Abstract

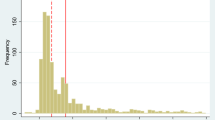

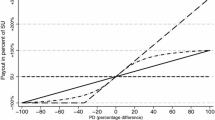

Controlled laboratory conditions using monetary incentives have been utilized in previous studies that examine individual discount rates, and researchers have found several apparently robust anomalies. We conjecture that subject behavior in these experiments may be affected by (uncontrolled) factors other than discount rates. We address some experimental design issues and report a new series of experiments designed to elicit individual discount rates. Our primary treatments include: (i) informing subjects of the annual and effective interest rates associated with alternative payment streams, and (ii) informing subjects of current market interest rates. We also test for the effect of real (vs. hypothetical) payments and for the effect of delaying both payment options (vs. offering an immediate payment option). The statistical analysis uses censored data techniques to account for the interactions between field and lab incentives. Each of the information treatments appears to reduce revealed discount rates. When both types of information are provided, annual rates in the interval of 15%–17.5% are revealed, whereas rates of 20%–25% are revealed in the control session. Each of the treatments also lowers the residual variance of subject responses.

Similar content being viewed by others

References

Ainslie, G. and Haendel, V. (1982). “The Motives of Will.” In E. Gottheil, K. Druley, T. Skolda, and H. Waxman (eds.), Etiologic Aspects of Alcohol and Drug Abuse. Springfield, IL: Charles C. Thomas.

Benzion, U., Rapoport, A., and Yagil, J. (1989). “Discount Rates Inferred from Decisions: An Experimental Study.” Management Science. 35, 270–284.

Camerer, C.F. and Ho, T. (1994). “Violations of the Betweeness Axiom and Nonlinearity in Probability.” Journal of Risk and Uncertainty. 8, 67–196.

Carlson, C.R. and Johnson, R.D. (1992). “Measuring Rate of Time Preference as a Function of Delay: An Experimental Study.” Unpublished Manuscript, University of Alberta, Edmonton, Alberta, Canada.

Fisher, I. (1930). The Theory of Interest. New York: McMillan.

Gately, D. (1980). “Individual Discount Rates and the Purchase and Utilization of Energy-using Durables: Comment.” Bell Journal of Economics. 10, 373–374.

Greene, W.H. (1993). Econometric Analysis. New York: McMillan.

Greene, W.H. (1995). LIMDEP, Version 7.0: User's Manual. Plainview, NY: Econometric Software, Inc.

Hartman, R.S. and Doane, M.J. (1986). “Household Discount Rates Revisited.” Quarterly Journal of Economics. 7, 139–148.

Hausman, J.A. (1979). “Individual Discount Rates and the Purchase and Utilization of Energy-using Durables.” Bell Journal of Economics. 10, 33–54.

Holcomb, J.H. and Nelson, P.S. (1992). “Another Experimental Look at Individual Time Preference.” Rationality and Society. 4, 199–220.

Horowitz, J.K. (1991). “Discounting Money Payoffs: An Experimental Analysis.” Handbook of Behavioral Economics. 2B, 309–324.

Kirby, K.N. and Marakoviċ, N.N. (1996). “Delay-Discounting Probabilistic Rewards: Rates Decrease as Amounts Increase.” Psychonomic Bulletin & Review. 3(1), 100–104.

Lawrance, E.C. (1991). “Poverty and the Rate of Time Preference.” Journal of Political Economy. 99(1), 54–77.

Lazo, J.K., McClelland, G.H., and Schulze, W.D. (1992). “What is the FutureWorth: An Experimental Examination of Rates of Time Preference.” Unpublished Manuscript, Department of Economics, University of Colorado at Boulder.

Loewenstein, G.F. (1987). “Anticipation and the Valuation of Delayed Consumption.” Economic Journal. 97, 666–684.

Loewenstein, G.F. (1988). “Frames of Mind in Intertemporal Choice.” Management Science. 34, 200–214.

Pender, J.L. (1996). “Discount Rates and Credit Markets: Theory and Evidence from Rural India.” Journal of Development Economics. 50, 257–296.

Ruderman, H., Levine, M., and McMahon, J. (1986). “Energy-Efficiency Choice in the Purchase of Residential Appliances.” In Willett Kempton and Max Neiman (eds.), Energy Efficiency: Perspectives on Individual Behavior. Washington, D.C.: American Council for an Energy Efficient Economy.

Rutström, E. Elisabet. (1998). “Home-Grown Values and the Design of Incentive Compatible Auctions.” Journal of International Game Theory. 27, 427–441.

Shelley, M.K. (1993). “Outcome Signs, Question Frames and Discount Rates.” Management Science. 39, 806–815.

Thaler, R.H. (1981). “Some Empirical Evidence on Dynamic Inconsistency.” Economics Letters. 8, 201–207.

Wagenaar, W.A. and Sagaria, S.D. (1975). “Misperception of Exponential Growth.” Perception and Psychophysics. 18(6), 416–422.

Winston, G.C. and Woodbury, R.G. (1991). “Myopic Discounting: Empirical Evidence.” Handbook of Behavioral Economics. 2B, 325–342.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Coller, M., Williams, M.B. Eliciting Individual Discount Rates. Experimental Economics 2, 107–127 (1999). https://doi.org/10.1023/A:1009986005690

Issue Date:

DOI: https://doi.org/10.1023/A:1009986005690