Abstract

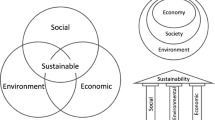

The notion of sustainability has lead to the evaluation of public projects in terms of wider socio-economic and environmental benefits. The Cost Benefit Analysis and its respective, Social Discount Rate (SDR), is of crucial importance, especially when the advantages of private financing are to be demonstrated in comparison with the alternative traditional procurement of works and services. The SDR seen as a measure of a country’s value of future costs and benefits is related to the notion of promoted sustainability. The impact of smaller and declining SDRs on project selection is investigated, and a conceptual formulation concerning the selection of the project procurement method is presented. The modelled formulation will assist central and local governments in assessing projects and the potential benefit of private financing.

Similar content being viewed by others

References

Abdel Aziz, A. M. (2007). Successful delivery of public-private partnerships for infrastructure development. Journal of Construction Engineering and Management, 133(12), 918–931. doi:10.1061/(ASCE)0733-9364(2007)133:12(918).

Akintoye, A., Beck, M., & Hardcastle, C. (2003). Public-private partnerships: Managing risks and opportunities. Oxford: Blackwell Science.

Ciriacy-Wantrup, S. V. (1942). Private enterprise and conservation. Journal of Farm Economics, 24.

Commissariat Général du Plan (2005). Révision du Taux d’Actualisation des Investissements Publics, Rapport du groupe d’experts présidé par Daniel Lebègue, Paris.

Debande, O. (2002). Private Financing of Transport Infrastructure: An Assessment of the UK Experience. Journal of Transport Economics and Policy, 36(3), 355–387.

Department for Transport (2002), Major Scheme Appraisal in Local Transport Plans Part 1 Detailed Guidance on Public Transport and Highways Schemes, June.

EIB. (2005) Evaluation of PPP Projects Financed by the EIB. EIB.

Federal Register. (1994). Principles for federal infrastructure investments, executive order 12893 of January 26, 1994, Codes of Federal Regulations (Vol. 3). Washington, DC: National Archives and Records Administration.

Florio, M. (2006). Cost-benefit analysis and the European Union cohesion fund: on the social cost of capital and labour. Regional Studies, 40(2), 211–224. doi:10.1080/00343400600600579.

Frederick, S., Loewenstein, G., & O’Donoghue, T. (2002). Time discounting and time preference: a critical review. Journal of Economic Literature, XL, 351–401. doi:10.1257/002205102320161311.

Grimsey, D., & Lewis, M. K. (2005). Are public private partnerships value for money? Evaluating alternative approaches and comparing academic and practitioner views. Accounting Forum, 29, 345–378. doi:10.1016/j.accfor.2005.01.001.

Grout, P. A. (2003). Public and private sector discount rates in public private partnerships. The Economic Journal, 113(486), C62–C68. doi:10.1111/1468-0297.00109.

Harrod, R. (1948). Towards a dynamic economy. London: St. Martin 's.

Howarth, R. B. (2005). Against high discount rates. In: Perspectives on Climate Change: Science, Economics, Politics, Ethics Advances in the Economics of Environmental Resources, 5, 99–120.

Loewenstein, G., & Prelec, D. (1992). Anomalies in intertemporal choice: evidence and an interpretation. The Quarterly Journal of Economics, 107, 573–597. doi:10.2307/2118482.

Office of Management and Budget (OMB) (1992). Guidelines and discount rates for benefit-cost analysis of federal programs, Circular A-94.

OXERA. (2002), A social time preference rate for use in long-term discounting, Office of the Deputy Prime Minister, Department for Environment, Food and Rural Affairs, and Department for Transport, London.

Sáez, C. A., & Requena, J. C. (2007). Reconciling sustainability and discounting in cost–benefit analysis: a methodological proposal. Ecological Economics, 60, 712–725. doi:10.1016/j.ecolecon.2006.05.002.

Schelling, T. C. (1995). Intergenerational discounting. Energy Policy, 23(4/5), 395–401. doi:10.1016/0301-4215(95)90164-3.

Shue, H. (1999). Bequeathing hazards: security rights and property rights of future humans. In M. H. I. Dore & T. D. Mount (Eds.), Global environmental economics: Equity and the limits to markets. Oxford: Blackwell.

Spackman, M. (2004). Time discounting and the cost of capital in government. Fiscal Studies, 25(4), 467–518. doi:10.1111/j.1475-5890.2004.tb00547.x.

Treasury, H. M. (2006). Stern review on the economics of climate change, Final report. London: HM Treasury.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Roumboutsos, A.B. Sustainability, Social Discount Rates and the Selection of Project Procurement Method. Int Adv Econ Res 16, 165–174 (2010). https://doi.org/10.1007/s11294-009-9250-7

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11294-009-9250-7