Abstract

This paper took the technological innovation status of the Daqing Petroleum Company in China during 2012–2015 as the subject to analyze the technological innovation efficiency (TIE) from an input-oriented perspective. It presents an approach combining BCC model and Malmquist index model to analyze the TIE and its varying trend of petroleum companies from both static and dynamic perspectives. It finds out the characteristics of changes of the TIE of petroleum companies. It conducts analysis on distribution characters of the results of the evaluation. It ranks the important parameters influencing the TIE. It tests the feasibility and applicability of the new method applied to measure the TIE. It provides analysis tools to evaluate the company TIE. This approach will be helpful to explore new applied area of the DEA models and lay down foundations for the decision makers in related industries.

Similar content being viewed by others

Introduction

In the nineteenth century, German classical economist Friedrich Liszt put forward the theory of national technological innovation system when studying the issue of national political and economic development. This is the earliest research on technological innovation from the national level. Some economists such as Christopher Freeman and Richard Nelson have combined Schumpeter’s “technical innovation” with Liszt’s “national system” theory to form the theory of national technological innovation systems (Freeman and Perez 1987). After introducing the concept of efficiency into technological innovation activities, technological innovation efficiency has become an important part of research in the field of technological innovation. With regard to the concept of technological innovation efficiency, scholars have conducted much in-depth discussions on it, and given various forms of definition from different angles. The concept of technological innovation efficiency is “technical innovation”. Kaukomen (1997) put forward the concept of technological innovation when studying the effect of R&D, mainly discussing the technological innovation from the perspective of the adaptability of R&D and industrial economy. The Organization for Economic Co-operation and Development (OECD) also put forward the concept of “technical innovation”, saying that it is necessary to establish national technological innovation systems or regional technological innovation systems to integrate innovations in technological innovation systems to improve national or regional technological innovation.

Chinese scholars (Liu 1997; Chi et al. 2004) have done much research on the definition of the concept of technological innovation efficiency. Based on the research results of the above scholars, this paper believes that the efficiency of technological innovation is a kind of production efficiency, which is essentially subordinate to technical efficiency. It refers to the proportion of input in the process of technological innovation, in the case of constant market price and production technology. It is the ratio of the minimum cost to the actual cost required to produce a certain quantity of product, or the percentage of the actual output level and the maximum output that can be achieved under the same input scale, input ratio, and market price.

Scholars have taken different approaches and conducted in-depth research on national technological innovation systems from different angles, forming different schools. Hak-Yeon Lee and Yong-Tae Park (2005) used the DEA evaluation method to compare the research and development efficiency among countries, and ranked the technological innovation efficiency of each country. Kortelainen (2008) took the innovation efficiency of EU member states as the research object and used the Malmquist efficiency evaluation index to dynamically evaluate its innovation efficiency. As the research and application of technological innovation efficiency continue to expand, some scholars have begun to pay attention to the application of technological innovation efficiency in specific industries (kihiro, Hashimotoa and Haneda 2008). Scholars’ research on the regional level of technological innovation efficiency is basically between a certain region or a specific organization in the world (Fritsch 2000; Bampatsou et al. 2013; Thomas et al. 2011). Chinese scholars have studied the efficiency of technological innovation at the regional level. It includes the regional technological innovation efficiency of a certain province and city, the comparison of the technological innovation efficiency of specific industries in different regions of China, and the impact of regional innovation environment on the efficiency of technological innovation (Chen and Ning 2011; Huang and Miao 2014; Du and Hu 2015; Zhang 2016).

Foreign scholars have studied the efficiency of technological innovation in the industrial sector. Some scholars have evaluated and analyzed the efficiency of technological innovation in a certain industry (or enterprise) from a vertical perspective (Chandra 2012; Honma 2013). In recent years, scholars have focused more attention to the evaluation of the efficiency of all-factor technology innovation, and the characteristics of complexity and diversity during the model selection process, such as using the Malmquist index model to dynamically analyze the technological innovation efficiency (Xu and Song 2015; Hou 2016).

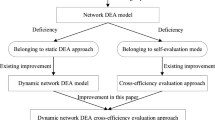

With regard to the efficiency of technological innovation, scholars both at home and abroad have conducted research from different levels and angles and have achieved good results. It breaks the limitation of using DEA non-parametric method or parameter method for analysis. More attention has been to focus on the research of DEA–Malmquist decomposition index on the efficiency of total factor technology innovation and improve the accuracy of technology innovation efficiency. Therefore, this study takes a Chinese oil company as the research object, and uses the combination of BCC model and Malmquist index model in DEA to empirically analyze the technological innovation efficiency of Chinese petroleum enterprises from both static and dynamic perspectives.

Methodology and model

The functional relationships among the input and output indicators are complicated. It also needs to ensure the accuracy and reference values of the evaluation results. Therefore, this article applied the BBC model and Malmquist index model using the DEA method to evaluate TIE of the companies. The evaluation system using the DEA method has the some advantages such as the characters of multi-input and multi-output, which would effectively evaluate TIE.

BCC model for evaluating technological effects

The concept of “relative efficiency” was proposed by Charnes et al. (1979). After that, Data Envelopment Analysis (DEA) has been a kind of evaluation of the relative effectiveness of the same type of unit (department) benefit based on multiple input variables and output variables. It is a new data analysis method, an area of cross research in operations research, management science, and mathematical economics. Banker et al. (1984) added the conditions of variable return to scale into DEA and derived the BCC Model. In the new model, Efficiency of Integrated Technological Innovation = Pure Technological Efficiency × Scale Efficiency OECD (1992). Up to now, the most representative DEA models are CCR, BCC, FG, and ST models. With the continuous development of sustainable development, the public is paying more and more attention to environmental problems. More scholars begin to study the models and applications of DEA related to environmental problems. In 1986, Fare and others studied the efficiency of American steam power plants from the traditional output DEA model. Dyckhoff and Allen (2001) mentioned in the literature review conducted by Allen that there were 22 articles relating to applying DEA to environmental research and seven of which were simply comparative studies of different evaluation models Pardo and Martínez (2015). Sarkis (2001, 2005) studied the application of DEA in ecological efficiency of the power plants and waste treatment technology of eco-efficiency analysis (Sarkis and Dijkshoorn 30; Sarkis 31). He suggested that the use of DEA be in the assessment of energy efficiency and industrial area development, industrial productivity, and agricultural aspects involved in environmental issues. Wang and Zhang (2002) discussed the relationship between model and measurement of environmental constraints of different values of production efficiency Schumpeter (1939). Wu and Ho (2006) established the DEA model and applied to Beijing, China for nearly 10 years of sustainable development Thomas et al. (2011).

CCR model assumes that return to scale is constant, for example, expanding the input scale of surveyed unit can increase its output scale proportionally. Relative to CCR model, BCC model introduces convexity assumption, i.e., increases constraint condition, to evaluate relative efficiency of each decision-making unit when scale return is different, thereby obtaining the input-oriented BCC model.

The formula of the BCC model is as follows:

Through the BCC Model, we can calculate the value of pure technological efficiency to specifically test whether the inputs of technological innovation system are effectively utilized and meet the requirements of minimum input or maximum output. According to Färe (1997), the higher pure technological efficiency indicates the higher use efficiency of the input elements Wang and Zhang (2002). Since we can get comprehensive technological innovation from the CCR model so scale efficiency can be derived, which represents the ratio of output and input to measure returns to scale of the DMU (decision-making unit). According to the previous research (Mahdiloo et al. 2015; Pardo and Martinez 2015), the high ratio indicates that the returns to scale are appropriate and the productivity is in a good state (Wu et al. 2006; Xu and Song 2015). \(\sum\nolimits_{{j=1}}^{n} {{\lambda _j}}>1\) indicates that returns to scale are in a diminishing state. \(\sum\nolimits_{{j=1}}^{n} {{\lambda _j}} =1\) indicates that returns to scale are in an optimal state. \(\sum\nolimits_{{j=1}}^{n} {{\lambda _j}} <1\) indicates that returns to scales are in an increasing state.

Malmquist index model

The Malmquist index model is based on the concept of non-parametric distance function, which combined the DEA method describing production TIE with multiple input–output variables. It uses panel data to dynamically analyze the changes in each decision unit over time without explaining specific standards of conduct. Using the geometric mean of the Malmquist productivity index of the T and (t + 1) period, Färe et al. (1997) constructed the productivity variable M index from t to (t + 1). Moreover, Fare further identified the key factors, which affect the ineffectiveness of TFP (Total Factors Productivity) in decision-making units, from the perspectives of comprehensive technological efficiency fluctuations, pure technology efficiency fluctuations, scale efficiency fluctuations, and technological progress fluctuations (Duan 2014; Zhang 2016). The Malmquist index is calculated by the ratio of distance function, which is the reciprocal of technological efficiency. The Malmquist index for decision unit productivity improvement from t to (t + 1) period is defined as following mathematical expression:

In Eq. 2, the total factor productivity change (TFPC) under the Malmquist index model can be divided into technological progress change (TECHCH) and comprehensive technological efficiency change (EFFCH). The comprehensive technological efficiency change can be divided into pure technological efficiency change (PTEC) and scale efficiency change(SEC). We define the distance function under the change of returns to scale as \({D_v}\left( {x,y} \right)\), and constant distance function of returns to scale as \({D_c}\left( {x,y} \right)\). \(\frac{{{D^c}_{{t+1}}\left( {{x_{t+1}},{y_{t+1}}} \right)}}{{{D^c}_{t}\left( {{x_t},{y_t}} \right)}}\) is the comprehensive technological efficiency change (EFFCH) from perspective of resource allocation. It analyzes to see if there is an input of waste factor input for technological innovation. In other words, it catches the effect of DMU to production frontier. EFFCH > 1 means that decision-making unit is close to the production frontier, and EFFCH < 1 means that decision-making unit is far from the production frontier. \(\frac{{{D^v}_{{t+1}}({x_{t+1}},{y_{t+1}})}}{{{D^v}_{t}\left( {{x_t},{y_t}} \right)}}\) is the pure technological efficiency changes (PTEC), to measure the extent to which technological inefficiencies affect the technical inefficiency. PTEC < 1 means that pure technological efficiency is decreasing. \({\left[ {\frac{{{D^c}_{t}\left( {{x_t},{y_t}} \right)}}{{{D^c}_{{t+1}}\left( {{x_t},{y_t}} \right)}} \times \frac{{{D^c}_{t}\left( {{x_{t+1}},{y_{t+1}}} \right)}}{{{D^c}_{{t+1}}\left( {{x_{t+1}},{y_{t+1}}} \right)}}} \right]^{\tfrac{1}{2}}}\) is scale efficiency change, which is used to determine whether a decision-making unit is in the optimal production scale. SEC > 1 means the increasing of scale efficiency change. \({\left[ {\frac{{{D^c}_{t}\left( {{x_t},{y_t}} \right)}}{{{D^c}_{{t+1}}\left( {{x_t},{y_t}} \right)}} \times \frac{{{D^c}_{t}\left( {{x_{t+1}},{y_{t+1}}} \right)}}{{{D^c}_{{t+1}}\left( {{x_{t+1}},{y_{t+1}}} \right)}}} \right]^{\tfrac{1}{2}}}\) is technological change, reflecting production technological change.

The above results, calculated by the Malmquist model, can precisely identify the key factors that invalidate the total factor productivity of decision-making units and make it easier for decision makers to propose more targeted strategies. Therefore, this paper chose the Malmquist index model to dynamically evaluate the TIE of petroleum companies.

Building up evaluation indicator system of relative eco-efficiency in petroleum industry

It needs to take the production and innovation of the innovative activities of petroleum companies into consideration to reflect completely the integration process from the input of the innovative resources to the output when constructing the evaluation indicator system of TIE. This paper mainly chooses the tangible elements to evaluate, because the results of technological innovation are generally reflected in new products sales and number of effective patents. Considering the requirement of DEA model to indicator selection, we constructed an input–output index evaluation system for TIE of petroleum firms in China. To construct this system, we studied the strategic planning for technological innovation of petroleum enterprises, and checked the China Energy Statistics Yearbook, China Statistics Yearbook, and selected the relative index that is available to us. The model is illustrated in Fig. 1.

Technologies and production equipment in petroleum industry update rapidly. Considering this fact, the technological innovative input index for oil companies can be categorized into three sub-indexes: R&D stuff input, R&D investment, and Non-R&D investment. The R&D stuff means personnel involved in R&D, but not conducted any technological activates. Similarly, R&D investment refers to research and development funding, rather than science and technology funding. Non-R&D investment and R&D investment constitute technological innovation investment. In the Frascati’s handbook, R&D expenditures and R&D stuff are selected as input indicators for measuring. This is also the foundation for selecting indicators as the technological innovation of petroleum firms.

Model calculation

Static efficiency evaluation

Data Collection. Considering the requirements of index evaluation system for data of input and output indicators and following the principles of accessibility and representative of the data, this paper selected 10 oil plants as the decision-making units. Insufficient decision-making units would weaken the applicability of the result, while over-sufficient decision-making units can lead to “overcrowding” in the data processing. Therefore, it was appropriate to select 10 decision-making units for evaluation. The data are from China Energy Statistical Yearbook, Petroleum Statistical Yearbook, annual reports, and other relevant sources in 2015. After collecting and organizing the data, we obtained the panel data of 10 oil plants under discussion during 2012–2015. In this paper, 10 oil plants (C1, C2, .. C10) of an oilfield firm were selected as the decision-making units. We selected the cost indexes of input and output to evaluate the TIE using the BCC–Malmquist model. The specific data of 10 oil plants obtained for 2012–2015 through field surveys are shown in Table 1.

Data Processing. The static evaluation of the TIE of a petroleum company refers to the evaluation in a particular year, which is used to analyze the specifically input and output of the company during the given year. The advantages of the BCC model include not only to find whether a decision-making unit meets the effectiveness of DEA, but also to further evaluate the pure technological efficiency and scale efficiency of each decision-making unit to facilitate the company to identify the right remedy. We used DEAP2-1 software of DEA to analyze TIE. Taking the characteristics of the petroleum company into consideration, from the perspective of input orientation, we adopted the BCC model to analyze TIE of the 10 oil plants from four aspects: comprehensive technology innovation efficiency, pure technology efficiency, scale efficiency, and scale benefit innovative efficiency. The results obtained are shown in Table 2.

Results Analysis. Integrated TIE refers to the maximum production possibility frontier of output with a given input level of production factors. It comprehensively reflects production structures, R&D, and management of a company. Table 2 illustrates that the average TIE of the 10 plants is 0.867 over the 4 years. It tells us that the overall TIE is high. The comprehensive TIE of plant C4 is 1, which indicates that the allocation of the input and output factors is reasonable in technological innovation and higher in resource utilization. The comprehensive TIE for each of the other plants is less than 1, C8 plant with 0.992, C2 plant with 0.991, and C7 plant with 0.989. The integrated TIE among the refinery plants presents the trend of increasing polarization overall. According to the comparative analysis of the evaluation results (Table 3), it is not difficult to see that the optimum value of indicator was in 2014, with a slight decline in 2015. As seen the fluctuations of the data above, the changes in 2014–2015 had better development, compared with that of 2013–2014. Pure technological efficiency refers to the analysis of maximizing output under certain production input, without the effect of enterprise size. From Table 4, pure technological efficiency of refinery plants was relatively high, with an average of 0.965. The pure technical efficiency of the C1, C2, C4, C7, and C8 plants reached the technical frontier, and the pure technical efficiency value reached one. It shows that the efficiency of the comprehensive technological innovation of these four plants is only affected by the efficiency of scale.

The scale efficiency is the value obtained by dividing the efficiency of technological innovation by the pure technological efficiency, so as to evaluate whether the production scale of an enterprise reaches the optimal condition. Over the past 4 years, the average productivity of the 10 oil plants was 0.892, which was generally at a high level. The scale efficiency of Plant four reached one, which indicates that its production scale was relatively reasonable over the past 4 years. The scale efficiency of C1, C2, C3, C7, and C8 was all above 0.9. The scale efficiency of C6 was the lowest one, 0.624, which led to its efficiency of integrated technological innovation placed in the last row. From the perspective of returns to scale, the returns to scale of C4 were in a constant state for four consecutive years, and the returns to scale of C6 kept increasing.

Dynamic efficiency evaluation

Data Processing. Dynamic evaluation for TIE is used to examine dynamic changes of TIE of the company under discussion every year. We used the Malmquist index model and DEAP2.1 software to analyze the changes of total factor productivity of the 10 refinery plants of the oil field company between 2012 and 2015. In addition, we calculated the specific changes of decomposition indicators to facilitate decision makers to see the advantages and disadvantages of technological innovation of enterprises.

-

1.

Technological Fluctuation Results of the 10 Plants under Malmquist Model during 2012–2015

In Table 3, the average total factor productivity of the 10 plants of the petroleum company from 2012 to 2015 was 0.984, which was less than one and did not fall on the frontier of TIE. Overall, it showed a declining trend. The overall average technological efficiency was 0.998, and the overall average technological progress was 0.986. Each of these values is less than one, indicating that these indicators have an impact on the decline in total factor productivity. In comparison, the decline in technological progress was worse than the decline in efficiency of integrated technologies, indicating that the decline in total factor productivity was mainly due to the inadequate technological progress. The average pure technological efficiency was 0.967, and the average scale efficiency was 1.032. The average scale efficiency was greater than one, but the average comprehensive technical efficiency still failed to reach one due to the sharp decrease of pure technical efficiency mean.

-

2.

Dynamic Changes of TIE of the 10 Plants under Malmquist Model in 2012–2015

In Table 4, the data analysis of the Malmquist model presents the relative efficiency fluctuations of year t + 1 data compared with year t data. The results show that the dynamic data can better reflect the development of technological efficiency of a company in a long run. From 2012 to 2015, the average change of comprehensive technological efficiency of the 10 plants was 0.998, and the overall technological efficiency showed an upward trend. For instance, according to the data of C1 in 2014–2015, the comprehensive technological efficiency in 2014 was 0.936, indicating that there was still 6.4% redundant input or insufficient output in C1. The pure technological efficiency reached 1, and the scale efficiency was 0.936, indicating that the comprehensive efficiency of C1 in 2014 was mainly affected by the scale efficiency. While the scale returns decreased, indicating that the scale of production decreased, with the given input–output level in 2014. From 2014 to 2015, the technological efficiency fluctuation of C1 was 0.998, suggesting that the technological efficiency decreased by 0.2%. The technological progress of fluctuation was 1.284, indicating that the technological progress of C1 increased by 28.4% and it progressed greatly. The pure technological efficiency fluctuation was one, and the scale efficiency fluctuation was 0.998, suggesting that C1 had strong R&D capabilities, excellent in introduction and application of technological innovation. The decline in technological efficiency was mainly due to the management scale. The total change of productivity factor was 1.282, indicating that the production level of Plant one increased by 28.2%.

Comparing and analyzing the trends of specific indicators under total factor productivity in 2012–2015, we can summarize the changes and causes of total factor productivity in 4 years. The average factor productivity of the 10 plants in 2012–2013 was 1.002, reaching the frontier of efficiency production. In 2014–2015, the total factor productivity of the 10 plants reached a maximum of 1.163, reaching the frontier of efficiency production, mainly due to the technical progress value of 1.325 during this period. It was a significant increase in total factor productivity. In 2013–2014, however, the value of total factor productivity was only 0.817, which lags far behind the efficiency frontier. Although the scale efficiency has been improved during this period, the average technical efficiency average is greater than one, but the technological progress value is only 0.755. This leads to a large decline in total factor productivity. In 2012–2015, the total factor productivity of the eight oil plants kept rising, and the level of technological progress increased significantly, especially in C7, C9 and C10 plants, which is highly related to the emphasis on technology upgrading and new technology applications. Therefore, while the 10 plants emphasize the improvement of the efficiency level of comprehensive technology, they must pay attention to the improvement of technological progress and maintain a more sustained and stable development of various plants.

Analysis of Distribution Characteristics. We obtained the values of comprehensive TIE and the pure TIE of the 10 plants during 2012–2015. Then, we analyzed these specific data values using SPSS19.0 statistical software to reflect the comprehensive TIE and pure concentration and dispersion of technological efficiency.

According to Table 5, the efficiency of comprehensive technological innovation of the plants under discussion decreased every year during 2012–2015. The dispersion of the data was gradually moving towards concentration and the data fluctuate greatly in 2015. Figure 2 demonstrates the large gaps of comprehensive TIE. The skewness coefficient is negative, and the curve is biased to the right. In 2012, the overall negative bias of TIE was minimum followed by the data in 2013. It reached the maximum in 2014, gradually lower to both sides. It illustrates that the efficiency of comprehensive technological innovation reached the peak in 2012, and there was a stable period in 2014. Overall, the levels of efficiency of comprehensive technological innovation during 2014–2015 were higher than the previous period (Table 6).

In 2012–2015, the distribution of pure technology efficiency shares the same characteristics with the distribution of efficiency of comprehensive technology innovation. It should be noted that to reflect the data changes more clearly, the vertical and horizontal coordinate scales on the frequency graph of comprehensive TIE and the pure technological efficiency were on the same scale. Since the values of pure technical efficiency are higher due to the impact of the scale efficiency, the bar charts present more slender and dense (Fig. 3).

Conclusion

Based on the BCC model and Malmquist index model analysis, this paper used the technological innovation status of the Daqing Petroleum Company during 2012–2015 as the sample subject to analyze the TIE from an input-oriented perspective. It selected data from the 10 refinery plants of the Daqing Petroleum Company. The conclusions are as follows:

-

(1)

The study applied the BCC Model to analyze the TIE of the 10 plants from the aspects of comprehensive TIE, pure technological efficiency, scale efficiency, and scale efficiency. The results of the analysis reveal that the company under discussion has high level of overall TIE. It presents upward trend in its comprehensive TIE, pure TIE, and scale efficiency. On the other hand, only the comprehensive TIE of Plant 4 fell on the curve of production possibility frontier. It demonstrates that there were large gaps among the comprehensive technological efficiencies of the plants. There was a situation of polarization.

-

(2)

The study applied the Malmquist index model to dynamically analyze the total factor productivity and decomposition indicators of the Daqing Petroleum Company during 2012–2015. From the analysis, it is clear that the total factor productivity fell every year. In addition, the technological progress declined greater than the comprehensive technological efficiency did. It illustrates that the decline in total factor productivity was mainly due to the insufficient technological progress.

-

(3)

According to the result, it might be concluded that the investment in R&D personnel input was the most influential parameter, while the non-R&D investment was the least influential parameter. The number of decision-making units is inversely proportional to the level of efficiency, while the number of parameters is proportional to the level of efficiency. By increasing the number of decision-making units and nailing down the number of precise parameters, the company can improve its TIE. The results reveal that from 2012 to 2015, the degree of dispersion of comprehensive technological innovation efficiency of this petroleum enterprise has been decreasing year by year, and it has been developing towards a high concentration trend.

-

(4)

The efficiency of technological innovation of China’s petroleum enterprises is on the rise, indicating that the efficiency of input and output of technological innovation of enterprises is obviously improved. It can help the economic construction of oil companies through the improvement of technological innovation efficiency. However, with the change of time, the efficiency of technological innovation is not balanced and continuous growth trend, indicating that oil companies need to work hard to improve their technological innovation efficiency. There are many reasons for the high efficiency of technological innovation. For example, the investment in technology research and development is too high with the insufficient output of technological innovation. Enterprises are affected by international oil prices, resulting in unstable economic conditions.

References

Adhikari CB, Bjorndal T (2012) Analyses of technical efficiency using SDF and DEA models: evidence from Nepalese agriculture. Appl Econ 44:3297–3308

Bampatsou C, Papadopoulos S, Zervas E (2013) Technical efficiency of economic systems of EU-15 countries based on energy consumption. Energy Policy 55:426–434

Banker RD, Charnes A, Cooper WW (1984) Some models for estimating technical and scale inefficiencies in data envelopment analysis. Manag Sci 30:1078–1092

Chandra.Analyses of (2012) technical efficiency using SDF and DEA models: evidence from Nepalese agriculture. Appl Econ 44:3297–3308

Charnes A, Cooper WW, Rhodes E (1979) Measuring the efficiency of decision-making units. Euro J Oper Res 3(4):339–338

Chen HM, Ning YC (2011) Evaluation and comparative study on the efficiency of technological innovation in the province of China. Explor Econ Prob 8:66–70

Chi RY, Yu XF, Li ZW (2004) Analysis of the differences and reasons of the efficiency of technological innovation in the eastern and western regions of China. China Soft sci 16:128–132

Du XJ, Hu (2015) S.Dynamic evaluation of competition oriented regional technological innovation efficiency. Res Sci Technol Manag 24:44–49

Duan S (2014) Jiang,T.W.A study on the evaluation of technological innovation development of regional enterprises—analysis of the evaluation index system of technological innovation in Zhejiang. China Soft Sci 13:85–96

Dyckhoff H, Allen K (2001) Measuring ecological efficiency with data envelopment analysis (DEA). Eur J Oper Res 132:312–325

Färe R, Grosskopf S, Norris M (1997) Productivity growth, technical progress, and efficiency change in industrialized countries: reply. Am Econ Rev 87:1040–1044

Freeman C, Perez C (1988) Structural crises of adjustment: business cycles. Technical change and economic theory. Pinter, Londres

Fritsch M (2000) Interregional differences in R&D activities—an empirical investigation. Eur Plan Stud 8:409–427

Hashimoto A, Haneda S (2008) Measuring the change in R&D efficiency of the Japanese pharmaceutical industry. Res Policy 37:1829–1836

Honma S, Hu JL (2013) Total-factor energy efficiency for sectors in Japan. Energy Sources Part B 8:130–136

Hou R (2016) Research on the evolution and driving difference of regional technological innovation efficiency in China based on Malmquist index. Industrial Technol Econ 13:122–129

Huang Q, Miao J (2014) .j.Innovation efficiency of Chinese industrial enterprises based on regional heterogeneity. Syst Eng 23:20–26

Kaukomen E (1997) The evaluation of scientific research: selected experiences. OECD, Pairs, pp 194–191

Korhonen PJ, Luptacik M (2004) Eco-efficiency analysis of power plants: an extension of data envelopment analysis. Euro J Oper Res 154:437–446

Kortelainen M (2008) Dynamic environmental performance analysis: a Malmquist index approach. Ecol Econ 64:701–715

Lee HY, Park YT (2005) An international comparison of R&D efficiency: DEA approach. Asian J Technol Innov 13:207–222

List F 1904. The national system of political economy, translated from the German edition of 1841 by Sampson S. Lloyd, with an introduction by J. Sheild Nicholson

Liu YL Management of technological innovation of enterprises. Beijing Science and Technology Literature Press 1997; 21–53

Lujano-Rojas JM, Dufo-Lopez R, Bernal-Agustín JL (2014) Technical and economic effects of charge controller operation and coulombic efficiency on stand-alone hybrid power systems. Energy Convers Manag 86:709–716

Mahdiloo M, Saen RF, Lee KH (2015) Technical, environmental and eco-efficiency measurement for supplier selection: an extension and application of data envelopment analysis. Int J Prod Econ 168:279–289

Mullarkey S, Caulfield B, McCormack S, Basu B (2015) A framework for establishing the technical efficiency of electricity distribution counties (EDCs) using data envelopment analysis. Energy Convers Manag 94:112–123

Nelson R (2004) The challenge of building an effective innovation system for catch-up. Oxford Dev Stud 32:365–374

Organisation for Economic Co-operation and Development. OECD (1992) Proposed guidelines for collecting and interpreting technological innovation data: Oslo Manual. na

Pardo, Martínez (2015) C.I.Estimating and analyzing energy efficiency in German and Colombian manufacturing industries using dea and data panel analysis. Part I: energy-intensive sectors. Energy Sources Part B 10:322–331

Sarkis J (2001) Ecoefficiency: how data envelopment analysis can be used by managers and researchers. In: Proceedings of SPIE - The International Society for Optical Engineerin. https://doi.org/10.1117/12.417264

Sarkis J, Dijkshoorn J (2005) November. Eco-efficiency of solid waste management in Welsh SMEs. In: Environmentally conscious manufacturing V (Vol. 5997). International Society for Optics and Photonics, pp. 59970L

Schumpeter JA (1939) Business cycles (Vol, 1. McGraw-Hill, pp. 161–74). New York

Thomas VJ, Sharma S, Jain SK (2011) Using patents and publications to assess R&D efficiency in the states of the USA. World Patent Inf 33:4–10

Wang B, Zhang (2002) Q.Study on different production efficiency models under environmental constraints. Syst Eng Theory Pract 56:1–8

Wu YY, Ho (2006) J.Beijing sustainable development ability evaluation based on the DEA method. Syst Eng Theory Pract 32:117–123

Xu JZ, Song Y (2015) Research on the efficiency of environmental technology innovation in the equipment manufacturing industry and its influencing factors—based on the empirical analysis of DEA-malmquist and tobit Oper Res Manag ;4:246–254

Zhang JP (2016) Research on efficiency evaluation of technological innovation of industrial enterprises based on green growth perspective. Taiyuan University of Technology, Taiyuan

Acknowledgements

The authors appreciate the financial support provided by National Social Science Foundation of China (No. 16BJY029). The authors appreciate the financial support provided by New energy industry development and innovation team (KYCXTD201805) and Research on the advantage research direction of Business Administration Discipline (2017YSFX-01) too.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Wang, Y., Zhu, Z. & Liu, Z. Evaluation of technological innovation efficiency of petroleum companies based on BCC–Malmquist index model. J Petrol Explor Prod Technol 9, 2405–2416 (2019). https://doi.org/10.1007/s13202-019-0618-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13202-019-0618-9