Abstract

This study examines the stock market reaction to the announcement of green bond issuance. The cumulative abnormal returns are positive and significant. This implies that shareholders view this form of financing as value-enhancing and funds from green bonds issuance are used to undertake profitable green projects or as a means of risk mitigation. Regression analysis shows that green bonds with higher coupon rates elicit a negative investor reaction. Also, firm size, Tobin’s Q, and growth are positively related to the CAR, while operating cash flow is negatively related to the CAR. The positive coefficient for firm growth is consistent with the value-enhancing function of funds from green bonds.

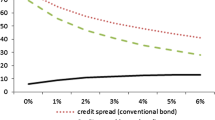

Source: Climate Bonds Initiative

Source: Climate Bonds Initiative

Similar content being viewed by others

Notes

Apple’s $1.5bn green bond, announced February 16, 2016, will fund several initiatives, including the company’s conversion to 100% renewable energy, installation of more energy-efficient heating and cooling systems and an increase in the company’s use of biodegradable materials.

These are self-labeled as green bonds. There are other fixed income instruments issued to fund environmentally friendly projects such as wind or solar farms, but these are not examined in this study.

Green projects are defined as projects that promote environmental sustainability such as reduction in greenhouse gas emissions, investment in renewable energy and clean transportation technology.

Tobin’s Q is a proxy for forward-looking growth opportunities, while asset growth is a historical measure of firm growth.

Credit Agricole Corporate and Investment Bank, a subsidiary of Credit Agricole SA (publicly listed), was the first commercial bank to issue green bonds in January 2013. We did not include Credit Agricole in the sample since it has multiple announcements each year since 2013. This contaminated the market model estimation window.

Announcement date November 21, 2013.

Buyers of BoA green bonds include: AP4, BlackRock, Breckinridge Capital Advisors, California State, Teachers’ Retirement System, Calvert Investment Management, Pax World Management, Praxis Intermediate Income Fund, State Street Global Advisors, Standish Mellon Asset Management Company, TIAA-CREF and Trillium Asset Management (BoA Nov. 21, 2013 Press Release).

The green bond principle has been updated in 2016.

Utilizing an estimation window approximately 1 year prior to the event date to estimate the parameters of the market model is a common practice. For example, Klassen and McLaughlin (1996) utilized a 200-day estimation window while Dasgupta et al. (2001) used an estimation window from − 120 to − 210 days prior to the event date.

Amount issued is converted to US dollars at an exchange rate at the time of the announcement.

For firms that issue floating rate coupons we use the interest rate for the floating rate benchmark as of the announcement date.

As the referee pointed out, it is possible that Tobin’s Q also indicates potential assets substitution risk.

I thank the referee for suggesting that I examine firm risk before and after the announcement.

I thank the referee for suggesting that I look at countries with different shareholder protection.

References

Bauer, R., K. Koedijk, and R. Otten. 2005. International evidence on ethical mutual fund performance and investment style. Journal of Banking & Finance 20: 1751–1767.

Bello, Z.Y. 2005. Socially responsible investing and portfolio diversification. Journal of Financial Research 28: 41–57.

Benabou, R., and J. Tirole. 2010. Individual and corporate social responsibility. Economica 77: 1019.

Brown, S., and J. Warner. 1985. Using daily stock returns: The case of event studies. Journal of Financial Economics 14: 3–31.

Dasgupta, S., B. Laplante, and N. Mamingi. 2001. Pollution and capital markets in developing countries. Journal of Environmental Economics and Management 42: 310–335.

Dhaliwal, D., O.Z. Li, A.H. Tsang, and Y.G. Yang. 2011. Voluntary non-financial disclosure and cost of equity capital: The case of corporate social responsibility reporting. Accounting Review 86: 59–100.

Derwall, J., N. Gunster, R. Bauer, and K. Koedijk. 2004. The eco-efficiency premium puzzle. Financial Analyst Journal 61: 51–63.

Dowell, G., S. Hart, and B. Yeung. 2000. Do corporate global environment standards create or destroy market value? Management Science 46: 1059–1074.

Eccles, R., I. Ioannou, and G. Serafeim. 2012. The impact of a corporate culture of sustainability of corporate behavior and performance, Harvard Business School working paper.

El Ghoul, S., O. Guedhami, C.C.Y. Kwok, and D.R. Mishra. 2011. Does corporate social responsibility affect cost of capital? Journal of Banking & Finance 35: 2388–2406.

Goss, A., and G.S. Roberts. 2011. The impact of corporate social responsibility on the cost of bank loans. Journal of Banking & Finance 35: 1794–1810.

Hamilton, S. 1995. Pollution as news: Media and stock market reactions to the toxic release inventory data. Journal of Environment Economics and Management 28: 98–113.

Hamilton, S., H. Jo, and M. Statman. 1993. Doing well while doing good? The investment performance of socially responsible mutual funds. Financial Analyst Journal 49: 62–66.

Heinkel, R., A. Kraus, and J. Zechner. 2001. The effect of green investment on corporate behavior. Journal of Financial and Quantitative Analysis 36: 431–450.

Ioannou, I., and G. Serafeim. 2010. The impact of corporate social responsibility on investment recommendations, Harvard Business School working paper.

Johnsen, D.B. 2003. Socially responsible investing: A critical appraisal. Journal of Business Ethics 43: 219–222.

Kliger, D., and O. Sarig. 2000. The information value of bond ratings. The Journal of Finance 55: 2879–2902.

Klassen, R., and C. McLaughlin. 1996. The impact of environmental management on firm performance. Management Science 42: 1199–1214.

Lee, D., and R. Faff. 2009. Corporate sustainability performance and idiosyncratic risk: A global perspective. Financial Review 44: 213–237.

Statman, M. 2000. Socially responsible mutual funds. Financial Analyst Journal 35: 30–39.

Acknowledgements

I acknowledge the research assistantship of Karen Gonzalez Rodriguez in collecting the corporate green bond data. I would also like to thank participants at the 2017 World Banking and Finance Symposium in Bangkok, Thailand and the 2018 International Banking and Finance Society conference in Santiago, Chile. Funding for this research was provided by the University of Lethbridge Community of Research Excellence Development Opportunities Fund.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Baulkaran, V. Stock market reaction to green bond issuance. J Asset Manag 20, 331–340 (2019). https://doi.org/10.1057/s41260-018-00105-1

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41260-018-00105-1