Abstract

Assuming that the stock price X follows a geometric Brownian motion with drift \(\mu \in \mathbb {R}\) and volatility \(\sigma >0\), and letting \(\mathsf {P}_{\!x}\) denote a probability measure under which X starts at \(x>0\), we study the dynamic version of the nonlinear mean–variance optimal stopping problem

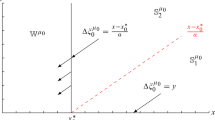

where t runs from 0 onwards, the supremum is taken over stopping times \(\tau \) of X, and \(c>0\) is a given and fixed constant. Using direct martingale arguments we first show that when \(\mu \le 0\) it is optimal to stop at once and when \(\mu \ge \sigma ^2\!/2\) it is optimal not to stop at all. By employing the method of Lagrange multipliers we then show that the nonlinear problem for \(0 < \mu < \sigma ^2\!/2\) can be reduced to a family of linear problems. Solving the latter using a free-boundary approach we find that the optimal stopping time is given by

where \(\gamma = \mu /(\sigma ^2\!/2)\). The dynamic formulation of the problem and the method of solution are applied to the constrained problems of maximising/minimising the mean/variance subject to the upper/lower bound on the variance/mean from which the nonlinear problem above is obtained by optimising the Lagrangian itself.

Similar content being viewed by others

Notes

We are indebted to Sven Rady for pointing out possible connections with the economics literature after seeing the results on the static and dynamic optimality exposed in Theorem 3 above.

References

Basak, S., Chabakauri, G.: Dynamic mean–variance asset allocation. Rev. Financ. Stud. 23, 2970–3016 (2010)

Björk, T., Murgoci, A.: A general theory of Markovian time inconsistent stochastic control problems. Preprint SSRN (2010)

Czichowsky, C.: Time-consistent mean-variance portfolio selection in discrete and continuous time. Financ. Stoch. 17, 227–271 (2013)

Doob, J.L.: Heuristic approach to the Kolmogorov–Smirnov theorems. Ann. Math. Stat. 20, 393–403 (1948)

Du Toit, J., Peskir, G.: Selling a stock at the ultimate maximum. Ann. Appl. Prob. 19, 983–1014 (2009)

Ekeland, I., Pirvu, T.A.: Investement and consumption without commitment. Math. Financ. Econ. 2, 57–86 (2008)

Frederick, S., Loewenstein, G., O’Donoghue, T.: Time discounting and time preferences: a critical review. J. Econ. Lit. 40, 351–401 (2002)

Goldman, S.M.: Consistent plans. Rev. Econ. Stud. 47, 533–537 (1980)

Li, D., Ng, W.L.: Optimal dynamic portfolio selection: multiperiod mean-variance formulation. Math. Financ. 10, 387–406 (2000)

Markowitz, H.M.: Portfolio selection. J. Financ. 7, 77–91 (1952)

Pedersen, J.L.: Explicit solutions to some optimal variance stopping problems. Stochastics 83, 505–518 (2011)

Peleg, B., Yaari, M.E.: On the existence of a consistent course of action when tastes are changing. Rev. Econ. Stud. 40, 391–401 (1973)

Peskir, G., Shiryaev, A.N.: Optimal Stopping and Free-Boundary Problems. Lectures in Mathematics. ETH Zürich, Birkhäuser, Zürich (2006)

Pollak, R.A.: Consistent planning. Rev. Econ. Stud. 35, 201–208 (1968)

Richardson, H.R.: A minimum variance result in continuous trading portfolio optimization. Manag. Sci. 35, 1045–1055 (1989)

Samuelson, P.: A note on measurement of utility. Rev. Econ. Stud. 4, 155–161 (1937)

Strotz, R.H.: Myopia and inconsistency in dynamic utility maximization. Rev. Econ. Stud. 23, 165–180 (1956)

Acknowledgments

The second named author gratefully acknowledges financial support and hospitality from the Hausdorff Research Institute for Mathematics at the University of Bonn under the Trimester Programme entitled Stochastic Dynamics in Economics and Finance where the present research was exposed and further developed (June 2013).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Pedersen, J.L., Peskir, G. Optimal mean–variance selling strategies. Math Finan Econ 10, 203–220 (2016). https://doi.org/10.1007/s11579-015-0156-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11579-015-0156-2

Keywords

- Nonlinear optimal stopping

- Static optimality

- Dynamic optimality

- Mean–variance analysis

- Smooth fit

- Free-boundary problem