Abstract

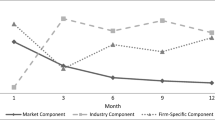

Previous event studies which deal with new products do notdistinguish between preannouncements (made in advance of a new productintroduction into the marketplace) and new product announcements (made closeto the time when the new product is introduced). Methodologically, eventstudies implicitly assume that information is homogeneous; that is, they donot consider the amount of information contained in the news release or thetype (e.g., whether detailed or not). This paper argues that new productevent studies should distinguish between announcements and preannouncementsbecause both types of information release events (IRE) are strategicallydistinct and convey different information signals to the marketplace.Methodologically, event studies should allow for informationalheterogeneity. We analyze a large sample of IREs from the 1980–1989period for firms whose stock is publicly traded, distinguishing betweenpreannouncements and announcements. We use content analysis to classify IREsaccording to the type and amount of information provided. The results showthat it is incorrect to jointly analyze announcements and preannouncements.On average, only preannouncements have a significant positive effect onstock prices. However, the signaling effect of preannouncements on stockprice is industry-specific. In particular, the results support Klein andLeffler‘s theory (1981) that preannouncements in the manufacturing industryare effective strategic tools. We also investigate the impact of IREs onthe market risk (i.e., the risk that stockholders cannot diversify away) ofthe announcing and preannouncing firms. The results show that firm-specificand informational variables do not have any effect on market risk,regardless of the type of IRE (i.e., announcement or preannouncement).

Similar content being viewed by others

References

Acs, Z., and D. Audretsch (1988). "Innovation in Large and Small Firms: An Empirical Analysis," American Economic Review, 78, pp. 678–690.

Agrawal, D., and W. A. Kamakura (1995). "The Economic Worth of Celebrity Endorsers: An Event Study Analysis," Journal of Marketing, 59, pp. 56–62.

Brown, S. J., and J. B. Warner (1985). "Using Daily Stock Returns: The Case of Event Studies," Journal of Financial Economics, 14, pp. 3–31.

Center for Research in Security Prices (1991). CRSP Tapes, University of Chicago, Chicago, IL.

Chaney, P. K., T. M. Devinney, and R. S. Winer (1991). "The Impact of New Product Introduction on the Market Value of Firms," Journal of Business, 64, October, pp. 573–611.

Devinney, T. M. (1992). "NewProducts and Financial Risk Changes," Journal of Product Innovation Management, 9(3), pp. 222–231.

Eddy, R. A., and G. B. Saunders (1980). "New Product Announcements and Stock Prices," Decision Sciences, 11, January, pp. 90–97.

Eliashberg, J., and T. S. Robertson (1988). "New Product Preannouncing Behavior: A Market Signaling Study," Journal of Marketing Research, 25, August, pp. 282–292.

Fama, E. F., L. Fisher, M. C. Jensen, and R. Roll (1969). "The Adjustment of Stock Prices to New Information," International Economic Review, 10, pp. 1–21.

Fama, E.F., L. Fisher, M.C. Jensen, and R. Roll (1970). "Efficient Capital Markets: A Review of Theory and Empirical Work," Journal of Finance, 25, pp. 383–417.

Horsky, D., and P. Swyngedouw (1987). "Does It Pay to Change Your Company’s Name? A Stock Market Perspective," Marketing Science, 6, Fall, pp. 320–334.

Klein, B., and K. B. Leffler (1981). "The Role of Market Forces in Assuring Contractual Performance," Journal of Political Economy, 89, August, pp. 615–641.

Mathur, L. K., and I. Mathur (1996). "Is Value Associated with Initiating New Advertising Agency-Client Relations?" Journal of Advertising, 25, 3, pp. 1–11.

Rutherford, R. C., D. L. Thompson, and R. W. Stone (1991). "The Impact of Changes in Advertising Agencies on Corporate Common Stock Prices," Journal of Current Issues and Research in Advertising, 16, pp. 1–18.

Scholes, M., and J. Williams (1977). "Estimating Beta from Nonynchronous Data," Journal of Financial Economics, 5, pp. 309–327.

Standard and Poor’s (1992). Compustat Tapes, New York, Standard and Poor’s Corporation.

Vermaelen, T. (1981). "Common Stock Repurchases and Market Signalling: An Empirical Study," Journal of Financial Economics, 9, pp. 131–183.

Wittink D., A. Ryans, and N. Burrus (1982). New Products and Security Prices. Working Paper. Ithaca, N.Y.: Cornell University.

Yau, J., M. G. Ferri, and T. F. Sugrue (1994). "An Analysis of the Wall Street Journal’s Coverage of Corporate News and the Research Design of Event Studies," Journal of Financial Research, 17(2), pp. 161–172.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Koku, P.S., Jagpal, H.S. & Viswanath, P.V. The Effect of New Product Announcements and Preannouncements on Stock Price. Journal of Market-Focused Management 2, 183–199 (1997). https://doi.org/10.1023/A:1009735620253

Issue Date:

DOI: https://doi.org/10.1023/A:1009735620253