Abstract

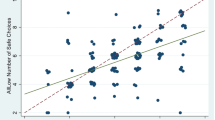

This paper estimates individual risk preferences based upon data that are generated by the same individuals acting in different institutions. The results show that the (estimated) numerical values of individuals' implied risk parameters are not stable within individuals across institutions. Furthermore, the ranking across subjects of the numerical values of individuals' implied risk parameters is not preserved across institutions.

Similar content being viewed by others

References

Allais, Maurice. 1953. “Le Comportement de l'Homme Rational Devant le Risque: Critique des Postulants et Axiomes de l'Ecole Americane, ” Econometrica 21, 503–546.

Becker, Gordon M., Morris H. Degroot, and Jacob Marschak. 1964. “Measuring Utility by a Single-Response Sequential Method, ” Behavioral Science 9, 226–232.

Bernoulli, Daniel. 1738. “Specimen Theoriae Novae de Mensura Sortis, ” Commentarii Academiae Scientarum Imperialis Petropolitanae 5, 175–192. Translated and published in Econometrica 22, 23–26.

Camerer, Colin. 1995. “Individual Decisionmaking. ” In J. H. Kagel and A. E. Roth eds., The Handbook of Experimental Economics. Princeton, N.J.: Princeton University Press.

Cox, James C., and R. Mark Isaac. 1986. “Experimental Economics and Experimental Psychology: Ever the Twain Shall Meet?” In A. J. MacFadyen and H. W. MacFadyen eds., Economic Psychology: Intersections in Theory and Application. Amsterdam: North Holland.

Cox, James C., R. Mark Isaac, Paula Cech, and David Conn. 1996. “Moral Hazard and Adverse Selection in Procurement Contracting, ” Games and Economic Behavior 17, 147–176.

Cox, James C., and Ron Oaxaca. 1996. “Is Bidding Behavior Consistent With Bidding Theory for Private Value Auctions?” In R. M. Isaac ed., Research in Experimental Economics, Vol. 6. Greenwich, Conn.: JAI Press, Inc.

Cox, James C., Bruce Roberson, and Vernon L. Smith. 1982. “Theory and Behavior of Single-Object Auctions. ” In V. L. Smith ed., Research in Experimental Economics, Vol. 2. Greenwich, Conn.: JAI Press, Inc.

Cox, James C., Vernon L. Smith, and James M. Walker. 1988. “Theory and Individual Behavior of First-Price Auctions, ” Journal of Risk and Uncertainty 1, 61–99.

Friedman, Milton, and L. J. Savage. 1948. “The Utility Analysis of Choices Involving Risk, ” Journal of Political Economy 56, 279–304.

Harrison, Glenn W. 1989. “Theory and Misbehavior of First-Price Auctions, ” American Economic Review 79, 749–762.

Harrison, Glenn W. 1990. “Risk Attitudes in First-Price Auction Experiments: A Bayesian Analysis, ” Review of Economics and Statistics 72, 541–546.

Isaac, R. Mark, and James M. Walker. 1985. “Information and Conspiracy in Sealed Bid Auctions, ” Journal of Economic Behavior and Organization 6, 139–159.

James, Duncan, and Willard Carleton. 1998. “Venture Capital Financing: The Role of Individuals and Institutions. ” Mimeo.

James, Duncan, and R. Mark Isaac. 1998. “A Theory of Risky Choice. ” Mimeo.

Kagel, John. 1995. “Auctions: A Survey of Experimental Research. ” In J. H. Kagel and A. E. Roth eds., The Handbook of Experimental Economics. Princeton, N.J.: Princeton University Press.

Kagel, John, and Dan Levin. 1993. “Independent Private Value Auctions: Bidder Behavior in First-, Second-, and Third Price Auctions With Varying Numbers of Bidders, ” Economic Journal 103, 868–879.

Kahnemann, Daniel, and Amos Tversky. 1979. “Prospect Theory: An Analysis of Decision Under Risk, ” Econometrica 47, 263–291.

Rothschild, Michael, and Joseph Stiglitz. 1970. “Increasing Risk: I. A Definition, ” Journal of Economic Theory 2, 225–243.

Schorvitz, Eric. 1998. “Experimental Tests of Fundamental Economic Theories, ” unpublished Ph.D. Dissertation, Department of Economics, University of Arizona.

Von Neumann, John and Oscar Morgenstern. 1944. Theory of Games and Economic Behavior. Princeton, New Jersey: Princeton University Press.

Walker, James M., Vernon L. Smith and James C. Cox. 1986. “Inducing Risk Neutral Preferences: An Examination in a Controlled Market Environment, ” University of Arizona, Dept. of Economics Working Paper 86–9.

Walker, James M., Vernon L. Smith and James C. Cox. 1987. “Bidding Behavior in First Price Sealed Bid Auctions: Use of Computerized Nash Competitors, ” Economics Letters 23, 239–244.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Isaac, R.M., James, D. Just Who Are You Calling Risk Averse?. Journal of Risk and Uncertainty 20, 177–187 (2000). https://doi.org/10.1023/A:1007881008177

Issue Date:

DOI: https://doi.org/10.1023/A:1007881008177