,\,d_{{it}} ,\,\eta _{i} ,\,\theta _{p} } \right)} \) (e.g., Keane and Wolpin 1997). We take the latter approach in this paper.

Smoking is a potentially addictive behavior and various explanations have been proposed for the consumption of such commodities (e.g., Becker and Murphy 1988; Gruber and Köszegi 2001; Gul and Pesendorfer 2001; Bernheim and Rangel 2004). Our focus is not on examining the impact of addiction on beliefs although this may be worthwhile research.

The sample of Hamermesh (1985) is from a survey of 650 white male academic economists and a survey of 975 persons randomly selected from a telephone directory in a medium-sized Midwestern city. Smith et al. (2001a) use data from the first four waves of the HRS. The two papers by Hurd and McGarry (1995, 2002) use data from the first, and the first two waves of the HRS, respectively.

A Weibull distribution imposes a monotonicity property on the hazard; US National Center for Health Statistics data shows that mortality exhibits a monotonically increasing hazard, see e.g., National Vital Statistics Report, Vol. 48, No. 18, February 7, 2001, “United States Life Tables 1998,” Table 1, p. 7, http://www.cdc.gov/nchs/data/nvsr/nvsr48/nvs48_18.pdf.

We compare results from our sample and a sample which excludes respondents reporting focal values and those reporting higher probabilities for living to 85 than 75 or equal probabilities below. See footnote 17.

Gan et al. (2003) develop a method to correct for focal responses that reduce the difference between subjective survival curves and observed survival. Given our study aims of comparing the subjective beliefs to objective probabilities, we want to retain the focal values.

Nineteen percent of the observations (N = 1,836) reported no chance of survival, and 22% (N = 2,184) reported absolutely certain chance of survival to age 75 and/or 85. Twenty-eight percent (N = 2,709) reported the same values for both questions and 30% (N = 2,957) reported a survival probability at age 85 greater than or equal to that for survival to 75. Respondents gave values of 0.5 in 33% (N = 3,249) of cases. In results not shown, to assess the information content of subjective probabilities of zero, one, and 0.5, we compared the mortality rate within 10 years of baseline for persons giving these values relative to those who did not give these values. Persons who reported a subjective probability of living to age 75 or 85 as zero had a higher and statistically significant probability of death within 10 years relative to the sample that reported values that are not zero, one or 0.5. However, for those reporting a subjective probability of survival of one or 0.5, there was no statistically significant difference in mortality. Comparing responses on the subjective probability questions by smoking status, we found that current and former smokers were more likely to report a value of zero, which is consistent with having a higher mortality risk than others. There were no statistically significant differences by smoking status for values of one and 0.5. Although statistical significance was lacking, current smokers were less likely to report subjective probabilities of one than were former or never smokers. Thus, focal values do have information content, even though the actual values seem unlikely to be true subjective probabilities of survival.

In our sample, the mean values for the subjective probabilities of survival to age 75 (85) are 0.64 (0.43).

Lancaster (1990) provides an excellent review of the estimation of duration models.

The Weibull is general enough to allow for positive, negative, or no duration dependence and is a reasonable distributional assumption for mortality data. US National Center for Health Statistics data shows that mortality exhibits a monotonically increasing hazard.

Three assumptions required to account for unobserved heterogeneity are: (1) the heterogeneity term is independent of the covariates; (2) the heterogeneity term has a distribution known up to some parameters; and (3) the heterogeneity term enters the hazard function multiplicatively. The mean also needs to be normalized to one for identification.

We also estimated the objective hazard without incorporating unobserved heterogeneity. In this case, we found that the estimated duration in mortality was much higher with the corresponding mortality hazards being much lower, implying an extremely high degree of pessimism among all individuals and sub-samples.

The individuals who were lost from the sample are treated as censored 1 year after the last interview.

The HRS elicits subjective beliefs on a scale ranging from 0 to 10. Our analysis converts this scale to 0–1 in increments of 0.1. Further, we analyze the difference between subjective and objective probabilities using a hazard which is defined as the ratio of the density to (one minus) the cumulative distribution function. Since the hazard represents annual rates of failure (mortality), the values of the hazards are as small as they are.

Results based on a sample that excluded responses with focal values and responses from persons who gave a higher probability of living to 85 than 75 or an equal probability (N = 2,543) were qualitatively similar to those reported in the text (see Appendix Table 7, given the small sample this comparison is not done separately for the different age groups). In Appendix Tables 8–9 we report comparisons of subjective and objective hazards for (1) when the objective hazard does not account for unobserved heterogeneity (Appendix Table 8), and (2) by gender (Appendix Table 9).

Hamermesh (1985) used data from a survey of 650 white male academic economists and a survey of 975 persons randomly selected from a telephone directory in a medium-sized Midwestern city.

Dominitz (1998) finds that the subjective value systematically overpredicts actual earnings at the bottom of the distribution in a spring 1993 survey. However, in that study, by fall 1993, this effect had disappeared.

Using data from Spain, Viscusi et al. (2000) examine the effect of health risks on the decision to smoke, finding that perceived primary risks from personal smoking have a stronger effect than do perceiving risks from second-hand smoke (passive smoking) on the decision to smoke.

References

Becker, Gary S. and Kenneth M. Murphy. (1988). “A Theory of Rational Addiction,” Journal of Political Economy 96(4), 675–700.

Benitez-Silva, Hugo and Debra S. Dwyer. (2005). “The Rationality of Retirement Expectations and the Role of New Information,” Review of Economics and Statistics 87(3), 587–592.

Bernheim, B. Douglas. (1989). “The Timing of Retirement: A Comparison of Expectations and Realizations.” In D.A. Wise (ed), The Economics of Aging. Chicago: University of Chicago Press.

Bernheim, B. Douglas. (1990). “How Do the Elderly Form Expectations? An Analysis of Responses to Information.” In D.A. Wise (ed), Issues in the Economics of Aging. Chicago: University of Chicago Press.

Bernheim, B. Douglas and Antonio Rangel. (2004). “Addiction and Cue-Triggered Decision Processes,” American Economic Review 94(5), 1558–1590.

Börsch-Supan, Axel. (1998). “Comment on ‘Subjective Survival Curves and Life Cycle Behavior.’” In D.A. Wise (ed), Inquiries in the Economics of Aging. Chicago: University of Chicago Press.

Carroll, Christopher D. (2003). “Macroeconomic Expectations of Households and Professional Forecasters,” Quarterly Journal of Economics 118(1), 269–298.

Caskey, John P. (1985). “Modeling the Formation of Price Expectations: A Bayesian Approach,” American Economic Review 75(4), 768–776.

Dominitz, Jeff. (1998). “Earnings, Expectations, Revisions and Realizations,” Review of Economics and Statistics 80, 374–388.

Dominitz, Jeff and Charles Manski. (1997). “Perceptions of Economic Insecurity: Evidence from the Survey of Economic Expectations,” Public Opinion Quarterly 61, 261–287.

Dominitz, Jeff, Charles Manski, and Jordan Heinz. (2002). “Social Security Expectations and Retirement Savings Decisions,” NBER Working Paper 8718.

Fischhoff, Baruch, Sarah Lichtenstein, Paul Slovic, Stephen L. Derby, and Ralph L. Keeney. (1981). Acceptable Risk. Cambridge: Cambridge University Press.

Gan, Li, Michael D. Hurd, and Daniel L. McFadden. (2003). “Individual Subjective Survival Curves,” NBER Working Paper 9480.

Gan, Li, Guan Gong, Michael D. Hurd, and Daniel L. McFadden. (2004). “Subjective Mortality Risk and Bequests,” NBER Working Paper 10789.

Grossman, Michael. (1972). “On the Concept of Health Capital and the Demand for Health,” Journal of Political Economy 80(2), 223–255.

Gruber, Jonathan and Botand Köszegi. (2001). “Is Addiction ‘Rational’? Theory and Evidence,” Quarterly Journal of Economics 116(4), 1261–1303.

Gul, Faruk and Wolfgang Pesendorfer. (2001). “Temptation and Self-Control,” Econometrica 69(6), 1403–1435.

Hakes, Jahn K. and W. Kip Viscusi. (2004). “Dead Reckoning: Demographic Determinants of the Accuracy of Mortality Risk Perceptions,” Risk Analysis 24(3), 651–664.

Hamermesh, Daniel S. (1985). “Expectations, Life Expectancy, and Economic Behavior,” Quarterly Journal of Economics 50(2), 389–408.

Hurd, Michael D. and Kathleen McGarry. (1995). “Evaluation of the Subjective Probabilities of Survival in the Health and Retirement Study,” Journal of Human Resources 30, S268–S292.

Hurd, Michael D. and Kathleen McGarry. (2002). “The Predictive Validity of Subjective Probabilities of Survival,” The Economic Journal 112, 966–985.

Hurd, Michael D. and Susann Rohwedder. (2003). “The Retirement-Consumption Puzzle: Anticipated and Actual Declines in Spending and Retirement,” NBER Working Paper 9586.

Keane, Michael P. and David E. Runkle. (1990). “Testing the Rationality of Price Forecasts: New Evidence from Panel Data,” American Economic Review 80(4), 714–735.

Keane, Michael P. and David E. Runkle. (1992). “On the Estimation of Panel Data Models with Serial Correlation When Instruments Are Not Strictly Exogenous,” Journal of Business and Economic Statistics 10(1), 1–9.

Keane, Michael P. and Kenneth I. Wolpin. (1997). “The Career Decisions of Young Men,” Journal of Political Economy 105, 473–522.

Lancaster, Tony. (1979). “Econometric Methods for the Duration of Unemployment,” Econometrica 47(4), 939–956.

Lancaster, Tony. (1990). The Econometric Analysis of Transition Data. New York: Cambridge University Press.

Lancaster, Tony and Andrew Chesher. (1983). “An Econometric Analysis of Reservation Wages,” Econometrica 51(6), 1661–1676.

Lichtenstein, Sarah, Paul Slovic, Baruch Fischoff, Mark Layman, and Barbara Combs. (1978). “Judged Frequency of Lethal Events,” Journal of Experimental Psychology: Human Learning and Memory 4, 551–578.

Manski, Charles F. (2004). “Measuring Expectations,” Econometrica 72(5), 1329–1376.

Picone, Gabriel A., Frank A. Sloan, and Donald H. Taylor, Jr. (2004). “Effects of Risk and Time Preference and Expected Longevity on Demand for Medical Tests,” Journal of Risk and Uncertainty 28(1), 39–53.

Rovira, Joan, W. Kip Viscusi, Fernando Antoñanzas, Joan Costa, Warren Hart, and Irineu Carvalho. (2000). “Smoking Risks in Spain: Part II Perceptions of Environmental Tobacco Smoke Externalities,” Journal of Risk and Uncertainty 21(2/3), 187–212.

Rust, John and Christopher Phelan. (1997). “How Social Security and Medicare Affect Retirement Behavior in a World of Incomplete Markets,” Econometrica 65(4), 781–831.

Schoemaker, Paul J. H. (1982). “The Expected Utility Model: Its Variants, Purposes, Evidence and Limitations,” Journal of Economic Literature 20(2), 529–563.

Schoenbaum, Michael. (1997). “Do Smokers Understand the Mortality Effects of Smoking? Evidence from the Health and Retirement Survey,” American Journal of Public Health 87(5), 755–758.

Sloan, Frank A., Jan Ostermann, Gabriel A. Picone, Christopher J. Conover, and Donald H. Taylor, Jr. (2004). The Price of Smoking. Cambridge: MIT.

Slovic, Paul. (2000). “Perception of Risk.” In P. Slovic (ed), The Perception of Risk. London: Earthscan Publications.

Slovic, Paul (ed). (2001). Smoking: Risk, Perception, & Policy, Sage Publications, Thousand Oaks, CA.

Smith, V. Kerry, Donald H. Taylor, Jr., and Frank A. Sloan. (2001a). “Longevity Expectations and Death: Can People Predict Their Own Demise?” American Economic Review 91(4), 1126–1134.

Smith, V. Kerry, Donald H. Taylor, Jr., Frank A. Sloan, F. Reed Johnson, and William H. Desvousges. (2001b). “Do Smokers Respond to Health Shocks?” Review of Economics and Statistics 83(4), 675–687.

Stephens, Melvin. (2004). “Job Loss Expectations, Realizations, and Household Consumption Behavior,” Review of Economics and Statistics 86(1), 253–269.

Turnovsky, Stephen J. (1970). “Empirical Evidence on the Formation of Price Expectations,” Journal of the American Statistical Association 65(332), 1441–1454.

Urich, Thomas and Paul Wachtel. (1984). “The Structure of Expectations of the Weekly Money Supply Announcement,” Journal of Monetary Economics 13, 183–194.

Van der Klaauw, Wilbert and Kenneth I. Wolpin. (2005). “Social Security and the Retirement and Savings Behavior of Low Income Households,” mimeo, University of North Carolina-Chapel Hill and University of Pennsylvania.

Viscusi, W. Kip. (1985). “A Bayesian Perspective on Biases in Risk Perception,” Economics Letters 17(1), 59–62.

Viscusi, W. Kip. (1990). “Do Smokers Underestimate Risks?” Journal of Political Economy 98(6), 1253–1269.

Viscusi, W. Kip and Jahn K. Hakes. (2003). “Risk Ratings That Do Not Measure Probabilities,” Journal of Risk Research 6(1), 23–43.

Viscusi, W. Kip and Jahn K. Hakes. (2007). “Risk Beliefs and Smoking Behavior,” Economic Inquiry (in press).

Viscusi, W. Kip and Wesley A. Magat. (1987). Learning About Risk: Consumer and Worker Responses to Hazard Information. Cambridge: Harvard University Press.

Viscusi, W. Kip, Irineu Carvalho, Fernando Antoñanzas, Joan Rovira, Francisco J. Braña, and Fabiola Portillo. (2000). “Smoking Risks in Spain: Part III Determinants of Smoking Behavior,” Journal of Risk and Uncertainty 21(2/3), 213–234.

Working, Holbrook. (1949). “The Investigation of Economic Expectations,” American Economic Review 39(3), 150–166.

Acknowledgements

This research has been supported in part by a grant from the Robert Wood Johnson Foundation’s Substance Abuse Research Program. “Why Mature Smokers Don’t Quit.” We have benefited from discussions with Manju Puri and David Robinson. All remaining errors are our own.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Excluding focal responses

Overall, our results are not importantly affected by whether or not we include observations with focal responses. In Table 3, based on the entire sample, the mean difference for (S−O) is 0.004. In Appendix Table 7, the corresponding mean difference is −0.003. For current smokers, the mean difference is −0.029 without observations with focal responses versus −0.015 for the entire current smoker sample. Thus, excluding observations with focal values, current smokers are more optimistic about their longevity than when focal values are included. However, for never smokers, the comparison is 0.010 when observations with focal values are excluded versus 0.016 for the entire never smoker sample.

1.2 Importance of accounting for unobserved heterogeneity

In the text, we report estimates for the objective mortality hazard controlling for heterogeneity. With controlling for unobserved heterogeneity, the differences in S and O are substantially larger than those reported in the text (Appendix Table 8).

1.3 Differences in subjective and objective mortality hazards by gender

Overall, men are more optimistic about surviving than are women (Appendix Table 9). Nevertheless, by smoking status, results are qualitatively similar for men and women.

Rights and permissions

About this article

Cite this article

Khwaja, A., Sloan, F. & Chung, S. The relationship between individual expectations and behaviors: Mortality expectations and smoking decisions. J Risk Uncertainty 35, 179–201 (2007). https://doi.org/10.1007/s11166-007-9019-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-007-9019-4