Abstract

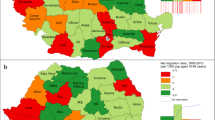

We analyse the determinants of the regional disparity of FDI inflows to Russia. The spatial distribution of FDI is attributed to regional and/or trans-regional factors. Region specific characteristics such as wage, education level, transportation as well as gross regional product, which accounts for market size, in host and alternative regions are considered to analyze the spatial interaction between regions employing spatial econometrics. We find that shocks to FDI levels in proximate regions have no effect on FDI inflows to hosts. However, FDI in a region depends on spatial market size and endowment of natural resources in alternative host regions.

Similar content being viewed by others

Notes

See Blonigen (2005) for a survey of the empirical literature on FDI determinants.

Blonigen et al. (2007) mention resource-seeking FDI as part of vertical-complex type.

Krai is mostly translated as province or territory and oblast means region.

These models originate from the seminal paper of Harris (1954) and have been used by Krugman (1992) and others (such as Hanson, 2005) in analysing geographic concentration of economic activity at inter- and intra-national levels such as Head and Mayer (2004), Cieslik and Ryan (2004) and Carstensen and Toubal (2004), Altomonte (2008) investigate the determinants of FDI employing market potential models.

Statistical data sometimes include portfolio investment and business loans as well as direct investment in the foreign investment item. Portfolio investment indicates that although the foreigners have some shares in the firm they have no control over its operations. FDI, on the other hand, means that foreign investors have control over the operations of the company.

It was 1.286 trillion dollars in 2007.

See Bayulgen (2005) for details.

According to Yudaeva et al. (2000) as the share of foreigners grow in a company, the firm becomes more productive and as the foreign share increases in an industry, productivity of the medium-sized firms increases. FDI is observed to force local firms to reorganize and restructure their activities.

The region administered by the city council.

Moscow city and the surrounding region are treated separately.

She estimates the model for three different periods, i.e. 1995–1998, 1999–2002 and 2003–2005. The variables indicate averages in each period.

Coughlin and Segev (2000), who look at the geographic distribution of FDI within China, find that a shock to FDI in one province has a positive effect on FDI in a nearby province. Baltagi et al. (2007) analyse the third country effects on US outward FDI in different industries to various host countries and find evidence for spatial correlation in independent variables and error terms. Emphasizing that FDI into a particular host country is not independent of FDI into alternative host countries, Blonigen et al. (2007) estimate a model, which differentiates between types of US based FDI to OECD countries and find a significant interdependence between the FDI a host country receives and the FDI inflows to its neighbours.

They suggest to use the spatial error model in case that the ‘groups’ are not defined by “specifically observable characteristics but by ‘likeness’ in a way that is best captured by geographic proximity”.

The elements of the weighting matrix are the inverse distances between regions. Following the general practise, rows are normalised to 1. An extensive evaluation of weights can be found in Anselin (1988)

Since the natural logarithms are used in the estimations, substituting such a small number for zero outward FDI observations does not affect the estimation results, however allows us to keep the regions without any FDI at a given period in the data set. Razin et al. (2004) and Eichengreen and Tong (2007) have done a similar fill-in without any change in estimation results.

We could have used GRP per capita to reflect final demand and industry output to capture intermediate demand but these variables are closely correlated therefore we opted for the GRP variable on its own.

Apart from these variables we used domestic investments, profitability, railway and road density as alternative explanatory variables however they were statistically insignificant.

We have calculated the Moran’s I statistics on annual basis. For all years, but only 1999, the statistics show significant spatial autocorrelation.

References

Altomonte C (2008) Regional economic integration and the location of multinational firms. Rev World Econ 143:277–305

Anselin L (1988) Spatial econometrics: Methods and models. Kluwer Academic Publishers, Boston

Anselin L (1999) Spatial econometrics (mimeo) University of Texas, Dallas

Baltagi BH, Egger P, Pfaffermayr M (2007) Estimating models of complex FDI: are there third-country effects? J Econ 140:260–281

Bayulgen O (2005) Foreign investment, oil curse, and democratization: a comparison of Azerbaijan and Russia. Bus Polit 7:1–37

Bevan AA, Estrin S (2004) The determinants of foreign direct investment into European transition economies. J Compar Econ 32:775–787

Blonigen BA (2005) A review of the empirical literature on FDI determinants. NBER Working Paper Series, Cambridge 11299

Blonigen BA, Davies RB, Waddell GR, Naughton HT (2007) FDI in space: spatial autoregressive relationships in foreign direct investment. Europ Econ Rev 51:1303–1325

Brenton P, Di Mauro F, Lucke M (1999) Economic integration and FDI: an empirical analysis of foreign investment in the EU and in Central and Eastern Europe. Empirica 26:95–121

Broadman HG, Recanatini F (2001) Where has all the foreign investment gone in Russia? World Bank Policy and Research Working Paper No. 2640, World Bank, Washington

Brock G (1998) Foreign direct investment in Russia’s regions, 1993–95: why so little and where has it gone? Econ Transit 6:349–360

Brock G (2005) Regional growth in Russia during the 1990 s-What role did FDI play? Post Communist Econ 17:319–329

Buch CM, Kokta RM, Piazolo D (2003) Foreign direct investment in Europe: is there redirection from the South to the East? J Compar Econ 31:94–109

Carstensen K, Toubal F (2004) Foreign direct investment in Central and Eastern European Countries: a dynamic panel analysis. J Compar Econ 32:3–22

Chakrabarti A (2003) A theory of the spatial distribution of foreign direct investment. Int Rev Econ Financ 12:149–169

Cieslik A, Ryan M (2004) Explaining Japanese direct investment flows into an enlarged Europe: a comparison of gravity and economic potential approaches. J Japan Intern Econ 18:12–37

Coughlin CC, Segev E (2000) Foreign direct investment in China: a spatial econometric study. World Econ 23:1–23

Eichengreen B, Tong H (2007) Is China’s FDI coming at the expense of other countries? J Japan Intern Econ 21:153–172

Fabry N, Zeghni S (2002) Foreign direct investment in Russia: how the investment climate matters. Communist Post Communist Stud 35:289–303

Hanson GH (2005) Market potential, increasing returns and geographic concentration. J Intern Econ 67:1–24

Harris CD (1954) The market as a factor in the localization of industry in the United States. Ann Assoc Am Geogr 44:315–348

He C (2006) Regional decentralisation and location of foreign direct investment in China. Post Communist Econ 18:33–50

Head K, Mayer T (2004) Market potential and the location of Japanese investment in the European Union. Rev Econ Stat 86:959–972

Iwasaki I, Suganuma K (2005) Regional distribution of foreign direct investment in Russia. Post Communist Econ 17:153–172

Krugman PR (1992) A dynamic spatial model, NBER Working Papers 4219, NBER, Cambridge

Ledyaeva S (2009) Spatial econometric analysis of determinants and strategies of foreign direct investment in Russian regions. World Econ 32:643–666

LeSage PJ (1998) Spatial econometrics, Working Paper, Department of Economics, University of Toledo, Toledo

LeSage PJ (1999) The theory and practice of spatial econometrics, Working Paper, Department of Economics, University of Toledo, Toledo

LeSage JP (2006) Spatial econometrics library, www.spatial-econometrics.com

Linneman H (1966) An econometric study of international trade flows. North Holland Publishing Company, Amsterdam

Pöyhönen P (1963) A tentative model for the volume of trade between countries. Weltwirtschaftliches Archiv 90:93–99

Razin A, Rubinstein Y, Sadka E (2004) Which countries export FDI, and how much? HKIMR Working Paper No. 15/2004, HKIMR, Cambridge

Rosstat (2004) Russian Regions, Social and Economic Indicators, Moscow, Russia

Rosstat (2005) Russian Regions, Social and Economic Indicators, Moscow, Russia

Rosstat (2007) www.gks.ru

Tinbergen J (1962) Shaping the World Economy: Suggestions for an International Economic Policy, New York

Yudaeva K, Kozlov K, Melentieva N, Ponomareva N (2000) Does foreign ownership matter? Russian experience, CEFIR Working Paper No.1, Russia

Author information

Authors and Affiliations

Corresponding author

About this article

Cite this article

Kayam, S.S., Yabrukov, A. & Hisarciklilar, M. What Causes the Regional Disparity of FDI in Russia? A Spatial Analysis. Transit Stud Rev 20, 63–78 (2013). https://doi.org/10.1007/s11300-013-0272-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11300-013-0272-8