Abstract

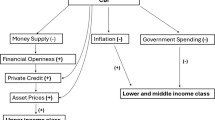

This paper provides evidence that financial globalization—liberalization of the capital account—makes income distribution more uneven by raising the share of income that goes to the richest income deciles. We also offer evidence that changes in domestic fiscal policies in the aftermath of financial globalization are one channel through which these distributional effects could occur. Specifically, we show that episodes of capital account liberalization are followed by greater fiscal consolidation and reduced fiscal redistribution, both of which lead to increased inequality.

Similar content being viewed by others

Notes

Furceri et al. (2019) also find that the impact of capital account liberalization on output is, on average, small and statistically insignificant. The uncertain aggregate benefits associated with capital account liberalization have also been documented in the previous literature (Eichengreen 2001; Prasad et al. 2003; Edison et al. 2004; Kose et al. 2009), while the distributional impacts appear to be quite strong (Jayadev 2007; Larrain 2015; Furceri and Loungani 2018).

See Chinn and Ito (2008) for details on the methodology.

Data on top income shares are taken from Atkinson, Piketty and Saez (2011).

See Ostry et al. (2009) for a description of how the data are constructed.

We use real debt rather than the debt-to-GDP ratio to isolate the effect of capital account liberalization on fiscal discipline from the effect on GDP. Data on income inequality are taken from the Standardized World Income Inequality Database (SWIID 5.1). The SWIID includes measures of net (post-tax, post-transfers) and market (pre-tax, pre-transfers) income.

In this case, we look at the effect of capital account liberalization on net Gini.

The main advantage of this approach relative to estimating SVARs for each regime is that it uses a larger number of observations to compute the impulse response functions of only the dependent variables of interest, improving the stability and precision of the estimates. This estimation strategy can also more easily handle the potential correlation of the standard errors within countries, by clustering at the country level.

The specification also includes redistribution not interacted.

References

Acemoglu, D. 1998. Why Do New Technologies Complement Skills? Directed Technical Change and Wage Inequality. Quarterly Journal of Economics 113(4): 1055–1089.

Agénor, P.R. 2004. The Economics of Adjustment and Growth. La Editorial, UPR.

Atkinson, Anthony B., Thomas Piketty, and Emmanuel Saez. 2011. Top Incomes in the Long Run of History. Journal of Economic Literature 49(1): 3–71. https://doi.org/10.1257/jel.49.1.3.

Bartolini, Leonardo, and Allan Drazen. 1997. Capital-Account Liberalization as a Signal. American Economic Review 87(1): 138–154.

Bernal-Verdugo, L., D. Furceri, and D. Guillaume. 2013. Banking Crises, Labor Reforms and Unemployment. Journal of Comparative Economics 4: 1202–1219.

Bouis, Romain, Orsetta Causa, Lilas Demmou, Romain Duval, and Aleksandra Zdzienicka. 2012. The Short-Term Effects of Structural Reforms: An Empirical Analysis. OECD Economics Department Working Papers 949. OECD Publishing.

Bound, J., and G. Johnson. 1992. Changes in the Structure of Wages in the 1980s: An Evaluation of Alternative Explanations. American Economic Review 83: 371–392.

Chinn, M., and H. Ito. 2008. A New Measure of Financial Openness. Journal of Comparative Policy Analysis 10(3): 309–322.

Ciminelli, Gabriele, Romain Duval and Davide Furceri. 2018. Employment Protection Deregulation and Labor Shares in Advanced Economies. IMF Working Paper 18/186.

Collins, S.M. 2007. Comments on “Financial Globalization, Growth, and Volatility in Developing Countries” by Eswar Prasad, Kenneth Rogoff, Shang-Jin Wei, and M. Ayhan Kose. In Globalization and Poverty, National Bureau of Economic Research Conference Report, ed. A. Harrison. Chicago: University of Chicago Press.

Edison, H. J., M. W. Klein, L. Ricci, and T. Slok. 2004. Capital Account Liberalization and Economic Performance: Survey and Synthesis. International Monetary Staff Paper, 02/120.

Eichengreen, Barry J. 2001. Capital Account Liberalization: What Do the Cross-Country Studies Tell Us? World Bank Economic Review 15: 341–366.

Feenstra, R.C., and G.H. Hanson. 1996. Globalization, Outsourcing, and Wage Inequality. American Economic Review 86(2): 240–245.

Furceri, Davide, and Prakash Loungani. 2018. Capital Account Liberalization and Inequality. Journal of Development Economics 130: 127–144.

Furceri, Davide, Prakash Loungani, and Jonathan D. Ostry. 2019. The Aggregate and Distributional Effects of Financial Globalization: Evidence from Macro and Sectoral Data. Journal of Money, Credit and Banking 51: 163–198.

Furceri, Davide, and Aleksandra Zdzienicka. 2012. Financial Integration and Fiscal Policy. Open Economies Review 23(5): 805–822.

Granger, Clive W.J., and Timo Teräsvirta. 1993. Modelling Nonlinear Economic Relationships. New York: Oxford University Press.

Henry, P.B. 2007. Capital Account Liberalization: Theory, Evidence, and Speculation. Journal of Economic Literature XLV: 887–935.

Jaumotte, Florence, Subir Lall, and Chris Papageorgiou. 2013. Rising Income Inequality: Technology, or Trade and Financial Globalization? IMF Economic Review 61(2): 271–309.

Jaumotte, F., and C. Osorio Buitron. 2015. Inequality and Labor Market Institutions. IMF Staff Discussion Note 15/14, IMF, Washington DC.

Jayadev, Arjun. 2007. Capital Account Openness and the Labour Share of Income. Cambridge Journal of Economics 31(3): 423–443.

Karahan, F., and S. Ozkan. 2013. On the Persistence of Income Shocks Over the Life Cycle: Evidence, Theory, and Implications. Review of Economic Dynamics 16(3): 452–476.

Kim, W. 2003. Does Capital Account Liberalization Discipline Budget Deficit? Review of International Economics 11(5): 830–844.

Kose, M.A., E. Prasad, K. Rogoff, and S.J. Wei. 2009. Financial Globalization: A Reappraisal. IMF Staff Papers 56: 8–62. https://doi.org/10.1057/imfsp.2008.36.

Larrain, Mauricio. 2015. Capital Account Opening and Wage Inequality. Review of Financial Studies, Society for Financial Studies 28(6): 1555–1587.

Obstfeld, Maurice. 1998. The Global Capital Market: Benefactor or Menace? Journal of Economic Perspectives 12(4): 9–30.

Ostry, Jonathan D., Alessandro Prati, and Antonio Spilimbergo. 2009. Structural Reforms and Economic Performance in Advanced and Developing Countries, IMF Occasional Paper 268. Washington: International Monetary Fund.

Ostry, Jonathan, Andrew Berg, and Charalambos Tsangarides. 2014. Redistribution, Inequality, and Growth. Staff Discussion Notes 14(02): 1. https://doi.org/10.5089/9781484352076.006.

Prasad, Eswar., Kenneth Rogoff, Shang-Jin Wei and M. Ayhan Kose. 2003. Effects of Financial Globalization on Developing Countries: Some Empirical Evidence. IMF Occasional Paper No 220.

Quinn, Dennis. 1997. The Correlates of Change in International Financial Regulation. American Political Science Review 91(03): 531–551. https://doi.org/10.2307/2952073.

Quinn, Dennis P., and A. Maria Toyoda. 2008. Does Capital Account Liberalization Lead to Economic Growth? Review of Financial Studies 21(3): 1403–1449.

Tytell, Irina., and Shang-Jin Wei. 2004. Does Financial Globalization Induce Better Macroeconomic Policies? IMF Working Paper, 04/84.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Furceri, D., Loungani, P., Ostry, J. et al. Financial Globalization, Fiscal Policies and the Distribution of Income. Comp Econ Stud 62, 185–199 (2020). https://doi.org/10.1057/s41294-020-00113-4

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41294-020-00113-4