Abstract

Income inequality, poverty, and economic growth are defined as an economy's exposure to exogenous shocks arising out of poverty. The study used various econometric estimations to measure the effect of inequality and poverty on economic development during 1990 to 2016 in Vietnam. Various econometric estimation tests confirmed the presence of a long-run association between inequality and poverty, and economic growth is the matter of poverty headcount ratio in Vietnam. When we added the investment-to-GDP ratio and the number of years in education, it decreases by -0.144. This is reduced to -0.05 when log population growth rate was added while the employment, the coefficient decreases to -0.04 and becomes statistically insignificant. We found a negative impact of poverty and we reassess the hypothesis's emphasis on inequality and poverty and their combining effect of inclusive economic growth. Interestingly our results verify the previous findings that inequality and poverty show a negative impact on economic growth. The negative impact of poverty and inequality on economic growth appears to be concentrated at the high poverty level. These findings recommend that poverty reduction policies should be beneficial in encouraging economic growth even if they do not decrease income inequality.

Similar content being viewed by others

Introduction

Inclusive growth, poverty alleviation, and sustainable development are associated with each other, while poverty reduction is considered a sustainable development principle. Poverty in all shapes remains a vulnerable challenge facing humanity (Park and Mercado 2018; Omar and Inaba 2020). The Sustainable Development Goals (SDGs) are a daring pledge to finish poverty in all forms and dimensions through 2030. Worldwide life-threatening poverty deep-rooted in 2020 due to the interruption of the COVID-19. During the pandemic of COVID-19 and the worldwide economic recessions, the pace of poverty alleviation is slow down as compared to the desired level. Poverty-fighting losing its battle during this COVID-19 pandemic; it is likely that development will be set back for decades (Ouechtati 2020). Poverty is pushing millions of people into food shortage and lack of other necessities of life in Vietnam.

From an economic point of view, for two decades, Vietnam's GDP has increased by about 6–7 percent annually, with GDP per capita increasing from about $500 in 1990 to around $2000 in 2018 (Nguyen et al. 2020). Poverty has also been substantially decreased from 2014 to 9.8 percent in 2016, for instance through 4% (Do et al. 2021). The alleviation of poverty in Vietnam stimulates the private sector to raise the level of its consumption and the quality of life, in addition to the standard of living, in addition to the rise in the market for electricity (Feeny et al. 2021). The worldwide pandemic’s economic downturn may raise global poverty about 8% of the total human population or half a billion people, especially in the developing world (UNU-WIDER, 2020). Therefore, it's hard to end poverty by 2030 due to the global pandemic economic recession. In order to arrest the above mention problem and if we achieve an intended plan to target zero poverty according to the SDGs, there is a dire need for policy and decision-makers to reformulate their strategies and efficiently allocate their resources for the proposed objective for Vietnam poverty reduction. There is a dire need to develop and plan practical policy endorsements to shape the development plans on poverty alleviation, especially in the developing world (Erlando et al. 2020; Deutsch et al. 2020; Zhang et al. 2019), while (Li et al. 2020).

Poverty in Vietnam is a multifaceted phenomenon and thus is driven by a wide range of factors (Mohsin et al. 2021). According to the economic definition of poverty, a person is considered poor if they are unable to maintain a subsistence level of living (Neaime and Gaysset 2018). However, poverty alleviation cannot be defined in material terms alone but also encompasses various elements of social development (Mushtaq and Bruneau 2019). Development is how well-being and quality of life are improved by giving exposure and freedom that can be relished. Human beings, at their core, are desirous of social, cultural and political freedom, which, if given, helps foster self-efficacy that further aids welfare to an individual and social level (Gutiérrez-Romero and Ahamed 2021). The great efforts are needed from the integrated planning and government spending in Vietnam that will enable the economic project to kick off of poverty, as well as the local participation in the implementation and usage of different sources of financing. Availability of public safety, primary education, quality healthcare and sound infrastructure nurtures a sense of security and also paves the way to enhanced production capacity as well as greater employability which improves income and well-being of individuals (Nanda 2019).

Even with the affirmation of poverty as a social issue, some nations and countries fall below the poverty breadline. According to the ASEAN development report (Alvaredo and Gasparini 2015). According to the World Bank reports (2016), approximately 766 million people globally live below the poverty line with earnings less than $1.90 per day. Historical and political landscape plays an important role in shaping the structure of poverty in specific areas (Aghaei and Lin Lawell 2020; Balaji 2020).

A family in Vietnam is announced poor because most family members do not eat grains daily, do not eat roots or vegetables and fruits, dairy and eggs a few times a week. A household faces deprivation if they do not have enough food and any home sleep hungry or eats small meals during one year (Mutsonziwa and Fanta 2019). A family is considered poor if it experiences one full day of hunger during the last one of the year. The kind of fuel utilized for cooking is considerable for the health of a family unit, especially for ladies who are only engaged with cooking in Pakistan. On the off chance that for cooking, solid waste material, for example, dairy animal’s fertilizer, firewood, or coal, is utilized. The health of family unit individuals who take in such a domain for long stretches can be antagonistically influenced (Karim and Noy 2016) and (RI P 2018). Besides cooking, fuel additionally impacts nature. In a roundabout way, this measurement compares to MDG's Goal 7 to ensure environmental sustainability.

A family is announced poor on the off chance that for cooking, it utilizes wood, cow waste, or coal and heating they used solid fuel or wood. Possession of land, regardless of whether it is non-horticultural/urban or country/agrarian arrive, is a vital and profitable resource. Crosswise over rural ASEAN, the majority of the family units are related to the agricultural sector. They hold small farms and gain jobs via subsistence cultivation (Karim and Noy 2016). Along these lines, land possession, be it rural or non-rural, is considering as an imperative dimension of family units' welfare; what is more, it is incorporated as a different dimension in this examination. This measurement depends upon farming areas. Family units are first proclaimed poor or non-poor in measurement. A family is announced poor in rural land possession and does not possess livestock if they have less than one-acre land for crops (Awad-warrad and Muhtaseb 2017). If households have squatting, possession of land is considering poor. If the soil cover of land is not good and land is steep, then it means that households face deprivation in this dimension. If the family unit does not afford seeds and compost/ fertilizers, no access to sufficient water and labour force for crops in every growing season is pronounced poor. Non-farm belonging assesses a family’s non-wealth earning capabilities; they contact credit history, wealth, and saving (Lau et al. 2015).

Empirically, the current study addressed two simple questions: is there any negative association between economic growth and income inequality while measures the robust analysis of poverty (calculated US$1.90 income /day) by taking an explanatory variable for the economy's growth? Secondly, the relationship between economic growth and inequality associated with the level of poverty? To address these two questions, we measure the cross-country growth econometric estimation analysis for controlling poverty, inequality, and interaction. In order to control endogeneity, we employed a generalized method of moments, including numerous improvements to cope with an unbalanced panels model to regress the underlying variables.

Empirically, (i) we measured that poverty through regressions analysis that provides the effect of inequality and poverty on economic growth. Particularly, we evaluated the negative impact of inequality and poverty on economic growth based on poverty headcount ratio, the incidence of poverty, education, employment, investment to GDP ratio and Gini coefficient. (ii) We reassessed that when poverty is less than 30%, a statistically insignificant association between economic growth, inequality and poverty is noted. (iii) The contribution of this study is to see the objectives include exploring solutions to the problems of poverty in the policy. These problems are caused by the stability of the financial and economic sector in a low-rate regime. The study also focuses on catalyzing the given challenges due to resource dependence in the developing country.

The rest of the study is organized as follows; Sect. 2 constitutes the background and literature review. Section 3 presents the data and methodology. Section 4 provides findings and discussion, while Sect. 5 concludes the study while presenting policy implications.

Background and Brief Review of Literature

Vietnam household's level probability estimation is higher than a threshold variable of about 0.5 (Duong and Nghiem 2014). Based on Dutta's measure, the mean susceptibility is 17.50% in 2000, 13.70% in 2005, and the lowest mean about 9.12 in 2007. The average mean values that Vietnamese households had probability values of poverty falling in starting the year of 2000 and 13.70% next year in 2005 and continuous declined to 19.14% in 2007. That means the mean vulnerability values from (Tiep et al. 2021) measure are lesser than Dutta's measure for all study years. Based on a surveys report, the absolute poverty rates are 22.91% in the year 2000, the following year 18.40% in 2005, and last year 15.34% in 2007 and (Kouton 2021). These different statistical figures on absolute poverty and vulnerability indicate that vulnerable households might not be disadvantaged simultaneously and that low-income families are not inherently vulnerable (World Bank 2019).

According to World Bank, technically reported a 24.6% opinion reduction in poverty per headcount index. This result demonstrates that Vietnam was among the fastest reported poverty reduction achievements in early 1990 and mid-2005. Growth has also been relatively wide: actual incomes and well-being have increased in Vietnam. All urban and rural regions' 55% population of minorities is below the poverty line and 39% unemployment ratio with a Gini coefficient of 12.345% (Aparicio et al. 2020). During the change, but often slightly, the primary social indicators, including life expectancy, child mortality, and education, have been almost equally improved from 5 to 10% every year (Nguyen et al. 2020). Between 1999 and 2005, some nutrition measures enhanced rapidly, and children between the ages of five fell from 53% to 35.8%. However, others decreased much more slowly, for example, overweight children under five years. In Vietnam, average lifespan and child mortality were relatively high from 1990 to 200, but modest (relatively low) increases (from 85% in 1998 to 90% in 1999). Vietnam was also relatively high in the period between 1985 and 1999. After all, in these above measurements, the well before era from the pre‐1980s marks have speedy progress (Pham and Riedel 2019). Yet, success in poverty reduction has been unequal in several dimensions. Urban and rural inequality was high in 2006, but geographical changes were also significant for extreme poverty, 3.9% in urban versus 22.3%, rural areas, food poverty, 1.3%, and 9.6% (Thanh Binh and Van 2019). In Vietnam, northern regions show a high poverty ratio of about 48.0%, and food level poverty is 31.1%. In every household, 5.7% and 3.7% were reported to have extreme poverty and food poverty, respectively. The lowest poverty rate in each year’s survey (38.6% in 2008) and the most rapid decline in poverty, which decreases 3.3% each year during the 2008–2008 period.

Confirming the negative link between economic development and poverty: in the long term, sustainable economic growth leads to poverty reduction. In general, our 25-year research in Vietnamese provinces tests the relationship among 06 macroeconomic variables from 2012 to 2015: economic growth, (ii) the poverty rate; (iii) the rate of unemployment; (iv) the amount of public expenditure; (v) the value of export & import; (vi) public investment in the Vietnamese provinces. Firstly, the impact of public spending on economic growth is positive. Second, it has a negative impact on jobs, as well as export and import. Thirdly, the effect of public spending on unemployment is substantial and optimistic. Fourthly, poverty is negative, as is unemployment, export and import, and public expenditure.

Inequality and poverty might interrelate, having a negative impact on economic growth. As Bui and Nguyen (2017) concluded, an inequality can destabilize institutional efficiency that spreads economic security. Economic growth estimation, including control for inequality and incomes but not poverty, might not successfully capture drawback that reduces the growth. The impact of poverty can be distinct along with the effects of inequality. Furthermore, Ravallion (2002) argued that poverty negatively impacted consumption growth, and consequently, less poverty decreases with economic growth.

Methodology and Data Description

Non-Baking Financial Institution and Economic Growth

An alternative approach with neo-classical production functions has been used to measure the relationship between inequality, poverty, and economic growth. The neo-classical growth model was created by Solow and Swan (1956). This is done to achieve the study's objective regarding an estimate of how Vietnam's economic growth is affected by the individual welfare of non-banking financial institutes. This model explains how inputs of production functions, such as Capital series (K), aggregate Labor (L), and technological parameter (A), measure up to the total production of the economy (Xin-tu et al, 2021, Afzal et al, 2017, Youdeowei et al, 2019).

This growth rate of output per capita shown through the given Solow Swan growth model is dependent on the growth model parameters. Factors such as non-banking financial institutes, deposit interest rate, inflation and financial development determine the aggregate productivity (A) (Nguyen et al. 2021) and (Dang 2019). Hence, the following can be assumed:

According to Model 1, y represents the natural log of real gross domestic product (GDP) per capita, Gini shows Gini coefficients and P0 has been taken as poverty headcount ratio through mediating role of education which represents the years of schooling, population growth rate and employment rate,

where i shows the country and, Gini shows Gini coefficients, pov shows the level of poverty, InvGDP shows investment to GDP ratio, P0 shows poverty headcount ratio, Edu represents the years of schooling, Popgr signifies population growth rate, and Emp shows employment rate. We then measure the empirical estimation regression model to check the effect of inequality and poverty on economic growth. μi and ρt are country-specific fixed effects and the time dummies on the empirical model. To ensure robustness and accuracy in empirical estimation, we used various underlying variables for the growth elements. Poverty headcount and Gini coefficient are based on World Bank's definition (US$1.90/day). We then examine the econometric estimation to measure the impact of poverty (Dang Thi Hoa et al. 2019).

The development of the hypothesis based on the econometric model is constructed. Due to a small range in the data set, an estimate of three models with different independent variables is available in the table mentioned above. According to the pre-requisition of the OLS, the data is normally distributed or stationary in the case of normally distributed time-series data (Pesaran et al. 2013).

Equations 3 and 4 explains how Yt depends on its lagged value Yt-1.

Subtract Yt-1 from both sides of the Eq. 3,

To overcome the first difference and system of econometric estimation techniques by taking the first difference of model (1) to eliminate country fixed effects by taking an accurate lagged Y and X values as econometric estimation instruments. The transformation of the first difference characterizes the problematic features recommended by (Pham et al. 2019). According to the hypothesis, the series consists of a unit root problem and is non-stationary if we reject the null hypothesis. The econometric estimation equation for model 1 is as follows (Wang 2020):

The series is stationary regardless of the null hypothesis being rejected. While applying the econometric estimation technique for more productive results, the model parameters have been assessed for inequality and economic growth (Vieira et al, 2021). To measure the impact of inequality and poverty on economic development, empirical estimation regression model education × employment, and poverty × Gini has been added. Same as the original estimation model, the poverty headcount and Gini coefficient have been considered based on World Bank's definition (US$1.90/day). We then examine the econometric estimation to measure the impact of poverty and its association with inequality on economic growth (Nkoro and Uko 2016).

Data

We collected data from the World Bank Indicator (WBI), and the statistical handbook of Vietnam has been collected for the period between 1990–2016. Further, the following data sources have been used to collect the data for empirical estimation, Vietnam finance ministry, Vietnam state bank, and statistical year-book of Vietnam.

Results and Discussions

Econometric analysis

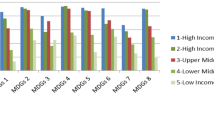

This section introduces the econometric estimation about the measurement of inequality, poverty and economic growth. Results show the potential consequences for nominal GDP data (national income accounts) and economic development. Vietnam's GDP at fixed cost has recorded a growth of 1.259%. This GDP growth can be accompanied by an increase in public spending, an advanced level of economic activity, an increase in household income, and, thus, an increase in savings. Investment in three studies of reducing tariffs by 50%, 75%, and 100%, respectively, is appreciated by 2.35%, 1.171%, and 4.683%. This spending intensification is attributed to an acceleration of institutional sales and a consequent boost in savings (Chaudhuri et al. 2017). Government consumption has risen by 0.282%, 0.136% and 0.607% over three separate periods of time, while private consumption has increased by 0.686%, 0.333% and 1.458%, respectively. This growth in demand is attributed to an increase in institutional sales and a reduction in the prices of both manufactured products and imports in the domestic currency, as their value is recognized. The incomes of all sixteen household groups as categorized in this model display a promising trend due to all three simulations, i.e., a 50%, 75%, and 100% decrease in the tariff rate. However, from household to household, the rate of rising varies. The growth rate of income growth for rural farmworkers is higher than that of household income growth for all other groups. It is recorded as 1.202% in model 1 (50%), 0.581% in model 2 (75%), and 2.582% in model 3 (100%) for poor household forms, while 1.142%, 0.553%, and 2.448%, respectively, are recorded for extreme poor household type performance. It is reported as 1.202% in model 1 (50%), 0.581% in model 2 (75%), and 2.582%in model 3 (100%) for poor household types, while for extreme poor household style results, 1.142%, 0.553%, and 2.448%, respectively, are recorded.

One percent rise in the Gini coefficient results in a 0.183%-point decrease in the five-year average growth rate centered on the regression of no restrictions. Table 1 shows that this is reduced to -0.05 when we added the log population growth rate. When we added the employment, the coefficient decreases to -0.04 and becomes statistically insignificant. The GDP growth rate of 4% is used to assess a country's development progress over a specific time as a critical macroeconomic indicator. In the past ten years amid the global financial and sovereign debt crisis, the Vietnam economy's growth has been stable with an average of 2% to 3% growth rate of 6.29%. In today's economic challenges, this is a significant accomplishment. At the sense levels of 95%, model 1 is statistically significant (sig. F-test = 0.038). However, the Adjusted R2 is poor (2.8%), which shows inefficient GDP growth changes. Our findings show that public spending with sig-test < 1% and correlation coefficient 0.258 > 0 positively affects economic development. This means that the higher the government spending level, the higher the growth rate. The key factor of economic growth is an investment.

In a variety of theoretical and empirical studies, economic growth and investment relationship were studied. Public investment in developed countries accounts for a small proportion of all economic investments by private sector funding and investment in risky fields. On the other hand, the economy plays an important role in all economic activities in developing countries. Even though the nature of our study is macro-level, we hypothesized that inequality is negatively associated with economic growth by using numerous channels. Existing studies in this line of research argued that inequality might conclude that under-investment in schooling, physical capital and health yielded lower economic growth.

This under-investment might be associated with a shortage of resources such as poverty instead of inequality. This argued that observing poverty as an additional channel can slow economic growth. Furthermore, since Vietnam's population is a small fraction of China's, the Southeast Asian nation's accomplishments have accounted for just about 3.2% of the decrease in global poverty since 1990. A more comprehensive image of poverty alleviation is given by comparing progress around these three international poverty lines (Fu et al. 2021). The following animation illustrates how, from 1990 to 2018, poverty rates in China have been improved. This implies that the per capita country with the highest GDP may or may not be the highest. As technology progresses, the per capita GDP of these countries will also increase significantly (Westmore 2018). Technology can be a ground-breaking force that can help to reduce the level of poverty in countries.

This results in a substantial proportion of all public spending. The outcome of the regression is therefore essential to the economy in Vietnam. There is little effect on Vietnam's economic growth (sig. t-test > 0.05) due to other dependent variables of job rate, poverty rate, government expending, and export and importation value. These findings do not reveal the negative correlation between economic growth and unemployment. The significance level of model 2 (sig. F test = 0.000) is statistically relevant at 99%. Adjusted R2 is 39.6%, which means that the impact on the change in the unemployment rate is reasonably successful. 03 independent poor rate variables; the importance of exports and importations, and the significance level of public investment is essential at 99% (t-test < 1%). There is a negative relationship between the poverty rate and the unemployment rate for export and import values. The higher the rate of poverty, the lower the rate of unemployment. Many reports show that the unemployment rate is positive about poverty. Moreover, the negative relationship between export and import’s value and unemployment means that exports' production reduces unemployment by creating many jobs. Our findings show that government spending has a significant and optimistic impact on provincial unemployment in Vietnam (a significance level of 99%).

Meanwhile, numerous previous study reports on the negative relationship between economic development and unemployment. The level of poverty is linked with economic growth and development, including the existence of education and employment. It means that macroeconomic indicators heavily influence the country's poverty level, (Table 2). The non-poverty incidence also shows an association with underlying variables such as poverty headcount, education, employment and investment. At the same time, the degree of inequality is associated with economic growth and development, employment, and investment to GDP ratio. In the meantime, schooling poverty headcount, education, employment and investment are related to economic growth and development.

Results in Table 3 find that high economic growth has helped to reduce the unemployment in their Vietnam study. The significance level of model 2 (sig. F test = 0.000) is statistically relevant at 99%. Adjusted R2 is 54.3%, which indicates that the shift in poverty rate is reasonably successful. The rate of unemployment, the volume of exports and imports, and 03 independent variable public expenditures with a production of 99% (T-test < 1%). Their relationship with poverty is negative. The greater the rate of poverty, the higher the rate of unemployment. The findings from Model 2 and several previous research findings are supported. This leads to economic development and poverty reduction through growth in exports and public investments. In 2016, the unemployment rate in Vietnam was significantly influenced by the provincial level (sig. t-test > 0, 05). Therefore, the findings do not show the correlation between economic growth and poverty rate (with the explanatory variable of economic growth).

The econometric model has no control variable with a very small p-value implying the rejection of the null hypothesis . The findings of the proposed methodological framework show that the poverty assessment (US$1.90/day) yielded the poverty interaction and inequality relationship between GDP and poverty is around 84%. In contrast, the coefficient at lagged GDP cannot be taken as a pure "conjunction" parameter. Meanwhile, there is a 43% relationship between injustice and poverty, including poverty-related indicators.

We have done the Arellano and Bond (1991) test to check the serial correlation at first-differenced errors and it shows no significance for serial correlation at second and third level first-differenced errors. It is necessary to mention that the instrument numbers generally reduce when we add multiplication of education × employment to check the coming effects at poverty. It is due to the unavailability of data for a specific period. Results scrutinizes whether the original relationship between economic growth and inequality is continuously observed in the new sample. We observe control variable in the new sample in Table 4. The new and changing sample sizes did not show any impact on this fundamental relationship.

Robustness Analysis

In this section, we evaluated robustness analysis. We assessed whether inaccurately measured Gini coefficients impact the study's major findings to ensure the robustness analysis. We then undertake further robustness analysis. These outcomes considerably rise in our econometric estimation sample size and we reassess whether the results change due to counting these provinces. Table 5 explains the robustness analysis.

Lastly, we combine these two robustness analyses and include comparatively rich provinces by describing the definition of no poverty poverty. However, we measure some minor variations due to these changes, while our applicable conclusions are robust. Unfortunately, inequality data are poorly measured and therefore. The outcomes are nearly identical to the study of (Omar and Inaba 2020; Islam et al. 2017). We consequently recommended that there is no impact of roughly evaluated inequality on our results.

Discussion

In the ASEAN area, the poverty rate is on the decline, and according to the World Bank, Vietnam has been the most effective in decreasing poverty. Thailand has driven the $1.25 and $2 (PPP) measures, comparing poverty lines through countries. The official poverty lines, in 2005 PPP dollars/person/day, are as follows: Malaysia $3.02; Cambodia $1.88; Philippines $1.84; Malaysia $3.02; Cambodia $1.88; Thailand ($1.75), Lao PDR ($1.48), Indonesia ($1.43), and Vietnam ($1.43). Consequently, the $1.25 standard developed in Africa is too poor to be implemented in the ASEAN region (Quy 2016). The World Bank's poverty definition is $1/$1.08/$1.25 a day (PPP). In the near past years, the single dependence is on monetary welfare interventions (Li et al. 2019). According to the most recent World Bank revisions, the most significant observations are that global poverty has decreased 745 million Asians benefited from the increase of 54.7% in 1990 to 20.7% in 2014. As a result, Asia's early achievement of the MDG first milestone (having severe global poverty) would not have been feasible without it. According to the recent World Bank revisions, chronic poverty in Southeast Asia has decreased by 31% (Ouechtati 2020). If current patterns persist, Asia, including Southeast Asia, would have eradicated severe poverty (a poverty rate of less than 3%) by the year 2025. Li et al. (2020) calculate an Asia-specific extreme poverty line based on the World Bank's extreme poverty line. Using a technique close to that of the World Bank, the authors calculate a severe poverty line for Asia of $1.51 per individual per day (PPP). Using this recent Asia-specific severe poverty line, the analysts estimate that extreme poverty will rise 9.8 percentage points in 2010 (from 20.7% to 30.5%), resulting in a 343.2 million increase in the number of deprived (Shuai et al. 2021).

In contrast, Bangladesh’s imported oil dependence reduced from 26 to 21% over the last ten years. 70% of the urban Indian population consumes LPG for cooking, while only 19% of the population in these areas uses firewood, chips, and dung cake to generate energy to cook food. However, 30% of the country’s population is deprived of modern cooking methods due to the country’s energy poverty. One-third of the world's population uses accommodations provided by the South Asia area, despite making up only 3.4% of the planet's total land. Governance is a significant element in energy poverty. Inadequate governance, especially concerning distribution and transmission of energy systems, leaves residents unable to get and afford an adequate supply of energy. South Asia's theft and (T&D) losses surpass the global average, standing at 34% compared to the 8% reported for the globe. T&D Losses from transmission and maintenance due to an energy-poor society.

The proportion of total fossil fuel energy consumption in India was 68.69%, making it the world's most energy-consuming country ( Nguyen et al. 2018).

In 2015, Sri Lanka and Pakistan used 0.31 and 0.34 (per million persons) of energy. In 2015, 44% and 36% of the dependency rate were recorded for India and Pakistan (Qasim et al. 2020) and, (Ma et al. 2019).

A percentage of GDP was taken to calculate the expenditures for research and development (R&D). Nepal remained stagnant in terms of energy intensity despite the small decline in 2012. India and Pakistan had an energy intensity of 5.37 and 4.19, respectively, showing a decrease from 2001 to 2015.

Conclusion and Policy Recommendation

The study used the econometric estimation to measure the impact of inequality and poverty on economic growth from 1990 to 2016 in Vietnam. Various econometric estimation tests confirmed the presence of a long-run association between the impact of inequality and poverty on economic growth in the matter of poverty headcounter ratio in Vietnam. Empirically, the current study addressed two simple questions: The current study answers the question of “is their negative correlation exists between economic growth and income inequality while poverty has been taken as the US$1.90 income per day?”. Our study shows the following findings,

-

(i)

The empirical estimation based on the negative impact of inequality and poverty on economic growth is based on poverty headcount ratio, the incidence of poverty, education, employment, investment to GDP ratio and Gini coefficient. The result shows the negative impact of poverty and combining impact on inclusive economic growth. Interestingly, our results verify the previous findings that inequality and poverty negatively impact economic growth. The negative effect of poverty and inequality on economic growth appears to be concentrated at the level of high poverty.

-

(ii)

Our findings verify the general arguments that the negative impact of inequality on economic growth raises the level of poverty. These findings recommend that poverty reduction policies encourage economic growth even if they do not decrease income inequality. This paper provides new insights into the important economic indicators and the relationship between these indicators, such as poverty, inequality, and economic growth. The major findings show that the structure of inequality is harmful and destructive to economic growth. Results reveal that inequality interrelates greater poverty levels.

-

(iii)

Our results do not implicate that inequality and poverty have a positive impact on economic growth. Therefore, countries need to decrease inequality. Also, poverty and inequality's effect on the construction of social cohesiveness and institutions is low. The policy suggestion of this study implies that decreasing inequality solitary may not progress economic growth scenarios. As an alternative, poor economies might find ways to reduce poverty, providing more benefit to economic growth instead of re-arrangement that does not decrease poverty.

Following policies are recommended to improve the non-banking financial institutes to attain a higher level of economic growth in Vietnam. To achieve the sustainable inflation rate target, the government state bank of Vietnam should maintain an inflation rate of up to 5–6%. (c) The political stability in Vietnam is one of the important factors through which we can achieve economic development by reducing the volatility in inflation and interest rate, and finally unpredictability in the economic growth to invest in Vietnam. So, stability in the economic policies and the interest rate directly increases foreign capital flow from foreign countries to host countries, stimulating the non-banking financial institutes in Vietnam. In the end, a wide range of research is felt necessary to make the LR policies for the establishment of modern financial institutions in the non-banking sector, which will serve as a sound base for economic growth in Vietnam.

The overall development of all economic entities in society dictates the development of a country. Economic growth, the prosperity of a country, and its participation in raising funds for excess and deficit sectors are driven primarily by the country's financial system (Jalali-Naini and Naderian 2020) and (Afonso et al. 2016). In most countries, particularly developing countries, institutions have a crucial role in raising funds. Nevertheless, to ensure a stable and concrete financial system, it is crucial to develop banking and non-banking financial institutions, which, in turn, support the economic growth and prosperity of a country's entire national system (Mersland and Øystein Strøm 2009). Non-banking financial institutions allow financial systems to withstand the economic crisis while reinforcing economic power. The gap in financial intermediaries is filled with the help of a wide range of products and services provided by the NBFIs, while it also plays a significant supporting role in commercial banks (Jalali-Naini and Naderian 2020).

Data availability

The data that support the findings of this study are openly available on request.

References

Afonso JR, Araújo EC, Fajardo BG (2016) The role of fiscal and monetary policies in the Brazilian economy: Understanding recent institutional reforms and economic changes. Q Rev Econ Financ. https://doi.org/10.1016/j.qref.2016.07.005

Afzal M, Rizwan MA (2017) To assess the trends of living and poverty in a dessert climate. Water Conservation and Management 15–18 https://doi.org/10.26480/wcm.01.2017.15.18

Aghaei M, Lin Lawell CYC (2020) ENERGY, ECONOMIC GROWTH, INEQUALITY, and POVERTY in IRAN. Singapore Econ Rev. https://doi.org/10.1142/S0217590820500198

Alvaredo F, Gasparini L (2015) Recent trends in inequality and poverty in developing countries. In: Handbook of Income Distribution

Aparicio S, Audretsch D, Urbano D (2020) Does Entrepreneurship Matter for Inclusive Growth? The Role of Social Progress Orientation. Entrep Res J. https://doi.org/10.1515/erj-2019-0308

Awad-warrad T, Muhtaseb BMA (2017) Trade Openness and Inclusive Economic Growth : Poverty Reduction through the Growth – Unemployment Linkage. Int J Econ Financial Issues 7(2):348–354

Balaji M (2020) Negotiating poverty line-study on density effect around the poverty line for indian state. Singapore Econ Rev 65;Suppl. 1:139–160

Chaudhuri, Basudeb; Chatterjee, Boishampayan; Mazumdar, Mainak; Karim, Safayet (2017) Income Ranking of Indian States and Their Pattern of Urbanisation: An Introduction to the Dynamics of Ordinary Towns, Springer : Cham, p. 91–118. https://doi.org/10.1007/978-81-322-3616-0_4

Dang TTH (2019) Does Horizontal Inequality Matter in Vietnam? Soc Indic Res. https://doi.org/10.1007/s11205-018-1896-1

Deutsch J, Silber J, Xu Y, Wan G (2020) Measuring inequality, poverty, growth and welfare via the use of asset indexes: The case of Armenia, Azerbaijan and Georgia. Singapore Econ Rev 65;No. supp01:7–33

Do QA, Le QH, Nguyen TD et al (2021) Spatial Impact of Foreign Direct Investment on Poverty Reduction in Vietnam. J Risk Financ Manag. https://doi.org/10.3390/jrfm14070292

Duong H, Nghiem H (2014) Effects of microfinance on poverty reduction in Vietnam : a pseudo-panel data analysis. J Accounting, Finance Econ 4(2):58–67

Erlando A, Riyanto FD, Masakazu S (2020) Financial inclusion, economic growth, and poverty alleviation: evidence from eastern Indonesia. Heliyon. https://doi.org/10.1016/j.heliyon.2020.e05235

Feeny S, Trinh TA, Zhu A (2021) Temperature shocks and energy poverty: Findings from Vietnam. Energy Econ. https://doi.org/10.1016/j.eneco.2021.105310

Fu R, Jin G, Chen J, Ye Y (2021) The effects of poverty alleviation investment on carbon emissions in China based on the multiregional input–output model. Technol Forecast Soc Change. https://doi.org/10.1016/j.techfore.2020.120344

Gutiérrez-Romero R, Ahamed M (2021) COVID-19 response needs to broaden financial inclusion to curb the rise in poverty. World Dev. https://doi.org/10.1016/j.worlddev.2020.105229

Islam R, Ghani ABA, Abidin IZ, Rayaiappan JM (2017) Impact on poverty and income inequality in Malaysia’s economic growth. Probl Perspect Manag. https://doi.org/10.21511/ppm.15(1).2017.05

Jalali-Naini AR, Naderian MA (2020) Financial vulnerability, fiscal procyclicality and inflation targeting in developing commodity exporting economies. Q Rev Econ Financ. https://doi.org/10.1016/j.qref.2020.01.001

Karim A, Noy I (2016) Poverty and Natural disasters-A qualitative survey of the empirical literature. Singapore Econ Rev 61(01):640001

Kouton J (2021) The impact of renewable energy consumption on inclusive growth: panel data analysis in 44 African countries. Econ Chang Restruct. https://doi.org/10.1007/s10644-020-09270-z

Lau CKM, Yang FS, Zhang Z, Leung VKK (2015) Determinants of innovative activities: Evidence from Europe and central Asia region. Singapore Econ Rev. https://doi.org/10.1142/S0217590815500046

Li C, Guo M, Li S, Feldman M (2020) The Impact of the Anti-Poverty Relocation and Settlement Program on Rural Households’ Well-Being and Ecosystem Dependence: Evidence from Western China. Soc Nat Resour. https://doi.org/10.1080/08941920.2020.1728455

Li C, Kang B, Wang L et al (2019) Does China’s anti-poverty relocation and settlement program benefit ecosystem services: Evidence from a household perspective. Sustain. https://doi.org/10.3390/su11030600

Ma B, Cai Z, Zheng J, Wen Y (2019) Conservation, ecotourism, poverty, and income inequality – A case study of nature reserves in Qinling China. World Dev. https://doi.org/10.1016/j.worlddev.2018.11.017

Mersland R, Øystein Strøm R (2009) Performance and governance in microfinance institutions. J Bank Financ. https://doi.org/10.1016/j.jbankfin.2008.11.009

Mohsin M, Ullah H, Iqbal N et al (2021) How external debt led to economic growth in South Asia: A policy perspective analysis from quantile regression. Econ Anal Policy 72:423–437. https://doi.org/10.1016/J.EAP.2021.09.012

Mushtaq R, Bruneau C (2019) Microfinance, financial inclusion and ICT: Implications for poverty and inequality. Technol Soc. https://doi.org/10.1016/j.techsoc.2019.101154

Mutsonziwa K, Fanta A (2019) Over-indebtedness and its welfare effect on households: Evidence from the Southern African countries. African J Econ Manag Stud. https://doi.org/10.1108/AJEMS-04-2018-0105

Neaime S, Gaysset I (2018) Financial inclusion and stability in MENA: Evidence from poverty and inequality. Financ Res Lett. https://doi.org/10.1016/j.frl.2017.09.007

Nguyen HTT, Van Nguyen C, Van Nguyen C (2020) The effect of economic growth and urbanization on poverty reduction in Vietnam. J Asian Financ Econ Bus. https://doi.org/10.13106/jafeb.2020.vol7.no7.229

Nguyen LT, Hoai Nguyen AP, van Passel S et al (2018) Access to Preferential Loans for Poverty Reduction and Rural Development: Evidence from Vietnam. J Econ Issues. https://doi.org/10.1080/00213624.2018.1430953

Nkoro E, Uko AK (2016) Autoregressive Distributed Lag (ARDL) cointegration technique: application and interpretation. J Stat Econom Methods 5:63–91. https://doi.org/10.1002/jae.616

Omar MA, Inaba K (2020) Does financial inclusion reduce poverty and income inequality in developing countries? A panel data analysis. J Econ Struct.(2020) 9:37. https://doi.org/10.1186/s40008-020-00214-4

Ouechtati I (2020) The contribution of financial inclusion in reducing poverty and income inequality in developing countries. Asian Econ Financ Rev. https://doi.org/10.18488/JOURNAL.AEFR.2020.109.1051.1061

Park CY, Mercado R (2018) FINANCIAL INCLUSION, POVERTY AND INCOME INEQUALITY. Singapore Econ Rev. https://doi.org/10.1142/S0217590818410059

Pesaran MH, Vanessa Smith L, Yamagata T (2013) Panel unit root tests in the presence of a multifactor error structure. J Econom. https://doi.org/10.1016/j.jeconom.2013.02.001

Pham QT, Nguyen VT, Nguyen HH et al (2019) Possible planting areas for Panax vietnamensis var. fuscidiscus toward poverty reduction in Vietnam. World J Adv Res Rev. https://doi.org/10.30574/wjarr.2019.2.1.0034

Pham TH, Riedel J (2019) Impacts of the sectoral composition of growth on poverty reduction in Vietnam. J Econ Dev. https://doi.org/10.1108/jed-10-2019-0046

Qasim M, Pervaiz Z, Chaudhary AR (2020) Do Poverty and Income Inequality Mediate the Association Between Agricultural Land Inequality and Human Development? Soc Indic Res. https://doi.org/10.1007/s11205-020-02375-y

Quy NH (2016) Relationship between Economic Growth, Unemployment and Poverty: Analysis at Provincial Level in Vietnam. Int J Econ Financ. https://doi.org/10.5539/ijef.v8n12p113

Shuai J, Liu J, Cheng J et al (2021) Interaction between ecosystem services and rural poverty reduction: Evidence from China. Environ Sci Policy. https://doi.org/10.1016/j.envsci.2021.01.011

Thanh Binh PT, Van Ha V (2019) Poverty Reduction in Vietnam and the Role of Public Administration. J Contemp Asia. Pages 151–163 | Published online: 13 Sep 2018

Tiep NC, Wang M, Mohsin M et al (2021) An assessment of power sector reforms and utility performance to strengthen consumer self-confidence towards private investment. Econ Anal Policy. https://doi.org/10.1016/j.eap.2021.01.005

Van Nguyen T, Lv JH, Ngo VQ (2021) Factors determining upland farmers’ participation in non-timber forest product value chains for sustainable poverty reduction in Vietnam. For Policy Econ. https://doi.org/10.1016/j.forpol.2021.102424

Vieira TP, De Vieira DMVPV, Kaline DM, Valente DMRA (2021) Protected areas and forest fragmentation: sustainability index for prioritizing fragments for landscape restoration. Geol Ecol Landscapes 5(1):19–31

Wang Z (2020) Development and integration model of marine tourism resources based on sustainable development. J Coastal Res 103(sp1):1030. https://doi.org/10.1080/24749508.2019.1696266

Westmore B (2018) Do government transfers reduce poverty in China? Micro evidence from five regions. China Econ Rev. https://doi.org/10.1016/j.chieco.2018.05.009

World Bank (2019) Tanzania Economic Update : Transforming Agriculture - Realizing the Potential of Agriculture for Inclusive Growth and Poverty Reduction. World Bank Gr Macroecon Trade Invest Glob Pract Africa Reg

Xin‐tu, Lei Qing‐yuan, Xu Cheng‐ze, Jin (2021) Nature of property right and the motives for holding cash: Empirical evidence from Chinese listed companies. Managerial and Decision Economics https://doi.org/10.1002/mde.3469

Youdeowei PO, Nwankwoala HO, Desai DD (2019) Dam structures and types in Nigeria: sustainabilty and effectiveness. Water Conservation Manag 20–26 https://doi.org/10.26480/wcm.01.2019.20.26

Zhang Y, Filipski MJ, Chen KZ (2019) HEALTH INSURANCE and MEDICAL IMPOVERISHMENT in RURAL CHINA: EVIDENCE from GUIZHOU PROVINCE. Singapore Econ Rev. https://doi.org/10.1142/S021759081650017X

Funding

This research is partly funded by University of Economics Ho Chi Minh City, Vietnam.

Author information

Authors and Affiliations

Contributions

YU ZHU contributed to conceptualization, data curation, methodology, writing—original draft, data curation, and visualization. Dr. Shahid Bashir contributed to visualization, supervision, and editing. Mohamed Marie contributed to writing—review & editing and software.

Corresponding author

Ethics declarations

Ethical approval

The manuscript has not been submitted to more than one journal for simultaneous consideration. No data, text, or theories by others are presented in our manuscript. We don’t have any conflict of interest.

Consent for participate

We do not have any person's data in any form.

Consent for publication

We do not have any individual person’s data in any form.

Competing interest statement

We declare that there is no conflict of interest.

Additional information

Responsible Editor: Philippe Garrigues.

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhu, Y., Bashir, S. & Marie, M. Assessing the Relationship between Poverty and Economic Growth: Does Sustainable Development Goal Can be Achieved?. Environ Sci Pollut Res 29, 27613–27623 (2022). https://doi.org/10.1007/s11356-021-18240-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-18240-5