Abstract

The present study investigates the effect of institution quality, technological innovation, and financial development on environment quality using 37 OECD nations from 1998 to 2018. The cross-sectional dependence (CD) and Lagrange multiplier (LM) techniques are used to measure the cross-sectional dependence. The second-generation panel unit root tests and panel cointegration tests are applied to examine the unit-root properties and long-run association existence between variables. Finally, we employed the two-step (SYS-GMM) methodology to estimate the coefficient values. The findings showed that financial development has a positive effect on selected carbon (CO2) emission dimensions. When the moderating term is introduced, it was identified that institutional quality and technology innovation conditioning effects are crucial between financial development and CO2 emission. Our evidence-based study provides significant results for technology innovation and institutional quality moderating role in reducing CO2 emissions in OECD economies. Our findings are also robust to alternative measures, which could be useful for policymakers to formulate long-term and short-term strategies and policies for a better sustainable environment.

Similar content being viewed by others

Introduction

After the signature of the Paris Agreement in November 2016, major-emitting countries agreed to mitigate the harmful effects of rising carbon emissions. This agreement is an attempt to solve the challenge of global warming and climate change and to maintain greenhouse gas (GHG) emissions to a degree that prevents environmental issues by adopting advanced structures. Thus, global warming gained full consideration as many countries worldwide have noticed environmental problems (Hughes et al. 2017). Then, new technologies, production methods, and consumption are needed to achieve eco-innovations and mitigate the GHG effects (Durán-Romero et al. 2020). Since 1970, the OECD and developing economies have contributed to about 85% of the world’s carbon emissions, revealed by the Global Atmospheric Research (EDGAR) database. In 2007, the carbon emission of OECD economies was very high. After the global financial crisis of 2008, the emissions have been declined due to slow industrialization and economic activities and strengthened environmental policies. However, it is expected that in the years after the COVID-19 pandemic, GHG emissions are set to increase again due to recent rises in emissions, production, and energy usages. In order to achieve sustainable economic growth, several countries around the world are implementing financial, institutional, and innovation measure to mitigate the GHG emission and to improve environmental quality (Godil et al. 2021a, b, c; Ullah et al. 2021a, b; Luo et al. 2021). Financial sector development can directly enhance their expenditure on goods and services, which might rise in the demand for energy in both personal and business setups which ultimately effect the environment quality in a country (Godil et al. 2021a, b, c). Similarly, Luo et al. (2021) explained that innovation activities derive energy efficiency and promote sustainable production, leads to reduce carbon emission. Institutional quality is also seen to have a significant role in promoting. Efficient institutions offer governance mechanisms that reduce risk and transaction costs. They advocate for effective production and financing in technical innovation and energy-efficient developments that all improve the environment conditions (Kassi et al. 2021). Hence, the present study is conducted with comprehensive objective to examine the influence of institutional quality, financial development, and technology innovation on environmental quality of OECD economies.

The OECD economies were selected for the analysis since these countries have the greatest contribution to the emissions. According to OECD (2021), OECD economies emit 35% of global CO2 Ems. A slower pace of industrialization, human and economic activity, and stronger environmental policies have helped reduce emissions. CO2 emissions decrease in OECD economies during the COVID-19 epidemic, especially in 2020. From 2017 to 2020, the overall OECD economies’ environmental quality will improve, reducing CO2 emissions (tons/capita) from 8.69 to 7.64%. Canada and Australia emitted 15.3%, USA 15%, and Luxembourg 14.7% are the top-releasing CO2_Emiss (tons/per capita) OECD economies, while Colombia 1.5%, Sweden 3.4%, and Mexico 3.6% are the low-releasing CO2_Emiss countries. Thus, an increase in energy consumption for industrialization and production is demanded from countries in process of industrialization and economic development. It can also be argued as larger economic development implies consuming higher energy resulting in more environmental degradation if not using renewable energy sources. To the best of our knowledge, no empirical research has been existing so far, to examine the effects of FDV, INSTQ, TINNOV, and environmental quality indicators on 37 OECD economies. Recent studies related to OECD members, such as Martínez-Zarzoso et al. (2019), Paramati et al. (2020), Ozcan et al. (2020), Cheng et al. (2021), Petrović and Lobanov (2020), Saidi and Omri (2020), and Teng et al. (2020). From these selected studies, the aim of the research conducted by Teng et al (2020) was to investigate the effects of TINNOV, INSTQ, and FDV on CO2_Emiss indicators in OECD countries from the period 1998–2018 (Figs. 1 and 2).

Several scholars identified that financial development could enhance energy efficiency or environmentally friendly technologies. According to Pata (2018), carbon emissions including environmental pollution will be decreased. This strong assumption is mainly due to the perception that the development of financial intermediaries and financial openness would draw more FDI, which could increase the level of research and development (R&D) and support the enhancement of the climate issues (Frankel and Romer 1999; Mahalik et al. 2017). Several research studies assessed the effect of different factors influencing carbon emission, e.g., globalization (Xu et al. 2018), renewable energy (Sharif et al. 2019), urbanization (R. Ali et al. 2019a, b), tourism (Jebli et al. 2019), financial development (FDV) (K. Ali et al. 2020), institutional quality (INSTQ) (Salman et al. 2019), information and communication technology (ICT) (Godil et al. 2020), and technological innovation (TINNOV) (Erdoğan et al. 2020; Bakhsh et al. 2021).

Despite all these efforts, a study addressing the financial, technological, and institutional aspects of environmental sustainability is still needed for OECD economies. Our study provides new insights into important role of these key elements for achieving sustainable development. These elements were selected due they are considered as the leading environment degradation influence, which is appropriate for the conditions of OECD economies, and thus helpful indicators for structuring environmental policies in those countries.

The justifications behind studying FDV when analyzing the relations between INSTQ, TINNOV, and CO2_Emiss indicators are (i) FDV can encourage foreign direct investment (FDI) and increasing the degrees of R&D investments, which can boost the economy’s expansion and raise CO2_Emiss (Frankel and Romer 1999); (ii) according to Dasgupta et al. (2001), stock market development helps listed companies to minimize funding costs, expand financing sources, distribute operating risks, optimize the asset/responsibility system, and invest in new ventures, leading to an increase in carbon emissions and energy consumptions; (iii) FDV encouraging to consumer lending practices, making it easier for customers to buy more expensive products, such as houses, automobiles, washing machines, air conditioners, refrigerators, and kitchen appliances, and then generate more CO2_Emiss (Sadorsky 2011); (iv) Birdsall and Wheeler (1993) underlined that FDV offers the incentive and potential for developed countries to use modern technologies, to assist them with sustainable, environmentally-friendly production and, ultimately, to boost the global environment and enhance the sustainability at regional development; and (v) FDV may contribute to more industrial emissions and environmental deterioration (Fig. 3).

The contributions of this research to the literature are numerous. (i) Our research explores the impact of FDV on environmental quality along with the moderating role of INSTQ and TINNOV. The study expands to the region, i.e., to the 37 OECD countries, which received relatively little interest in previous studies. (ii) We used four environmental quality indicators CO2pc, emissions (per capita); CO2IS (intensity); CO2HE (heat and electricity generation); and CO2FL (fuel and liquid consumption), independently considering the environmental quality proxies for the related policy implications not considered in earlier studies for OECD economies. (iii) The current research explores the effects of FDV, INSTQ, and TINNOV on CO2_Emiss, as well as other different control dimensions, such as GDPG, FDI, ENU, and TOP as control indicators, for the 37 OECD economies from 1998 to 2018. We used the cross-section dependency approach (CADF) and IPS (CIPS) panel unit root methods. Also, we employed a generalized method of moment two-step (system-GMM) econometric technique. This empirical approach enables us to elaborate model descriptions to address the potential endogeneity and heterogeneity issues and to check the findings’ robustness. The findings demonstrate that FDV, GDPG, ENU, and TOP mitigate environmental quality by increasing CO2_Emiss, while TINNOV and INSTQ increase environmental quality by decreasing CO2_Emiss.

This study is structured as follows. Following the “Introduction” section, (2) the literature review explores the determinants selected for our study (FDV, TINNOV, INSTQ, and CO2_Emiss). (3) Research design is then presented, where the data collection and analysis procedures are described. (4) The main findings and a summary of the estimation and policy implications are explained in the section of results and discussion. The paper ends with major conclusion and policy suggestions.

Literature review

This section consists on the empirical studies regarding the influence of financial development, institutional quality, and technology innovation on environmental quality. For the better understanding of the influence of these variables, we divided the literature review into three sub-sections.

Financial development and CO2 emissions

The role of FDV on environmental quality has recently gained attention in the literature (Tamazian and Rao 2010); however, prior study’s conclusions showed conflicting results. Few studies reported positive relation between FDV and the CO2_Emiss release, since a well-organized financial sector might provide financial support to finance projects that enhance the environment. The outcomes indicated positive relation between FDV and energy consumption. Further, Boutabba (2014) examined the effect of income and FDV on CO2_Emiss, emphasizing that the Indian economy has a positive relation between FDV and CO2_Emiss release. We can identify various studies suggesting that FDV has a positive impact on CO2_Emiss (Ali et al. 2019a, b; Nasreen and Anwar 2020; Shahbaz et al. 2016; Khan and Ozturk 2021). Extensive attention has been drawn to promoting sustainable development and addressing global climate change. According to Zhang (2011), emissions in a country are dependent on their income level and FDV. In a recent study, Godil et al. (2020) also observed the influence of ICT, institutional efficiency, and financial development on environment quality in Pakistan. The study found an adverse impact of financial development and ICT on CO2 emission, whereas institutional quality found to have augmenting impact on CO2 emission. Anser et al. (2021) also explained that financing in low-carbon energy improves the clean production by using data of ASEAN states. The empirical study by Ullah et al. (2022) also found the finical development as a key factor to abate CO2 emission in case of OECD economies.

Otherwise, some studies demonstrated a negative relation between FDV and CO2_Emiss. The findings showed a negative indicator of the coefficient of financial development. Shahbaz et al. (2016) indicated that FDV hampers the environment quality in Pakistan. Xu et al. (2018) stated the nexuses between FDV and emission in Saudi Arabia. Other negative influences on CO2_Emiss were studied by other relevant studies (Dar and Asif 2018; Shahbaz et al. 2020).

Empirically, several findings have been performed to investigate the FDV effects on the environment, CO2_Emiss in different regions worldwide (Pan and Yang 2019; A. Khan et al. 2019; Z. Khan et al. 2020; Yang et al. 2020). Earlier studies generally concentrated on investigating and exploring the key determents of CO2 emission, energy usage, institutional quality, trade openness, FDI, economic growth, technological innovation, and financial development (Xu et al. 2018; Shahbaz et al. 2020; Zakaria and Bibi 2019; Bayar and Maxim 2020; Godil et al. 2020; Neog and Yadava 2020; Öztürk and Le 2020; Zhao and Yang 2020; Erdoğan et al. 2020; Qin and Ozturk 2021).

From the perspective of cross-country studies, few empirical findings have revealed the impact of FDV on energy usages and CO2_Emiss. Among these studies, there are De Vries and Withagen (2005) indicating that TINNOV mitigates emissions in 13 OECD economies and Omri and Hadj (2020) focusing on 12 North Africa and the Middle East (MENA) countries, indicating a neutral relationship between FDV and CO2_Emiss. Additionally, Ziaei (2015) examined the associations in 12 East Asia, Oceania, and 13 European countries. Abbasi and Riaz (2016) found that in small, emerging economies, FDV plays an essential role in reducing CO2_Emiss. Other studies applied FDV in different countries, Kais and Sami (2016) for North African countries and Bekhet et al. (2017) in all Gulf Cooperation Council (GCC) countries. The studies of Baloch et al. (2019), Khattak et al. (2020), Rafique et al. (2020), and Ulucak (2020) examined the relations between the BRICS economies’ FDV, energy usages, TINNOV, and CO2_Emiss and suggested that FDV is an essential factor for environmental quality. Bayar and Maxim (2020) addressed the effect of FDV, economic growth, and energy usage in 11 post-transition European economies on CO2_Emiss, and Gök (2020) used the results of 72 studies and found that changes in the magnitude and direction of the effects of FDV on CO2_Emiss focus on the measures of FDV. Erdoğan et al. (2020) examined the impact of technology innovation on emissions for 14 G20 countries and investigated that while an increase in TINNOV in the industrial sector leads to a decrease in CO2_Emiss, an increase in TINNOV in the construction sector increases CO2_Emiss.

Thus, the aforementioned studies presented several proofs of long-term relations between financial development and CO2 emissions; however, the more recent empirical relationship between financial development and CO2 emission is missing. Moreover, the combine effect of financial development and institutions on CO2 emission is also missing in the empirical literature.

Technological innovation and CO2 emissions

Financial sector development boosts investments in technologies that are energy-efficient and thus reduces emissions. Several empirical research findings have already shown that the financial sector can significantly reduce CO2_Emiss by promoting technological enhancement in the energy industry. According to Aghion and Howitt (1990) and Romer (1990), a panel data model was used to define the environmental problems from a global context. They discuss the heterogeneity of the TINNOV of CO2_Emiss. The country’s FDV attracts more FDI and induces a higher level of R&D investments that results in better climate conditions (Frankel and Romer 1999). Tamazian and Rao (2010) found that FDV has enabled the listed companies to improve energy efficiency by implementing new technologies. Moyer and Hughes (2012) and Al-Mulali et al. (2015) have also shown that technological progress reduces environmental emissions due to the technology spillover impact. According to Fei et al. (2016), the relation among CO2_Emiss and TINNOV was investigated, and the results showed that R&D investments enable the use of renewable energy. Sohag et al. (2015) found that technological development declines energy consumptions and decreases CO2 emissions. In the study of Asongu et al. (2018), the effect of ICT on CO2_Emiss is positively related; however, more advanced ICT use reduces CO2_Emiss and leads to an improved environment in Sub-Saharan African countries. Henriques and Borowiecki (2017) studied the carbon emission determination measured in Japan, Northern America, and European Union. The outcome showed that technological transformation mainly affects CO2_Emiss in the long term. According to Ibrahim (2020), the role of CO2_Emiss, TINNOV, renewable energy resources, economic growth, and FDV in Egypt (1971–2014) showed that while TINNOV and renewable energy enhance the quality of environment, FDV reduces the economic growth in country. Rafique et al. (2020) argued that the impact of FDI, TINNOV, and FDV on CO2_Emiss in BRICS economies indicated long-term significant and negative correlations with CO2_Emiss. Many studies suggested that TINNOV helps reduce CO2_Emiss and increase the quality of the environment (Tan et al. 2019; Lin and Zhu 2019; Chen and Lee 2020; Shahbaz et al. 2020). Murad et al. (2019) investigated the dynamic connection between innovations, energy, energy price consumption, and economic growth by using the Denmark data. The cointegration results confirmed the existence of long-run relationship among the considered variables. Moreover, innovations in energy sector improve the energy efficiency and energy consumption. Koondhar et al. (2021) argued that modern technologies usage is also increasing along with CO2 emission as consequence of large fossil fuels. The study further explained that an enlargement in use of fossil fuels to operate modern technology is the key reason behind CO2 emission increase.

TINNOV is of considerable interest to environmental quality. TINNOV not only has a significant effect on production development but also decreases energy usage and emission indicators. The most significant contribution of TINNOV is to reduce GHG emissions without affecting economic and social development. Weitzman (2017) and Frankel and Romer (1999) examined that FDV allows companies to accumulate resources and minimize costs by using environmentally friendly technologies. This justification is supported by Yuxiang and Chen (2011) when promoting FDV measures as a major issue in developing technological spillovers, reducing CO2_Emiss, and boosting domestic consumption. According to Yeh and Rubin (2012), the most critical theoretical hypotheses in the investigation of global warming, relating to energy and the atmosphere, discuss the existence and pace of technological change. Ahmed et al. (2016) examined that TINNOV mitigates emissions by enhancing energy consumption over the long term. Simultaneously, technological innovation was found to raise energy efficiency and decrease energy usages, then ultimately leading to a decline in carbon emissions. Erdoğan et al. (2020), studying the impact of TINNOV on emissions on an industrial and construction basis, found that an enhancement in technology in the construction sector increases emissions, and a boost in TINNOV in the industrial sector leads to a decline in emissions. Rafique et al. (2020) examined that the effect of FDI, TINNOV, and FDV has significant and adverse on CO2_Emiss indicator. Godil et al. (2021a, b, c) explained that technology innovations have adverse impact on CO2 emission in by using data from 1990 to 2018 in case of China. They illustrates that an increase in innovation, the carbon emission from the transportation sector tends to reduce. By using the data of selected Asian countries, Luo et al. (2021) also explained that technology innovation can significantly reduce the CO2 emission and promote sustainability.

The previous literature has largely ignored the technology innovation to influence the environment quality, or primarily consist on environment innovations such as R&D in energy sector, which is narrow prospective of overall all innovation quality of a country. We filled this gap by using a broader proxy of innovation, i.e., total number of patents that was also missing in empirical literature especially in case of OECD economies.

Institution quality and CO2 emission

The importance of INSTQ and the increase in CO2_Emiss has not been addressed in the current literature. The majority of papers that considered institutions merely focused on one or two indicators only. Kaufmann et al. (1999) presented six separate indicators related to INSTQ, political stability, the effectiveness of government, regulation quality, voice and accountability, corruption control, and the rule of law. Kaufmann et al. (2010) observed that various governance dimensions are concentrated on single dimension of institutions. Halkos and Tzeremes (2013) stated that different aspects of governance quality might have varying effects on CO2 emissions. Ozturk and Al-Mulali (2015) noted that an effective governance system encourages environmentally sustainable policies and enhances the quality of the environment. Abid (2016, 2017), analyzed the impact of various INSTQ dimensions on environmental quality, suggests that their influence is quite strong. Additionally, effective governance plays a significant role in reducing CO2_Emiss, and INSTQ determines CO2_Emiss in equally ways.

das Neves Almeida et al. (2017) also stated that political dimensions are related to the environment, and democratic institutions improve the environment since successful legislation and regulations improve the environment. Wang et al. (2018) reported that the control of corruption helps reduce carbon emissions directly and indirectly. Ali et al. (2020) stressed that institutional quality imposes an environmentally sustainable approach. According to Teng et al. (2020), renewable energy usage has been shown to help minimize environmental degradation. Foreign direct investments, energy usage, economic development, and institutional quality have positively affected environmental degradation. Bakhsh et al. (2021) suggest that the amount of CO2_Emiss is substantially reduced between INSTQ dimensions and FDI inflows.

Some empirical research found a significant positive relationship between INSTQ and emissions (Batool et al. 2020; Godil et al. 2020; Le and Ozturk 2020; Salman et al. 2019), although some findings confirmed that institutional efficiency is important to decrease in CO2 emission (Lau et al. 2018; Zakaria and Bibi 2019; Batool et al. 2020).

Institutional quality is a significant but somewhat neglected factor that also affects environmental sustainability (Ibrahim and Law 2016; Lau et al. 2018). Prior studies have also neglected the impact of INSTQ on emissions. During the economic growth process, neutral and efficient domestic institutions play an essential role in reducing emissions (Mehmood et al. 2021). Hosseini and Kaneko (2013) stated that institutional quality influences countries’ environmental quality and can also spread the environment quality of the countries to their neighboring countries through a spatial institutional spillover channel at the same time. Low institutional quality is the main determining factor of a low-income trap in a country (Kar et al. 2019). According to Zakaria and Bibi (2019), institutions are sufficiently effective to enforce environmental regulations and improve the quality of the environment. Similarly, many other recent studies found institutional quality as a main factor to promote sustainable development (Bakhsh et al. 2021; Batool et al. 2020; Omri and Hadj 2020).

The previous studies only included one or two dimensions of institution quality and examine their impact on the environment quality. In contrast, we used six institutional indicators to estimate more efficient results, which is not analyzed before in the empirical literature.

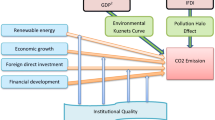

The conceptual framework of our research

Figure 4 represents the conceptual structure of presented research. The financial development and effects have been measured upon CO2_Emiss indicators. Moreover, the moderating effects of institutional quality and technology innovation are also assessed on the financial development regarding its impact on CO2_Emiss. Control variables are also involved in the study, which comprises FDI, GDPG, TOP, and ENU. The control variables are also assessed for evaluating the effects of FDV on CO2_Emiss.

Research design

The present study examined the influence of financial development on the CO2 emission by incorporating institutional quality and technology innovations as moderating variables for the sample of 37 OECD economies. The study performs following methods to examine the influence of considered variables.

Cross-sectional dependency test

To initiate the empirical research, the paper used the cross-sectional dependence (CD) test Pesaran (2021) to establish if the countries under consideration are cross-sectional dependent or independent. For instance, regions are linked via border sharing, culture, social, economic, and trade agreements. Thus, the CD test is required to establish the best panel unit root and panel cointegration technique for dealing with CD. To test cross-sectional dependence in time series panel data, we employed the CD test proposed by Pesaran (2021) and the LM test introduced by Breusch and Pagan (1980). Based on the results in Table 3, the null of cross-section independence is rejected and the alternative of cross-section dependence is accepted. This indicates there is a cross-section of economies. We used following equations:

where i denotes the dimension of cross-sections, whereas t is indicating the time period in Eq. 1.

In Eq. 2, the term N showing the sample size and T shows the time period whereas pij shows the estimates cross-sectional error correlation of the country i and j.

Unit root test

After determining cross-sectional dependence, the determinants’ integration order is checked. The panel unit root test should be used to determine the order of integration for each variable because the cointegration tests require all factors to be integrated into orders one (Al-mulali et al. 2015). The present study used the second generation of unit root tests, including the Pesaran cross-sectionally (CADF) and the Pesaran cross-sectionally (CIPS) (Pesaran 2007) because the first-generation unit root testing methods are inappropriate when there is cross-sectional dependency present in the model (Luo et al. 2021; Ullah et al. 2022). The econometrics specification is below:

where term \(\Delta\) denotes the difference operator and xit indicates the examined variable. The term α signifies the intercept, T shows the time tendency, and \(\varepsilon\) indicates the error term.

The Westerlund (2007) panel cointegration results

After the unit root analysis, the panel cointegration analysis is used to assess if the indicators have long-run correlations. The adoption of first-generation panel cointegration methods is not acceptable, as it was in the case of unit root analysis. In our study, we used the Westerlund (2007) panel cointegration test; this technique is preferable over traditional cointegration tests and is widely used in CD. The Westerlund panel cointegration method findings are shown in Table 6.

where in Eq. 4\({d}_{t}\) denoted as residual of the model, i denotes the cross-sections, and t represents the time, null hypothesis signifying no cointegration among the variables.

Two-step system generalized method of moments (SYS-GMM)

Our research utilized the generalized method of moments (GMM), specifically the system-GMM data analysis method. Various explanations served as inspirations to use this methodology. For instance, the total period in years T = 21, from 1998 to 2018, is smaller than cross-section N = 37 (number of countries). Secondly, the existence of a relation between unobserved country-specific impacts and the lagged value of dependent variables and the possible endogeneity of the variables used in the model in solving these issues. Previous studies already suggested the system-GMM for such kind of study (Arellano and Bover 1995; Blundell and Bond 1998). Compared to the first-difference GMM, the GMM system incorporates possible level relation information and the association between levels and the first differences (Ahn and Schmidt 1995). Thus, by manipulating stationary constraints, the GMM system method produces a more robust performance. In addition, when the instruments are weak, the GMM system can minimize possible biases and inaccuracy correlated with first-differenced GMM estimation techniques. In the context of these econometrics problems, the SYS-GMM method is used in this study. The Sargan test was conducted to over-identify the constraints on the validation of the instruments. The Sys-GMM estimator method’s effectiveness is further validated by analyzing the autocorrelation of the error conditions. The absence of autocorrelation in Eqs. (6) and (7) is supported if the errors in the first-differenced equation show autocorrelation in order 1 and the absence of autocorrelation in order 2.

Data collection and analysis

The goal of this research is to investigate whether technology innovations (TINNOV) and the institution quality (INSTQ) have a mediating effect in FDV decline CO2 emission. The study used yearly data over time period 1998 to 2018 focusing on the OECD countries, and dataFootnote 1 are collected from various sources.

The proxy indicator for analyzing environmental pollution is CO2_Emiss. There are several carbon emission dimensions, but four of them are going to be used in this research: (i) CO2, carbon emission (per capita metric ton); (ii) CO2 generated from electricity and heat production; (iii) CO2, from fuel liquids consumption; and (iv) CO2, intensity.

Financial development (FDV) index is an important independent variable, in this study; we used the index of financial development developed by the “International Monetary Fund (IMF).” Current researches have already highlighted the importance of using FDV on CO2_Emiss proxies and preferred the IMF’s FDV index (Bayar and Maxim, 2020; Rafique et al. 2020).

This research used technological innovation (TINNOV) as the number of total patent applications. Several empirical research used patents as a proxy for technology innovation (Saudi 2019; Alam and Murad 2020; Rafique et al. 2020; Bakhsh et al. 2021) because patent shows the range of R&D activities and sources of technology in an economy. Study expects a positive relationship among the TINNOV and CO2_Emiss indicators of the sample countries, and the results of this research are aligned with the current study (Bakhsh et al. 2021).

Regarding institutional quality index, this research considers six dimensions as a proxy for INSTQ: political stability, effectiveness of government, the rule of law, regulation quality, and corruption control. Study expects a positive link among INSTQ and CO2_Emiss as estimated by Bakhsh et al. (2021) and Batool et al. (2020).

As per previous empirical studies, several control variables are also included in our study such as FDI is taken (percentage of GDP), GDP per capita growth, and openness to trade is total measure trade (exportations plus importations) percentage of GDP and energy intensity, defined as an energy consumption to GDP ratio is used to measure energy efficiency, are used as a indicators of CO2 emissions (Baloch et al. 2019; Mardani et al. 2019; Bakhsh et al. 2021).

Econometric model specification

We applied the following dynamic panel regression model in this study, which connects CO2 emissions to FDV, TINNOV, and INSTQ with control variables:

where CO2_Emiss represents the four indicators of carbon dioxide emissions, i shows countries, t shows a time of the study conducted, and α, β, δ are considered as the coefficient, νt specifies country-specific impact, and ε is the residual term. The coefficients β1, β2… β11 represent the estimates of CO2_Emiss for mediating, explanatory, and control variables. FDV = financial development, TINNOV = technological Innovation, INSTQ = institutional quality, and ROL, COR, GOE, POS, ROQ are the six indicators of institution quality. While control variables FDI = foreign direct investment, GDPG = GDP growth, TOPS = trade openness, and ENU = energy usage.

In Eqs. 6 and 7, we checked the interaction effect of FDV*TINNOV on CO2_Emiss and FDV*INSTQ on CO2_Emiss between technological innovation, institutional quality, and financial development where \({\delta }_{j}{Z}_{it}\) represents control variables.

Two-step Sys-GMM generates more accurate results than one-step GMM estimator. The Sargan and Hansen tests (Hansen and Singleton 1982; Sargan 1958) have to be used for instrumental validity tests. Even though Sargan test is sufficiently appropriate (Bakhsh et al. 2021; Iqbal and Daly 2014), we extend the Sargan test to over-identify conditions on the validation of the instruments.

Robustness test

Principal component’s analysis (PCA), FDV*QOGI, and QOGI_INSTQ

PCA minimizes the dimension of data and combines them into a single index. Simultaneously, multicollinearity’s potential problem by including more than one proxy in a given model can be mitigating (Lenka 2015). Table 9 in Appendix reports PCA results that are used to develop the index institutional quality and quality of governance.

Equation 10 shows the lag value of carbon emission indicators, t for time, for country i, and QOGI quality of governance index; the dependent variable’s lagged is linked to the residual. Our study suggested employing the lagged value of dependent and independent variable as instrument. Blundell and Bond (1998) condemned the difference GMM estimates because the difference level gives very small evidence regarding future dynamics and shows that Sys-GMM can resolve this issue and is more consistent than difference GMM.

Results and discussions

Table 1 displays the descriptive stats and the association of FDV, TINNOV, INSTQ, and CO2_Emiss. The average value of CO2_Emiss, carbon per capita, emissions from electricity and heat production, CO2_Emiss from the liquid fuel consumption, and carbon emission intensity are 9.784, 56.740, 12,652.02, and 4.805, respectively. The average value of FDV index and TINNOV patent per thousand are 13.458 and 1152.08, respectively; the INSQ dimension mean values varied from − 0.879 to − 0.604. For the value of dispersion, the emissions from the standard deviation’s intensity indicate less variance than the other CO2_Emiss measures in the study. Although TINNOV is highly volatile than FDV, there is less volatility in the INSTQ; thus, during 1998–2018, institutional dimensions have been stable.

Table 1 shows the correlation among variables used in this study, and the result indicates a low association between variables. It is essential to say that some independent variables show a strong correlation but evaluated independently in econometric model. As result, it is verified that there is non-existence of multicollinearity in our outcomes.

The coefficient value of all dependent variables is less than 0.85, indicating no multicollinearity. Table 2 estimates the variance inflation factors (VIF) for the indicators to rule out the possibility of multicollinearity, which can lead to skewed results. The findings show that the VIF values for each variable are less than 5, indicating that there is no multicollinearity in our model.

Table 3 shows substantial evidence of CD in our OECD panel dataset from Breusch-Pagan and Pesaran tests (LM and scaled LM). The statistics demonstrate the rejection of cross-sectional independence and the presence of CD. Based on panel data analysis, it appears that CD is currently the focus of scholarly study in environmental economics. This work examined the CD among selected indicators. The OECD countries have several contracts and trade with each other. Thus, these economies are interconnected.

Table 4 exhibits, after revealing the CD findings, this research used the second-generation IPS (CADF) and CIPS unit root test to check the stationarity. Regarding CIPS, CO2PC, CO2HE, CO2FL, CO2IS, TINNOV, VOS, POS, ROQ, GOV, ROL, COC, GDPG, ENU, FDI, and TOP are stationary at level; however, FDV is stationary at first difference. The CADF test show a mixed order of integrations as CO2PC, CO2HE, CO2FL, CO2IS, TINNOV, VOS, POS, ROQ, GOV, ROL, COC, GDPG, ENU, and TOP are stationary at level; however, FDV and FDI are stationary at first difference.

Table 5 shows the Westerlund panel cointegration test results. The results confirm the model’s cointegrating equations. Thus, there are long-run relationships between environmental quality indicators and the explanatory variables obtained in this study. Our result shows that one group (Gt) and one panel (Pt) test provide significant statistics. Based on these findings, our model’s variables are cointegrated.

After confirming the existence of long-run relationship among variables through Westerlund panel cointegration test, long-run coefficients of the explanatory variables are estimated by Sys-GMM. Table 6, Table 7, and Table 8 indicate the results of the Sys-GMM related to the statistical relation between FDV, INSQ, TINNOV, and the applied CO2_Emiss indicators. The results show the relation between INSTQ, FDV, and CO2_Emiss indicator. Concerning the impact of FDV on CO2_Emiss proxies, FDV showed a significant and positive impact on CO2_Emiss, ranging from 0.103 to 0.547 percentage term. The positive relation between FDV and CO2_Emiss is supported by existing literature (Ahmad et al. 2018; Salahuddin et al. 2018; Esmaeilpour Moghadam and Dehbashi 2018; Zakaria and Bibi 2019; Neog and Yadava 2020; Bayar and Maxim 2020). This positive linkage between FDV and environmental quality can be explained by the fact that FDV degrades the environment in developing countries; FDV is used for capitalization in these countries, i.e., to motivate the development of industries from small scale. The small industries have some advantages of economies of scale in resources usage and the pollution reduction. For that reason, pollution has enlarged in such countries after FDV.

Secondly, the INSTQ variables have a significant and negative influence on the environment, ranging from the 0.090 to a value of 0.983. These results indicate that a stronger institution climate could efficiently and conveniently decline the country’s CO2_Emiss and thereby protect the environment from degradation. This negative impact of INSTQ and environmental quality is consistent with North (1990) and Omri and Hadj (2020), when suggesting that efficient institutions will contribute to environmental sustainability, thereby reducing CO2_Emiss (Zhang et al. 2020; Zugravu et al. 2009) that the environment is harmed by more corruption and that INSTQ enhances the environment.

Our analysis focuses on another weakness in the current literature, the composite impact of the FDV indicators of INSTQ on the four CO2_Emiss dimensions. Tables 6 and 7 present that the finding of the moderating role between INSTQ variables and FDV on CO2_Emiss indicators has significant negative effects on all CO2_Emiss dimensions. The negative coefficients of the mediating role FDV and INSTQ suggest that, when institutions are strong, FDV will reduce CO2_Emiss. In turn, if INSTQ is statistically weak, CO2_Emiss would increase as a result of FDV. These assumptions validate the regulatory impact of the hypothesis that FDV is good for the economy in the presence of (climate change) regulations. The institutions are that the financial industry would provide loans to environmentally sustainable projects in the presence of strong institutions. Thus, the moderation nexuses’ negative and significant effect suggests the complementary influence of FDV and INSTQ on CO2_Emiss (Zakaria & Bibi, 2019). Al-Mulali et al. (2015) suggested that a well-functioning institutional framework promotes environmental policy decisions that decrease CO2_Emiss. Omri and Hadj (2020) also endorse the negative correlation between FDV and governance variables with CO2_Emiss. However, the positive effect of INSTQ is supported by previous studies (Godil et al., 2020; Ibrahim, 2020). The key findings are that a significant and positive interaction variable between CO2_Emiss and INSTQ suggests that efficient and impartial domestic institutional framework is significant for improving FDV and decreasing the carbon emission. The findings regarding the effect of control variables such as GDP, energy usage (ENU), foreign direct investment (FDI), and trade openness (TOP) on CO2 emissions are also in line with previous empirical studies (see, for example, Ullah et al., 2022; Luo et al., 2021; Ullah et al., 2021a, b; Ali and Kirikkaleli 2021; Shabir et al., 2021).

Table 8 outcome indicates the nexuses between TINNOV, FDV, and CO2_Emiss dimensions. Concerning the correlations among FDV on different dimensions of CO2_Emiss (per capita, heat and electricity production, liquid fuel, intensive) showed a positive effect on FDV on CO2_Emiss indicators, which range from 0.185 to 0.852. The outcomes revealed that all coefficients of TINNOV have significantly negative on CO2_Emiss indicator, as revealed in the Table 8, ranges from value − 0.089 to value − 0.118 indicates surging TINNOV leading to mitigates CO2_Emiss in OECD economies. Ganda (2019) found that TINNOV has an environmentally friendly influence on CO2_Emiss. Thus, with the increase in TINNOV, the result decreases the CO2_Emiss. This inverse relation was also supported by Sohag et al. (2015), Salahuddin and Gow (2016), Ozcan and Apergis (2018), Godil et al. (2020), and Bakhsh et al. (2021).

Our study also examined the essential gap in the current study and investigated the mediating role between TINNOV and FDV on the consideration of CO2_Emiss variable indicators. Table 8 indicates that the moderating role between TINNOV and FDV on considering CO2_Emiss dimensions showed negative and statistically significant scores across proposed models. These outcomes imply for the sample countries that technology development is the principal situation FDV reduces CO2_Emiss. The findings of our study are also coherent with Batool et al. (2020), Fan et al. (2019), Rafique et al. (2020), and Tan et al. (2019), confirming that technological developments and innovations in the impact of the technological spillover of FDV, therefore, reduce CO2_Emiss indicators and improve quality of environment.

Lastly, regarding the relation between FDV, INSQ, TINNOV, and CO2_Emiss indicators, our research analyzed that the control variable (the coefficient) and the sign of GDP growth (openness to trade and energy usage) have been statistically significant and positively effecting the CO2_Emiss. The outcomes of our study are consistent with the results of Bakhsh et al. (2021). Moreover, our findings have been verified by Khan and Ozturk (2020), when GDP growth contributes to the increased atmospheric pollution. Furthermore, the correlation between energy use and CO2_Emiss is significantly positive. This refers to the conclusion that the rise in energy usages indicates an upsurge in CO2_Emiss. The coefficient of trade openness, which directly or indirectly influences CO2_Emiss, proved to positively affect on the CO2_Emiss indicators.

Robustness check

To ensure that the main findings are robust, we developed the institutional quality index and the quality governance (QOG) based on the vital component analysis and evaluated the overall effect on CO2_Emiss indicators. Results are consistent with our primary outcome robustness control (as seen in Table 9 in Appendix).

Conclusion and policy implications

This study investigated the linkage among financial development (FDV), institutional quality (INSTQ), and technological innovation (TINNOV) on carbon emissions (CO2_Emiss) indicators in OECD countries over the period 1998–2018, employing GMM method. Precisely, our research investigated the conditioning effect of INSTQ and TINNOV on the relation between FDV and CO2_Emiss. TINNOV and INSTQ indicators are used for policy proxies in our study, attempt to imitate FDV to reduce CO2_Emiss. Additionally, four CO2_Emiss dimensions and six INSTQ indicators, and FDV index indicators for the financial institution and financial market (depth, efficiency, and access) were incorporated into our study. The outcomes provide significant results for the mediating role of INSTQ and TINNOV in reducing CO2_Emiss in OECD economies. The empirical outcomes indicate the significant and positive relation between FDV and different dimensions of carbon emission. On contrary, institutional quality and technology innovations are negatively affecting the carbon emission dimensions. Secondly, we identified a negative moderating role of institutional quality and technology innovations with financial development on different carbon emission dimensions.

Our research addresses important implications for policymakers. There is a trend to neglect the association between financial development, technology innovation, institution quality, and environmental quality in OECD economies. Though, inadequate external analyses often result in significant environmental effects. Our results suggest that, the extent of financial development and the CO2 emission connection is highly dependent on institution quality and technology innovation. Environmentally friendly technologies could also been an essential factor in decreasing the adverse impact of FDV on the quality of environment. The study recommends that more investments in the technology field are needed, which could provide an incentive to import new technology to carbon reduction. Similarly, the authorities should also introduce effective regulations to encourage financial development and innovation measures in clean energy sources to offset the environmental damages. Finally, environmentally sound technologies could assist to protect the environmental quality by reduction of toxic waste and energy preservation.

We address some of our study’s limitations. The scope of our analysis is confined to one indication of technological innovation; however, other indicators such as government expenditure on R&D, the number of research articles published per 1000 citizens in-country, and the global innovation index can be used in future research studies. Moreover, the same methodology and indicators can be utilized for the sample countries of other regions, and the countries classified on the level of income and development to ensure the significance of analyzed variables in environmental sustainability.

Data availability

The dataset used and analyzed during the current study are available from the corresponding author on reasonable request.

Notes

Data were extracted from the World Bank Development Indicators (published by WDI-2020), International Monetary Fund (IMF) database, World Governance Indicator, British Petroleum database (BP Statistical Review, 2020), and OECD database.

References

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–14

Abid M (2016) Impact of economic, financial, and institutional factors on CO2 emissions: evidence from sub-Saharan Africa economies. Util Policy 41:85–94

Abid M (2017) Does economic, financial and institutional developments matter for environmental quality? A comparative analysis of EU and MEA countries. J Environ Manag 188:183–194

Aghion P, Howitt P (1990) A model of growth through creative destruction

Ahmad M, Khan Z, Ur Rahman Z, Khan S (2018) Does financial development asymmetrically affect CO2 emissions in China? An application of the nonlinear autoregressive distributed lag (NARDL) model. Carbon Manag 9(6):631–644

Ahmed K, Shahbaz M, Kyophilavong P (2016) Revisiting the emissions-energy-trade nexus: evidence from the newly industrializing countries. Environ Sci Pollut Res. 23(8):7676–7691

Ahn SC, Schmidt P (1995) Efficient estimation of models for dynamic panel data. J Econ 68(1):5–27

Alam MM, Murad MW (2020) The impacts of economic growth, trade openness and technological progress on renewable energy use in organization for economic co-operation and development countries. Renew Energy 145:382–390

Ali HS, Law SH, Lin WL, Yusop Z, Chin L, Bare UAA (2019a) Financial development and carbon dioxide emissions in Nigeria: evidence from the ARDL bounds approach. GeoJournal 84(3):641–655

Ali R, Bakhsh K, Yasin MA (2019) Impact of urbanization on CO2 emissions in emerging economy: evidence from Pakistan. Sustain Cities Soc 48:101553

Ali M, Kirikkaleli D (2021) The asymmetric effect of renewable energy and trade on consumption-based CO2 emissions: the case of Italy. Integr Environ Assess Manag. https://doi.org/10.1002/ieam.4516

Ali K, Bakhsh S, Ullah S, Ullah A, Ullah S (2020) Industrial growth and CO2 emissions in Vietnam: the key role of financial development and fossil fuel consumption. Environ Sci Pollut Res 28(6):7515–7527

Al-Mulali U, Tang CF, Ozturk I (2015) Does financial development reduce environmental degradation? Evidence from a panel study of 129 countries. Environ Sci Pollut Res 22(19):14891–14900

Anser MK, Usman M, Godil DI, Shabbir MS, Tabash MI, Ahmad M, Lopez LB (2021) Does air pollution affect clean production of sustainable environmental agenda through low carbon energy financing? Evidence from ASEAN countries. Energ Environ. https://doi.org/10.1177/0958305X211007854

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econ 68(1):29–51

Asongu SA, Le Roux S, Biekpe N (2018) Enhancing ICT for environmental sustainability in sub-Saharan Africa. Technol Forecast Soc Chang 127:209–216

Bakhsh S, Yin H, Shabir M (2021) Foreign investment and CO2 emissions: do technological innovation and institutional quality matter? Evidence from system GMM approach.Environ Sci Pollut Res 28(15):19424–19438

Baloch MA, Mahmood N, Zhang JW (2019) Effect of natural resources, renewable energy and economic development on CO2 emissions in BRICS countries. Sci Total Environ 678:632–638

Batool M, Jehan Y, Hayat N (2020) Effect of financial development and institutional quality on the environmental degradation in developed and developing countries. Int J Hum Capital Urban Manage 5(2):111–124

Bayar Y, Maxim A (2020) Financial development and CO2 emissions in post-transition European Union countries. Sustainability 12(7):2640

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: dynamic simultaneous equation models. Renew Sust Energ Rev 70:117–132

Birdsall N, Wheeler D (1993) Trade policy and industrial pollution in Latin America: where are the pollution havens? J Environ Dev 2(1):137–149

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87(1):115–143

Boutabba MA (2014) The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Econ Model 40:33–41

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47(1):239–253

Chen Y, Lee C-C (2020) Does technological innovation reduce CO2 emissions? Cross-country evidence. J Clean Prod 263:121550

Cheng C, Ren X, Dong K, Dong X, Wang Z (2021) How does technological innovation mitigate CO2 emissions in OECD countries? Heterogeneous analysis using panel quantile regression. J Environ Manag 280:111818

Dar JA, Asif M (2018) Does financial development improve environmental quality in Turkey? An application of endogenous structural breaks based cointegration approach. Management of Environmental Quality: An International Journal 29:368–384. https://doi.org/10.1108/MEQ-02-2017-0021

Dasgupta S, Laplante B, Mamingi N (2001) Pollution and capital markets in developing countries. J Environ Econ Manag 42(3):310–335

das Neves Almeida TA, Cruz L, Barata E, García-Sánchez IM (2017) Economic growth and environmental impacts: an analysis based on a composite index of environmental damage. Ecol Indic 76:119–130

De Vries FP, Withagen C (2005) Innovation and environmental stringency: the case of sulfur dioxide abatement

Durán-Romero G, López AM, Beliaeva T, Ferasso M, Garonne C, Jones P (2020) Bridging the gap between circular economy and climate change mitigation policies through eco-innovations and quintuple Helix model. Technol Forecast Soc Chang 160:120246

Erdoğan S, Yıldırım S, Yıldırım DÇ, Gedikli A (2020) The effects of innovation on sectoral carbon emissions: evidence from G20 countries. J Environ Manag 267:110637

Esmaeilpour Moghadam H, Dehbashi V (2018) The impact of financial development and trade on environmental quality in Iran. Empir Econ 54(4):1777–1799

Fan J-L, Da Y-B, Wan S-L, Zhang M, Cao Z, Wang Y, Zhang X (2019) Determinants of carbon emissions in ‘Belt and Road initiative’ countries: a production technology perspective. Appl Energy 239:268–279

Fei J, Wang Y, Yang Y, Chen S, Zhi Q (2016) Towards eco-city: the role of green innovation. Energy Procedia 104:165–170

Frankel JA, Romer DH (1999) Does trade cause growth? Am Econ Rev 89(3):379–399

Ganda F (2019) The impact of innovation and technology investments on carbon emissions in selected organisation for economic co-operation and development countries. J Clean Prod 217:469–483

Godil DI, Sharif A, Agha H, Jermsittiparsert K (2020) The dynamic nonlinear influence of ICT, financial development, and institutional quality on CO2 emission in Pakistan: new insights from QARDL approach. Environ Sci Pollut Res 27(19):24190–24200

Godil DI, Ahmad P, Ashraf MS, Sarwat S, Sharif A, Shabib-ul-Hasan S, Jermsittiparsert K (2021a) The step towards environmental mitigation in Pakistan: do transportation services, urbanization, and financial development matter? Environ Sci Pollut Res 28(17):21486–21498

Godil DI, Sharif A, Ali MI, Ozturk I, Usman R (2021) The role of financial development, R&D expenditure, globalization and institutional quality in energy consumption in India: new evidence from the QARDL approach. J Environ Manag 285:112208

Godil DI, Yu Z, Sharif A, Usman R, Khan SAR (2021) Investigate the role of technology innovation and renewable energy in reducing transport sector CO2 emission in China: a path toward sustainable development. Sustain Dev 29(4):694–707

Gök A (2020) The role of financial development on carbon emissions: a meta regression analysis. Environ Sci Pollut Res 27(11):11618–11636. https://doi.org/10.1007/s11356-020-07641-7

Halkos GE, Tzeremes NG (2013) Carbon dioxide emissions and governance: a nonparametric analysis for the G-20. Energy Econ 40:110–118

Hansen LP, Singleton KJ (1982) Generalized instrumental variables estimation of nonlinear rational expectations models. Econometrica: J Econ Soc 50(5):1269–1286

Henriques ST, Borowiecki KJ (2017) The drivers of long-run CO2 emissions in Europe, North America and Japan since 1800. Energy Policy 101:537–549

Hosseini HM, Kaneko S (2013) Can environmental quality spread through institutions? Energy Policy 56:312–321

Hughes TP, Kerry JT, Álvarez-Noriega M, Álvarez-Romero JG, Anderson KD, Baird AH et al (2017) Global warming and recurrent mass bleaching of corals. Nature 543(7645):373–377

Ibrahim DM (2020) Do technological innovations and financial development improve environmental quality in Egypt? Environ Sci Pollut Res 27(10):10869–10881

Ibrahim MH, Law SH (2016) Institutional quality and CO2 emission–trade relations: evidence from sub-Saharan Africa. S Afr J Econ 84(2):323–340

Iqbal N, Daly V (2014) Rent seeking opportunities and economic growth in transitional economies. Econ Model 37:16–22

Jebli MB, Youssef SB, Apergis N (2019) The dynamic linkage between renewable energy, tourism, CO2 emissions, economic growth, foreign direct investment, and trade. Latin Am Econ Rev 28(1):1–19

Kais S, Sami H (2016) An econometric study of the impact of economic growth and energy use on carbon emissions: panel data evidence from fifty eight countries. Renew Sust Energ Rev 59:1101–1110

Kar S, Roy A, Sen K (2019) The double trap: institutions and economic development. Econ Model 76:243–259

Kassi DF, Li Y, Dong Z (2021) The mitigating effect of governance quality on the finance-renewable energy-growth nexus: some international evidence. Int J Financ Econ. https://doi.org/10.1002/ijfe.2423

Kaufmann D, Kraay A, Zoido-Lobatón P (1999) Aggregating governance indicators, vol. 2195. World Bank Publications

Kaufmann D, Kraay A, Mastruzzi M (2010) Response to ‘what do the worldwide governance indicators measure?’ Eur J Dev Res 22(1):55–58

Khan MA, Ozturk I (2020) Examining foreign direct investment and environmental pollution linkage in Asia. Environ Sci Pollut Res 27(7):7244–7255

Khan M, Ozturk I (2021) Examining the direct and indirect effects of financial development on CO2 emissions for 88 developing countries. J Environ Manag 293:112812

Khan A, Chenggang Y, Hussain J, Bano S (2019) Does energy consumption, financial development, and investment contribute to ecological footprints in BRI regions? Environ Sci Pollut Res 26(36):36952–36966

Khan Z, Hussain M, Shahbaz M, Yang S, Jiao Z (2020) Natural resource abundance, technological innovation, and human capital nexus with financial development: a case study of China. Resour Policy 65:101585

Khattak SI, Ahmad M, Khan ZU, Khan A (2020) Exploring the impact of innovation, renewable energy consumption, and income on CO2 emissions: new evidence from the BRICS economies. Environ Sci Pollut Res 27(12):13866–13881

Koondhar MA, Shahbaz M, Ozturk I, Randhawa AA, Kong R (2021) Revisiting the relationship between carbon emission, renewable energy consumption, forestry, and agricultural financial development for China. Environ Sci Pollut Res 28(33):45459–45473

Lau LS, Choong CK, Ng CF (2018) Role of institutional quality on environmental Kuznets curve: a comparative study in developed and developing countries. In: Advances in pacific basin business, economics and finance. Emerald Publishing Limited

Le HP, Ozturk I (2020) The impacts of globalization, financial development, government expenditures, and institutional quality on CO2 emissions in the presence of environmental Kuznets curve. Environ Sci Pollut Res 27(18):22680–22697

Lenka SK (2015) Does financial development influence economic growth in India? Theoretical & Applied Economics 22(4)

Lin B, Zhu J (2019) The role of renewable energy technological innovation on climate change: empirical evidence from China. Sci Total Environ 659:1505–1512

Luo R, Ullah S, Ali K (2021) Pathway towards sustainability in selected Asian countries: influence of green investment, technology innovations, and economic growth on CO2 emission. Sustainability 13(22):12873. https://doi.org/10.3390/su132212873

Mahalik MK, Babu MS, Loganathan N, Shahbaz M (2017) Does financial development intensify energy consumption in Saudi Arabia? Renew Sust Energ Rev 75:1022–1034

Mardani A, Streimikiene D, Cavallaro F, Loganathan N, Khoshnoudi M (2019) Carbon dioxide (CO2) emissions and economic growth: a systematic review of two decades of research from 1995 to 2017. Sci Total Environ. 649:31–49

Martínez-Zarzoso I, Bengochea-Morancho A, Morales-Lage R (2019) Does environmental policy stringency foster innovation and productivity in OECD countries? Energy Policy 134:110982

Mehmood U, Tariq S, Ul-Haq Z, Meo MS (2021) Does the modifying role of institutional quality remains homogeneous in GDP-CO2 emission nexus? New evidence from ARDL approach. EnvironSci Pollut Res 28(8):10167–10174

Moyer JD, Hughes BB (2012) ICTs: do they contribute to increased carbon emissions? Technol Forecast Soc Chang 79(5):919–931

Murad MW, Alam MM, Noman AHM, Ozturk I (2019) Dynamics of technological innovation, energy consumption, energy price and economic growth in Denmark. Environ Prog Sustainable Energy 38(1):22–29

Neog Y, Yadava AK (2020) Nexus among CO2 emissions, remittances, and financial development: a NARDL approach for India. Environ Sci Pollut Res 27(35):44470–44481

OECD (2021) Air and GHG emissions (Publication no. doi: https://doi.org/10.1787/93d10cf7-en). Online accessed on 26-09-2021.https://www.oecd-ilibrary.org/content/data/93d10cf7-en

Omri A, Hadj TB (2020) Foreign investment and air pollution: do good governance and technological innovation matter? Environ Res 185:109469

Ozcan B, Apergis N (2018) The impact of internet use on air pollution: evidence from emerging countries. Environ Sci Pollut Res 25(5):4174–4189

Ozcan B, Tzeremes PG, Tzeremes NG (2020) Energy consumption, economic growth and environmental degradation in OECD countries. Econ Model 84:203–213

Ozturk I, Al-Mulali U (2015) Natural gas consumption and economic growth nexus: panel data analysis for GCC countries. Renew Sust Energ Rev 51:998–1003

Öztürk İ, Le HP (2020) The impacts of globalization, financial development, government expenditures, and institutional quality on CO2 emissions in the presence of environmental Kuznets curve. Environ Sci Pollut Res 27(18):22680–22697

Pan F, Yang B (2019) Financial development and the geographies of startup cities: evidence from China. Small Bus Econ 52(3):743–758

Paramati SR, Mo D, Huang R (2020) The role of financial deepening and green technology on carbon emissions: evidence from major OECD economies. Finan Res Lett 41:101794

Pata UK (2018) Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: testing EKC hypothesis with structural breaks. J Clean Prod 187:770–779

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22(2):265–312

Pesaran MH (2021) General diagnostic tests for cross-sectional dependence in panels. Empir Econ 60(1):13–50

Petrović P, Lobanov MM (2020) The impact of R&D expenditures on CO2 emissions: evidence from sixteen OECD countries. J Clean Prod 248:119187

Qin Z, Ozturk I (2021) Renewable and non-renewable energy consumption in BRICS: assessing the dynamic linkage between foreign capital inflows and energy consumption. Energies 14(10):2974

Rafique MZ, Li Y, Larik AR, Monaheng MP (2020) The effects of FDI, technological innovation, and financial development on CO2 emissions: evidence from the BRICS countries. Environ Sci Pollut Res 27(19):23899–23913. https://doi.org/10.1007/s11356-020-08715-2

Romer PM (1990) Endogenous technological change. J Polit Econ 98(5, Part 2):S71–S102

Roodman D (2009) How to do xtabond2: an introduction to difference and system GMM in Stata. Stand Genomic Sci 9(1):86–136

Sadorsky P (2011) Financial development and energy consumption in central and eastern European frontier economies. Energy Policy 39(2):999–1006

Saidi K, Omri A (2020) Reducing CO2 emissions in OECD countries: do renewable and nuclear energy matter? Prog Nucl Energy 126:103425

Salahuddin M, Gow J (2016) The effects of internet usage, financial development and trade openness on economic growth in South Africa: a time series analysis. Telematics Inform 33(4):1141–1154

Salahuddin M, Alam K, Ozturk I, Sohag K (2018) The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew Sust Energ Rev 81:2002–2010

Salman M, Long X, Dauda L, Mensah CN (2019) The impact of institutional quality on economic growth and carbon emissions: evidence from Indonesia, South Korea and Thailand. J Clean Prod 241:118331

Sargan JD (1958) The estimation of economic relationships using instrumental variables. Econometrica: Journal of the Econometric Society:393–415

Saudi MHM. (2019). The role of renewable, non-renewable energy consumption and technology innovation in testing environmental Kuznets curve in Malaysia.

Shabir M, Ali M, Hashmi SH, Bakhsh S (2021) Heterogeneous effects of economic policy uncertainty and foreign direct investment on environmental quality: cross-country evidence. Environ Sci Pollut Res 29(2):2737–2752

Shahbaz M, Shahzad SJH, Ahmad N, Alam S (2016) Financial development and environmental quality: the way forward. Energy Policy 98:353–364

Shahbaz M, Raghutla C, Song M, Zameer H, Jiao Z (2020) Public-private partnerships investment in energy as new determinant of CO2 emissions: the role of technological innovations in China. Energy Econ 86:104664

Sharif A, Raza SA, Ozturk I, Afshan S (2019) The dynamic relationship of renewable and nonrenewable energy consumption with carbon emission: a global study with the application of heterogeneous panel estimations. Renew Energy 133:685–691

Sohag K, Begum RA, Abdullah SMS, Jaafar M (2015) Dynamics of energy use, technological innovation, economic growth and trade openness in Malaysia. Energy 90:1497–1507

Tamazian A, Rao BB (2010) Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ 32(1):137–145

Tan X, Li H, Guo J, Gu B, Zeng Y (2019) Energy-saving and emission-reduction technology selection and CO2 emission reduction potential of China’s iron and steel industry under energy substitution policy. J Clean Prod 222:823–834

Teng J-Z, Khan MK, Khan MI, Chishti MZ, Khan MO (2020) Effect of foreign direct investment on CO2 emission with the role of globalization, institutional quality with pooled mean group panel ARDL. Environ Sci Pollut Res 28(5):5271–5282

Ullah S, Ozturk I, Majeed MT, Ahmad W (2021) Do technological innovations have symmetric or asymmetric effects on environmental quality? Evidence from Pakistan. J Clean Prod 316:128239

Ullah S, Nadeem M, Ali K, Abbas Q (2021a) Fossil fuel, industrial growth and inward FDI impact on CO2emissions in Vietnam: testing the EKC hypothesis. Manag Environ Qual Int J 33(2):222–240

Ullah S, Ali K, Shah SA, Ehsan M (2022) Environmental concerns of financial inclusion and economic policy uncertainty in the era of globalization: evidence from low & high globalized OECD economies. Environ Sci Pollut Res 1–15. https://doi.org/10.1007/s11356-022-18758-2

Ulucak R (2020) How do environmental technologies affect green growth? Evidence from BRICS economies. Sci Total Environ 712:136504

Wang Z, Zhang B, Wang B (2018) The moderating role of corruption between economic growth and CO2 emissions: evidence from BRICS economies. Energy 148:506–513

Weitzman ML (2017) Sustainability and technical progress. In: The economics of sustainability: Routledge, p 329–41

Westerlund J (2007) Testing for error correction in panel data. Oxf Bull Econ Stat 69(6):709–748

Xu Z, Baloch MA, Meng F, Zhang J, Mahmood Z (2018) Nexus between financial development and CO2 emissions in Saudi Arabia: analyzing the role of globalization. Environ Sci Pollut Res 25(28):28378–28390

Yang L, Hui P, Yasmeen R, Ullah S, Hafeez M (2020) Energy consumption and financial development indicators nexuses in Asian economies: a dynamic seemingly unrelated regression approach. Environ Sci Pollut Res 27(14):16472–16483

Yeh S, Rubin ES (2012) A review of uncertainties in technology experience curves. Energy Econ 34(3):762–71

Yuxiang K, Chen Z (2011) Financial development and environmental performance: evidence from China. Environ Dev Econ 16(1):93–111

Zakaria M, Bibi S (2019) Financial development and environment in South Asia: the role of institutional quality. Environ Sci Pollut Res 26(8):7926–7937

Zhang YJ (2011) The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy 39(4):2197–2203

Zhang J, Liang G, Feng T, Yuan C, Jiang W (2020) Green innovation to respond to environmental regulation: how external knowledge adoption and green absorptive capacity matter? Bus Strateg Environ 29(1):39–53

Zhao B, Yang W (2020) Does financial development influence CO2 emissions? A Chinese province-level study. Energy 200:117523

Ziaei SM (2015) Effects of financial development indicators on energy consumption and CO2 emission of European, East Asian and Oceania countries. Renew Sust Energ Rev 42:752–759

Zugravu CA, Parvu M, Patrascu D, Stoian A (2009) Correlations between lead and cadmium pollution of honey and environmental heavy metal presence in two Romanian counties. Bull UASVM Agric 66:230–233

Author information

Authors and Affiliations

Contributions

Responsibilities are as follows:

Du Jianguo: conceptualization; supervision; validation; writing—review and editing.

Kishwar Ali: conceptualization; writing—original draft preparation; formal analysis; validation; data curtain; methodology.

Faisal Alnori: conceptualization; methodology; formal analysis; validation; writing—review and editing.

Sami Ullah: conceptualization; methodology; writing—original draft reviews; validation.

Corresponding author

Ethics declarations

Ethics approval

Study did not use any data which need approval.

Consent to participate

All authors have participated in the process, read and agreed to the published version of the manuscript.

Consent for publication

All authors have read and agreed to the published version of the manuscript.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Ilhan Ozturk

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Prof. Dr. Du Jianguo research interest includes regional economic management, business management, sustainable development, environmental economics, management systems, and social management engineering. Dr. Kishwar Ali, Ph.D. research interests include financial stability, risk management, policy uncertainty, environmental economics, green finance, insurance, and banking. Prof. Dr. Faisal Alnori area of research includes financial stability, corporate governance, banking, green finance, and environmental economics. Sami Ullah (Ph.D. Scholar) research interests include environmental economics, regional development, and economic growth.

Rights and permissions

About this article

Cite this article

Jianguo, D., Ali, K., Alnori, F. et al. The nexus of financial development, technological innovation, institutional quality, and environmental quality: evidence from OECD economies. Environ Sci Pollut Res 29, 58179–58200 (2022). https://doi.org/10.1007/s11356-022-19763-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-19763-1