Abstract

In light of the rapidly growing industrialization in BRICS and G7 regions, thorough energy, financials, and environmental analyses are essential for sustainable financial development in these countries. In this context, this work analyzes the relationship between energy, financial, and environmental sustainability and the regions’ social performance. Data from 2000 to 2017 is analyzed through a data envelopment analysis (DEA) like a composite index. Results show China and Brazil’s better performance in the region, with a sustainability score of 0.96, India was the third, followed by South Africa and Russia. Japan, the UK, and the USA were the most energy-efficient countries for five consecutive years. A 0.18%, 0.27%, 0.22%, 0.09%, 0.31%, and 0.32% reduction in carbon emission is observed with a 1% increase in R&D costs by Canada, France, Germany, Italy, Japan, and the USA, respectively. This work contributes to the existing literature regarding an eco-friendly sustainable policy design for the G7 countries based on multiple indicators.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Climate change poses a severe threat to future generations and must be tackled through practical solutions. Policymakers and scientists propose effective, sustainable development solutions to reduce the adverse effects of climate change. Directly dependent on the challenges in the transformation of energy systems, sustainable development should be considered a priority in policy design as it improves people’s living standards without negatively affecting the environment. The development agenda “Transforming our world: the United Nations General Assembly adopted the 2030 Agenda for Sustainable Development” (Mohsin et al. 2019a) on November 25, 2015. The 2030 Agenda is to create a strategic partnership at all levels through the idea of “leaving no one behind” (Yang et al. 2021; He et al. 2020, and Mohsin et al. 2020b). The Sustainable Development Goals (SDGs) were developed, on January 1, 2016, to enable sustainable development in various areas, such as social, environmental, and financial. The efficiency of various financial sectors can be increased with a simultaneous decrease in environmental pollution by tackling climate change (Si et al. 2020; Mier and Weissbart 2020). China’s impressive financial development shows how the new sectors and effective financial development affect GHG emissions (Anser et al. 2018; Anser 2019, and Anser et al. 2020g). It is essential to measure different economies’ environmental performance due to GHG emissions’ debilitating effect on the environment. With a continuous effort to limit the rise in temperature to 1.5°C, such initiatives help formulate a precise summary for growth evaluation and form environmental objectives to keep the average temperature rise below 2°C (Mohsin et al. 2018a; Mohsin et al. 2019c).

In recent years, countries worldwide have liberalized their markets to enhance their economic efficiency, resulting in intensified competitiveness among companies. As a consequence, companies have raised their research and development (R&D) budgets. Domestic markets would benefit immensely from these changes, as domestic products have been more modernized, drawing domestic consumers (Liu et al. 2020a). Consequently, demand for imports has declined in countries with a high level of creativity and R&D investment. R&D investment funded by companies is believed to be a central element in explaining economic competitiveness and specialization. These expenses are important for designing innovative technologies and, as a result, enhancing the innovation process.

Furthermore, these R&D investments have a significant effect on the economy’s cost competitiveness. G7 countries have changed their economies from imitating countries to a community of dynamic economies by concentrating on R&D spending and consistent policies. As a consequence, together with the digitalization of the economy. According to Trotta (2018) and Zhang et al. (2021), another significant determinant of promoting progress is the security of innovations and imagination. However, financial risk must be reduced in order to foster innovations by digitalization in the economy and business-financed R&D investment.

In some regions of China, a specific amount of shift in carbon emission is expected. Regardless of its potential to help policy formulation, the relationship and trans-impact between different regional emissions lack factual information (Tiep et al. 2021; Xia et al. 2020, and Asbahi et al. 2019). Evaluating countries’ performances instead of identifying common trends among several individual indicators are facilitated by composite indices (C.I.s) (Iram et al. 2020b; Baloch et al. 2020, and Chandio et al. 2020). The development of composite indicators is recorded through various literature.) established the DEA approach to build a CI, where they incorporated loss of information during the aggregation of different indicators through a non-compensatory MCDA approach (Liu et al. 2020a). The nexus between the paths of structural modernization and countries’ capacity is used by introducing the inclusive-sustainable transformation index. With its ability to protect the environment, the study focuses on a nation’s ability to developed a gender-inclusive services-based economy or modern industry (Khalfaoui et al. 2019; Anser et al. 2020c; Anser et al. 2020h, and Anser et al. 2020a).

The BRICS region countries are discussed by focusing on assessing their efficiency relative to technological innovation into sustainable development and transforming productive resources. Assessed energy efficiency for the BRICS region through the Super-SBM model. In addition to measuring the nexus between carbon emissions and energy efficiency, the bootstrap is used to modify values through the DEA approach, applied on small data samples. The efficiency of the relationship between CO2 emissions in the transport sector and the transport logistics’ performance measured through the Logistics Performance Index is analyzed by Yodkhum et al. (2017) and Acar (2018). Indicator selection is made through traditional techniques to aggregate indicators focusing on specific aspects. This process is not enough to provide general acceptance of the research and does not address each indicator’s weight. However, comprehensive index methods and relevant index sets to measure energy and environmental efficiency are missing in previous studies. With the help of a DEA-like composite index, this study analyzes the relationship between energy, financial, environmental sustainability, and social performance of BRIC and G7 countries. In addition to the possibility to have an outline of development at a regional level, the base of this study is formed over the reconstruction and modification of regional emissions and analyzing factors, such as energy, efficiency, and utilization. Most of the previous studies analyzed emission levels and variation based on actors related to energy efficiency, energy structure, financial development, production, industry, technological development openness, and population through some important approaches. The kaya components can decrease CO2 emissions through a model capable of improving energy efficiency and structure.

This study uses a DEA-like standard mathematical weight composite indicator to consolidate all the factors into a single measure. Multiple sets of indicators are used to develop composite indicators, which help measure energy financials and environmental efficiency. In order to develop an eco-friendly index for BRICS and G7 nations and calculate the mathematical aggregation, the study includes significant contributions conducted by past research.

The rest of the study is organized as follows: the “Methodology” section consists of the methodology; the “Results and discussions” section discusses the results and discussions, and the “Conclusion and policy implication” presents the conclusion and policy implications.

Methodology

Table 1 represents a selection of the most recently developed relevant indicators based on multiple characteristics containing significant effects on country-wise policy measures, presenting a detailed instrument to investigate various countries’ tendencies. A set of indicator frameworks with new characteristics is included in this study (Wasif Rasheed and Anser 2017; Xu et al. 2020, and Ahmad et al. 2020). In short, there are two phases in the non-linear aggregation rule for building the climate change collaboration index. Build an outranking matrix by contrasting countries pairwise in terms of all sub-indicators. By utilizing the highest probability rating procedure, you will take account of any of the possible ranks. To extend the non-compensatory rule to the creation of a climate change collaboration map (Wang et al. 2019) suggest a heuristic rating method focused on minimum infringement ranking theory. The final results rating’s computing efficiency dependent on the non-compensatory law may be greatly increased using this technique.

A DEA nonparametric frontier approach, proposed by Akpansung and Waziri (2018) and later expanded by, is used to establish the energy financials and environmental index. Many energy and environmental studies use the slack-based model (Anser et al. 2020h) and (Anser et al. 2020a). However, when companies are looking to minimize the undesirable output, desirable output maximization is utilized instead of maximizing model efficiency (Mohsin et al. 2020b; Mohsin et al. 2018b, and Mohsin et al. 2021). Contaminants, such as greenhouse gases and other contamination, are as much a part of the production process, making it essential to have environmental performance and financial growth in a well-maintained balance (Anser et al. 2020b), and (Anser et al. 2020f).

In this context, underlying energy, financial, and environmental indicators are included in this study. The multidimensional perspectives are assessed and summarized with the help of CI (Liu et al. 2020b; Lin et al. 2020; Jun et al. 2020, and Chien et al. 2021). Several evaluation systems are used for such fundamental indicators. At the national level, energy, financial, environmental, and carbon emissions are measured with C.I.s, used to test, evaluate, and propose policy (Li et al. 2018; Sun et al. 2019a). Different features with substantial influence on policy changes from the base for different features used in decision-makers. Financial, energy, and environmental indicators are combined with the performance assessment of BRICS. Let the number of components for energy vector, financial, and environmental variable be n. Then the following should represent the model:

Now

The objective function of the proposed model is to combine these 2 models (Mohsin et al. 2019b), (Mohsin et al. 2020a; Mohsin et al. 2021). If tie-breaking is needed, remove the corresponding countries where ties exist to establish a new sub-outranking matrix, re-rank the subset of countries using the steps above, and then combine with previous ranking results to obtain a full ranking. Suppose the summations of all countries in the sub-matrix are still equivalent in the second stage. In that case, a country can be selected at random as the subset’s representative, and the procedure can be replicated to achieve a final full order. The definition of strength degree can be translated as the values of each factor (for example) in the outranking matrix, which supports the following statement: In the very least, the nation succeeds admirably. The higher the importance, the more effective the strength. Consequently, the sum of the row vectors in the outranking matrix can be used to determine a country’s total intensity degree in contrast to all others. As a consequence, it seems fair to offer a nation a higher ranking when it achieves a higher standard. In contrast to the original procedure’s complexity, the heuristic procedure will obtain the final full rating of countries’ cooperation success by measuring only intensity degree ratings. The number of scores that must be measured is largely decided by the probability of future relations between countries:

The constructed index is compensation-proof due to the non-linear aggregation theorem and is thus named for the non-compensatory index (Tyagi et al. 2020; Çelik et al. 2018). In comparison, the non-compensatory index includes a variety of attractive features. Trade-offs between sub-indicators are not tolerated owing to the non-compensatory characteristic. Consequently, the sub-indicators weight may be stated as the magnitude of a significant coefficient. Non-compensatory will, therefore, prevent the problem of double weighting. It also satisfies neutrality, Pareto optimality, monotonicity, and, most significantly, reinforcing. The definitions of Pareto optimality and monotonicity are clear. According to neutrality, the global change partnership index resulting from the non-compensatory law would handle both countries fairly. Suppose a country gets the same rating from the corresponding subset of sub-indicators. In that case, reinforcement means getting a consistent ranking outcome in terms of a mixture of the various subsets of sub-indicators. When dealing with several hierarchical indicator structures, this property comes in handy (Becker et al. 2017; Gygli et al. 2019).

Despite its merits, the non-compensatory index has certain shortcomings that must be recognized by utilizing it to measure climate change cooperation results. Since it is determined by pairwise contrast, the outranking matrix only includes sub-indicators’ ordinal details, meaning that the cardinal information underlying individual sub-indicators is almost entirely overlooked. As a consequence, we cannot use the non-compensatory rule’s findings to evaluate the difference in cooperation success between two countries. Furthermore, as Nasir et al. (2019) point out, as the number of countries rises, the final rating computation will rapidly become unmanageable. The output of a total of G7 countries will be reassessed in this report, and the resulting permutation will be. Among the shortcomings, the sophistication of the computation could be the most important issue that prohibits the non-compensatory rule from being applicable to the assessment of climate change cooperation results.

Calculate the summations of row vectors in the outranking matrix to decide which countries are listed first. A country with a higher summation earns a higher score. The process comes to an end if there are no relations. The climate change collaboration index will now be achieved using the outranking matrix and the heuristic ranking method in either scenario. However, Diesendorf and Wiedmann (2020) reported that indifferent local relation might be global indifference due to the elements’ transitivity property inside the outranking matrix. The definition of indicator thresholds is introduced into the construction of the outranking matrix to increase robustness. If the total gap between two countries’ respective indicator output is smaller than or equivalent to an indifference threshold, their performance on the sub-indicator is indifferent.

Similarly, the preference relationship between the output of two countries under the sub-indicator should satisfy and, where is the corresponding preference threshold if a new binary relationship between countries arises, namely, poor choice. The current partnership converts Eq. (1) into the following equation, which can create the outranking matrix.

Econometric specification

To measure various financial estimations, econometrics is one of the most accepted techniques (Hansen 1982). Econometric does not require a comprehensive understanding of data allocation necessary for the maximum likelihood estimation (MLE). However, a specified moment generated with the original model is required for this method (Asif et al. 2020; Sarker et al. 2020; Iram et al. 2020a, and Tehreem et al. 2020). The computation of econometric is easy for available data allocation, unlike the computation of MLE. Model for log-normal stochastic volatility can be considered as an excellent example of this process. The econometric estimation approach’s ability to present a definite direction for the models bounded by multiple moment conditions and moments model parameters makes this approach unique (Poudineh et al. 2020; Topcu and Payne 2018). It becomes difficult to apply the traditional static estimation methods due to the dynamic panel data model’s endogenous problems (Anser et al. 2020e; Steffen 2018, and Anser et al. 2020d).

The standard linear regression model is shown in equation (4). The lag terms used in this process are to be represented as:

where β1, β2, and β3 are unknown coefficients, and α represents the intercept. The energy indicator is given as β1 φ1, the financial indicator as β2 φ2, the environmental indicator as β3 φ3, and indicators from social development as β4 φ4. Since the current green performance growth index is hugely affected by the green performance index, the control variables set is signified as Xit, fixed time effect as ut, single fixed-effect as vi, and random error term as εit (Yousaf et al. 2020; Tehreem et al. 2020; Wasif Rasheed and Anser 2017, and Xu et al. 2020). The set of each indicator in comparison with each dimension is shown in Table 1 However, the differencing method is likely to cause some problems, starting with eliminating the individual effects (Ikram et al. 2019a; Shah et al. 2019). A negative relationship between the first differences and one-step system econometric is suggested through the two system econometric. It is possible to trigger higher efficiency through an econometric estimator, as it initiates more instruments (Ikram et al. 2019a; Sun et al. 2019b, and Ikram et al. 2019b).

Results and discussions

This section presents the results and discussions using the proposed methodology. Per capita energy usage of China and Russia is higher than the other countries in the zone, as shown in Table 2.

The accumulative average score for the environment efficiency is recorded at 0.92 to 0.98, whereas in 2016, the environmental efficiency score for China and South Africa is recorded at 0.98 and 0.92. 0.97 to 0.94 is the recorded range for energy efficiency, with India recorded as the maximum and South Africa as the minimum. A mere 0.9% increase in emissions of CO2 is recorded through the results. As the biggest threat to environmental conservation, carbon emission in Russia declined by 1.5%, whereas a 7.8% and 3.3% rise is recorded for India and Brazil, respectively. The per capita energy consumption for the various countries is shown in Table 3.

Canada’s ability to cope with energy, financial development, and environmental sustainability is evident through the overall composite index scores, with Canada recorded at 0.72. Considering factors, such as self-energy resources, higher financial production, and low carbon pollution, Canada shows better performance than other countries. Recorded at 0.72 and 0.62, France and Italy have secured second place, regardless of the insufficient energy resources, followed by Germany and Japan recorded at 0.63 and 0.50, respectively. The USA’s average efficiency score was recorded at the lowest value of 0.40, regardless of the high financial development. In order to stimulate green consumption and build an ecological civilization, people are motivated to submit environmentally friendly materials amid the fast-renewable energy development seen in many regions, and a −1.7% decrease in emissions is evident through the changes in energy structure. The southwest region with rich gas emissions has a good emission reduction performance (−0.5%), which is better in the southwest region. The comparison with BRICS shows that the BRICS’s overall environmental efficiency index score in Table 4 shows the CO2 emission per capita for the BRICS region.

Digitalization of the economy is important for a country’s economic development, and technical progress is unlikely without it. It also has a huge effect on factor productivity. The G7 countries’ impressive achievement in maintaining strong economic growth is attributed to accelerated technical progress and other factors. As a consequence of developments in information and communication technology (ICTs), the digitalization of markets has altered the market dynamics of G7 countries in recent years. In terms of improved growth, societal transformation, and industrial progress, these digitalization developments have helped the G7 economies. These seven countries manage 58% of the world’s net assets.

Furthermore, the G7 countries’ economic output has been slowly improving over time. Furthermore, these great seven economies invest billions in research and development (R&D), improving their economic and innovation success. As a consequence, it is important to explore the effect of digitalization and R&D on technical progress in the G7 countries. As a consequence, the G7 countries hold a substantial portion of the world’s net income, have accelerated their technical growth, and have made strides in digitalization. The literature on the variables that affect technological advancement is comprehensive. Wage, imports, human resources, operational efficiency, financial growth, debt servicing, corruption, knowledge spillovers, and, most significantly, R&D spending are all variables that affect technical advancement.

The regional development in the two regions has been significantly affected by the financial development rates of BRICS and China. A reduction recorded at −2.7%, −1.3%, −0.8%, and −0.4% of CO2 emissions is evident in the Northwest, Northeast, North China, and Central regions, respectively, due to the relatively weak financial growth and high energy consumption.

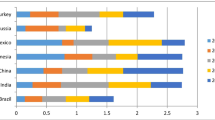

Figure 1 shows the overall environmental efficiency index score. The Human Development Index (HDI) for Germany, the USA, Canada, and Italy were recorded in the decreasing order as 0.916, 0.915, 0.913, and 0.873. The capability to assure energy security in supply, demand, and the production of green and other low-carbon energy supplies defines environmental sustainability. A range of 267.19 to 4.64 reflects the primary energy supply. A value of 482.79 is depicted by Canada, securing first place, with Germany at second position with a recorded score of 34.87, whereas Table 5 shows the minimum value for Japan, recorded at 4.64.

A variation between 22.03 and 6.31% insinuates the importance of renewable energy production. The highest value of 22.03% is recorded for Canada, with Italy and Germany at 16.52% and 14.21%, whereas Japan possesses the maximum value, recorded at 6.31%. An extensive, energy-intensive usage is evident as a result of increased energy sources in Germany and France. The overall environmental efficiency index score of BRICS. Considering CO2 emission efficiency, France and Italy proved to be equally competent and well-performed. In contrast, the least competent countries include Japan, Canada, and the USA among all G7 members for more or less every year. A significant variation can be seen in the emission efficiency of CO2 among G7 economies, with a collective score of less than 0.50. According to the study, the environmental condition can be improved with the help of energy consumption efficiency and emission efficiency of CO2, concluded through an analysis of the relationship between the two factors. Following a value of 70.3%, 82.4%, and 91.8% in 2001, the value between the frontier and BAU dropped to 45.1%, 30.7%, and 54.2% in 2015, pertaining to the widening difference between business as usual (BAU) and the frontier CO2 intensity in the petroleum, electricity, and chemical sectors. With small fluctuations, a rather stable value of CO2 intensity difference between frontier and BAU is evident for the ferrous metal, whereas an increase of 23.1% and 76.5% in 2015 from 7.5% and 69.4% in 2001 was seen between the BAU and frontier of non-ferrous metals and non-metallic products. The energy efficiency of G7 economies is shown in Fig. 3, where all types of equity and environmental sustainability were assessed to achieve the given results. The UK and the USA are the lowest performing countries according to the energy intensity and environmental index analysis. Without affecting energy consumption (i.e., compromising emission levels), maintaining financial development is highly challenging for a country. Ye et al. established how energy and environmental efficiency are primarily impacted by energy consumption and financial growth.

Figure 2 shows the energy efficiency score. Hence, it is vital to consider the direct impact of energy consumption on developing financial factors when formulating energy management policies. It is possible to aid energy security and reduce CO2 emissions if meaningful measures are established to improve energy efficiency. Consequently, the formulation of a policy framework should consider energy, financial, and environmental efficiency. Moreover, countries should be assessed based on their ability to save energy and reduce carbon emission. The environment is affected locally, regionally, and globally by increasing energy consumption and energy efficiency through increased efforts to generate clean energy. Therefore, environmental and financial factors should be considered for energy efficiency estimates.

As compared to the other G7 nations, Italy has improved its energy efficiency score due to the high-energy consumption rates. For carbon dioxide emissions and the overall performance, indicators, such as carbon intensity (carbon/GDP), total energy intensity (energy/GDP), per capita carbon dioxide emissions, and carbon factors (carbon/energy), are considered to assess the performance of various countries. Energy, financial and environmental efficiency, and CO2 emissions have been measured in this study to help factors such as energy, economy, and various environmental indicators. With the financial efficiency score as an output, the environmental efficiency is measured by fixing the best undesirable output, according to the financial and environmental efficiency scores of the G7 countries. With scores below 1, France and Canada are the least efficient countries. OECD member nations consume 55 btoe of energy, with a real gross domestic product considering of $39 trillion, showing the similar state of G7 countries and the OECD region in terms of energy consumption, GDP, and CO2 emission, which constitutes 75% of the world’s real GDP and 42.0% of the world’s total energy. An estimate of bmt 13 CO2 release was estimated for the primary energy extracted from oil and coal in 2010 (Sun et al. 2020c, Sun et al. 2020a. and Sun et al. 2020b).

China’s advanced economy requires 18.0% of global energy consumption. With a decrease in percentage over time, oil was retained as the core energy source with a 33.0% share. Significant global political pressure has been enforced on G7 and OECD countries to decrease their emissions. Resulting in a firm cut down to a value equivalent to that of the year 2000, 4.7% utilization of energy by OECD nations was recorded in 2009. With an assurance of preserving the environment for both current and future generations, it is vital to execute sustainable development. The higher GHG emissions are mainly due to the countries consuming renewable energy in low quantities (Australia, Belgium, the Netherlands, and Israel) in their nationwide demand for energy, supporting renewable energy argument resulting in decreased CO2 emission levels. Therefore, renewable utilization is low for countries with higher emissions (Alemzero et al. 2020b), (Sun et al. 2020a) and (Alemzero et al. 2020a).

The political economy mostly provides the financial base for assessing the extent of energy efficiency against per unit of power output (Fig. 3). With a specialized focus on analyzing total-factor efficiency, studies such as China and Germany have contributed to energy efficiency. A study supports the findings of this study. Compound energy inputs, different materials, and resources, such as greenhouse emissions, have been focused on by the combined production method used in these researches and calculated the rank-based assessment of electricity regarding this process. Analyzing a total-factor structure through the DEA analyzed the energy efficiency in the G7 (Japan, Canada, the UK, France, Italy, and Germany). The development of the financial model requires factors that carry out measures with higher energy performance. Focusing exclusively on the investigation of energy potency and the environmental Kuznets curve, a replacement information-intromission analysis technique was considered to provide environmental upgrading submissions.

Energy efficiency vs. environmental index

In the transportation sector, petroleum products are responsible for more than 90% of energy consumption. CO2 emission is continuously increased due to an increase in transportation demand, consuming more natural gas. With a one-way causal relationship between GDP growth and pollutant emissions for the G7 countries, declining energy efficiency is dependent on several strategies, policies, and technologies, related to the overall energy consumption for the G7 countries. Energy efficiency improvement has caused a decrease in the G7 economies’ energy intensity during the year. The energy efficiency (E.E.) and environmental index (EIN) for the G7 countries are shown in Table 6.

A total decoupling in stable energy utilization was observed in Italy, Japan, the UK, and the USA. Eco-friendly pressure from fossils-based energy utilization and production decreases due to the absolute decoupling. The mixture of solar, hydro, wind, and additional energy resources constituting independent energy production could be the reason. The empirical evidence of the given process is far from the scope of this study. Environmental deterioration and climate vulnerability are decreased by renewable energy. The index of energy efficiency trend, environmental index, and energy intensity index is given in Fig. 4. In addition to the concrete and effective policies, Canada also has energy security and vast crude oil reserves. The efficiency score of G7 countries is shown in Fig. 5.

Econometric analysis

The results of estimates calculated with different estimation tools are given in Table 7. The effect of fiscal spending for R&D on GEPI is shown in column 1 and 2 of the table, whereas the impact of public spending in terms of education on GEPI is observed in columns 3 and column 4. Both column 1 and column 3 help in observing the result of the one-step system econometric model. The one-step system econometric hypothesis consists of biased estimates considered by this study for comparison. Sargan test and the null hypothesis of second-order auto-correction, fixed through the AR (2) test, were used to expose the instrumental validity’s credibility. The econometric estimation in this study is validated with the help of the two given tests.

Infrastructure and R&D expenditure are all affected by national revenue. As a result, a rise in a country’s income boosts the G7 countries’ innovation. Fourth, the results indicate that the financial danger index has a detrimental effect on creativity, confirming the findings of International Energy Agency (2019). High financial risk contributes to low projected returns, which decreases the supply of bank funding for R&D. Because of the high financial danger that companies face, banks are also slow to support new concepts. As a consequence, high financial risk is seen as a threat to technical progress in the G7 countries. G7 countries must minimize financial risk to promote technology through digitalization in the economy and business-financed R&D investment. To conclude, the economy’s digitalization and R&D investment have important consequences for technical advancement. However, in order to enjoy the rewards of these trends, the G7 countries must reduce their financial risk.

This analysis focuses on the G7 nations, which are composed of seven main developed economies. However, the G7’s exposure to global economic growth is fluctuating, with the share of growth dropping from 24.1% in the 2000–2005 era to only 9% in the 2005–2010 period. The global financial crisis of 2007–2008, which triggered major losses to the G7 economies, was one of the key explanations for this substantial reduction in global development contribution. Nonetheless, between 2010 and 2017, these markets jointly recovered and accounted for 17.1% of global expansion. The G7 countries were selected mainly because of the “institutional collapse theory,” which ties a country’s natural resource curse to its low institutional consistency, which is mostly valid for developing countries. The G7, on the other side, are developing nations, and likely their administrative quality and, as a result, effective resource utilization can turn a curse into a blessing. These results are supported by the outcomes of alternative requirements in the table. Several essential findings are highlighted by Mohsin et al. (2018b), Mohsin et al. (2019b), Sadiq et al. (2020), and Chien et al. (2021), along with regression.

The efficiency index for energy and environment through DEA-Like composite indicator and econometric based estimation has been generated. It is in line with the sensitivity assessment of data uncertainty for robust econometric is consequently carried out, and for data errors, an assumption within ±20% is used. The range of [−20%, 20%] using random numbers has been produced to obtain the energy and environmental index. Following the uncertainty used to consider the data accuracy, the values fluctuate significantly, providing a comparison between the value of coefficients developed with the original dataset’s help and the newly developed dataset meant for sensitivity analysis. Figure. 6 presents some minor changes with the change of data. Table.8 presents the robustness analysis.

Although a favorable relationship between natural resources and financial growth could be a factor in G7 countries’ superior institutional consistency and productivity, this hypothesis will not be tested in this analysis. In addition, potential studies may involve variables such as inflation, financial globalization, technical progress, and energy use. This result can be related to the key factors of inequalities and CO2 pollution at the moment. Inequality plummeted between 1950 and 1975 due to the new agreement in the United States, the emergence of Keynesianism in Western Europe, egalitarian taxes, and the gradual growth of social welfare systems. The relationship between income disparity and CO2 emissions between 1950 and 2000 indicates that income redistribution and gross CO2 emissions are mutually exclusive. As it is known in the literature, the equity pollution problem is the concept that income redistribution may increase aggregate pollution. The equity pollution problem could have consequences for redistribution policies. On the surface, it seems that wealth redistribution programs, in the absence of policies to encourage clean energy sources, would lead to greenhouse warming. However, as Sokołowski (2019) points out, the equity pollution problem does not inherently suggest that income redistribution is undesirable; however, optimal redistribution would entail comprehensive welfare research and a variety of hypotheses regarding household welfare, market dynamics, and acceptable social outcomes.

Conclusion and policy implications

This work analyzes the relationship between energy, financial, and environmental sustainability and social performance of BRICS and G7 countries in the period 2000–2017 through a DEA-like composite index. A holistic combination approach was adopted for the multiple indicators sets to mitigate an information loss criterion of the composite index during the aggregation process. Each nation was analyzed through the energy, financial, environmental, and social performance ratings and specific metrics to obtain additional information on each country’s performance from suitable indicators. The significant findings of the study are listed below.

The multiple indicator analysis shows Canada’s dominance over other countries. These indicators include energy self-sufficiency ratio, energy dependence, and per capita energy consumption. Fossil fuel consumption is a major contributor to global warming; fossil fuel-based energy generation must be replaced by renewable, sustainable energy generation. A 0.18%, 0.27%, 0.22%, 0.09%, 0.31%, and 0.32% reduction in carbon emission is observed with a 1% increase in R&D costs by Canada, France, Germany, Italy, Japan, and the USA, respectively. In all nations, except Japan, the turning point for sustainable environmental conditions was between $6933 and $36,255.

Among the G7 countries, the USA is vulnerable with respect to the energy, financial, social, and environmental indicators. Canada has the best financial, environmental, and social performance score for oil, which translates into a greater capacity for it than the other G7 nations to preserve its self-sufficiency in energy, financial growth, and environmental sustainability. France, Italy, and Japan follow, respectively, while the USA ranks at the bottom in energy, socio-financial, and environmental performance with a score of 0.40. Despite the G7 countries’ developed economies, their environmentally fragile condition shows the overall global status in terms of environmental sustainability. In this context, the following policy changes are proposed for policymakers and government officials.

Corporations should adopt environmental safety policies to promote zero-emission awareness by providing green parks and developing green footprint. The state should also focus on reducing pollutant emissions and the conservation of electricity under the Paris Agreement by supporting and implementing energy efficiency strategies. Governments should regulate rising energy demand because the stakeholders should endorse contemporary and increasing concerns about sustainable development and global warming globally. Strong policies and processes to increase the supply of sufficient clean and affordable energy should be placed in place to sustain a stable environment without restricting financial growth and development. Based on these observations, the following suggestions can be made: First, it seems that the G7 countries have effectively escaped the resource curse pit. That may be because of their agencies’ efficiency, which policy capacities can assess in oversight and evaluation, public investment management, and budget procedures. As a consequence, politicians must be mindful of this aspect and adapt it to the productive usage of natural capital. Second, when designing strategies to strengthen financial growth metrics, the G7 economies must emphasize oil market stability. To promote faster long-term financial growth, policymakers must put an end to or at least restrict energy price fluctuations. This proposal, though, would be unnecessary unless adequate frameworks for achieving this policy objective were enforced. Finally, policymakers can ensure that the stock market is open and that it offers opportunities for prospective buyers and creditors to link, which would help to expand capital formation and, in turn, boost financial growth.

Availability of data and materials

The data that support the findings of this study are attached.

Abbreviations

- BA:

-

Business as usual

- CI:

-

Composite index

- DEA :

-

Data envelopment analysis

- GDP:

-

Gross domestic product

- GHG:

-

Greenhouse gases

- HDI:

-

Human Development Index

- MCDA:

-

Multi-criteria decision analysis

- OECD:

-

Organization for Financial Co-operation and Development

- R&D:

-

Research and development

- SDG:

-

Sustainable Development Goals

References

Acar C (2018) Potential energy solutions for better sustainability. Exergetic, Energ Environ Dimens 3–37. https://doi.org/10.1016/B978-0-12-813734-5.00001-9

Ahmad M, Li H, Anser MK et al (2020) Are the intensity of energy use, land agglomeration, CO2 emissions, and economic progress dynamically interlinked across development levels? Energy Environ. https://doi.org/10.1177/0958305X20949471

Akpansung AO, Waziri SE (2018) Has financial liberalisation promoted economic growth in Nigeria? Evidence from the auto-regressive distributed lag (ARDL) approach. Asian Econ Financ Rev. https://doi.org/10.18488/journal.aefr.2018.82.172.188

Alemzero DA, Iqbal N, Iqbal S et al (2020a) Assessing the perceived impact of exploration and production of hydrocarbons on households perspective of environmental regulation in Ghana. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-10880-3

Alemzero DA, Sun H, Mohsin M et al (2020b) Assessing energy security in Africa based on multi-dimensional approach of principal composite analysis. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-10554-0

Anser MK (2019) Impact of energy consumption and human activities on carbon emissions in Pakistan: application of STIRPAT model. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-04859-y

Anser MK, Zhang Z, Kanwal L (2018) Moderating effect of innovation on corporate social responsibility and firm performance in realm of sustainable development. Corp Soc Responsib Environ Manag. https://doi.org/10.1002/csr.1495

Anser MK, Alharthi M, Aziz B, Wasim S (2020a) Impact of urbanization, economic growth, and population size on residential carbon emissions in the SAARC countries. Clean Techn Environ Policy. https://doi.org/10.1007/s10098-020-01833-y

Anser MK, Ali M, Anwar F, Usman M (2020b) Subjective age and job satisfaction: a moderated mediation model of job burnout and chronological age. Front Public Health. https://doi.org/10.3389/fpubh.2020.00062

Anser MK, Hanif I, Alharthi M, Chaudhry IS (2020c) Impact of fossil fuels, renewable energy consumption and industrial growth on carbon emissions in Latin American and Caribbean economies. Atmosfera. https://doi.org/10.20937/ATM.52732

Anser MK, Khan MA, Nassani AA et al (2020d) Relationship of environment with technological innovation, carbon pricing, renewable energy, and global food production. Econ Innov New Technol. https://doi.org/10.1080/10438599.2020.1792607

Anser MK, Mohsin M, Abbas Q, Chaudhry IS (2020e) Assessing the integration of solar power projects: SWOT-based AHP–F-TOPSIS case study of Turkey. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-09092-6

Anser MK, Yousaf Z, Awan U et al (2020f) Identifying the carbon emissions damage to international tourism: turn a blind eye. Sustain. https://doi.org/10.3390/su12051937

Anser MK, Yousaf Z, Nassani AA et al (2020g) International tourism, social distribution, and environmental Kuznets curve: evidence from a panel of G-7 countries. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-07196-2

Anser MK, Yousaf Z, Zaman K et al (2020h) Determination of resource curse hypothesis in mediation of financial development and clean energy sources: go-for-green resource policies. Res Policy. https://doi.org/10.1016/j.resourpol.2020.101640

Asbahi AAMHA, Gang FZ, Iqbal W et al (2019) Novel approach of principal component analysis method to assess the national energy performance via Energy Trilemma Index. Energy Rep. https://doi.org/10.1016/j.egyr.2019.06.009

Asif M, Khan KB, Anser MK et al (2020) Dynamic interaction between financial development and natural resources: evaluating the ‘resource curse’ hypothesis. Res Policy. https://doi.org/10.1016/j.resourpol.2019.101566

Baloch ZA, Tan Q, Iqbal N et al (2020) Trilemma assessment of energy intensity, efficiency, and environmental index: evidence from BRICS countries. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-09578-3

Becker W, Saisana M, Paruolo P, Vandecasteele I (2017) Weights and importance in composite indicators: closing the gap. Ecol Indic. https://doi.org/10.1016/j.ecolind.2017.03.056

Çelik A, Yaman H, Turan S, et al (2018) Composite water management index. J Mater Process Technol

Chandio AA, Jiang Y, Rehman A et al (2020) Determinants of demand for credit by smallholder farmers’: a farm level analysis based on survey in Sindh, Pakistan. J Asian Bus Econ Stud. https://doi.org/10.1108/jabes-01-2020-0004

Chien F, Sadiq M, Kamran HW et al (2021) Co-movement of energy prices and stock market return: environmental wavelet nexus of COVID-19 pandemic from the USA, Europe, and China. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-12938-2

Diesendorf M, Wiedmann T (2020) Implications of trends in energy return on energy invested (EROI) for transitioning to renewable electricity. Ecol Econ. https://doi.org/10.1016/j.ecolecon.2020.106726

Gygli S, Haelg F, Potrafke N, Sturm JE (2019) The KOF Globalisation Index – revisited. Rev Int Organ. https://doi.org/10.1007/s11558-019-09344-2

Hansen LP (1982) Large sample properties of generalized method of moments estimators. Econometrica. https://doi.org/10.2307/1912775

He W, Abbas Q, Alharthi M et al (2020) Integration of renewable hydrogen in light-duty vehicle: Nexus between energy security and low carbon emission resources. Int J Hydrog Energy. https://doi.org/10.1016/j.ijhydene.2020.06.177

Ikram M, Mahmoudi A, Shah SZA, Mohsin M (2019a) Forecasting number of ISO 14001 certifications of selected countries: application of even G.M. (1,1), DGM, and NDGM models. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-04534-2

Ikram M, Sroufe R, Mohsin M et al (2019b) Does CSR influence firm performance? A longitudinal study of SME sectors of Pakistan. J Glob Responsib 11:27–53. https://doi.org/10.1108/jgr-12-2018-0088

International Energy Agency (2019) Energy Policies of IEA Countries - United Kingdom 2019 Review

Iram R, Anser MK, Awan RU et al (2020a) Prioritization of renewable solar energy to prevent energy insecurity: an integrated role. Singap Econ Rev. https://doi.org/10.1142/S021759082043002X

Iram R, Zhang J, Erdogan S et al (2020b) Economics of energy and environmental efficiency: evidence from OECD countries. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-07020-x

Jun W, Waheed J, Hussain H et al (2020) Working women and per capita household consumption expenditures; an untouched reality. Zb Rad Ekon Fak au Rijeci. https://doi.org/10.18045/zbefri.2020.1.35

Khalfaoui R, Sarwar S, Tiwari AK (2019) Analysing volatility spillover between the oil market and the stock market in oil-importing and oil-exporting countries: implications on portfolio management. Res Policy. https://doi.org/10.1016/j.resourpol.2019.03.004

Li J, Xiang Y, Jia H et al (2018) Analysis of total factor energy efficiency and its influencing factors on key energy-intensive industries in the Beijing-Tianjin-Hebei Region. Sustainability 10:111. https://doi.org/10.3390/su10010111

Lin K, Peng MYP, Anser MK et al (2020) Bright harmony of environmental management initiatives for achieving corporate social responsibility authenticity and legitimacy: glimpse of hotel and tourism industry. Corp Soc Responsib Environ Manag. https://doi.org/10.1002/csr.2076

Liu J, Abbas Q, Alharthi M et al (2020a) Managerial policy and economic analysis of wind-generated renewable hydrogen for light-duty vehicles: green solution of energy crises. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-11018-1

Liu X, Peng MYP, Anser MK et al (2020b) Key teacher attitudes for sustainable development of student employability by social cognitive career theory: the mediating roles of self-efficacy and problem-based learning. Front Psychol. https://doi.org/10.3389/fpsyg.2020.01945

Mier M, Weissbart C (2020) Power markets in transition: decarbonization, energy efficiency, and short-term demand response. Energy Econ 86:104644. https://doi.org/10.1016/j.eneco.2019.104644

Mohsin M, Rasheed AK, Saidur R (2018a) Economic viability and production capacity of wind generated renewable hydrogen. Int J Hydrog Energy. https://doi.org/10.1016/j.ijhydene.2017.12.113

Mohsin M, Zhou P, Iqbal N, Shah SAA (2018b) Assessing oil supply security of South Asia. Energy 155:438–447. https://doi.org/10.1016/J.ENERGY.2018.04.116

Mohsin M, Abbas Q, Zhang J et al (2019a) Integrated effect of energy consumption, economic development, and population growth on CO2 based environmental degradation: a case of transport sector. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-06372-8

Mohsin M, Rasheed AK, Sun H et al (2019b) Developing low carbon economies: an aggregated composite index based on carbon emissions. Sustain Energy Technol Assessments. https://doi.org/10.1016/j.seta.2019.08.003

Mohsin M, Zhang J, Saidur R et al (2019c) Economic assessment and ranking of wind power potential using fuzzy-TOPSIS approach. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-05564-6

Mohsin M, Nurunnabi M, Zhang J et al (2020a) The evaluation of efficiency and value addition of IFRS endorsement towards earnings timeliness disclosure. Int J Financ Econ. https://doi.org/10.1002/ijfe.1878

Mohsin M, Taghizadeh-Hesary F, Panthamit N et al (2020b) Developing low carbon finance index: evidence from developed and developing economies. Financ Res Lett. https://doi.org/10.1016/j.frl.2020.101520

Mohsin M, Hanif I, Taghizadeh-Hesary F et al (2021) Nexus between energy efficiency and electricity reforms: a DEA-based way forward for clean power development. Energy Policy. https://doi.org/10.1016/j.enpol.2020.112052

Nasir MA, Duc Huynh TL, Xuan Tram HT (2019) Role of financial development, economic growth & foreign direct investment in driving climate change: a case of emerging ASEAN. J Environ Manag. https://doi.org/10.1016/j.jenvman.2019.03.112

Poudineh R, Sen A, Fattouh B (2020) Electricity markets in the resource-rich countries of the MENA: adapting for the transition era. Econ Energy Environ Policy. https://doi.org/10.5547/2160-5890.10.1.RPOU

Sadiq M, Singh J, Raza M, Mohamad S (2020) The impact of environmental, social and governance index on firm value: evidence from Malaysia. Int J Energy Econ Policy 10(5):555–562

Sarker SA, Wang S, Mehedi Adnan KM et al (2020) Economic viability and socio-environmental impacts of solar home systems for off-grid rural electrification in Bangladesh. Energies. https://doi.org/10.3390/en13030679

Shah SAA, Zhou P, Walasai GD, Mohsin M (2019) Energy security and environmental sustainability index of South Asian countries: a composite index approach. Ecol Indic 106:105507. https://doi.org/10.1016/j.ecolind.2019.105507

Si T, Wang C, Liu R et al (2020) Multi-criteria comprehensive energy efficiency assessment based on fuzzy-AHP method: a case study of post-treatment technologies for coal-fired units. Energy 200:117533. https://doi.org/10.1016/j.energy.2020.117533

Sokołowski MM (2019) When black meets green: a review of the four pillars of India’s energy policy. Energy Policy. https://doi.org/10.1016/j.enpol.2019.03.051

Steffen B (2018) The importance of project finance for renewable energy projects. Energy Econ. https://doi.org/10.1016/j.eneco.2017.11.006

Sun H, Edziah BK, Sun C, Kporsu AK (2019a) Institutional quality, green innovation and energy efficiency. Energy Policy. https://doi.org/10.1016/j.enpol.2019.111002

Sun PH, Tariq G, Haris M, Mohsin M (2019b) Evaluating the environmental effects of economic openness: evidence from SAARC countries. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-05750-6

Sun H, Pofoura AK, Adjei Mensah I et al (2020a) The role of environmental entrepreneurship for sustainable development: evidence from 35 countries in Sub-Saharan Africa. Sci Total Environ. https://doi.org/10.1016/j.scitotenv.2020.140132

Sun L, Cao X, Alharthi M et al (2020b) Carbon emission transfer strategies in supply chain with lag time of emission reduction technologies and low-carbon preference of consumers. J Clean Prod. https://doi.org/10.1016/j.jclepro.2020.121664

Sun L, Qin L, Taghizadeh-Hesary F et al (2020c) Analyzing carbon emission transfer network structure among provinces in China: new evidence from social network analysis. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-08911-0

Tehreem HS, Anser MK, Nassani AA et al (2020) Impact of average temperature, energy demand, sectoral value added, and population growth on water resource quality and mortality rate: it is time to stop waiting around. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-09822-w

Tiep NC, Wang M, Mohsin M et al (2021) An assessment of power sector reforms and utility performance to strengthen consumer self-confidence towards private investment. Econ Anal Policy. https://doi.org/10.1016/j.eap.2021.01.005

Topcu M, Payne JE (2018) Further evidence on the trade-energy consumption nexus in OECD countries. Energy Policy 117:160–165. https://doi.org/10.1016/J.ENPOL.2018.03.007

Trotta G (2018) Factors affecting energy-saving behaviours and energy efficiency investments in British households. Energy Policy. https://doi.org/10.1016/j.enpol.2017.12.042

Tyagi S, Sharma B, Singh P, Dobhal R (2020) Water quality assessment in terms of water quality index. Am J Water Resour. https://doi.org/10.12691/ajwr-1-3-3

Wang X, Zheng H, Wang Z et al (2019) Kazakhstan’s CO2 emissions in the post-Kyoto Protocol era: production- and consumption-based analysis. J Environ Manag. https://doi.org/10.1016/j.jenvman.2019.109393

Wasif Rasheed HM, Anser MK (2017) Effect on brand loyalty in mobile phone purchasing (a case study in Bahawalpur, Pakistan). J Public Adm Gov. https://doi.org/10.5296/jpag.v7i1.11042

Xia Z, Abbas Q, Mohsin M, Song G (2020) Trilemma among energy, economic and environmental efficiency: can dilemma of EEE address simultaneously in era of COP 21? J Environ Manag. https://doi.org/10.1016/j.jenvman.2020.111322

Xu Y, Chen Z, Peng MYP, Anser MK (2020) Enhancing consumer online purchase intention through gamification in China: perspective of cognitive evaluation theory. Front Psychol. https://doi.org/10.3389/fpsyg.2020.581200

Yang Z, Abbas Q, Hanif I et al (2021) Short- and long-run influence of energy utilization and economic growth on carbon discharge in emerging SREB economies. Renew Energy. https://doi.org/10.1016/j.renene.2020.10.141

Yodkhum S, Gheewala SH, Sampattagul S (2017) Life cycle GHG evaluation of organic rice production in northern Thailand. J Environ Manag 196:217–223. https://doi.org/10.1016/j.jenvman.2017.03.004

Yousaf S, Anser MK, Tariq M et al (2020) Does technology orientation predict firm performance through firm innovativeness? World J Entrep Manag Sustain Dev. https://doi.org/10.1108/WJEMSD-11-2019-0091

Zhang X, Tang M, Guo F et al (2021) Associations between air pollution and COVID-19 epidemic during quarantine period in China. Environ Pollut 268:115897. https://doi.org/10.1016/j.envpol.2020.115897

Acknowledgements

This research is partly funded by the University of Economics Ho Chi Minh City, Vietnam.

Author information

Authors and Affiliations

Contributions

Fengsheng Chien: conceptualization, data curation, methodology, and writing—original draft. Ka Yin Chau: editing and visualization. Sri Utami Ady: review and editing. YunQian Zhang: writing—review and editing and software. Quyen Ha Tran: visualization, supervision, and editing. Talla M Aldeehani: methodology, data curation, and visualization.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

The authors declare that they have no known competing financial interests or personal relationships that seem to affect the work reported in this article. We declare that we have no human participants, human data, or human tissues.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Chien, F., Chau, K.Y., Ady, S.U. et al. Does the combining effects of energy and consideration of financial development lead to environmental burden: social perspective of energy finance?. Environ Sci Pollut Res 28, 40957–40970 (2021). https://doi.org/10.1007/s11356-021-13423-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-13423-6